We at Web3 Enabler see companies scrambling when their stablecoin hedging strategies fall apart during market stress. Smart treasury management means preparing for the unexpected before it hits your bottom line.

What Makes Stablecoins Unstable

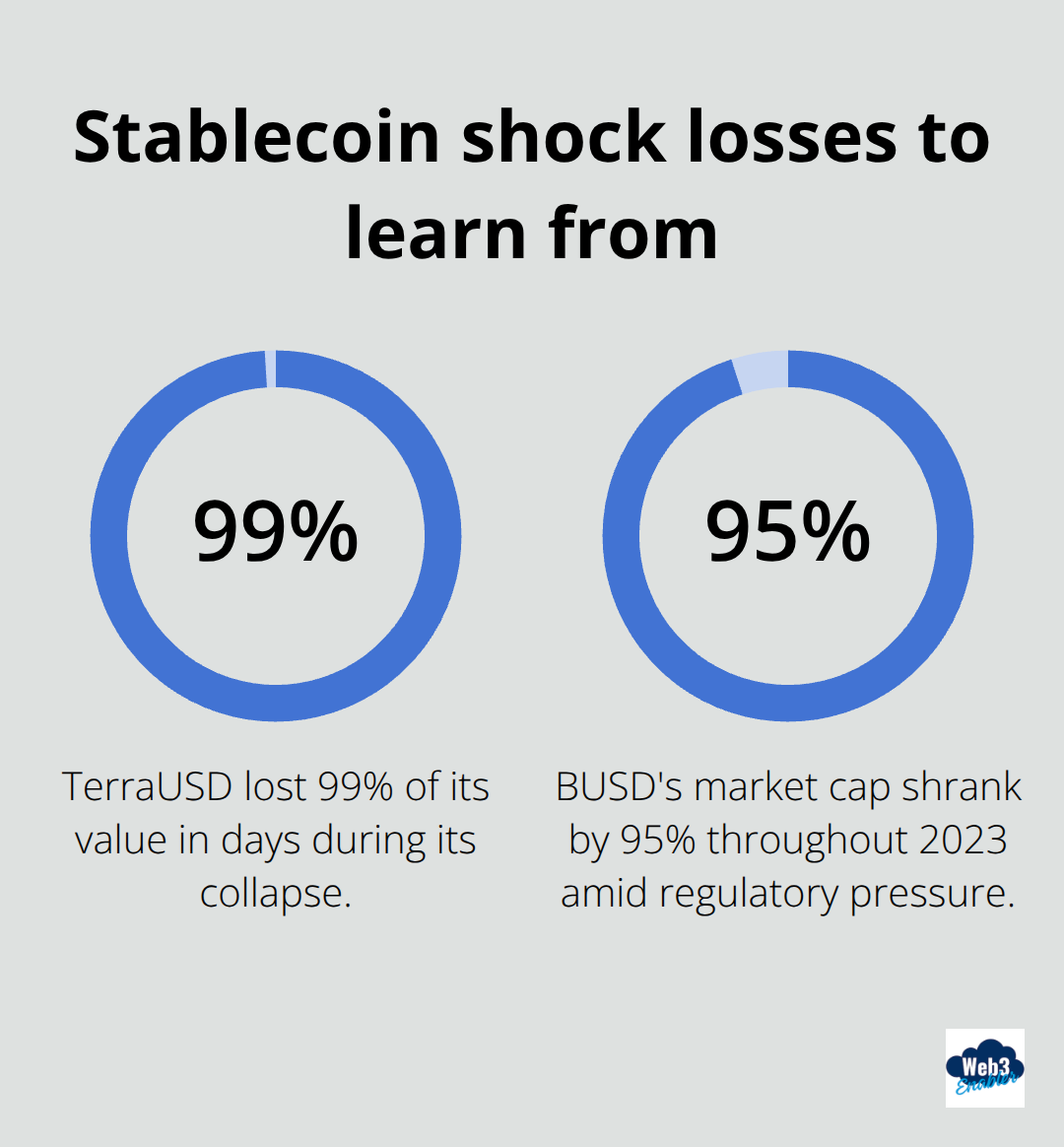

Stablecoin price stability mechanisms work until they don’t, and enterprise teams need to understand exactly where the cracks appear. USDC depegged to $0.87 in March 2023 when Silicon Valley Bank collapsed, which proved that even regulated stablecoins face serious risks. Tether has faced persistent questions about its reserves since 2017, while algorithmic stablecoins like TerraUSD completely imploded and lost 99% of their value in days.

The Federal Reserve’s 2023 report highlighted that stablecoin issuers hold reserves in commercial banks and short-term securities that can become illiquid when market stress hits. These mechanisms create vulnerabilities that treasury teams must account for in their payment strategies.

Regulatory Shocks Hit Fast

European Union’s Markets in Crypto-Assets regulation will ban multi-issuer stablecoins starting in 2024, which forces enterprises to restructure their payment strategies overnight. The Tornado Cash sanctions in 2022 showed how quickly regulatory action can freeze digital assets, with Circle immediately blacklisting affected addresses.

China’s central bank identified stablecoins as threats to financial stability back in 2017 and maintains strict restrictions that can impact global liquidity. Treasury teams should monitor regulatory calendars in major jurisdictions and maintain backup payment rails because compliance requirements change without warning periods.

Liquidity Vanishes When You Need It Most

Stablecoin liquidity drops dramatically when market volatility strikes, with bid-ask spreads widening from 0.01% to over 1% during the March 2020 crash. Coinbase reported trading halts for multiple stablecoins during peak volatility periods in 2022, which left enterprise payments stuck in limbo.

Smaller stablecoins like BUSD saw their market cap shrink by 95% throughout 2023 as regulatory pressure mounted (creating redemption bottlenecks that caught many treasury teams off guard). Smart treasury teams should stress-test their payment workflows with historical volatility data and maintain relationships with multiple exchanges to avoid single points of failure.

These volatility patterns reveal why enterprises need sophisticated hedging strategies that go beyond simple diversification approaches.

