International transfers are ripe for disruption. The current system is slow, expensive, and opaque, leaving businesses and individuals frustrated.

At Web3 Enabler, we’re witnessing a seismic shift in how global payments are conducted. Blockchain technology is revolutionizing this space, offering faster, cheaper, and more transparent solutions.

Why Traditional International Payments Fail Businesses

The Hidden Costs of Cross-Border Transactions

International payments have become a significant pain point for businesses worldwide. The current system, built on outdated infrastructure, fails to meet the demands of our increasingly globalized economy.

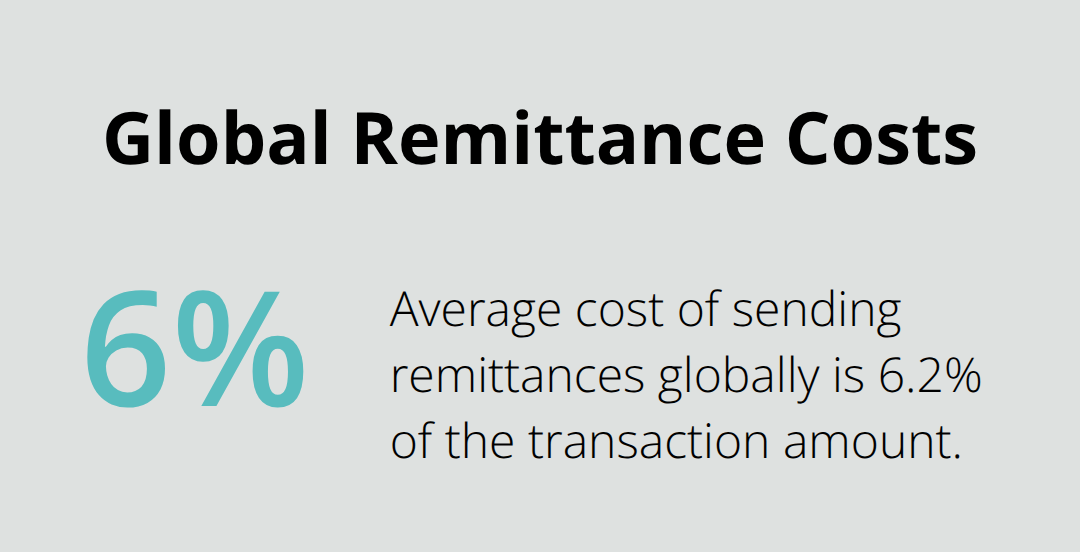

Traditional international payments come with a hefty price tag. A 2023 World Bank report reveals that the average cost of sending remittances globally stands at 6.2% of the transaction amount. For businesses dealing with large volumes of cross-border transactions, these fees can significantly erode profit margins.

But visible fees are just the tip of the iceberg. Hidden costs like unfavorable exchange rates and correspondent banking charges often blindside businesses. The implementation of Basel III reforms has been ongoing for fifteen years since the global financial crisis, addressing various aspects of international banking and potentially impacting these costs.

Snail-Paced Processing in a Fast-Paced World

In an era where information travels at light speed, international payments still crawl at a snail’s pace. The SWIFT network, which handles most international transfers, often requires days to complete a transaction. This delay can disrupt cash flow management and supply chain operations.

Consider a U.S.-based manufacturer waiting on a payment from Europe. These processing lags might lead to production delays, missed opportunities, or even penalties. In today’s competitive business landscape, such inefficiencies put companies at a severe disadvantage.

The Black Box of Payment Traceability

The lack of transparency in traditional international payments frustrates businesses the most. Once initiated, a payment often disappears into a black box, leaving businesses clueless about its status or location.

This opacity creates more than just inconvenience; it’s a compliance nightmare. Without clear traceability, businesses struggle to meet increasingly stringent anti-money laundering (AML) and know-your-customer (KYC) regulations. The Financial Action Task Force (FATF) estimates that lack of payment transparency contributes to billions in illicit financial flows annually.

The Need for a New Approach

These limitations of traditional payment systems hinder business growth and innovation. A new approach must leverage modern technology to overcome these longstanding challenges. The blockchain revolution in payments offers solutions to these persistent problems, promising faster, more transparent, and cost-effective international transactions.

As we explore how blockchain transforms the landscape of international payments, you’ll see why this technology represents more than just an incremental improvement-it’s a complete paradigm shift in how businesses conduct global transactions.

