Crypto portfolio management is reshaping the financial advisory landscape. As digital assets gain prominence, advisors must adapt their strategies to meet client demands and regulatory requirements.

Crypto portfolio management is reshaping the financial advisory landscape. As digital assets gain prominence, advisors must adapt their strategies to meet client demands and regulatory requirements.

At Web3 Enabler, we’ve seen a surge in financial professionals seeking guidance on integrating cryptocurrencies into their practice. This blueprint will equip you with the knowledge and tools to navigate this exciting new frontier in wealth management.

What Are Crypto Assets and Why Do They Matter?

The Rise of Cryptocurrency as an Asset Class

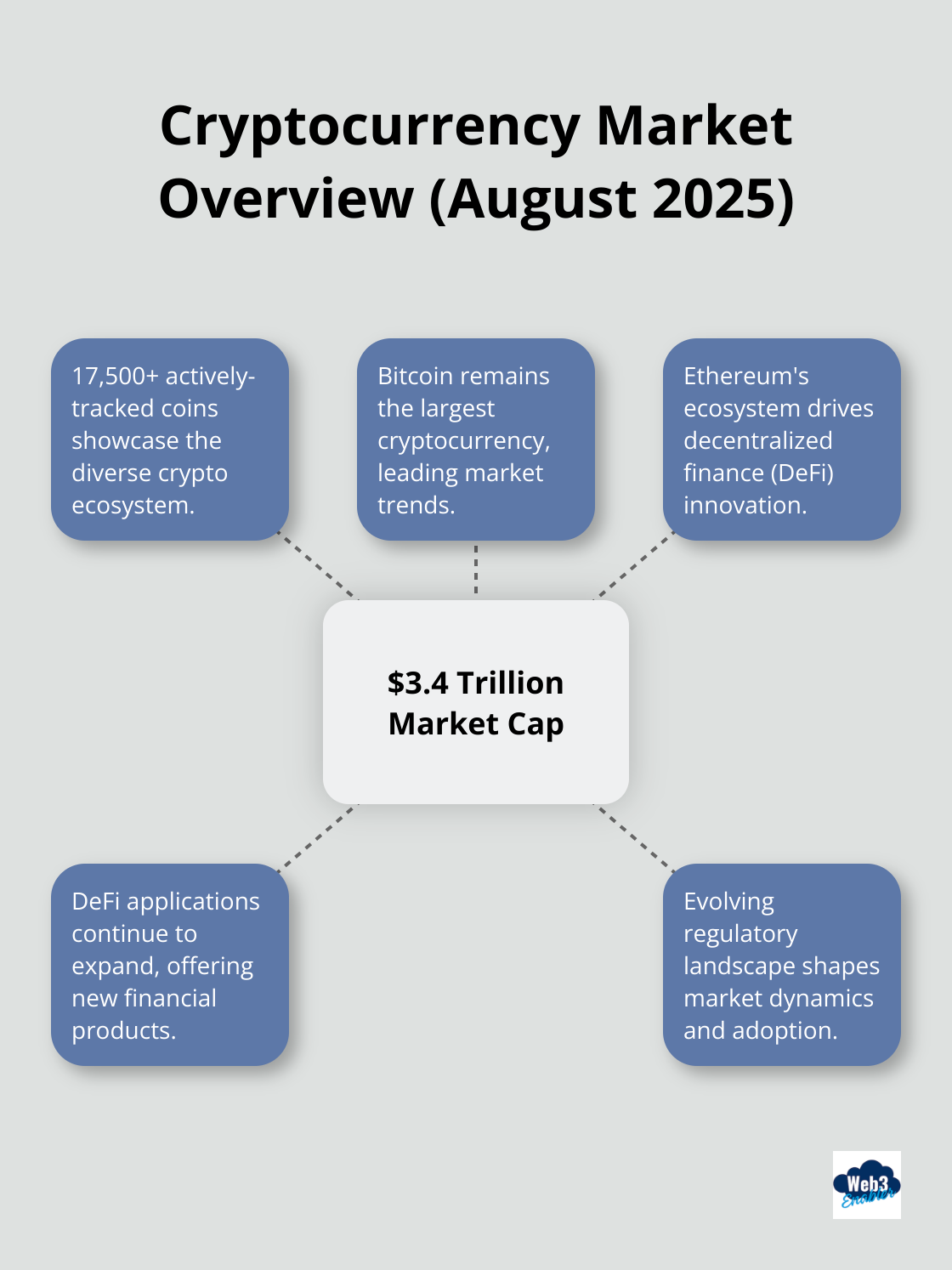

Cryptocurrency has transformed from a niche interest to a significant player in the financial world. As of August 2025, cryptocurrencies boast a total market capitalization of approximately $3.4 trillion, encompassing over 17,500 actively-tracked coins. This remarkable growth has captured the attention of both individual and institutional investors, making it essential for financial advisors to understand and incorporate these digital assets into client portfolios.

Beyond Bitcoin: The Expanding Crypto Ecosystem

While Bitcoin remains the most recognizable cryptocurrency, the ecosystem has expanded dramatically. Ethereum, the second-largest cryptocurrency by market cap, has become a cornerstone for decentralized finance (DeFi) applications. Stablecoins, pegged to fiat currencies, offer a bridge between traditional finance and the crypto world. Tokens like Cardano and Polkadot represent next-generation blockchain platforms with unique features and use cases.

Financial advisors must acquaint themselves with these various types of crypto assets to provide comprehensive advice. Each category carries its own risk profile and potential returns. For instance, Bitcoin’s intraday price swings are roughly five times larger than those of traditional S&P 500 stocks (according to a recent academic study). This volatility underscores the need for careful portfolio construction and risk management.

