International contractor payments drain enterprise budgets through excessive fees and week-long delays. Traditional banking systems charge 3-7% in combined fees while requiring 5-10 business days for settlement.

International contractor payments drain enterprise budgets through excessive fees and week-long delays. Traditional banking systems charge 3-7% in combined fees while requiring 5-10 business days for settlement.

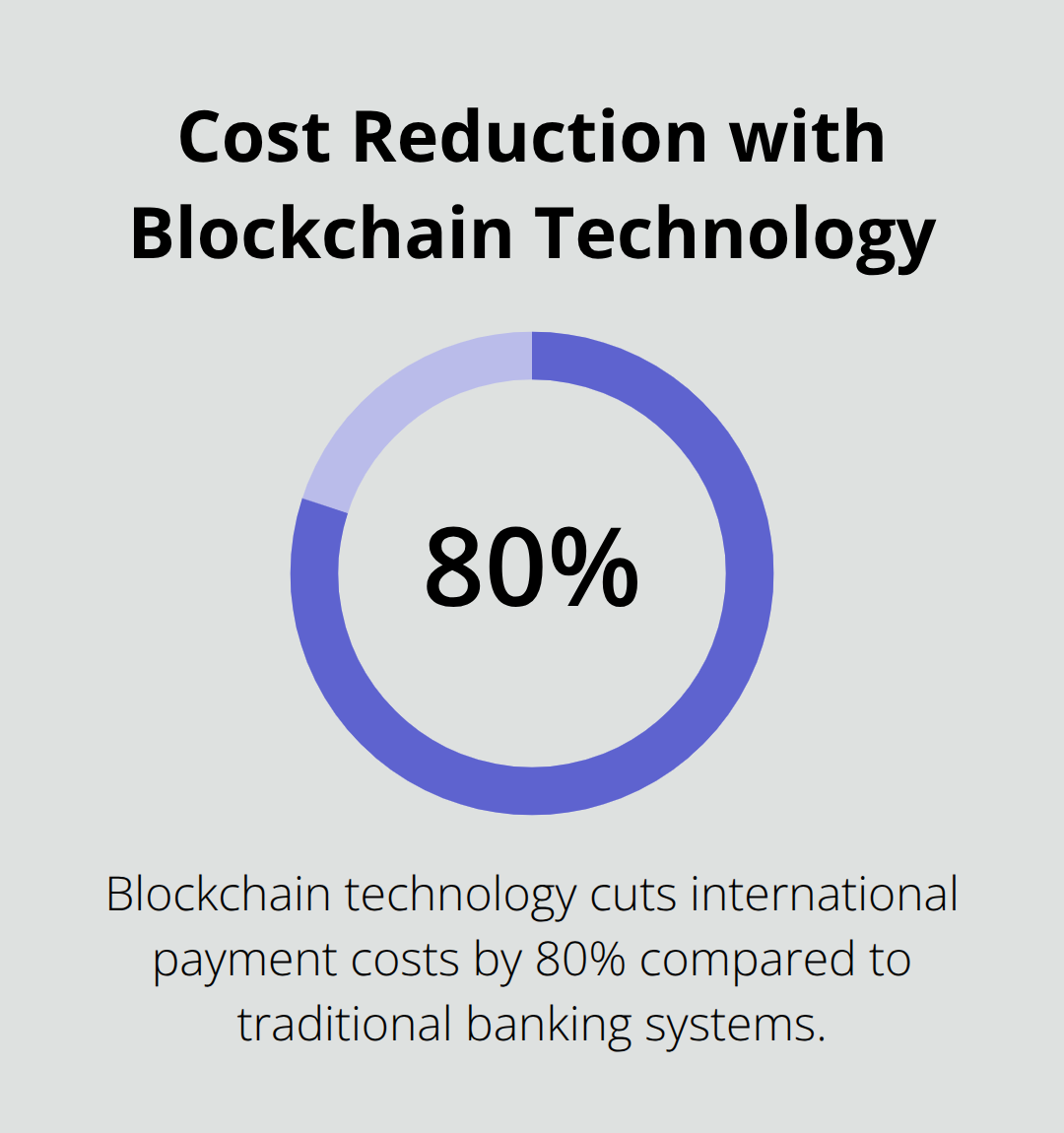

We at Web3 Enabler see crypto payments transforming how finance teams manage global contractor relationships. Blockchain technology cuts costs by 80% and reduces payment times to minutes, not days.

