Circle digital currency has quietly become one of the most trusted names in the stablecoin world, powering billions in transactions daily. While other crypto projects chase headlines with wild price swings, Circle built something different – a digital dollar that actually works like money should.

We at Web3 Enabler see businesses increasingly turning to Circle’s USDC for everything from international payments to treasury management. The reason? It bridges the gap between traditional finance and blockchain technology without the usual crypto chaos.

What Makes Circle Different from Other Crypto Companies

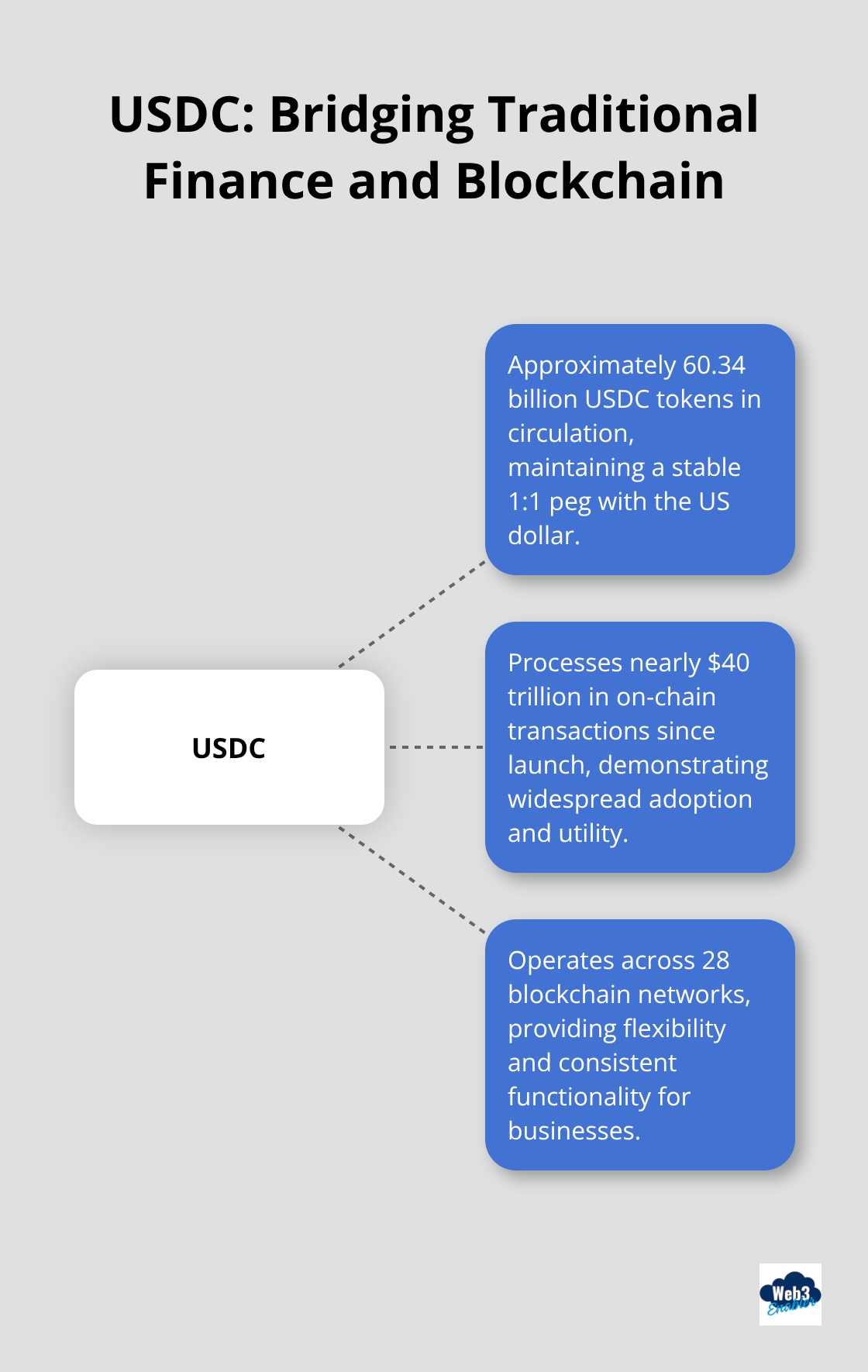

Circle operates more like a financial technology company than a typical crypto startup, and that distinction matters for businesses that consider digital currency adoption. Founded in 2013, Circle has focused on regulatory compliance and institutional partnerships rather than chased speculative trade volumes. The company holds money transmitter licenses across multiple U.S. states and works directly with traditional banks like BlackRock and BNY Mellon to custody USDC reserves. This approach has resulted in approximately 60.34 billion USDC tokens in circulation while the company maintains a stable 1:1 peg with the US dollar.

USDC Powers Real Business Operations

USDC stands as Circle’s flagship product and processes nearly 40 trillion dollars in on-chain transactions since launch. Unlike volatile cryptocurrencies that fluctuate wildly, USDC maintains price stability through full cash and short-dated U.S. government securities support. Circle publishes monthly reserve attestations that independent auditors verify, which provides transparency that most crypto projects avoid. The stablecoin operates across 28 blockchain networks and gives businesses flexibility in their preferred infrastructure choice while consistent functionality remains intact.

Traditional Finance Integration Sets Circle Apart

