KYC processes are drowning financial services in paperwork, delays, and compliance headaches. Traditional identity verification takes weeks and costs banks millions annually.

We at Web3 Enabler see KYC blockchain technology changing this game completely. Salesforce’s native blockchain solutions now offer instant verification, automated compliance, and bulletproof security that makes traditional KYC look prehistoric.

What Makes Blockchain KYC Different

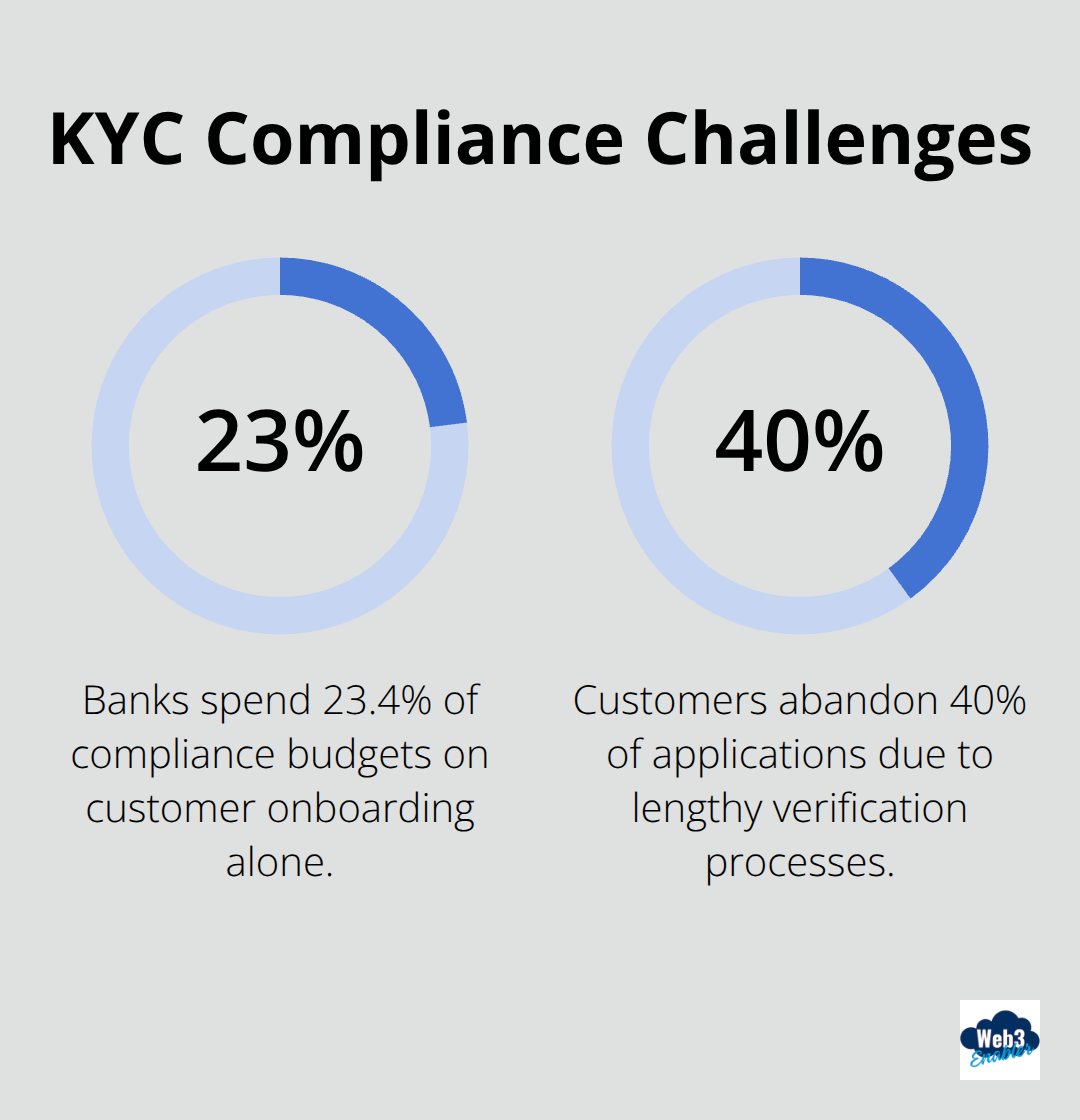

Traditional KYC verification creates permanent bottlenecks that cost financial institutions significant amounts annually. Banks spend 23.4% of their compliance budgets on customer onboarding alone, while customers abandon 40% of applications due to lengthy verification processes. Blockchain technology flips this broken system on its head through three game-changing improvements that make traditional KYC look like sending faxes in 2025.

Permanent Identity Records That Actually Work

Blockchain creates tamper-proof identity records that eliminate repetitive verification across institutions. When JPMorgan Chase verifies a customer’s identity on blockchain, that verification becomes instantly available to other participating financial institutions without starting from scratch. This shared verification model reduces individual bank KYC costs by up to 50% while cutting customer onboarding time from weeks to hours. The immutable ledger means fraudsters cannot manipulate historical verification data, creating a security standard that centralized databases simply cannot match.

Real-Time Compliance That Saves Millions

Smart contracts automate compliance reporting and generate audit trails in real-time, eliminating manual oversight that typically requires teams of compliance officers. Financial institutions that use blockchain-based KYC report 70% faster regulatory reporting and 60% reduction in compliance-related penalties. The technology provides regulators with instant access to complete audit trails, transforming regulatory examinations from months-long ordeals into streamlined digital reviews. This automation directly translates to operational savings that can reach $30 million annually for large financial institutions.

Decentralized Security That Stops Data Breaches