How Blockchain Redefines Global Payments

Lightning-Fast Settlement Times

Blockchain technology transforms international payments from a slow, cumbersome process to a near-instantaneous transaction. Traditional SWIFT transfers often take days to complete, but blockchain-based payments settle in seconds compared to SWIFT’s days-long processes. This speed revolutionizes cash flow management and allows businesses to seize market opportunities with unprecedented agility.

Dramatic Cost Reduction

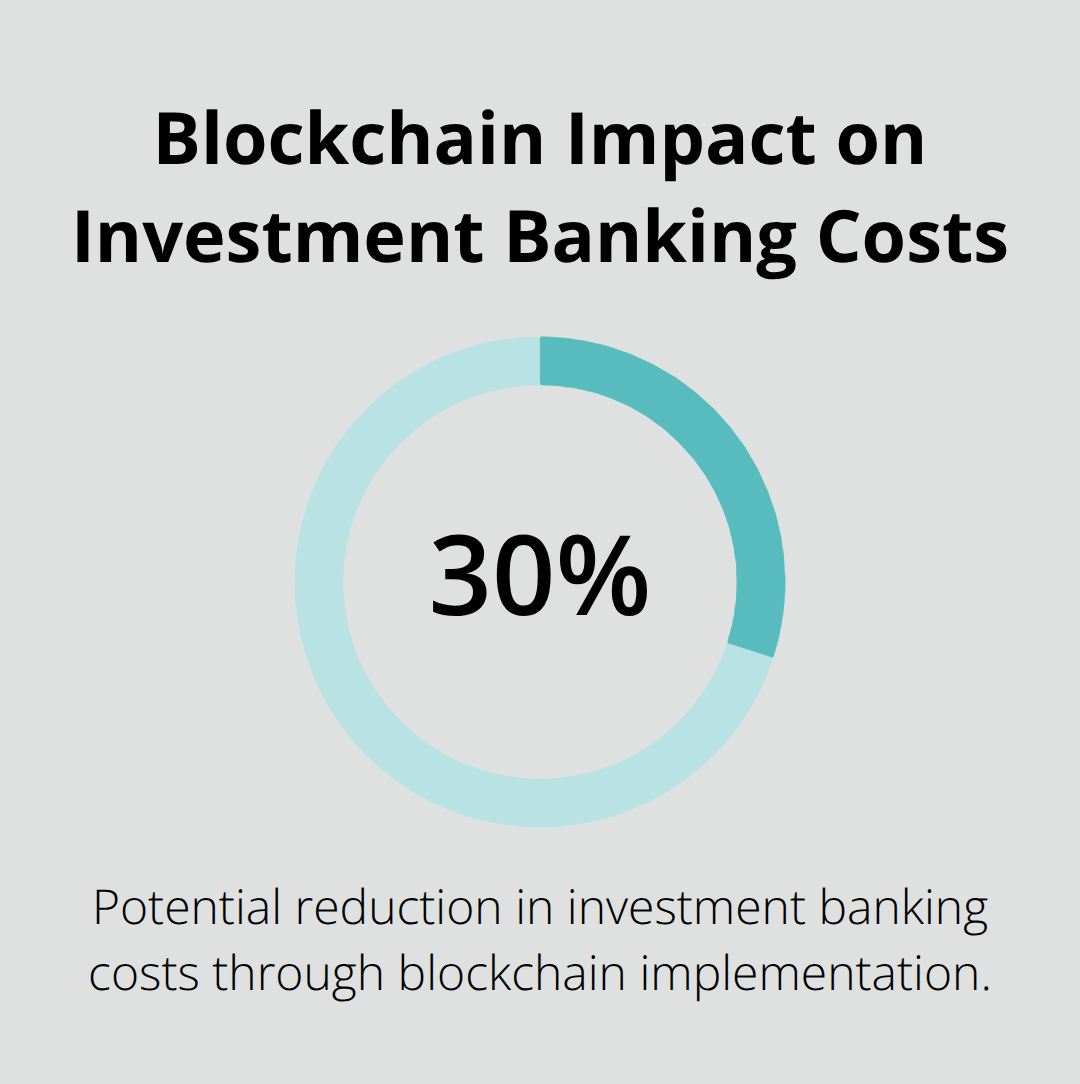

The financial benefits of blockchain payments are substantial. A study by Accenture revealed that blockchain could cut investment banking costs by 30%, saving over $8B annually. For businesses conducting international transfers, this cost efficiency opens new possibilities for global trade and expansion.