Circle built deep connections with traditional financial institutions rather than positioned itself as a disruptor. The Circle Payments Network enables 24/7 real-time settlement for global payments and connects banks and payment providers through a compliance-first architecture. Financial institutions can customize blockchain selection based on their risk requirements while they access the same USDC liquidity (without complex technical overhead). This approach has attracted thousands of businesses and developers who need reliable digital currency infrastructure without abandoned existing bank relationships.

Regulatory Compliance Creates Business Trust

Circle’s commitment to transparency and regulatory compliance separates it from most crypto companies that operate in legal gray areas. The company undergoes regular audits and publishes detailed reserve reports monthly, which traditional businesses appreciate when they evaluate digital currency options. Circle works closely with U.S. regulators and maintains licenses that allow legitimate business operations across multiple jurisdictions. This regulatory-first approach means businesses can adopt USDC without the compliance headaches that come with most cryptocurrency solutions.

Now that you understand what makes Circle unique in the crypto space, let’s examine exactly how their digital currency system works behind the scenes.

How Circle Creates and Manages USDC

Circle operates USDC through a direct minting and redemption system that connects traditional banks with blockchain networks. When businesses or institutions want USDC, they deposit US dollars with Circle’s regulated partners, which triggers the creation of equivalent USDC tokens on their chosen blockchain. The reverse process works just as smoothly – users redeem USDC tokens for US dollars at any time through Circle’s platform, and the company permanently removes the corresponding tokens from circulation.

