Traditional payment systems create bottlenecks that slow down business operations and drain resources through high fees and banking delays.

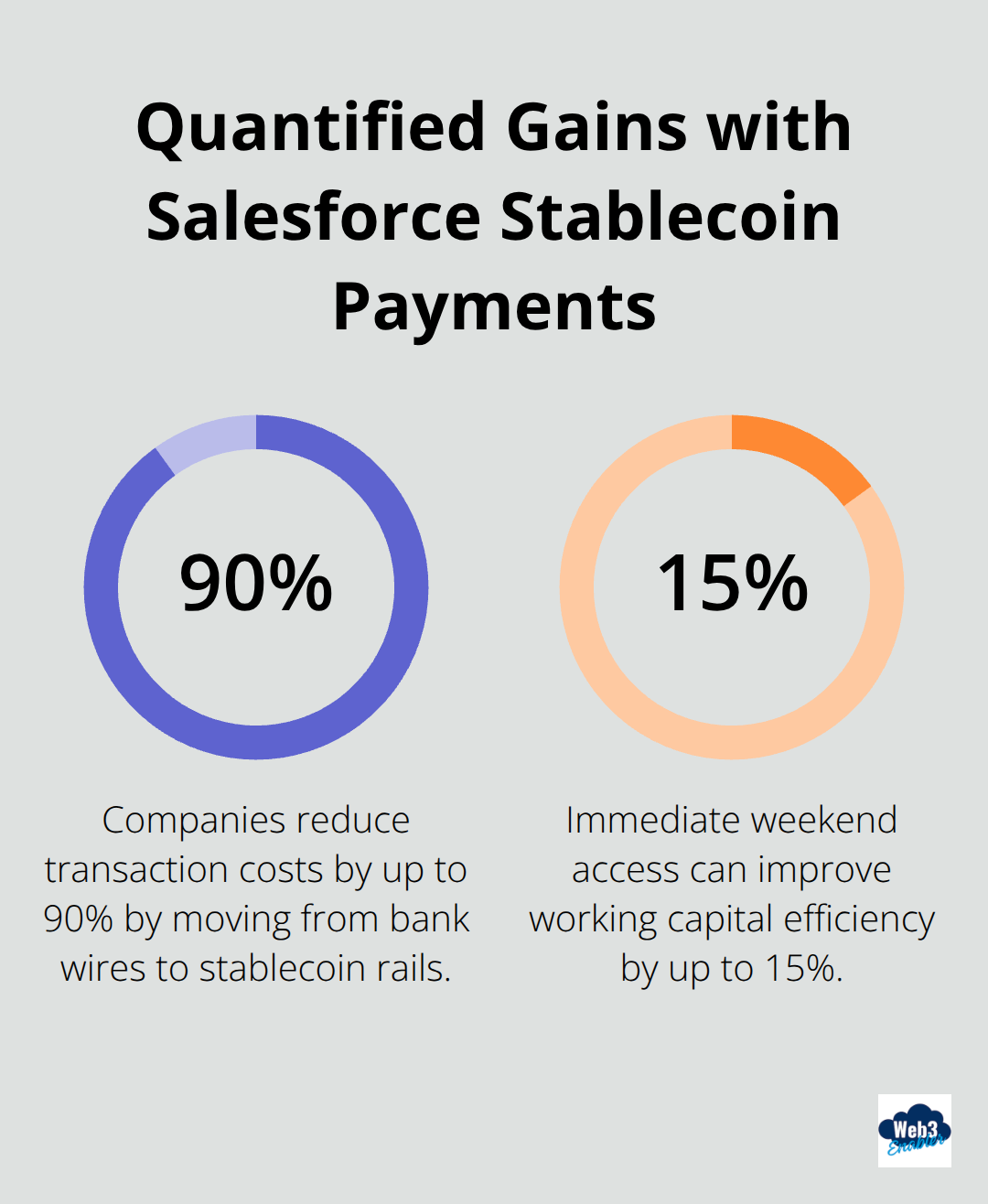

Salesforce stablecoin payments offer a game-changing solution that transforms how companies manage their treasury operations. We at Web3 Enabler have seen businesses cut payment processing time from days to minutes while reducing transaction costs by up to 90%.