Unmatched Transparency and Security

Blockchain’s distributed ledger technology introduces a level of transparency previously unattainable in banking systems. Every transaction is recorded on an immutable ledger, which enables real-time tracking and verification. This feature proves invaluable for businesses with complex supply chains or those operating under strict regulatory scrutiny.

The enhanced security of blockchain addresses a major vulnerability in international payments. Its decentralized nature creates a formidable barrier against cyber attacks. In 2022, banks and financial institutions reported $1.2 billion in losses due to cybercrime. Blockchain protects customer records with cryptographic security, drastically reducing the risk of breaches or unauthorized access.

Smart Contracts: Automating Financial Agreements

Smart contracts on blockchain platforms (such as Ethereum) revolutionize how businesses handle recurring payments and complex financial agreements. These self-executing contracts automatically trigger payments when predefined conditions are met. A manufacturer, for instance, could implement a smart contract that releases payment to a supplier only upon receipt and verification of goods. This automation streamlines procurement processes and reduces the potential for disputes.

Navigating the Transition

While the potential of blockchain in international payments is vast, challenges remain. Regulatory uncertainty and the need for widespread adoption present hurdles. However, the benefits are too significant to ignore. Businesses that embrace this technology now position themselves as leaders in the new era of global finance.

As the landscape of international payments evolves, forward-thinking companies seek solutions that bridge the gap between traditional systems and blockchain innovation. Platforms that integrate seamlessly with existing business infrastructure (like Salesforce) allow companies to leverage blockchain’s benefits without a complete overhaul of their systems. This approach enables a smoother transition to the future of global payments.

The next chapter will explore real-world applications and case studies that demonstrate how businesses are already reaping the benefits of blockchain-powered international payments.

How Companies Leverage Blockchain Payments

At Web3 Enabler, we observe a surge in companies that adopt blockchain for international payments. This trend reshapes how businesses operate globally. Let’s explore some concrete examples of how companies use blockchain to streamline their payment processes.

Cross-Border Remittances: A Game-Changer for Global Workforce

The remittance industry feels the impact of blockchain technology. Western Union, a traditional leader in this space, tests blockchain-based transactions with Ripple. Their pilot program shows a 50% reduction in operating costs for cross-border payments. This opens up new possibilities for global talent acquisition and retention.

A tech startup in Silicon Valley reports that blockchain use for contractor payments allows them to hire top talent from emerging markets without the usual friction of international transfers. They reduce their payment processing time from 3-5 business days to under an hour, while saving an average of 3.2% on transaction fees.

B2B International Transactions: Speed Meets Security

In the B2B space, blockchain addresses long-standing pain points of international transactions. IBM’s blockchain-based payment network, World Wire, pioneers in this area. By leveraging the Stellar blockchain, IBM enables near real-time clearing and settlement for cross-border payments.