Why Traditional Payment Systems Fail International Contractors

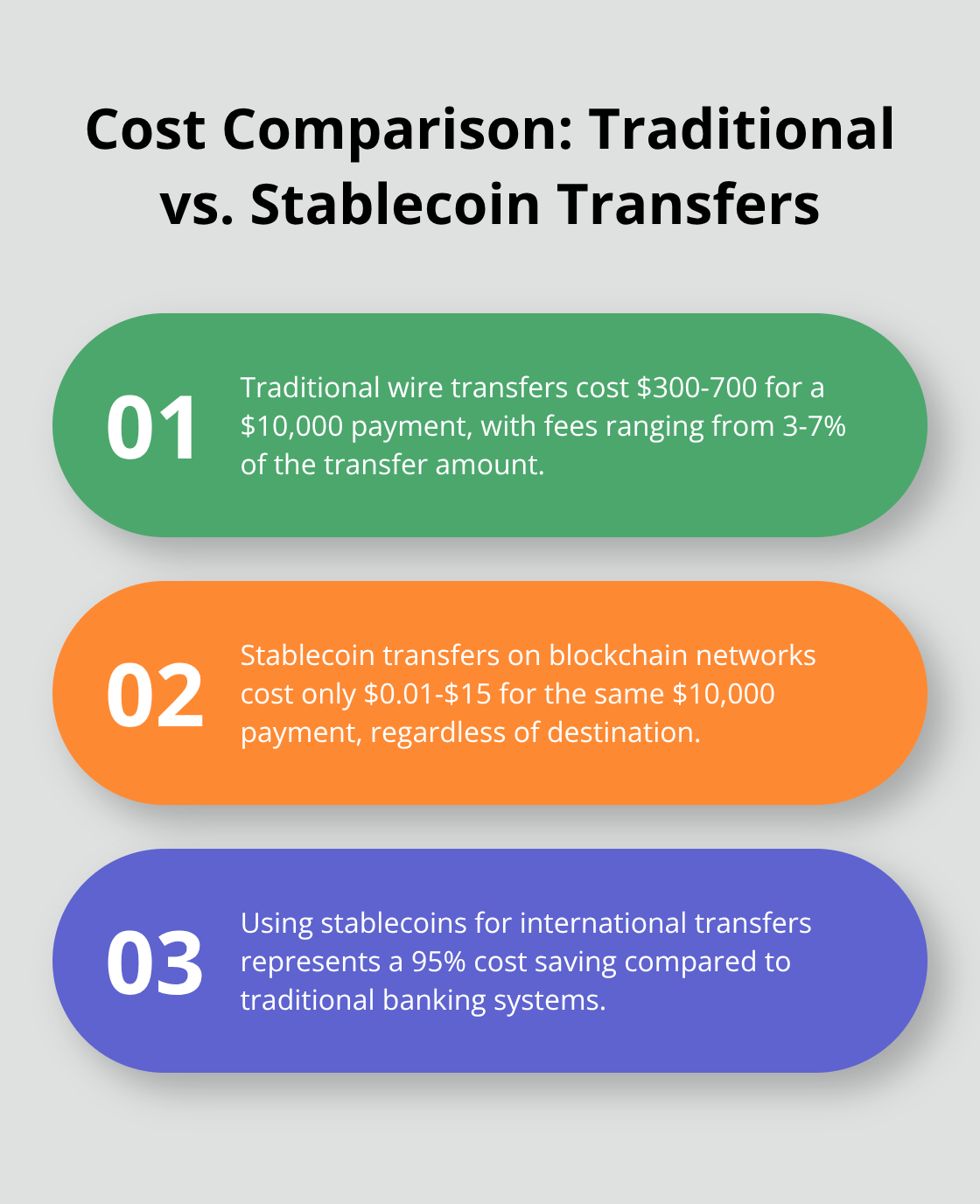

Finance teams lose thousands monthly to international payment inefficiencies that traditional banking systems refuse to address. Standard wire transfers consume 3-7% of payment value through combined fees, currency conversion spreads, and intermediary bank charges. A $10,000 contractor payment typically costs $300-700 in fees alone, with correspondent banks adding hidden markups on exchange rates where they offer rates less favorable than the interbank rate and pocket the difference.

Settlement Delays Create Operational Chaos

International wire transfers require 5-10 business days for completion, with weekends and holidays extending delays further. SWIFT network limitations force payments through multiple correspondent banks, each adding 1-2 days to processing time. Contractors in emerging markets face additional delays as local banks impose holding periods of 3-5 days before funds become available.

These delays damage contractor relationships and force finance teams into constant status update cycles that consume valuable resources. Project timelines suffer when contractors cannot access funds to purchase materials or pay subcontractors.