How Should You Hedge Stablecoin Payment Risks

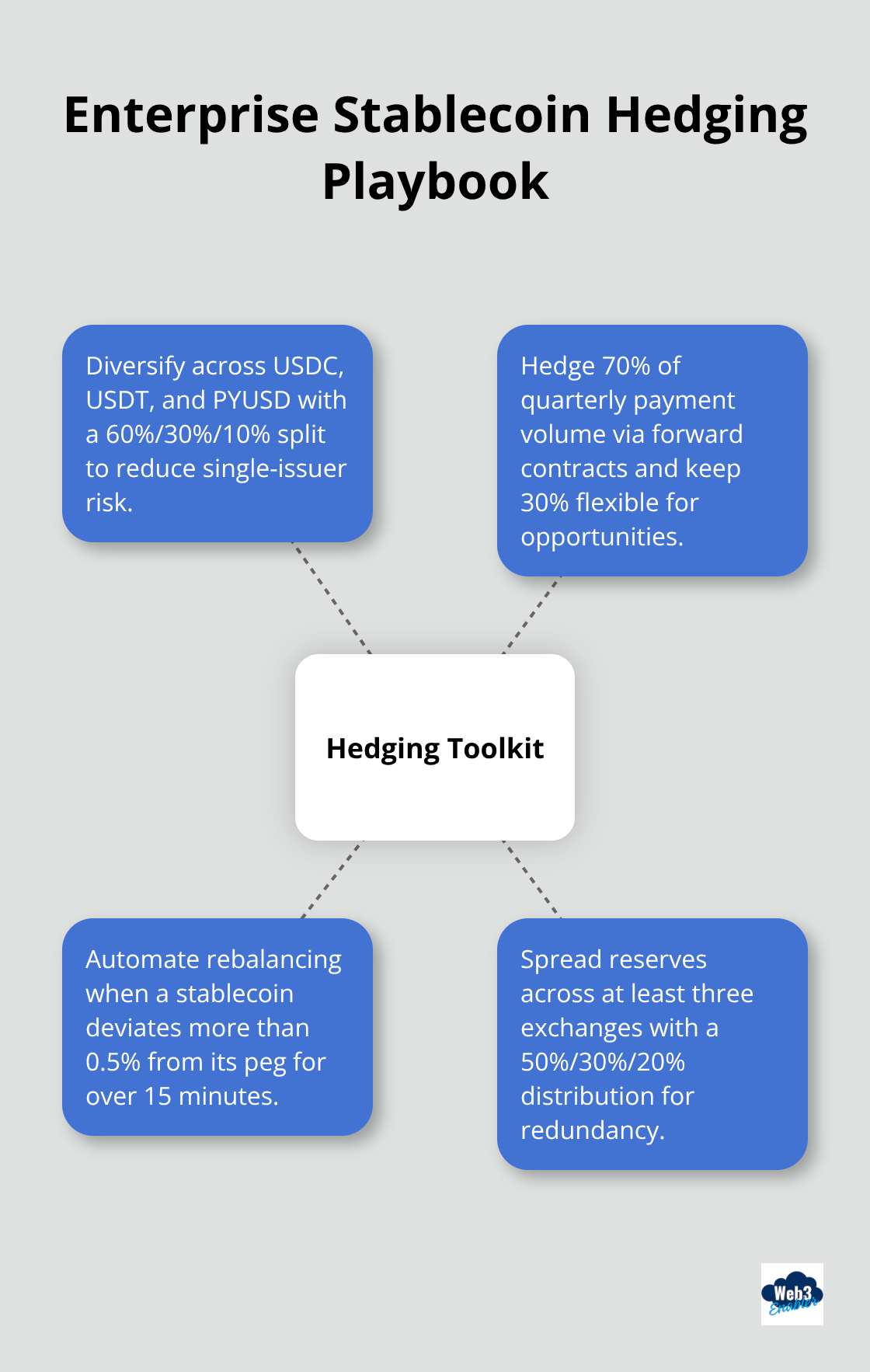

Enterprise teams need aggressive hedging strategies that match the speed of crypto volatility, not traditional finance timelines. Currency basket diversification works best when you split payments across USDC, USDT, and PYUSD rather than bet everything on one issuer.

Enterprise blockchain research shows that diversified stablecoin portfolios can help reduce volatility compared to single-stablecoin approaches during market stress. The key is to maintain 60% in the most liquid option like USDC, 30% in your backup choice, and 10% in regulated options like PayPal USD.

Forward Contracts Beat Spot Trading

Forward contracts through platforms like Cumberland and Genesis let treasury teams lock in stablecoin exchange rates up to 90 days ahead, which eliminates the guesswork when major payments are due. Circle offers institutional forward contracts that guarantee USDC redemptions at par value even during market stress (though these cost 15-25 basis points annually).

Smart treasury teams should hedge 70% of their quarterly payment volume through forwards and keep 30% flexible for opportunities. Traditional derivatives markets now offer stablecoin volatility swaps through CME Group, which gives enterprises the same risk management tools they use for foreign exchange.

Automated Rebalancing Saves Your Sanity

Real-time monitoring systems should trigger rebalancing when any single stablecoin deviates more than 0.5% from its peg for longer than 15 minutes. Fireblocks Treasury and similar platforms offer automated rebalancing that shifts funds between stablecoins based on predefined risk parameters.

The most effective setups monitor reserve ratios, trading volumes, and regulatory announcements across all major stablecoins simultaneously. Treasury teams should set alerts for unusual redemption patterns and maintain hot wallets with 5% of monthly volume across three different stablecoins for emergency rebalancing.