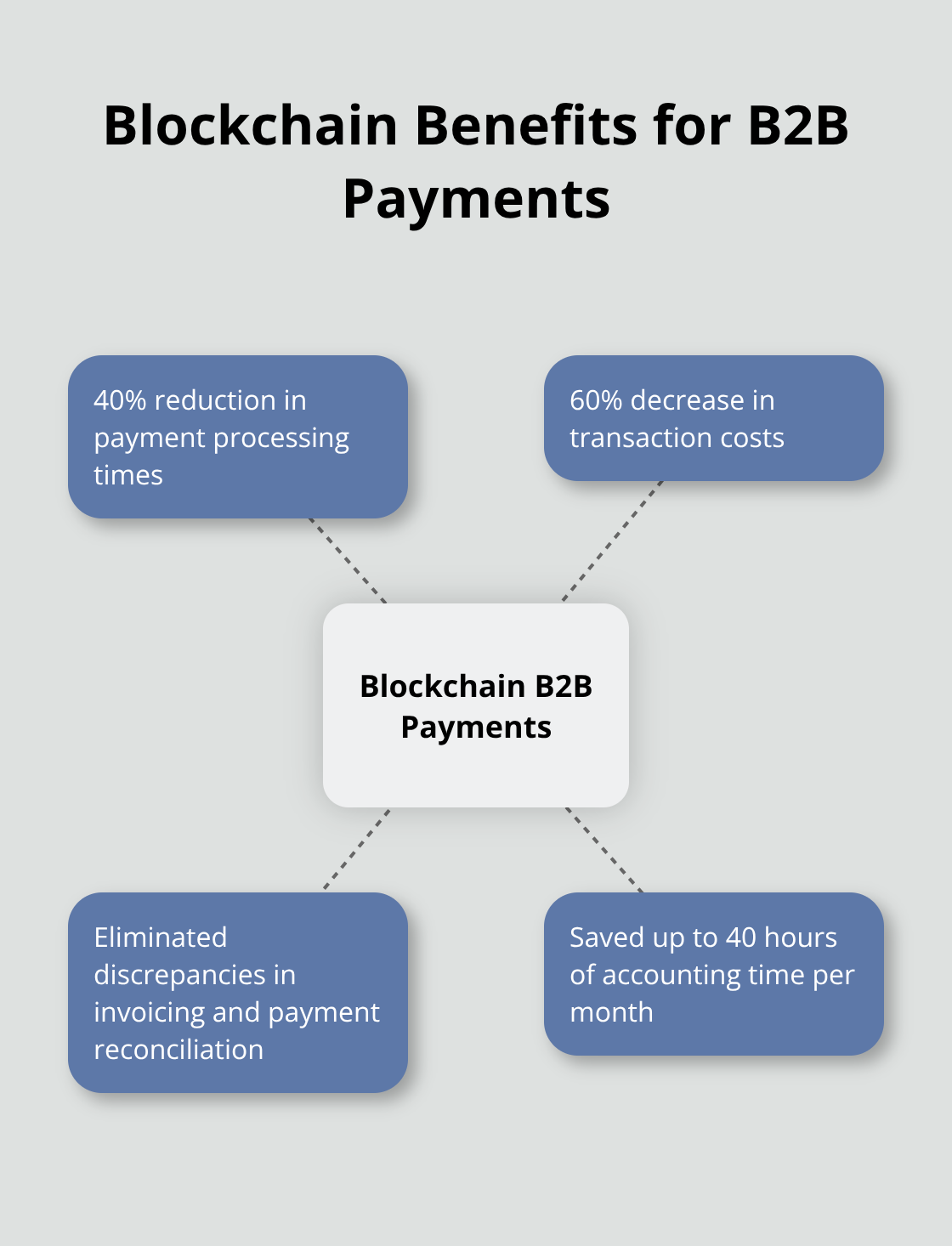

A mid-sized manufacturing company in Germany implements a blockchain solution for their international B2B payments. They report a 40% reduction in payment processing times and a 60% decrease in transaction costs. More importantly, they eliminate discrepancies in invoicing and payment reconciliation, which previously consumed up to 40 hours of accounting time per month.

Supply Chain Finance: Transparency and Efficiency

Blockchain revolutionizes supply chain finance by providing unprecedented transparency and efficiency. The express industry in India has evolved significantly, now playing an essential role in connecting businesses and markets.

A global electronics manufacturer integrates blockchain into their supply chain finance operations. This move allows them to offer early payment options to suppliers based on verifiable milestones in the production process. As a result, they strengthen relationships with key suppliers and negotiate better terms, leading to a 15% reduction in overall supply chain costs.

Bridging Traditional and Blockchain Systems

The potential of blockchain in international payments is clear, but implementation can be complex. Solutions that offer seamless integration with existing business systems (like Salesforce) enable businesses to harness these benefits without overhauling their entire system. Blockchain integration in Salesforce CRM opens up new possibilities for secure payment processing and financial management, including the acceptance of stablecoins.

Companies that embrace this technology see tangible benefits in cost reduction, efficiency, and competitive advantage. The question for businesses now isn’t whether to adopt blockchain for payments, but how quickly they can implement it to stay ahead in the global marketplace.

Final Thoughts

The blockchain revolution will reshape international payments and the global economy. Businesses that adopt this technology will benefit from faster, cost-effective, and transparent cross-border transactions. This transformation will boost global trade, reduce economic friction, and open new markets for companies of all sizes.

Regulatory uncertainty and technical integration challenges remain significant hurdles for widespread adoption. However, the opportunities outweigh the difficulties, which drives continued innovation and investment in blockchain payment solutions. Companies must educate themselves on blockchain technology and assess their current payment processes to identify areas for improvement.

Web3 Enabler offers a powerful solution for businesses ready to embrace the future of international transfers. Our platform integrates blockchain functionality directly into Salesforce, allowing companies to leverage crypto payments without overhauling existing systems. This approach enables businesses to process international transfers faster and more cost-effectively while maintaining the familiar Salesforce interface.