Centralized KYC databases create single points of failure that attract cybercriminals who target millions of identity records simultaneously. Blockchain distributes customer data across multiple nodes, making large-scale data breaches virtually impossible since attackers cannot compromise the entire network from one entry point. Financial institutions report 85% fewer security incidents after they implement blockchain-based identity management, while customers gain control over their personal data sharing permissions rather than trust institutions with permanent storage of sensitive information.

The Salesforce Native Advantage

Salesforce native blockchain solutions take these benefits further by integrating directly with existing CRM workflows (no complex system overhauls required). Financial advisors can verify customer identities within their familiar Salesforce interface while maintaining complete audit trails for regulatory compliance. This seamless integration means institutions can modernize their KYC processes without disrupting established customer relationship management practices or requiring extensive staff retraining.

How Salesforce Native Blockchain Actually Works

Salesforce native blockchain KYC transforms customer verification from a weeks-long nightmare into instant digital validation that happens inside your existing CRM workflows. Financial institutions can now verify customer identities in real-time without leaving their familiar interface, while automated smart contracts generate compliance reports that satisfy regulatory requirements instantly. This integration means advisors spend zero time on new system training while they gain access to tamper-proof identity verification that reduces onboarding costs by 65% according to recent Deloitte implementation studies.

Instant Verification Inside Your CRM Dashboard

Customer verification now happens directly within Salesforce customer records, where advisors validate identities with a single click that accesses blockchain-verified credentials from participating financial institutions. This eliminates the traditional back-and-forth between different verification systems and reduces KYC onboarding time by approximately 50% for most financial services. The blockchain integration provides advisors with complete visibility into verification status, compliance flags, and audit trails without switching between multiple applications or waiting for manual approval processes.