Reserve Management Maintains Full Transparency

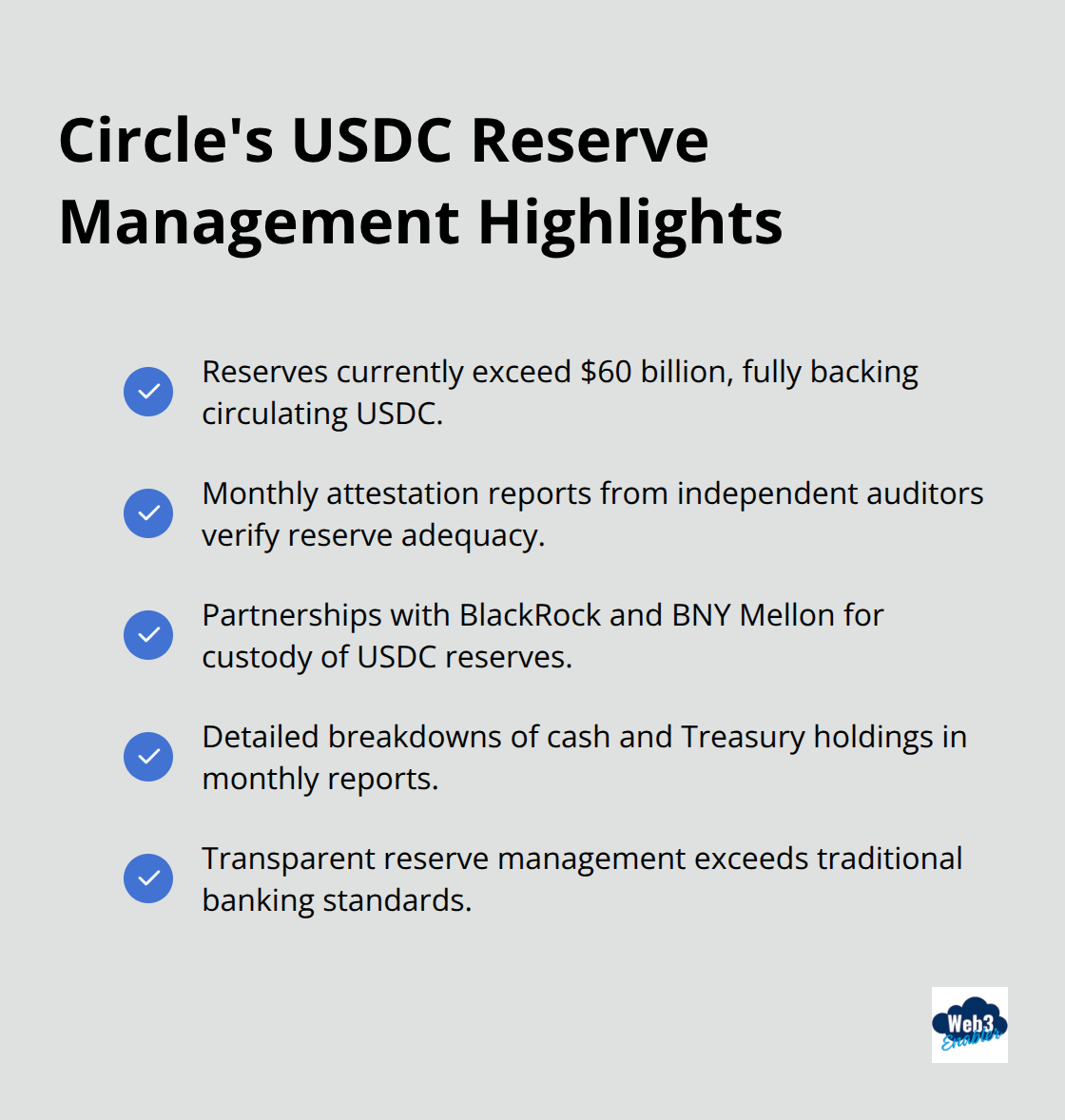

Circle holds every dollar that backs USDC in cash and short-dated US Treasury securities with custody partners like BlackRock and BNY Mellon. The company publishes monthly attestation reports from independent auditors such as Grant Thornton, which verify that reserves exceed circulating USDC through examination of bank statements and securities holdings. These reports show exact dollar amounts and provide more transparency than traditional banks offer their customers. Circle’s reserves currently exceed 60 billion dollars, and monthly reports include detailed breakdowns of cash versus Treasury holdings.

Banking Integration Simplifies Business Adoption

Circle connects directly with traditional banks through partnerships with major financial institutions rather than forces businesses to abandon existing relationships. The Circle Payments Network processes transactions 24/7 and settles payments in real-time across multiple blockchain networks while it maintains compliance with regulations. Financial institutions integrate USDC payments through Circle’s APIs without the need to build blockchain expertise internally, and they choose their preferred blockchain based on transaction costs and security requirements (which gives them flexibility in their infrastructure decisions).

