Global payment solutions are undergoing a massive transformation. Blockchain technology is reshaping how we send and receive money across borders.

At Web3 Enabler, we’re at the forefront of this revolution, offering cutting-edge solutions that tackle traditional payment challenges head-on – and doing it right in the existing IT Infrastructure, with native Salesforce Blockchain solutions.

In this guide, we’ll explore how blockchain is revolutionizing international transactions and why it’s the future of global finance.

Why Traditional Global Payments Fall Short

Exorbitant Fees Erode Profits

International wire transfers come with a hefty price tag. Banks typically charge between $25 and $65 per transaction. Add currency conversion fees (often 2-4%), and you’re looking at significant costs. For a $10,000 transfer, fees could reach $400 or more. These expenses quickly accumulate, particularly for businesses conducting frequent cross-border transactions.

Glacial Processing Times

The sluggish pace of traditional bank transfers frustrates many. Multiple intermediaries slow down the process, with each adding time to complete the transaction. SWIFT, the most widely used network for these transfers, often takes 3-5 business days to process a payment. In our fast-paced global economy, this delay can seriously impede business operations.

Currency Conversion Complexities

Converting between currencies presents numerous challenges. Exchange rates fluctuate constantly, and banks frequently offer less favorable rates than those publicly available. The timing issue compounds this problem – the rate at initiation may differ significantly by the time of processing. This unpredictability complicates financial planning and budgeting for businesses and individuals alike.

Hidden Costs and Lack of Transparency

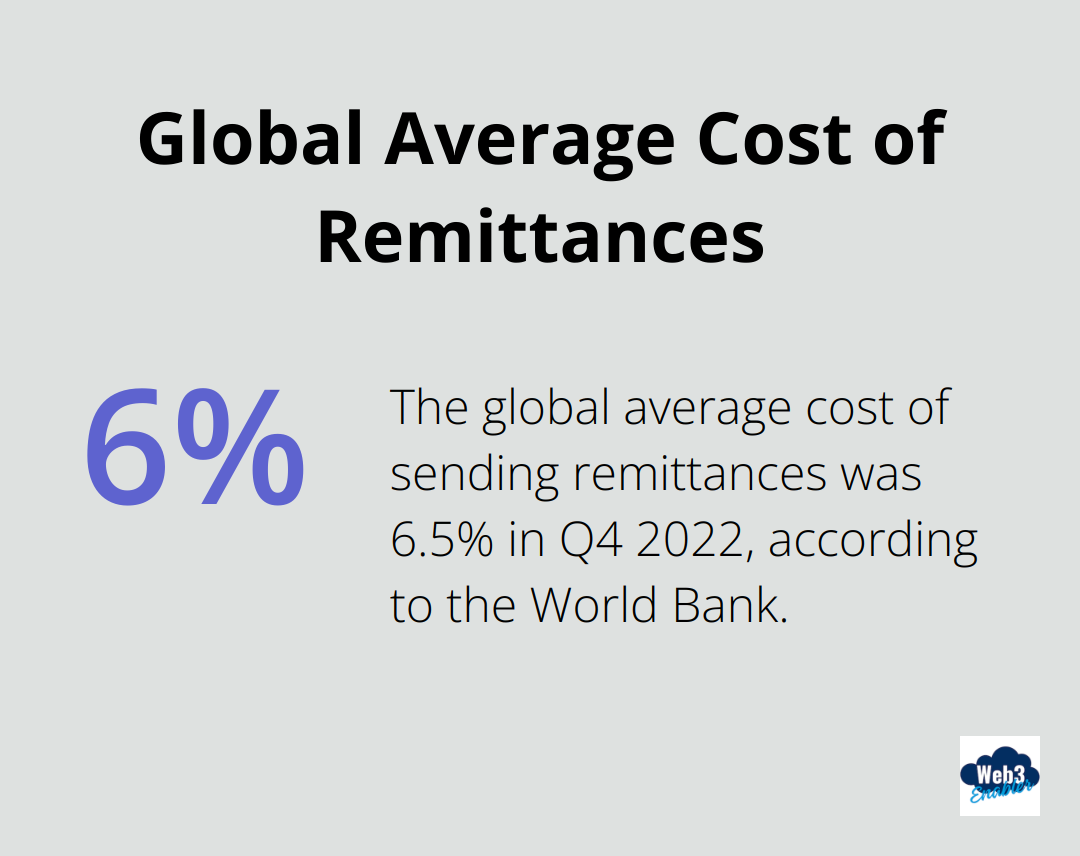

Many users are unaware of the full extent of fees associated with international transfers. Banks often bury additional charges in fine print or complex fee structures. The World Bank reports that the global average cost of sending remittances was 6.5% in Q4 2022 – a substantial portion lost in transit (especially for smaller transactions).