The Evolving Regulatory Landscape

The regulatory environment for cryptocurrencies changes rapidly. In July 2025, the Office of the Comptroller of the Currency (OCC), Federal Reserve, and FDIC released guidance for banking organizations regarding the safekeeping of crypto-assets. This guidance allows banks to act as custodians for digital assets, provided they comply with existing fiduciary standards and regulations.

Financial advisors must stay informed about these regulatory changes. Compliance with the Bank Secrecy Act, anti-money laundering regulations, and other legal requirements is necessary when dealing with crypto-assets. Advisors should also prepare to explain the tax implications of crypto investments to their clients, as the IRS treats cryptocurrencies as property for tax purposes.

Practical Steps for Advisors

- Education: Dedicate time to understand the technology behind different cryptocurrencies and their potential use cases.

- Risk Assessment: Develop a framework to evaluate the risk-return profile of various crypto assets.

- Portfolio Integration: Start small, perhaps allocate 1-5% of a client’s portfolio to cryptocurrencies (depending on their risk tolerance and investment goals).

- Compliance: Stay up-to-date with the latest regulatory guidelines and implement proper documentation processes.

- Technology Adoption: Learn about crypto-specific portfolio tracking software and blockchain integration tools. Web3 Enabler’s native blockchain solution for Salesforce can be particularly useful for advisors already using the Salesforce ecosystem.

As we move forward, it’s clear that the integration of crypto assets into traditional portfolio management requires a nuanced approach. Let’s explore how financial advisors can effectively blend these digital assets with conventional investment strategies.