Documentation Requirements Multiply Administrative Burden

Traditional international payments demand extensive documentation that slows operations and increases error rates. Each wire transfer requires beneficiary bank details, SWIFT codes, purpose codes, and regulatory compliance forms specific to destination countries. Anti-money laundering requirements force banks to scrutinize every transaction, creating unpredictable approval delays ranging from hours to weeks.

Currency controls in countries like India and China add additional reporting layers that require transaction-level data including name of the actual exporter, Unified Social Credit Code, and export amount with declaration numbers. Finance teams spend 15-20 hours monthly managing documentation requirements alone.

Hidden Costs Compound Payment Expenses

Banks layer multiple fees onto international transfers that often exceed disclosed rates. Correspondent bank fees (typically $15-50 per intermediary), receiving bank charges ($10-30), and currency conversion spreads create cost structures that vary unpredictably. Some payments encounter three or four intermediary banks, multiplying these charges exponentially.

Blockchain technology offers a direct alternative to these systemic inefficiencies, eliminating intermediaries and reducing both costs and complexity.

How Crypto Transforms International Payment Speed and Cost

Stablecoin payments through blockchain networks cut international transfer costs to under 1% while they settle in 2-3 minutes regardless of destination country. USDC transactions on Polygon network cost approximately $0.01 per transfer, compared to $300-700 for traditional wire transfers on $10,000 payments. Ethereum-based stablecoins like USDT process payments in under 15 minutes with fees that range from $2-15 (depending on network congestion), still representing 95% cost savings over correspondent banking systems.

Direct Peer-to-Peer Settlement Eliminates Banking Delays

Blockchain networks operate 24/7 without weekend closures or banking holidays that plague traditional systems. Smart contracts automatically execute payments when conditions are met, which removes human approval bottlenecks that cause 2-5 day delays in conventional transfers. Contractors receive funds directly into their digital wallets without waiting for local bank processing periods or currency conversion delays. Rise platform has processed over $800 million in transactions across 190 countries, demonstrating enterprise-scale reliability for crypto payroll systems.