Multi-Exchange Liquidity Management

Treasury teams should spread their stablecoin holdings across at least three major exchanges to avoid single points of failure during market stress. Coinbase Pro, Binance, and Kraken each offer different liquidity pools and redemption mechanisms that can save your payments when one platform faces technical issues.

The smart approach involves maintaining 50% of your stablecoin reserves on your primary exchange, 30% on your secondary platform, and 20% distributed across smaller venues for redundancy (this strategy proved essential during the FTX collapse when many enterprises lost access to their funds overnight).

These hedging strategies require sophisticated treasury management systems that can handle multiple stablecoins, exchanges, and key risks of stablecoins simultaneously.

How Do You Actually Implement Multi-Stablecoin Treasury Systems

Enterprise treasury teams need operational frameworks that handle multiple stablecoins without creating administrative nightmares. Your treasury management system should automatically monitor reserve ratios across USDC, USDT, and PYUSD while maintaining separate accounting for each token type.

Fireblocks Treasury and Copper.co offer enterprise-grade platforms that integrate with existing ERP systems like SAP and Oracle (though setup typically takes 6-8 weeks for full deployment). These systems eliminate the manual tracking that creates bottlenecks in traditional crypto treasury operations.

Treasury Infrastructure That Actually Works

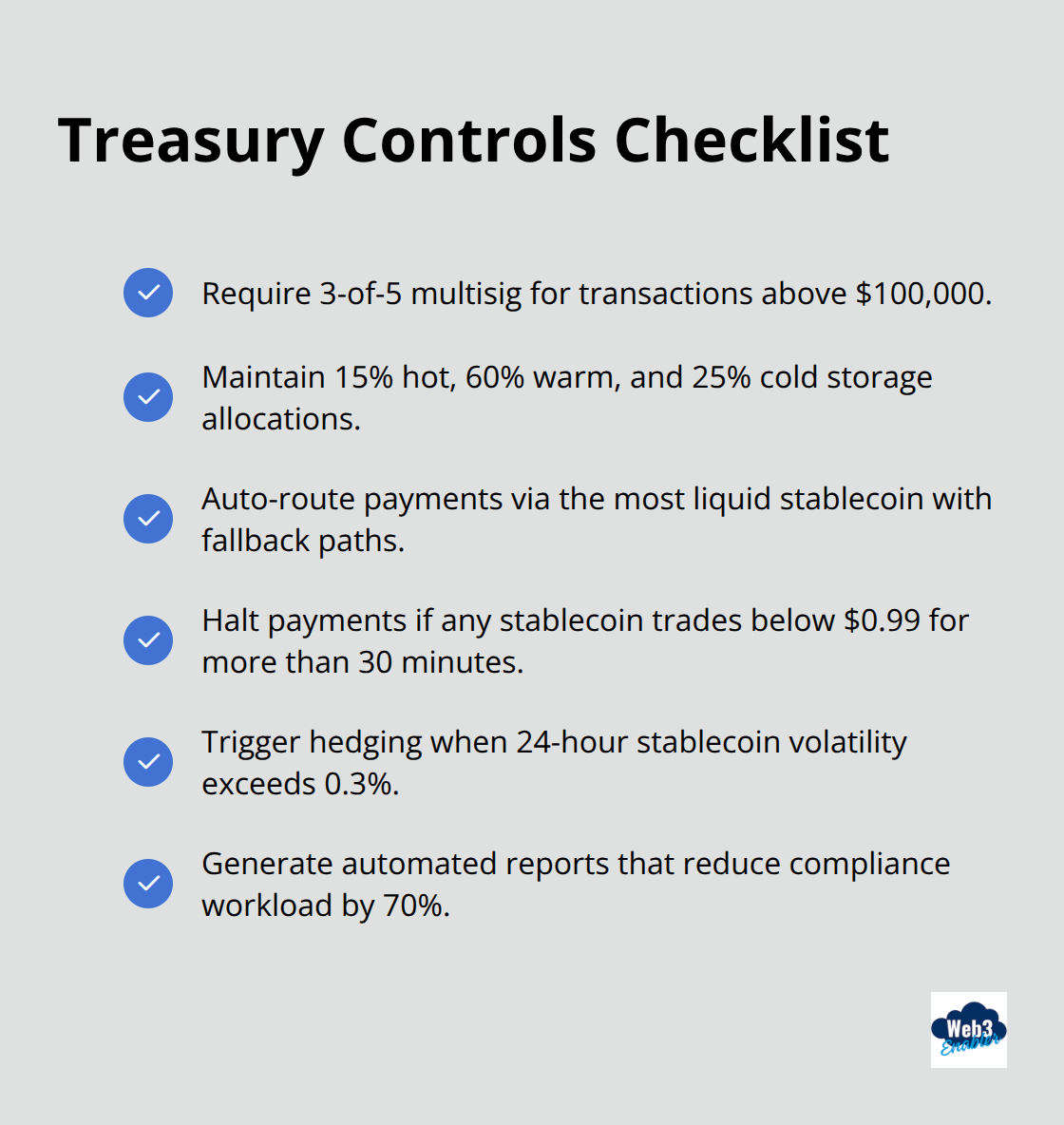

Multi-signature wallets should require at least 3-of-5 signatures for transactions above $100,000, with different approval thresholds for routine payments versus emergency rebalancing. Your system needs real-time visibility into exchange balances, on-chain holdings, and pending transactions across all stablecoins simultaneously.

Treasury teams should maintain 15% of monthly payment volume in hot wallets for immediate access, 60% in warm storage for weekly operations, and 25% in cold storage for security. Payment workflows should automatically route transactions through the most liquid stablecoin at execution time, with fallback options when primary tokens show stress signals.

Compliance Reporting That Makes Sense

Compliance reporting becomes manageable when your system generates audit trails that match traditional banking standards while capturing blockchain transaction hashes and timestamps. Most enterprise teams find that automated reporting reduces monthly compliance work by 70% compared to manual tracking across multiple exchanges and wallets.