This integration brings blockchain efficiency directly into your existing CRM workflows.

How Stablecoin Payments Speed Up Business Operations

Stablecoin payments remove the traditional banking delays that slow corporate treasury operations. When businesses send a $50,000 vendor payment through traditional banking, they wait 2-5 days for settlement while they pay $25-75 in wire fees. With stablecoins, the same payment settles in under 5 minutes for less than $1 in network fees. This speed advantage becomes massive for companies that process hundreds of payments monthly. Century Financial processes over 40,000 financial instruments, and institutions that handle this volume can achieve significant cost savings when they switch to stablecoin payments.

Weekend Operations Transform Cash Management

Traditional banking shuts down operations during weekends and holidays, which creates cash flow gaps that force companies to maintain larger cash reserves. This blog is being posted on Thanksgiving, where US-based banks will be closed but the rest of the planet considers a normal Thursday. Stablecoin networks operate continuously, so businesses can process payments, settle invoices, and manage liquidity 24/7. Companies in sectors like e-commerce and global trade benefit most from this availability.

A business that receives a $100,000 payment on Friday evening can access those funds immediately rather than wait until Monday morning (improving working capital efficiency by up to 15%).

Cross-Border Payments Become Instant

International wire transfers through correspondent banking networks take 3-7 business days and cost $40-60 per transaction. Stablecoin payments cross borders in minutes regardless of destination, with flat fees under $2. Businesses that operate across multiple time zones gain significant advantages. Treasury teams can optimize cash positions in real-time and move funds between subsidiaries instantly instead of planning transfers days in advance. This operational flexibility reduces the need to maintain excess cash balances in multiple currencies, which frees up capital for business growth initiatives.

Real-Time Settlement Improves Vendor Relations

Traditional payment delays strain vendor relationships and often result in late payment penalties or lost early payment discounts. Stablecoin payments allow companies to pay vendors instantly upon invoice approval (eliminating the typical 30-60 day payment cycles). Vendors receive immediate confirmation of payment through blockchain transparency, which reduces disputes and improves trust. Companies can now capture 2-3% early payment discounts that were previously impossible due to banking delays, turning payment speed into direct cost savings.

The next step involves integrating these payment capabilities directly into your existing Salesforce workflows to maximize operational efficiency.