How to Blend Crypto with Traditional Portfolios

Crafting a Balanced Crypto Allocation

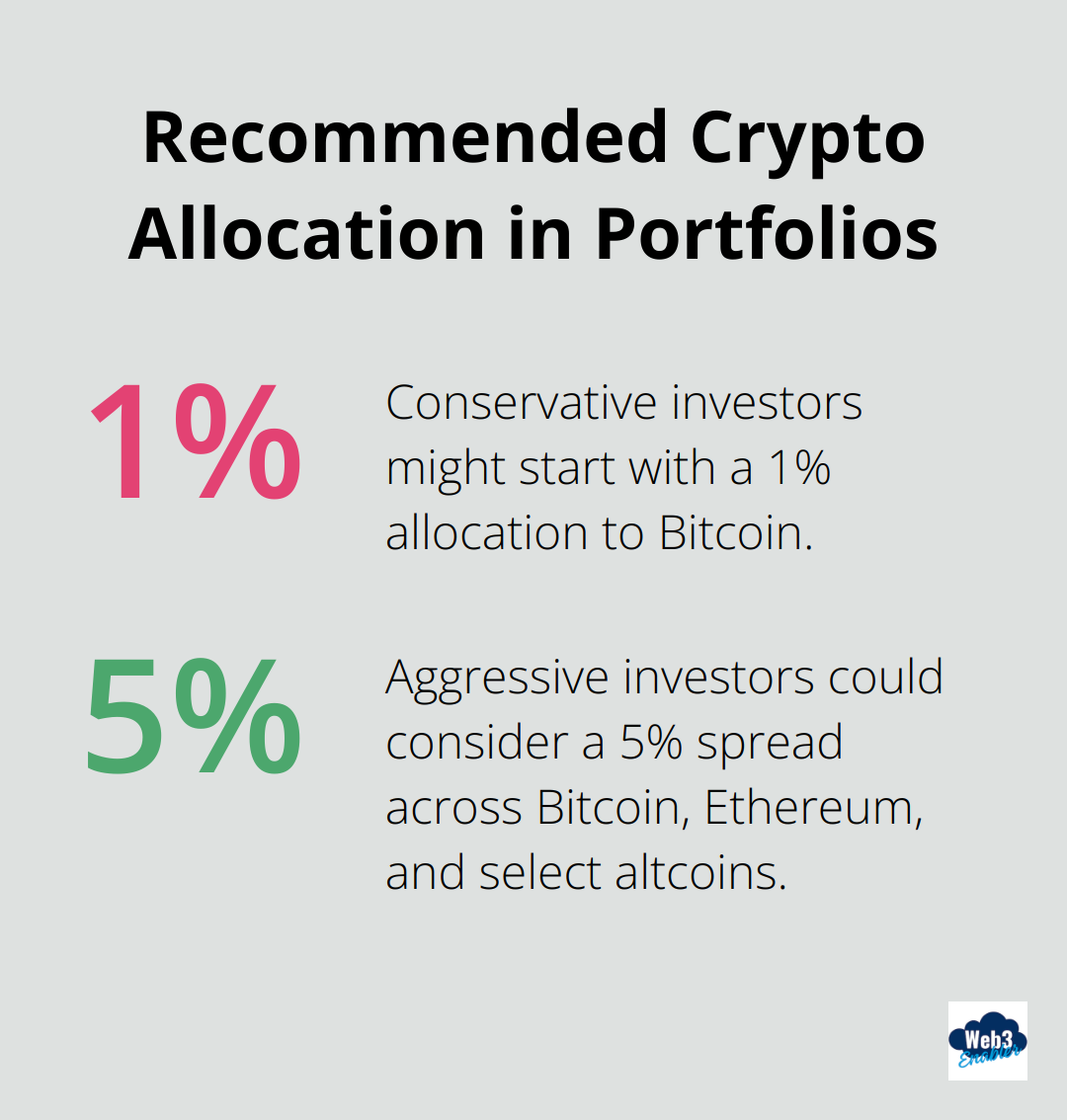

Financial advisors must consider a tailored approach when integrating cryptocurrencies into traditional investment strategies. A common starting point allocates 1-5% of a client’s portfolio to cryptocurrencies, based on risk tolerance and investment goals. This allocation can shift with market conditions and client needs.

Conservative investors might start with a 1% allocation to Bitcoin, while aggressive investors could consider a 5% spread across Bitcoin, Ethereum, and select altcoins. Regular rebalancing is essential, as crypto’s volatility can quickly alter portfolio weightings.

Managing Crypto Risk Effectively

Risk management takes center stage in crypto portfolios. Bitcoin’s recent 2% gain over a 24-hour period demonstrates the potential for significant price movements in short timeframes. This heightened volatility demands robust risk management strategies.

Implementing stop-loss orders can help limit potential losses during sharp market downturns. For example, setting a 20% stop-loss on a Bitcoin position automatically sells if the price falls below that threshold.

Diversification serves as another key risk management tool. Instead of concentrating all crypto holdings in one asset, advisors should consider spreading investments across:

- Large-cap cryptocurrencies (Bitcoin, Ethereum)

- Mid-cap assets (Cardano, Polkadot)

- A small allocation to promising small-cap projects

Navigating the Crypto Tax Maze

The tax implications of crypto investments vary by jurisdiction and can prove complex. In the United States, the IRS treats cryptocurrencies as property for tax purposes, meaning every sale, trade, or use of cryptocurrency can trigger a taxable event.