Your compliance system should flag unusual transaction patterns and maintain detailed records for regulatory inquiries. Smart treasury teams configure their systems to generate monthly reports that satisfy both internal auditors and external regulators without manual intervention, especially considering stablecoins regulation requirements under the comprehensive regulatory framework established by the European Union.

Risk Management Integration Points

Payment workflows should trigger automatic hedging when stablecoin volatility exceeds 0.3% in any 24-hour period, with preset rebalancing rules that shift funds between tokens based on liquidity metrics. Your risk management system needs direct API connections to major exchanges for real-time pricing data.

The system should halt payments when any stablecoin trades below 99 cents for more than 30 minutes (this prevents enterprises from accepting depegged tokens during market stress). Treasury teams should set compliance alerts for regulatory changes in major jurisdictions and maintain backup payment rails through traditional banking when stablecoin markets show stress.

Final Thoughts

Stablecoin hedging separates successful enterprise teams from those caught off guard by market volatility. Companies that thrive maintain diversified portfolios across multiple tokens, implement automated rebalancing systems, and prepare for regulatory changes before they hit. Your payment infrastructure needs redundancy at every level.

Multi-exchange liquidity management prevents single points of failure, while forward contracts lock in predictable costs for quarterly budgets. Real-time monitoring systems catch problems before they impact your operations. Enterprise adoption requires more than just buying different stablecoins (you need treasury management systems that integrate with existing workflows and compliance reporting that satisfies auditors).

The enterprises that win with stablecoin payments focus on operational excellence rather than speculation. They build systems that work during normal market conditions and survive when volatility strikes. Web3 Enabler provides Salesforce-native blockchain solutions that connect stablecoin payments with existing corporate infrastructure, making enterprise adoption practical rather than experimental.