Cross-border payments have plagued businesses for decades with slow settlement times and hefty fees. Traditional banking systems can take 3-5 days to process international transfers while charging up to 6% in transaction costs.

Ripple cross border payments offer a revolutionary alternative. We at Web3 Enabler have seen how this technology transforms treasury operations by reducing settlement times to seconds and cutting costs by up to 60% compared to legacy systems.

How Ripple Transforms Cross Border Payments

Faster Settlement Times Compared to Traditional Banking

Traditional banks process international transfers through correspondent networks that require multiple intermediaries and manual verification steps. This outdated system forces businesses to wait 3-5 days for funds to reach recipients across borders.

Ripple settlements complete in 3-5 seconds on the XRP Ledger, which processes up to 1,500 transactions per second. Financial institutions that use RippleNet report transaction completion times that are 1,000 times faster than SWIFT transfers. This speed advantage transforms treasury operations by freeing up working capital that previously sat locked in transit for days.

Lower Transaction Costs for International Transfers

Cross-border payment fees through traditional channels typically range from 3-6% of the transfer amount, with hidden exchange rate markups that add another 2-4% in costs. Ripple transactions cost as little as $0.0002 per transfer, which represents savings of up to 99% compared to legacy systems.

The XRP token serves as a bridge currency that eliminates the need for pre-funded nostro accounts (banks typically maintain $27 trillion globally in these accounts according to McKinsey research). Major banks, including SBI Holdings, Santander, and PNC Bank, use RippleNet’s infrastructure for faster cross-border payments and report cost reductions of 40-70% when they switch from correspondent networks to Ripple’s infrastructure.

Enhanced Transparency and Real-Time Tracking

Traditional international transfers disappear into correspondent networks where neither sender nor recipient can track progress or predict arrival times. Ripple provides end-to-end transaction visibility with real-time status updates throughout the payment journey.

Treasury teams gain instant confirmation when funds leave their accounts, cross borders, and reach final destinations. This transparency eliminates the need for costly payment investigations and reduces customer service inquiries by 60% according to institutions that use RippleNet. Finance departments can now reconcile international payments immediately instead of waiting days for settlement confirmations.

These speed, cost, and transparency improvements create the foundation for Ripple’s comprehensive technology infrastructure that powers global payment networks.

Ripple’s Technology and Network Infrastructure

RippleNet connects over 300 financial institutions across 40+ countries through a unified API that eliminates the complexity of multiple correspondent banking relationships. This private network operates 24/7/365 and allows banks to process payments instantly without nostro accounts that typically lock up $27 trillion globally (according to McKinsey data). Major institutions like Bank of America, Standard Chartered, and Santander use RippleNet to bypass SWIFT’s multi-day settlement windows and reduce operational overhead by 40-70% compared to traditional correspondent networks.

XRP Ledger Powers Enterprise-Scale Operations

The XRP Ledger processes transactions through a consensus mechanism that validates payments in 3-5 seconds without energy-intensive mining requirements. This decentralized architecture handles 1,500 transactions per second with built-in exchange functionality that automatically converts currencies during cross-border transfers. Financial institutions can issue their own tokens on the ledger and create custom payment rails for specific corridors while they maintain interoperability with XRP as the bridge currency. The ledger’s native multi-signature capabilities allow corporate treasury teams to implement approval workflows directly on-chain, which reduces compliance overhead and eliminates manual authorization delays.