Cross-Chain Protocol Enables Seamless Movement

Circle developed the Cross-Chain Transfer Protocol (CCTP) to allow USDC movement between different blockchain networks without complex bridge mechanisms. This protocol maintains the same USDC tokens across different blockchain networks and eliminates the need for wrapped versions or third-party bridges that introduce additional risks. Businesses can move USDC from Ethereum to Solana or Polygon instantly while they maintain the same regulatory backing and reserve transparency across all networks.

Now that you understand how Circle creates and manages USDC, let’s explore the specific benefits this system delivers for businesses and their payment operations.

Why Businesses Choose USDC Over Traditional Payments

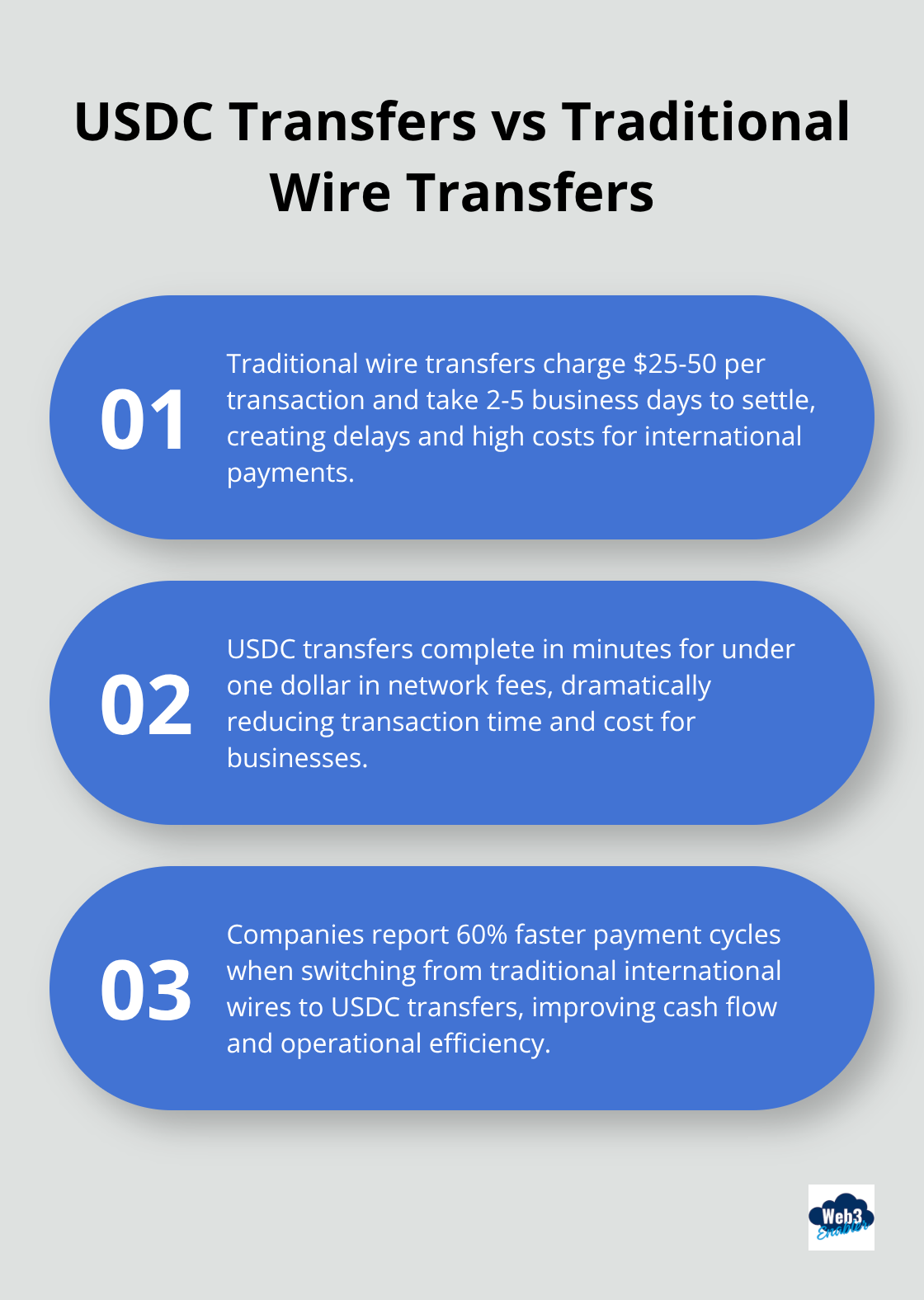

USDC transforms international payments from a multi-day ordeal into instant transfers that cost pennies instead of percentages. Traditional wire transfers charge 25-50 dollars per transaction and take 2-5 business days to settle, while USDC transfers complete in minutes for under one dollar in network fees. Stripe reports that businesses lose 2.9% plus 30 cents per credit card transaction, but USDC payments eliminate interchange fees entirely. Companies like Visa have integrated USDC into their settlement networks because it reduces their operational costs by 40% compared to correspondent banking relationships.

Treasury Operations Get Smarter With Programmable Money

Finance teams use USDC to automate treasury management through smart contracts that execute payments based on predefined conditions. Payroll systems can distribute salaries instantly to global employees without banking delays or currency conversion fees (which typically cost 3-5% per transaction). Circle Payments Network processes over 2.1 billion dollars in monthly volume because CFOs appreciate real-time settlement that improves cash flow forecasts. Companies hold USDC reserves that earn yield through DeFi protocols while they maintain instant liquidity for operational expenses, which beats traditional money market accounts that lock funds for weeks.

DeFi Applications Create New Revenue Streams