Native Salesforce Integration for Stablecoin Payments

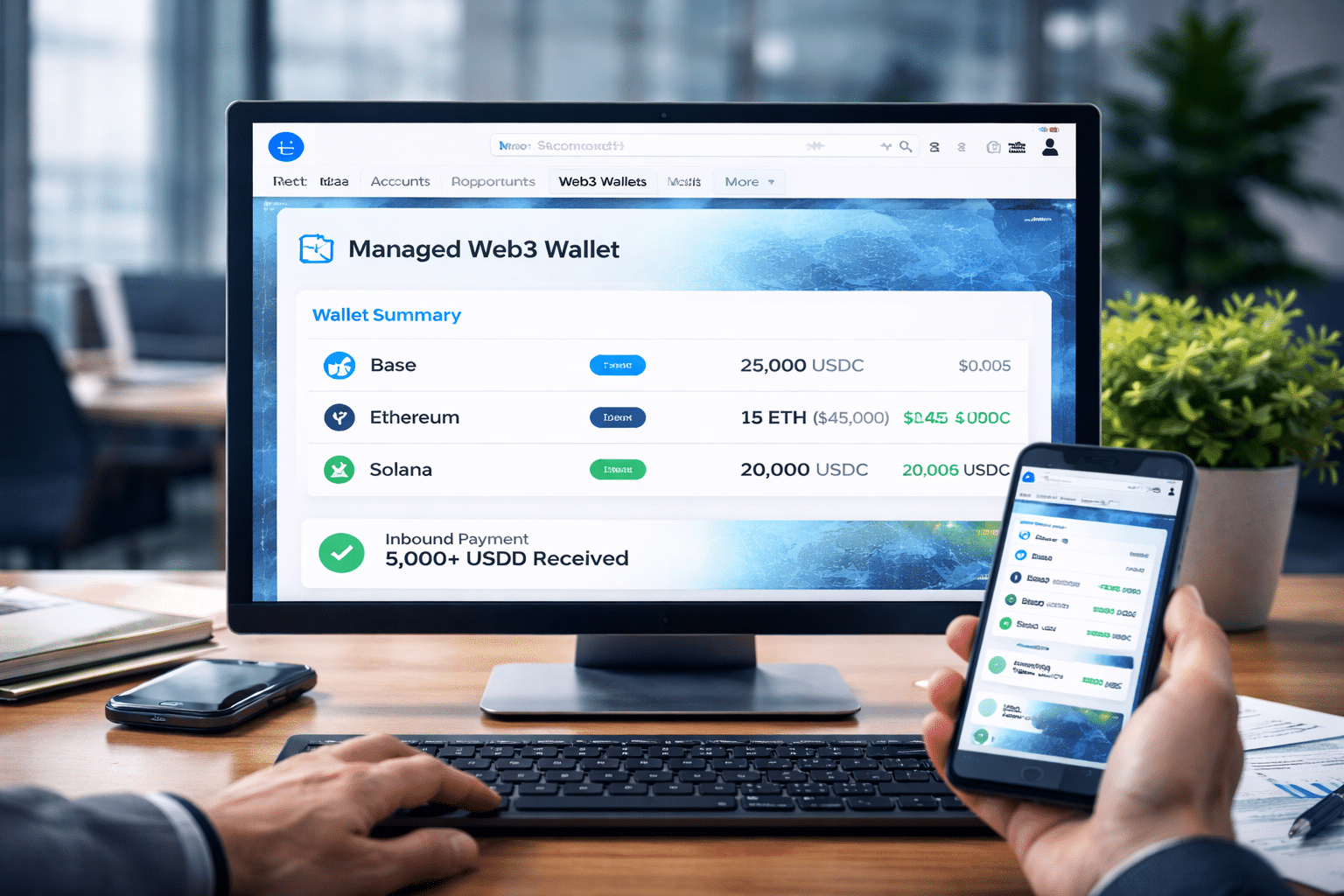

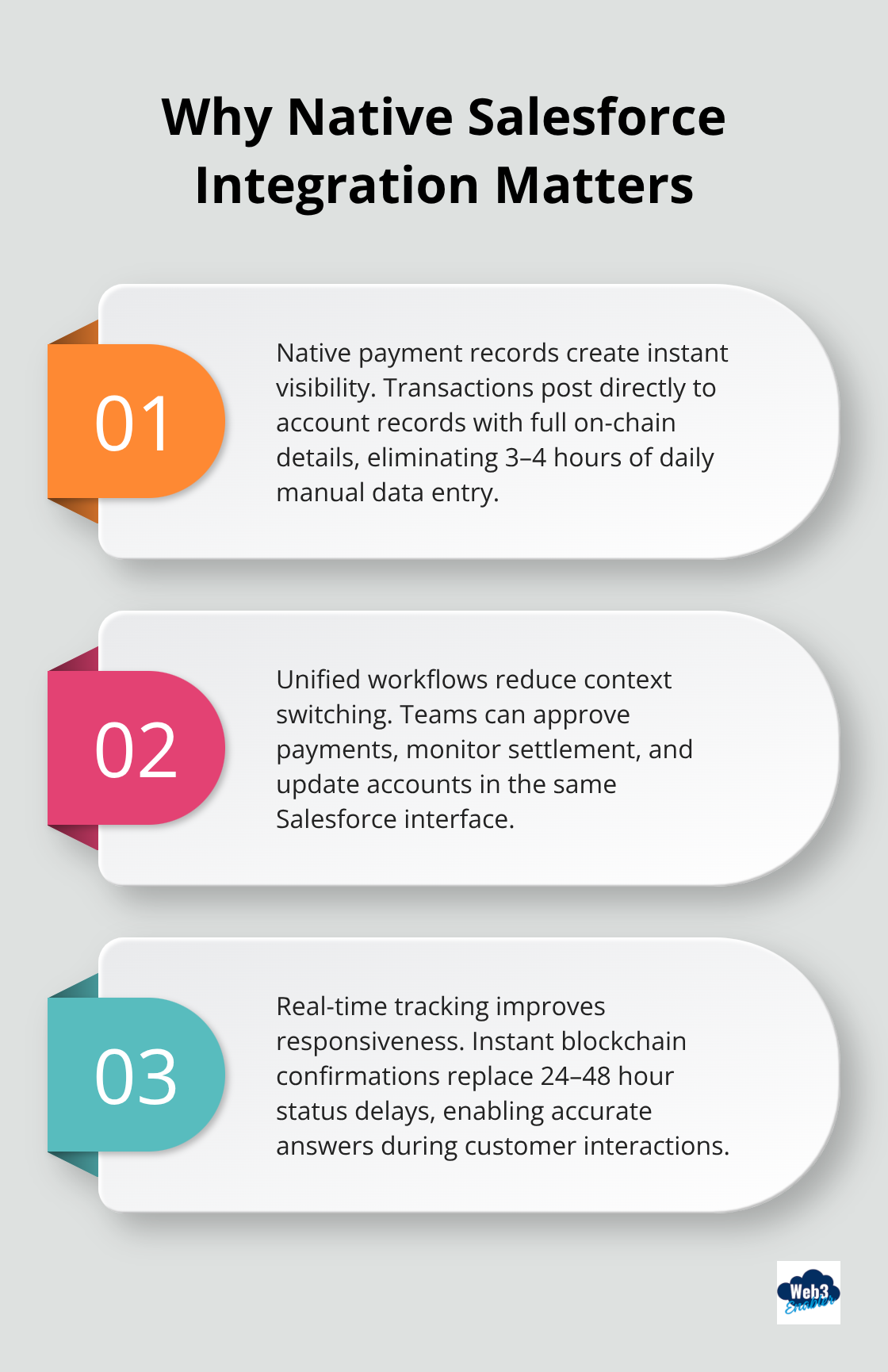

Salesforce Financial Services Cloud transforms stablecoin payments from external processes into native CRM operations that finance teams can manage without platform switching. Web3 Enabler built the only native blockchain platform on the Salesforce AppExchange, which means payment data flows directly into Salesforce objects where teams already work. When a $25,000 stablecoin payment processes, the transaction appears instantly in the account record with complete blockchain visibility – payment amount, wallet addresses, network fees, and settlement confirmation. This integration eliminates the manual data entry that typically consumes 3-4 hours per day for treasury teams who manage multiple payment systems.

Payment Data Becomes Native Salesforce Records

Traditional payment systems require finance teams to export data from banking portals and manually update Salesforce records, which creates delays and errors. Stablecoin payments through native Salesforce integration automatically create payment records, update account balances, and trigger workflow rules in real-time. Finance teams gain complete audit trails without separate spreadsheets or reconciliation files. Mashreq Bank uses Salesforce for personalized customer interactions through Mashreq Neo, and similar institutions can now extend this approach to payment processing. The blockchain provides immutable transaction records that automatically populate Salesforce fields (reducing reconciliation time from hours to minutes while improving accuracy to 99.9%).

Treasury Operations Stay Within Salesforce Workflows

Finance teams waste significant time when they switch between banking portals, accounting systems, and CRM platforms to track payment status and update customer records. Native Salesforce stablecoin integration consolidates these operations into existing workflows where teams can approve payments, monitor settlement, and update customer accounts from the same interface. Treasury managers can view real-time cash positions, pending settlements, and vendor payment schedules through Salesforce dashboards instead of multiple system logins.

This unified approach improves visibility into cash flow patterns that inform strategic decisions about working capital optimization.