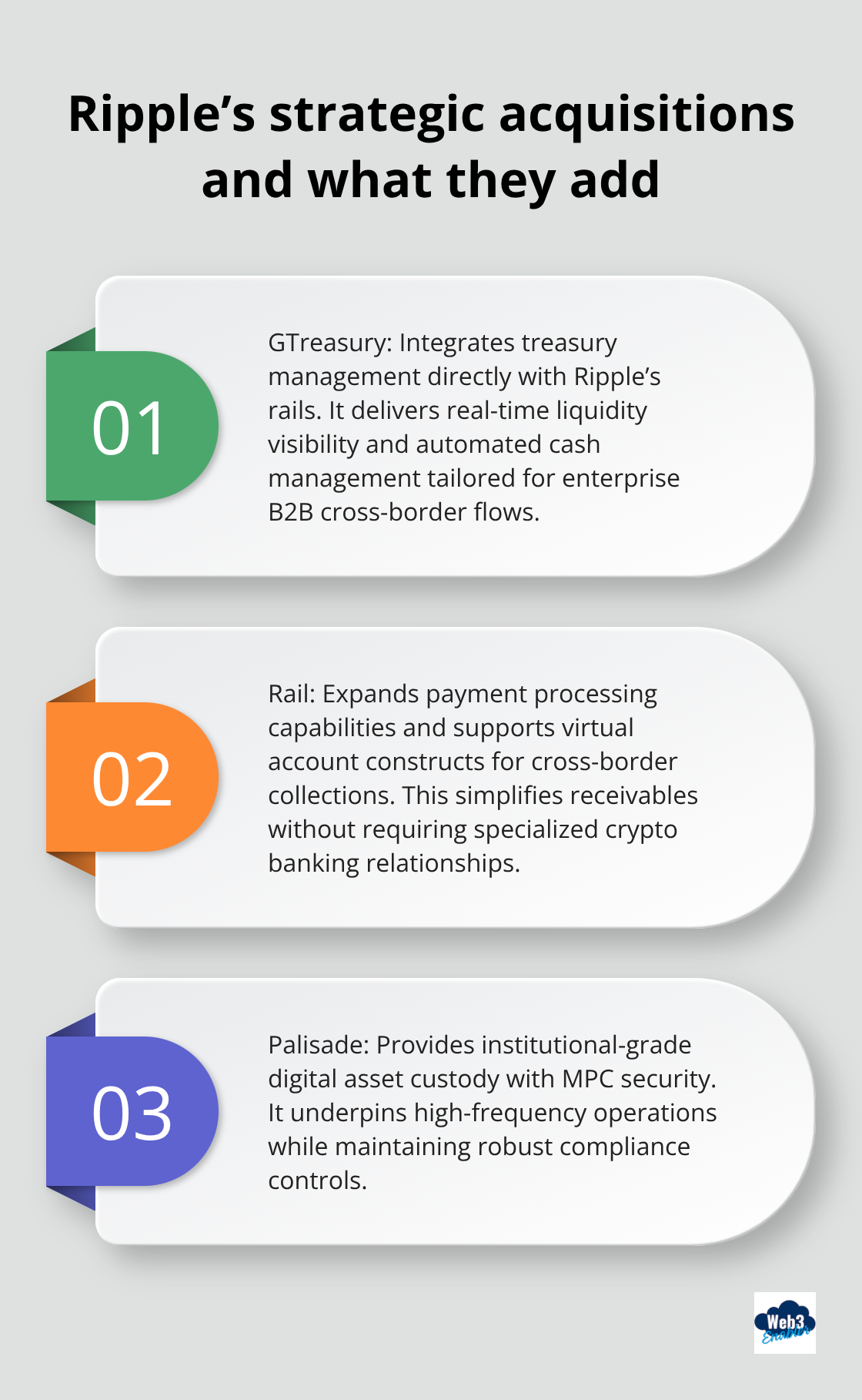

Strategic Acquisitions Create Comprehensive Infrastructure

Ripple’s recent $4 billion investment strategy includes acquisitions of GTreasury for $1 billion, Rail for $200 million, and Palisade for custody services. These acquisitions create an integrated infrastructure stack that provides corporate clients with end-to-end treasury management, stablecoin payment processing, and institutional-grade digital asset custody through a single platform. The GTreasury integration specifically targets the B2B cross-border payments market and offers real-time liquidity visibility plus automated cash management for enterprise clients.

Financial institutions can now offer their corporate customers comprehensive blockchain-powered treasury solutions without internal expertise development or multiple vendor relationship management. These integrated capabilities position Ripple as a complete financial infrastructure provider that addresses the full spectrum of enterprise payment and treasury needs.