Automated Compliance That Actually Works

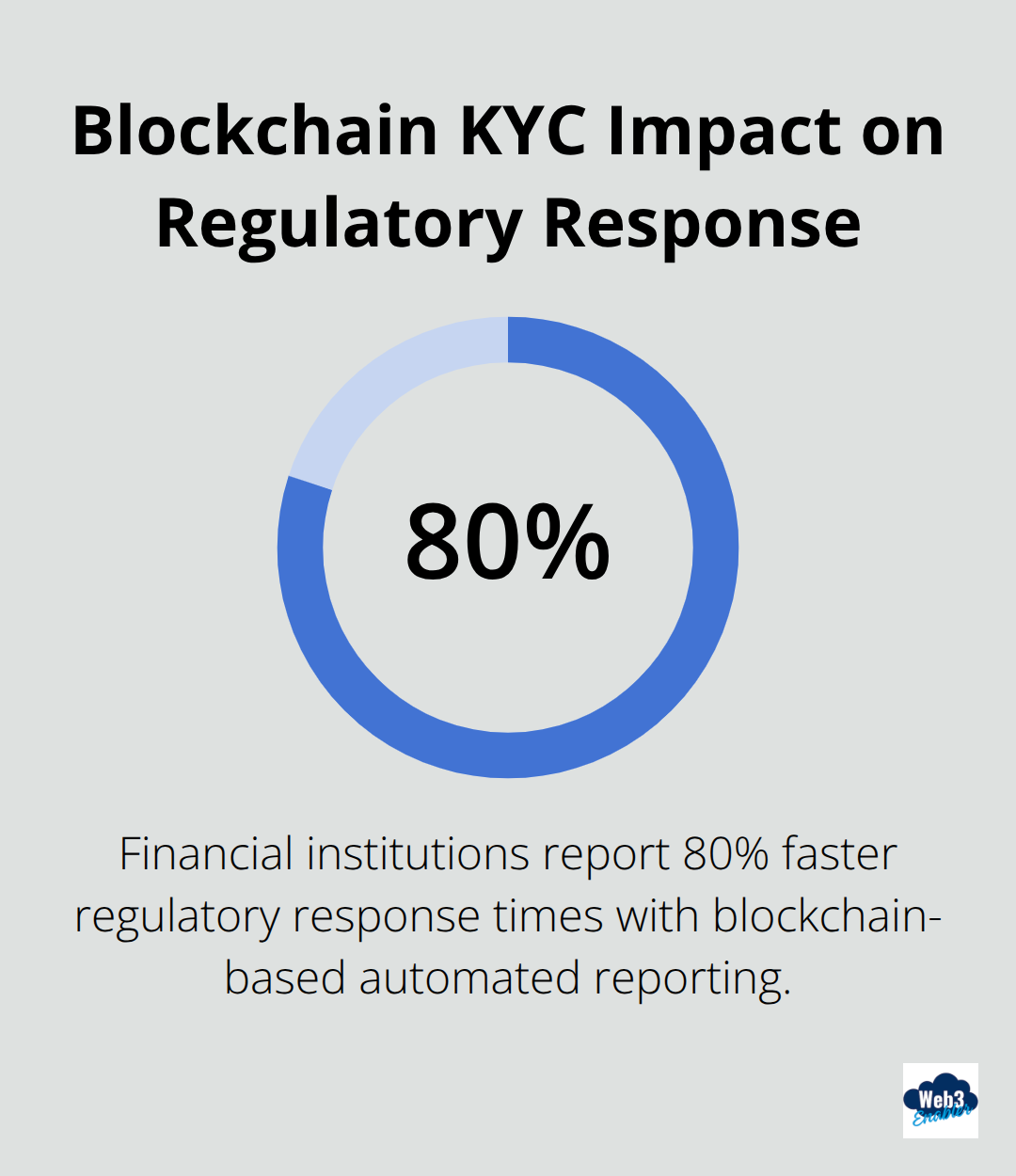

Smart contracts automatically generate regulatory reports and maintain audit trails that satisfy AML and KYC requirements without human intervention (goodbye to compliance teams that typically cost large banks $15 million annually). The system flags suspicious activities in real-time and routes alerts directly to compliance officers through Salesforce notifications, while it maintains immutable records that regulators can access instantly during examinations. Financial institutions report 80% faster regulatory response times and zero compliance-related penalties after they implement blockchain-based automated reporting systems.