Real-Time Payment Tracking Within CRM Workflows

Traditional payment tracking requires manual status checks across multiple systems, which creates information gaps and delays response times to customer inquiries. Stablecoin payments provide instant blockchain confirmation that updates Salesforce records automatically. Sales teams can see payment status in real-time during customer calls, while finance teams receive immediate notifications when settlements complete. This transparency eliminates the typical 24-48 hour delay between payment initiation and status visibility (allowing teams to provide accurate payment information instantly). Customer service representatives can now answer payment questions immediately rather than promise callbacks after system checks.

The next step involves setting up these automated workflows to maximize operational efficiency while maintaining compliance standards.

Implementation Best Practices for Stablecoin Adoption

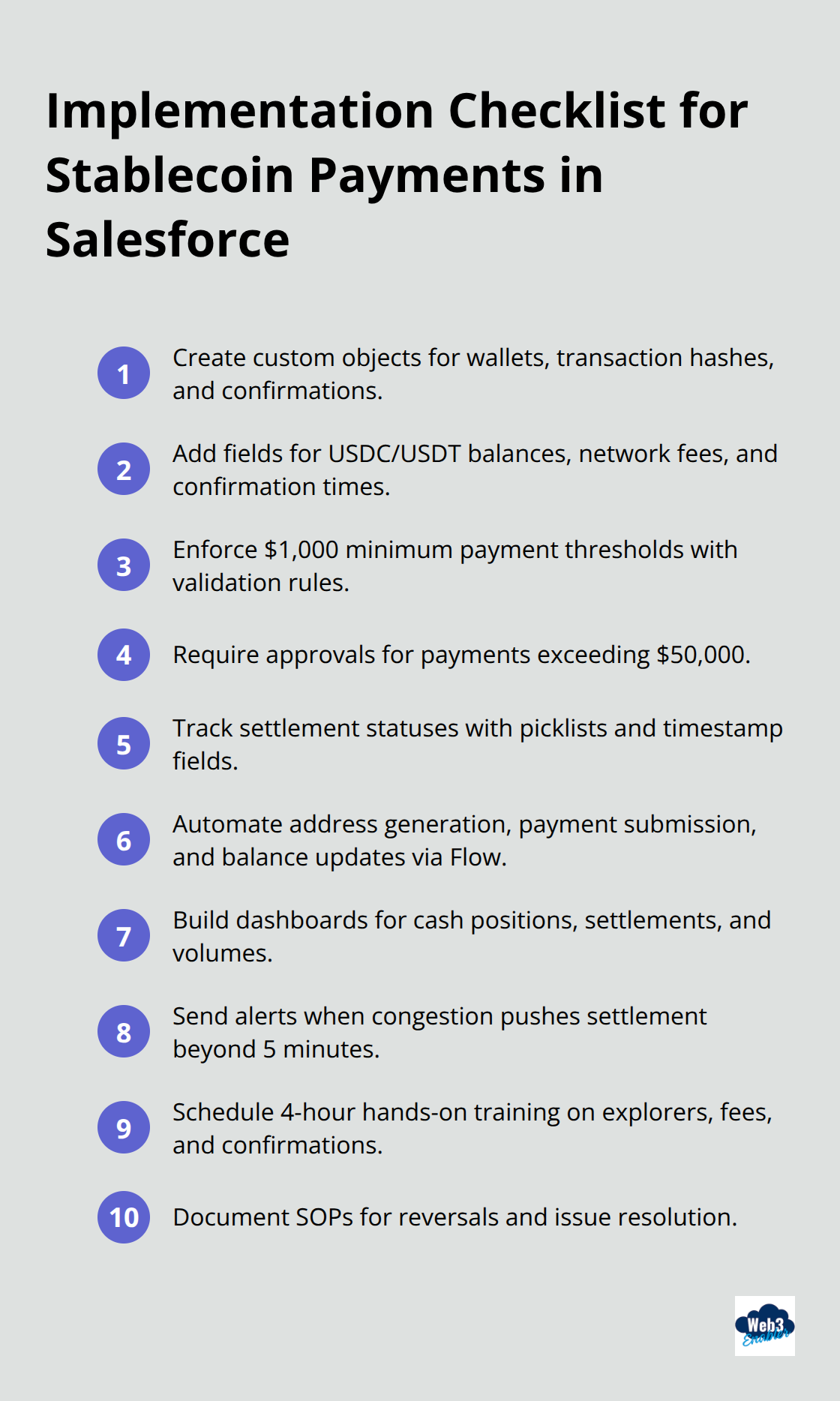

Implementing stablecoin payments requires specific configuration steps to handle digital currency transactions effectively. Start by creating custom objects that track wallet addresses, transaction hashes, and settlement confirmations within your existing account and opportunity structures. Finance teams need dedicated fields for USDC and USDT balances, network fees, and blockchain confirmation times. Configure validation rules that prevent payments below $1,000 minimum thresholds, which eliminates micro-transactions that waste network resources. Set up approval processes for payments exceeding $50,000 to maintain internal controls while preserving the speed advantages of blockchain settlement. The Commercial Bank of Dubai improved customer engagement through similar Salesforce implementations, and stablecoin integration follows comparable configuration patterns.

Custom Object Configuration for Payment Tracking

Treasury operations require custom Salesforce objects that capture blockchain-specific data points beyond traditional payment fields. Create wallet address fields with validation rules that verify proper format and checksum accuracy before payment initiation. Add transaction hash fields that automatically populate when payments process through blockchain networks.

Configure settlement status picklists that track pending, confirmed, and failed transaction states with timestamp fields for audit compliance. These custom objects integrate with standard Account and Opportunity records to provide complete payment visibility within existing CRM workflows (eliminating the need for external tracking systems).

Automated Settlement Workflows Reduce Manual Processing