USDC integration with decentralized finance protocols allows businesses to earn 4-8% annual yields on idle cash reserves through platforms like Compound and Aave. These protocols have processed over 400 billion dollars in total value locked, with USDC as the largest stablecoin allocation. Treasury managers can stake USDC in liquidity pools that generate fees while they maintain dollar stability (creating revenue streams that traditional banks cannot match). Automated market makers reward USDC providers with transaction fees that compound daily, which turns corporate cash management into an active profit center rather than a cost center.

Cross-Border Commerce Eliminates Banking Friction

International businesses use USDC to bypass correspondent banking networks that add delays to settlement times. E-commerce platforms process USDC payments instantly across 185 countries without the need for local banking relationships or currency hedges. Supply chain payments flow directly to vendors in emerging markets where traditional banking infrastructure remains unreliable or expensive. Companies report 60% faster payment cycles when they switch from traditional international wires to USDC transfers.

Final Thoughts

Circle digital currency has fundamentally changed how businesses approach money movement and treasury management. The company’s regulatory-first approach attracted over 60 billion dollars in USDC circulation while traditional crypto projects struggled with compliance issues. Circle’s partnerships with BlackRock and BNY Mellon legitimized stablecoins for institutional adoption, and monthly transparency reports built trust that most financial technology companies cannot match.

The stablecoin market will likely reach 2.8 trillion dollars by 2028 according to industry analysts, with USDC positioned to capture significant market share through its banking integrations and cross-chain capabilities. Circle’s expansion into 28 blockchain networks creates infrastructure that supports both current payment needs and future programmable money applications. This foundation positions Circle as the bridge between traditional finance and blockchain technology (without the usual crypto volatility).

Businesses ready to adopt Circle’s solutions can start with simple USDC payments for international transfers or treasury management. Web3 Enabler provides Salesforce-native blockchain solutions that connect Circle’s infrastructure with existing corporate systems, making stablecoin adoption seamless for finance teams. The transition from traditional payments to digital currency infrastructure represents the next evolution in business finance, and Circle has built the foundation that makes this shift practical for mainstream adoption.