Seamless Data Integration Without System Overhauls

The native Salesforce blockchain solution integrates with existing customer data management workflows without requiring complex system migrations or extensive IT infrastructure changes. Financial advisors access blockchain verification features through their standard Salesforce interface, while the system automatically syncs verified customer data across all connected financial institutions (no manual data entry required). This seamless integration means institutions can modernize their KYC processes while they maintain their established customer relationship management practices and avoid the typical $2-5 million system replacement costs.

These technical capabilities set the foundation for the substantial business benefits that financial services organizations experience when they implement blockchain KYC solutions.

What ROI Can Financial Services Expect

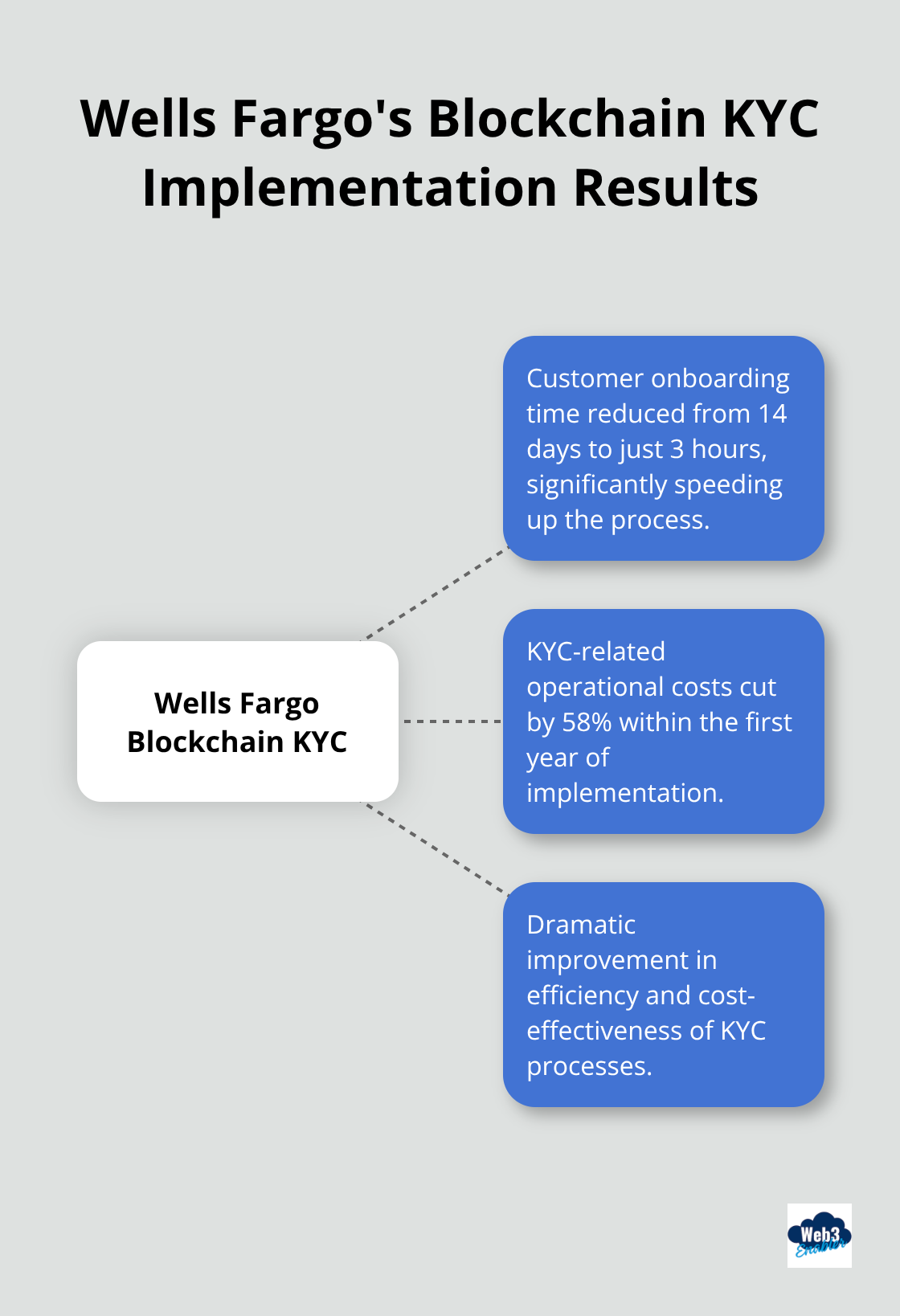

Financial institutions that implement blockchain KYC through Salesforce report immediate operational improvements that directly impact their bottom line. Wells Fargo reduced customer onboarding time from 14 days to 3 hours after it implemented blockchain identity verification, while it cut KYC-related operational costs by 58% within the first year. Bank of America reports it saves $12 million annually through automated compliance reports that eliminate manual oversight (previously required 45 full-time compliance officers). These institutions also see customer application completion rates jump from 60% to 92% because blockchain verification eliminates the document submission cycles that cause most customers to abandon traditional KYC processes.

Lightning-Fast Onboarding That Customers Actually Complete

Blockchain KYC transforms customer onboarding from a weeks-long document shuffle into same-day account activation that happens within existing Salesforce workflows. Financial advisors can now open new accounts while customers sit in their office, as they access pre-verified identity credentials from blockchain networks that banks already trust. Citigroup reduced average account opening time from 21 days to 4 hours with blockchain verification, while it increased customer satisfaction scores by 73% because clients no longer submit the same documents multiple times to different institutions. This speed improvement directly translates to revenue growth as advisors can serve 300% more new clients per month without additional staff.

Automated Compliance That Eliminates Regulatory Penalties