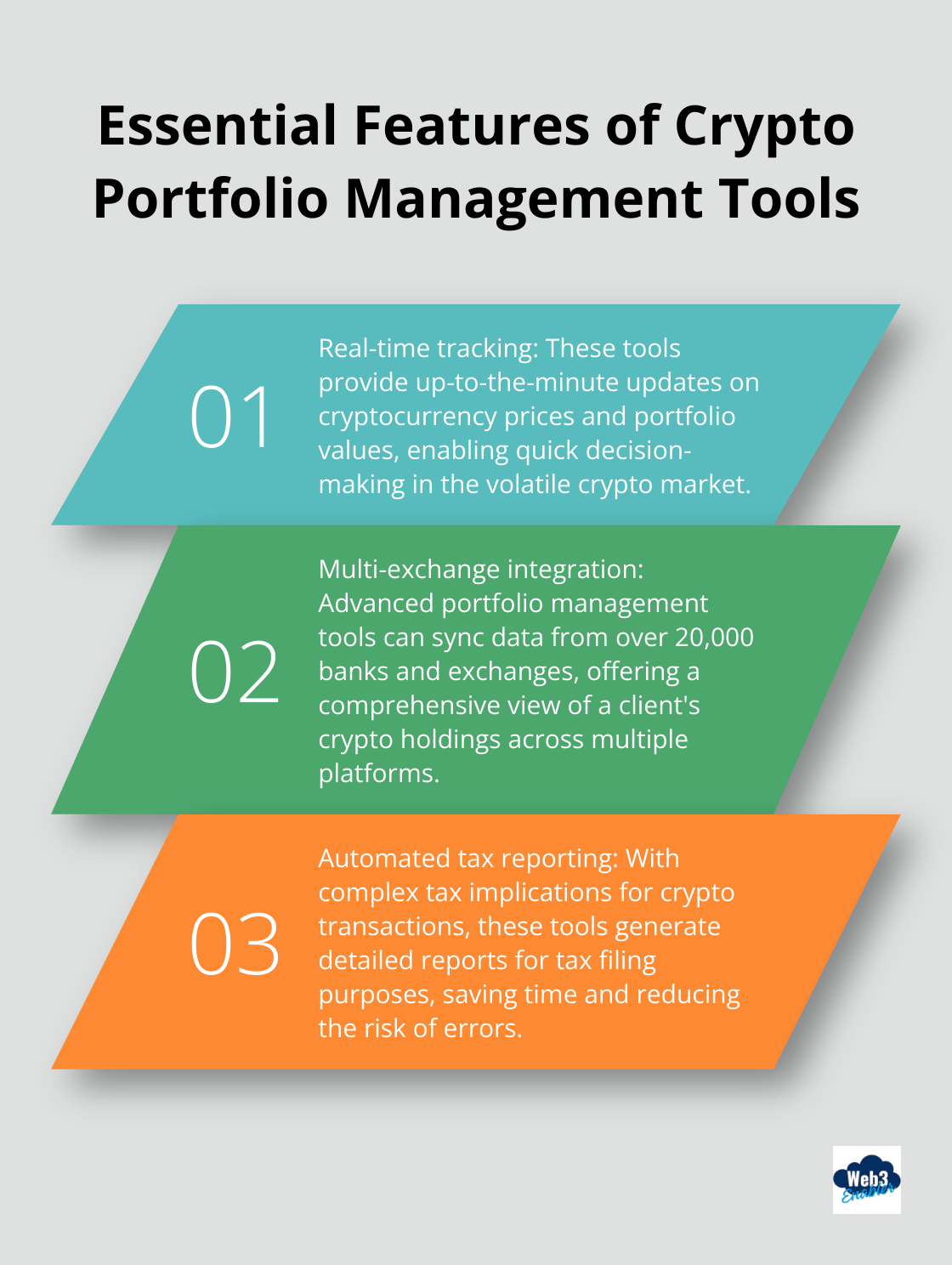

Financial advisors should use specialized crypto tax software to track transactions across multiple exchanges and wallets. These tools generate detailed reports for tax filing purposes, saving time and reducing error risk.

Educating clients about tax-loss harvesting opportunities in the crypto market is also important. The volatility of digital assets allows for strategic selling of underperforming cryptocurrencies to offset gains and potentially reduce a client’s overall tax burden.