Regulatory Hurdles and Compliance Issues

International payments must navigate a complex web of regulations and compliance requirements. Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures, while necessary, often result in delays and additional costs. Different countries have varying rules, making it challenging for businesses to maintain compliance across multiple jurisdictions.

These persistent issues with traditional global payment systems highlight the need for innovative solutions. Blockchain technology offers promising alternatives that address many of these pain points, paving the way for faster, secure, and cost-effective international transactions.

How Blockchain Transforms Global Payments

Blockchain technology revolutionizes global payments, addressing many pain points associated with traditional systems. This decentralized approach offers benefits that appeal particularly to businesses engaged in frequent cross-border transactions.

Dramatic Cost Reduction

Blockchain transfers avoid the 6%+ fees and steep bank charges common with traditional cross-border transactions, freeing budget for businesses. This cost advantage makes blockchain-based payments particularly attractive for companies engaged in frequent international transactions.

Rapid Settlement Times

Blockchain enables near-instantaneous settlement of transactions, regardless of geographical boundaries. Unlike the 3-5 day wait times associated with SWIFT transfers, blockchain transactions typically settle within minutes or seconds. This allows businesses to manage cash flow more effectively and reduce risks associated with currency fluctuations during extended processing periods.

Enhanced Security and Transparency

Blockchain’s cryptographic foundations provide security that traditional banking systems struggle to match. Each transaction is verified and recorded on a distributed ledger, making it virtually impossible to alter or falsify records. This transparency allows all parties to track payment progress in real-time, eliminating uncertainty often associated with international transfers.

Streamlined Compliance Processes

While regulatory compliance remains a critical concern in international payments, blockchain technology offers innovative solutions. Smart contracts – self-executing agreements with terms directly written into code – can automate many compliance checks. This automation reduces the manual workload associated with AML and KYC procedures.

As blockchain technology continues to mature, we can expect even more innovative solutions to emerge. The next chapter will explore how Web3 Enabler harnesses these transformative capabilities to provide cutting-edge payment solutions for businesses operating in the global marketplace.