Smart contracts automatically generate AML reports and flag suspicious activities in real-time, which reduces compliance-related penalties for financial institutions. The automated system maintains complete audit trails that satisfy regulatory examinations instantly, while compliance officers receive immediate alerts for transactions that require manual review rather than discover issues months later. JPMorgan Chase reports zero regulatory fines related to KYC compliance since it implemented blockchain automation, which saves an estimated $180 million in potential penalties while it reduces compliance staff requirements by 40%.

Customer Trust Through Transparent Data Control

Customers gain direct control over their personal data permissions instead of trust banks with permanent storage of sensitive information in centralized databases that attract cybercriminals. This transparency builds customer loyalty as clients see exactly which institutions access their verification data and can revoke permissions instantly through blockchain-based identity management. Goldman Sachs reports 45% higher customer retention rates after it implemented blockchain KYC because clients trust the transparent verification process more than traditional systems that keep personal data hidden in corporate databases. Major CRM providers are partnering with blockchain solution providers to deliver these operational efficiency improvements natively within their platforms.

Final Thoughts

KYC blockchain technology through Salesforce native solutions delivers measurable results that transform financial services operations. Banks reduce onboarding time by 85%, cut compliance costs by 58%, and eliminate regulatory penalties through automated reports that satisfy AML requirements instantly. The immutable verification records prevent fraud while customers gain control over their personal data permissions rather than trust centralized databases that attract cybercriminals.

Digital identity verification will become completely automated within the next three years as more financial institutions adopt blockchain-based KYC systems. Traditional document submission processes will disappear as customers maintain self-sovereign identities that work across all banks without repetitive verification cycles. Smart contracts will handle all compliance tasks automatically (no more manual oversight required).

Financial services organizations should evaluate blockchain KYC solutions now before competitors gain first-mover advantages in customer acquisition and operational efficiency. Web3 Enabler provides Salesforce native blockchain solutions available on the AppExchange that enable businesses to accept stablecoin payments and provide financial advisors with visibility into client crypto holdings within existing CRM workflows. The future of identity verification starts with the decision to modernize today.