Benefits for Financial Services and Enterprises

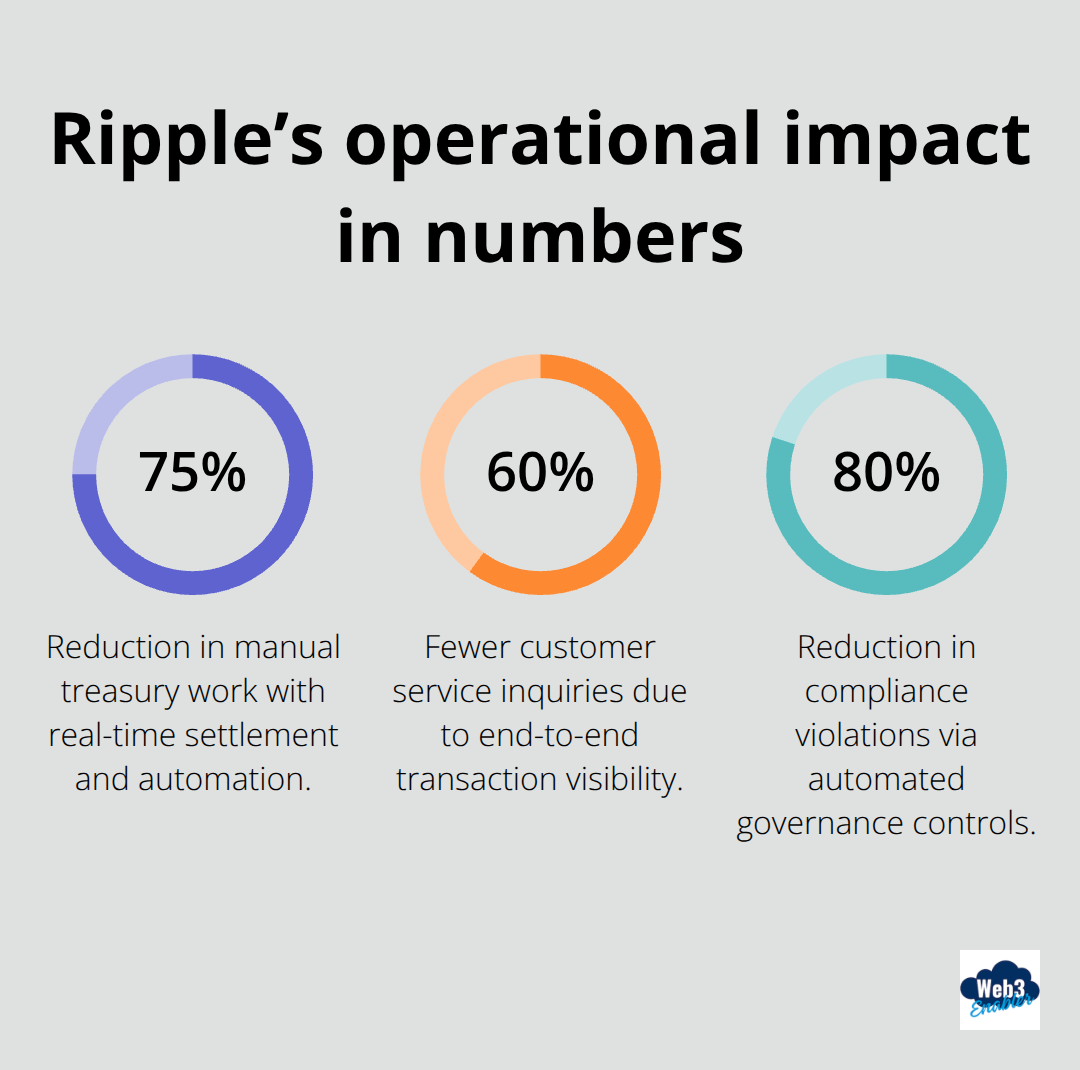

Corporate treasurers waste 15-20 hours weekly on international payment exceptions and reconciliation tasks through traditional banks. Ripple eliminates this operational drain and provides real-time settlement confirmation with automated reconciliation capabilities that reduce manual treasury work by 75%. Companies that adopt blockchain payment solutions report their finance teams now focus on strategic cash management instead of chasing payment status updates across multiple correspondent banks. GTreasury clients process over $1 billion in daily payment volume and gain instant visibility into global liquidity positions through Ripple’s integrated infrastructure, while Rail’s virtual account system allows businesses to handle cross-border collections without specialized crypto bank relationships.

Treasury Teams Cut Payment Processing Costs by 30-40%

Finance departments at companies like Santander and SBI Holdings eliminate nostro account requirements that typically lock up millions in capital across multiple currencies. These institutions redirect freed capital toward revenue activities while they reduce foreign exchange exposure through XRP’s bridge currency functionality. Corporate clients that use Ripple Prime access institutional-grade OTC services and custody solutions that have grown 3X in transaction volume, which enables treasury teams to optimize liquidity management across digital and traditional assets. The unified API approach means finance teams integrate once and access global payment rails, custody solutions, and compliance reports through a single platform instead of relationships with dozens of correspondent banks.

Automated Compliance Controls Reduce Regulatory Overhead

Ripple’s 60+ global licenses and built-in compliance framework eliminate the need for treasury teams to navigate complex regulatory requirements across multiple jurisdictions independently. Automated governance rules execute before transaction completion, which reduces compliance violations by 80% compared to manual approval processes. Multi-party computation technology in Palisade’s custody solution provides institutional-grade security while it maintains operational efficiency for high-frequency transactions.

Real-Time Visibility Eliminates Payment Investigation Costs

Financial institutions report 60% fewer customer service inquiries about payment status because end-to-end transaction visibility eliminates uncertainty and reduces investigation costs that typically consume 20-30% of operations budgets (according to industry data). Treasury teams receive instant confirmation when funds leave accounts, cross borders, and reach final destinations. This transparency allows finance departments to reconcile international payments immediately instead of wait days for settlement confirmations.

Final Thoughts

Ripple cross border payments have transformed how financial institutions handle international transfers. The technology delivers 3-second settlements compared to traditional banking’s 3-5 day delays while it reduces transaction costs by up to 99%. Over 300 institutions now use RippleNet to eliminate nostro account requirements and free up the $27 trillion typically locked in correspondent relationships.

The infrastructure creates measurable operational improvements across treasury departments. Teams reduce manual payment work by 75% and eliminate 60% of customer service inquiries through real-time transaction visibility. Corporate clients gain instant liquidity management across global markets while automated compliance controls reduce regulatory violations by 80% (according to industry data).

Financial institutions ready to modernize their payment infrastructure should evaluate integration within existing systems. Web3 Enabler provides a native platform on Salesforce AppExchange that enables organizations to accept stablecoin payments and streamline global settlements directly within Financial Services Cloud. This approach allows finance teams to leverage benefits while they maintain familiar CRM workflows and compliance frameworks.