How Web3 Enabler Streamlines Global Payments

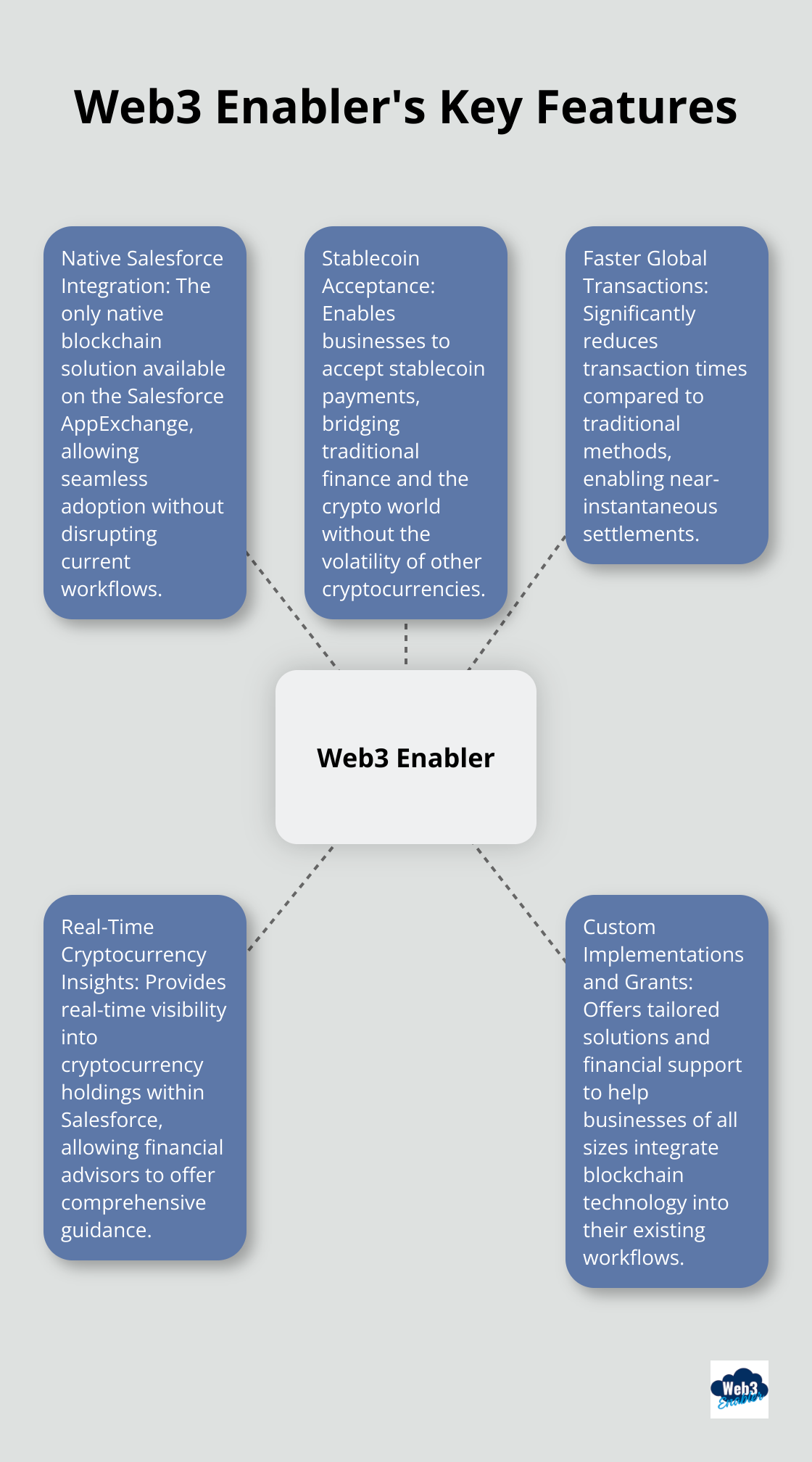

Native Salesforce Integration

Web3 Enabler offers the only native blockchain solution available on the Salesforce AppExchange. This unique position allows businesses to incorporate blockchain payment solutions without disrupting their current workflows. Companies already using Salesforce can seamlessly adopt our technology, eliminating the need for complex integrations or system overhauls.

Stablecoin Acceptance with No Effort

We enable businesses to accept stablecoin payments, bridging traditional finance and the crypto world. Stablecoins (digital assets pegged to stable currencies like the US dollar) provide the benefits of blockchain technology without the volatility associated with cryptocurrencies like Bitcoin. With our new liquidation wallets, you can have the stablecoins automatically off-ramped into your existing bank. You can the transmission speed of the blockchain with the end result of the fiat system.

Faster Global Transactions

Our blockchain-based payment system significantly reduces transaction times compared to traditional methods. While SWIFT transfers can take days, our solution enables near-instantaneous settlements.

Real-Time Cryptocurrency Insights

As cryptocurrency adoption grows, financial advisors need tools to effectively manage and monitor their clients’ digital assets. Our platform provides real-time visibility into cryptocurrency holdings directly within Salesforce, allowing advisors to offer more comprehensive financial guidance.

Custom Implementations and Grants

We offer custom implementations to help businesses of all sizes integrate blockchain technology into their existing workflows. Additionally, we provide grants to support companies in their blockchain adoption journey, making advanced payment solutions accessible to a wider range of businesses.

Global blockchain payment solutions can enhance the efficiency and security of cross-border transactions, streamlining global trade.

Final Thoughts

Blockchain technology reshapes global payment solutions, addressing longstanding issues in traditional systems. It reduces costs, enables instant settlements, and enhances security through cryptographic foundations. This technology offers a compelling alternative for businesses engaged in cross-border transactions.

Web3 Enabler leads this revolution as the only provider of native blockchain solutions on the Salesforce AppExchange. Our platform empowers businesses to integrate blockchain technology into their existing workflows, particularly within the Salesforce ecosystem. We facilitate stablecoin acceptance, faster global payments, and provide real-time cryptocurrency insights for financial advisors.

The future of blockchain-powered payment solutions looks promising. As adoption grows and technology matures, we expect more innovative applications to streamline global trade. Businesses that embrace these advancements now will thrive in an increasingly interconnected global economy. Web3 Enabler remains committed to driving this transformation forward (through custom implementations and grants).