Real-Time Transaction Visibility Replaces Payment Uncertainty

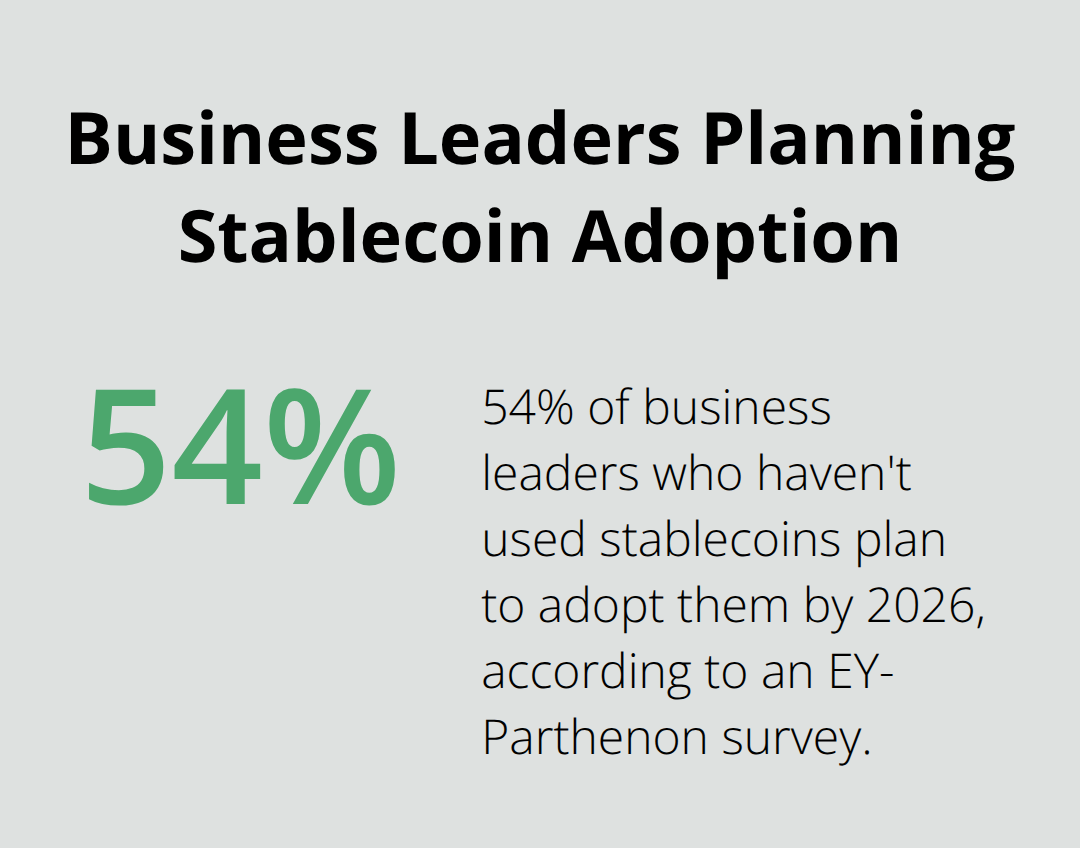

Blockchain explorers provide complete payment transparency with transaction hashes that contractors can verify independently within minutes of initiation. Finance teams track payment status in real-time through immutable ledger records that eliminate the need for bank inquiry calls or status update emails. Each transaction includes timestamp data, fee calculations, and confirmation status that creates audit-ready documentation automatically. According to an EY-Parthenon survey, 54% of business leaders who have yet to touch stablecoins plan to do so by 2026, with enterprises adopting crypto specifically for payment transparency and speed advantages over traditional banking infrastructure.

Enterprise Integration Streamlines Crypto Payment Adoption

Modern crypto payment platforms integrate directly with existing enterprise systems to minimize operational disruption during implementation. Finance teams can initiate payments through familiar interfaces while blockchain technology handles the complex settlement processes behind the scenes. This integration approach allows companies to capture crypto benefits without retraining staff or abandoning established workflows that already support their business operations.

How Native Salesforce Integration Changes Crypto Payments

Enterprise crypto payment adoption accelerates when blockchain functionality integrates directly into existing Salesforce workflows rather than forces finance teams to learn new platforms. We at Web3 Enabler provide 100% native Salesforce support for cryptocurrencies and digital assets, which connects blockchain transactions to existing corporate infrastructure without separate payment portals or additional software licenses. Finance teams initiate contractor payments through familiar Salesforce interfaces while blockchain technology handles settlement processes automatically, which reduces training requirements and implementation resistance that typically delays crypto adoption (6-12 months).

Automated Tax Compliance Eliminates Manual Work

Native Salesforce integration automatically generates IRS-compliant 1099 forms for crypto payments to contractors, calculates fair market values at payment dates, and tracks cost basis for tax reports. The system captures transaction hashes, payment amounts in both crypto and USD equivalents, and contractor wallet addresses to create audit-ready documentation that satisfies regulatory requirements across multiple jurisdictions. Finance teams benefit from streamlined tax preparation processes while they reduce compliance errors that trigger IRS audits. Integration with existing Salesforce workflows means crypto payment data flows directly into general ledger systems without manual data entry or reconciliation processes.

Real-Time Payment Visibility Through Salesforce Dashboards

Blockchain transaction visibility integrates directly into Salesforce dashboards, which provides finance teams with real-time payment status updates without platform switches. Each contractor payment displays confirmation status, network fees, transaction hashes, and estimated completion times within existing Salesforce case management workflows. Payment exceptions trigger automatic notifications through established Salesforce alert systems, which enables proactive issue resolution before contractors experience delays. This unified visibility eliminates the need for separate blockchain explorers or payment tools that fragment operational workflows and increase system complexity for enterprise finance teams.

Streamlined Contractor Onboarding Process

Salesforce-native crypto payments simplify contractor onboarding through automated wallet verification and KYC processes that integrate with existing vendor management systems. Finance teams can verify contractor identities, validate wallet addresses, and establish payment preferences without leaving their Salesforce environment. The platform automatically creates contractor profiles with crypto payment capabilities while it maintains compliance with international regulations (including GDPR and AML requirements). This integration reduces contractor onboarding time from weeks to days while it maintains the security standards that enterprise finance teams require.

Final Thoughts

Crypto contractor payments deliver measurable financial benefits that transform enterprise payment operations. Finance teams save 80% on international transfer costs while they reduce settlement times from 5-10 business days to under 15 minutes. A $10,000 contractor payment costs $300-700 through traditional banks but only $2-15 via stablecoin transfers on blockchain networks.

Native Salesforce integration eliminates the operational disruption that typically delays crypto adoption by 6-12 months. Finance teams manage contractor payments within existing workflows while automated compliance features generate IRS-compliant documentation and audit trails. Real-time transaction visibility through Salesforce dashboards replaces the uncertainty and manual tracking that plague traditional wire transfers.

The 54% of business leaders who plan stablecoin adoption by 2026 recognize that blockchain technology offers competitive advantages in global talent acquisition and retention (EY-Parthenon survey). Companies that delay crypto payment implementation risk losing contractors to competitors who offer faster, cheaper payment methods. Web3 Enabler provides the enterprise-grade infrastructure needed to capture these benefits immediately through 100% native Salesforce support that connects blockchain transactions to existing corporate systems.