Treasury operations become fully automated when you configure Flow Builder to trigger settlement processes based on invoice approval status and payment amounts. Create automated workflows that generate wallet addresses for new vendors, send payment instructions to blockchain networks, and update account balances upon settlement confirmation. Configure Einstein Analytics dashboards that display real-time cash positions across multiple stablecoin networks, pending settlements, and monthly transaction volumes. Set up notification rules that alert finance managers when settlements complete or when network congestion delays transactions beyond normal 5-minute windows. Alaan processes expense management for over 1,200 MENA businesses through similar automation, which demonstrates the scalability of these workflow configurations.

Finance Team Training Focuses on Blockchain Fundamentals

Finance teams need hands-on training with blockchain explorers, wallet security protocols, and transaction monitoring tools rather than theoretical cryptocurrency concepts. Schedule 4-hour training sessions that cover wallet address verification, network fee estimation, and settlement confirmation processes using live testnet environments. Teams must understand how to read blockchain transaction hashes, verify payment completion through network explorers, and troubleshoot common issues like insufficient network fees or wallet connectivity problems. Create standard operating procedures for payment reversals, which require different approaches than traditional banking chargebacks since blockchain transactions become irreversible after network confirmation.

Final Thoughts

Salesforce stablecoin payments deliver measurable financial benefits that transform treasury operations. Companies reduce transaction costs by 90% while they cut settlement times from days to minutes. These efficiency gains compound when businesses process hundreds of monthly payments, which creates annual savings that reach six figures for mid-sized enterprises.

Modern treasury teams gain strategic advantages through 24/7 payment processing and instant cross-border settlements. Finance departments eliminate weekend cash flow gaps and capture early payment discounts that traditional banking delays made impossible. Real-time blockchain transparency reduces reconciliation time from hours to minutes while it provides immutable audit trails (improving operational accuracy to 99.9%).

Treasury managers optimize working capital through continuous liquidity access and eliminate the need for excess cash reserves across multiple currencies. Vendor relationships improve through instant payment confirmation and reduced disputes. Web3 Enabler provides native blockchain integration on the Salesforce AppExchange, which enables finance teams to implement stablecoin payments without platform switching.