Leveraging Technology for Integration

To streamline the integration process, financial advisors need powerful tools. Some providers (like Web3 Enabler) offer blockchain solutions integrated with Salesforce, providing real-time visibility into clients’ cryptocurrency holdings. This integration simplifies portfolio tracking and tax reporting, allowing advisors to focus on strategic decision-making rather than administrative tasks.

As we move forward, it’s clear that the tools and technologies used for crypto portfolio management play a pivotal role in successful integration. Let’s explore these essential resources in the next section.

Essential Tools for Crypto Portfolio Management

Digital Asset Wallets – The Salesforce Native Solution

Financial advisors need dedicated tools to manage crypto portfolios effectively. Traditional software often lacks the capabilities to handle digital assets, making crypto-specific tracking platforms indispensable. These tools provide real-time price updates, detailed transaction histories, and performance analytics across multiple exchanges and wallets.

Web3 Enabler’s Digital Asset Wallet runs natively within Financial Services Cloud. It enables your clients to connect their wallets, feeding a financial account. You now see the cryptowallet alongside checking accounts, savings accounts, and investment accounts. This solution is perfect if you aren’t prepared to advise on Crypto directly.

A small allocation to a Bitcoin ETF may also give exposure without navigating the environment. Your clients can receive the direct Bitcoin movements, while not participating in the DeFi world.

Seamless Blockchain Integration

The integration of blockchain data with existing financial systems provides a holistic view of client portfolios. Some portfolio trackers allow users to sync over 20,000 banks and exchanges for a comprehensive financial overview.

Integration extends beyond tracking. Financial advisors require tools that incorporate crypto transactions into their existing workflows seamlessly. This need has led to the development of blockchain solutions that integrate directly with customer relationship management (CRM) systems.

Native Blockchain Solutions for CRM

For financial advisors using Salesforce, native blockchain solutions offer direct integration with the Salesforce ecosystem. These solutions provide real-time visibility into clients’ cryptocurrency holdings within the familiar Salesforce interface.

Such integrations allow advisors to track crypto assets alongside traditional investments, generate comprehensive reports, and manage client relationships in one place. This streamlined approach reduces errors and enables advisors to provide more informed guidance to their clients.

The ability to categorize transactions within the CRM aids in understanding investment habits and trading strategies. It also simplifies the process of generating tax reports (a key feature given the complex tax implications of crypto investments).

Security and Compliance Tools

Security remains paramount in crypto portfolio management. Advisors should use hardware wallets and enable two-factor authentication (2FA) to prevent unauthorized access to client assets.

Compliance tools help navigate the evolving regulatory landscape. These tools track regulatory changes, assist with KYC/AML procedures, and ensure adherence to reporting requirements.

AI-Powered Analytics

Artificial Intelligence (AI) enhances crypto portfolio management by providing advanced analytics and insights. AI-powered tools can analyze market trends, predict potential risks, and suggest optimal portfolio allocations.

These tools process vast amounts of data quickly, allowing advisors to make data-driven decisions in the fast-paced crypto market. Some AI solutions even offer natural language processing capabilities, enabling advisors to query their data using plain language.

Final Thoughts

The landscape of wealth management evolves rapidly, with crypto assets playing a significant role. Financial advisors who develop expertise in crypto portfolio management will meet the growing demands of their clients. Advisors must stay informed about the latest developments in the crypto space, understand the unique risks and opportunities these assets present, and leverage cutting-edge tools to manage them effectively.

Best practices for financial advisors entering the crypto space include ongoing education, small allocations, robust risk management strategies, and specialized software for tracking and reporting. It’s important to maintain a balanced perspective, recognizing both the potential benefits and risks of crypto investments. Financial advisors should first educate themselves and their clients about the fundamentals of blockchain technology and cryptocurrencies.

Web3 Enabler’s native blockchain solution for Salesforce offers a powerful tool for financial advisors looking to integrate crypto assets into their existing workflows. This solution provides real-time visibility into clients’ cryptocurrency holdings within the familiar Salesforce interface (simplifying the process of managing digital assets alongside traditional investments). As the crypto market matures, financial advisors who adapt to crypto portfolio management will be better equipped to serve their clients’ evolving needs.