Treasury teams waste hours reconciling accounts across currencies and time zones. Real-time treasury stablecoins eliminate that friction by giving you instant visibility into your reserve positions as transactions settle on-chain.

At Web3 Enabler, we’ve seen finance teams cut their settlement times from days to minutes while reducing operational overhead. This post shows how to implement stablecoin treasury solutions directly in Salesforce Financial Services Cloud.

What Makes Real-Time Visibility Possible With Stablecoins

Most treasury teams operate on outdated information. A cross-border wire sent this morning won’t settle until tomorrow or the day after, leaving your reserve position uncertain until banking hours align across time zones. Stablecoins change this completely. When you move USDC or RLUSD across blockchains, real-time settlement happens in seconds to minutes. Your reserve position updates instantly. Web3 Enabler integrates this capability directly into Salesforce Financial Services Cloud, so your treasury data lives in the same place as your client relationships and compliance records. No more jumping between banking platforms, blockchain explorers, and spreadsheets to understand where your money actually is.

Why Instant Settlement Matters for Your Bottom Line

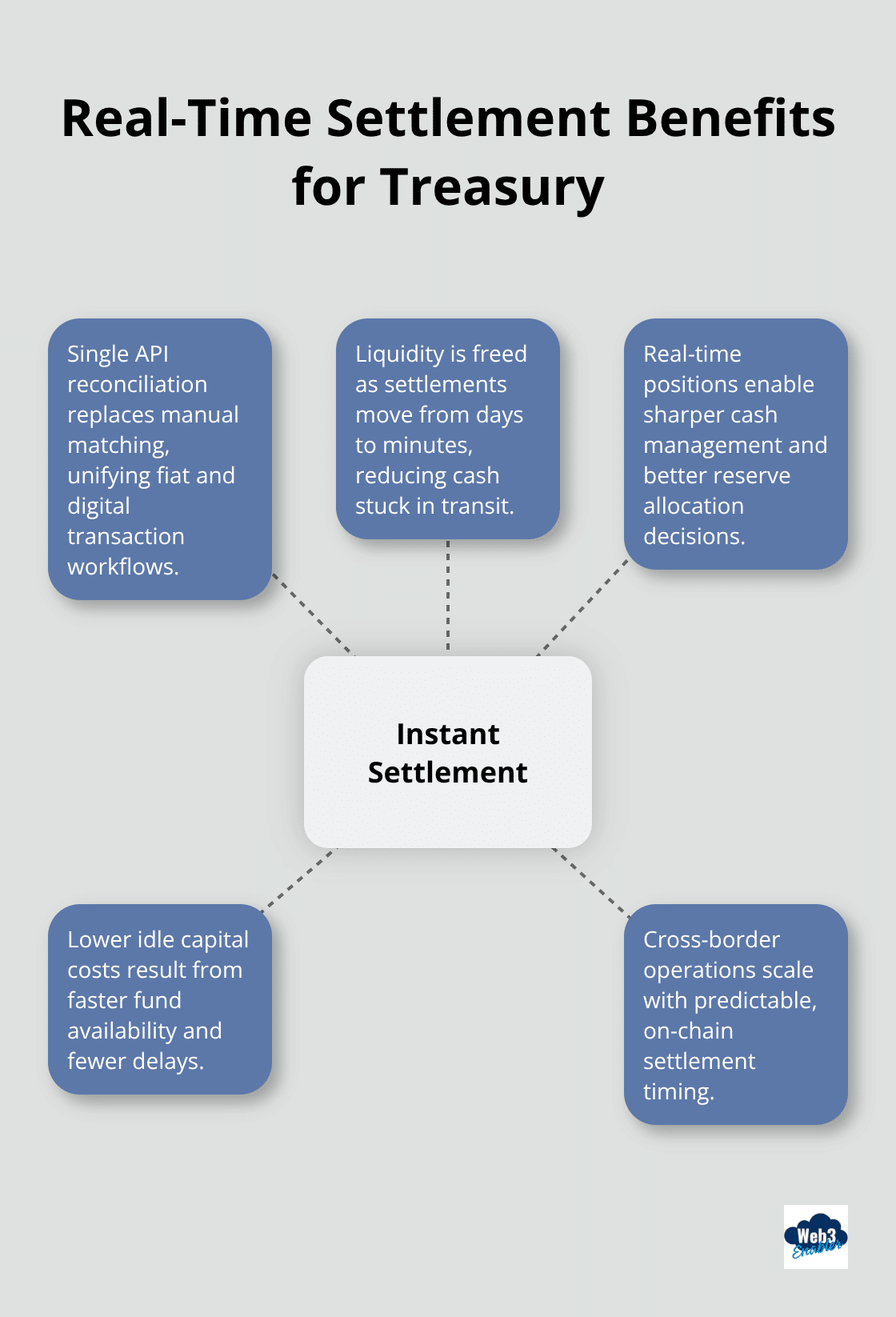

Real-time settlement cuts operational overhead in ways traditional banking can’t match. Modern Treasury’s integration with Paxos demonstrates this at scale-enterprises using stablecoin payments now reconcile fiat and digital transactions through a single API, eliminating the manual matching that consumes hours every month. Settlement times compress from days to minutes, which means liquidity trapped in transit gets freed up faster. For organizations managing reserves across multiple currencies and geographies, this translates directly to better cash positioning and lower idle capital costs.

Citi forecasts dollar-denominated stablecoins could grow 7 to 14 times by around 2030, driven largely by enterprises chasing these efficiency gains.

How to Connect Your Reserves to Live Data

Web3 Enabler’s native Salesforce integration surfaces your on-chain holdings directly in Financial Services Cloud dashboards alongside traditional banking data. This means advisors see client wallet balances and stablecoin positions in real time, without context-switching to external tools. BitRank Verified wallet risk scoring integrates into the platform, flagging anomalies before they become problems. Your compliance team gets on-chain transparency automatically-transaction hashes, timestamps, and settlement confirmations flow into Salesforce objects, making audit trails comprehensive and auditable. Organizations already using Salesforce avoid the middleware costs and integration complexity that plague point solutions.

What Happens When Finance Teams Stop Reconciling Manually

The shift from manual reconciliation to automated workflows frees your team to focus on strategy instead of spreadsheets. When settlement confirmations populate Salesforce objects automatically, your finance team stops waiting for bank statements and starts acting on live data. Compliance reporting becomes faster because transaction details (timestamps, counterparties, amounts) already exist in auditable form on-chain. Risk teams can set threshold alerts that trigger when reserve positions shift unexpectedly, catching problems in minutes rather than discovering them during month-end close. This operational shift-from reactive to proactive-is what separates treasury teams that compete on efficiency from those that don’t.

How Stablecoins Cut Costs and Accelerate Treasury Operations

Settlement speed directly impacts your cash position. Traditional cross-border wire transfers take two to three business days to settle, leaving your reserves in limbo across time zones and banking hours. Stablecoin transactions settle in minutes on-chain, which means your liquidity moves immediately and your reserve position updates without delay. This speed advantage compounds across your organization. If your treasury team processes fifty cross-border payments monthly, you’re looking at tens of millions of dollars in transit at any given time under the old model. Faster settlement frees that capital instantly. Citi projects dollar-denominated stablecoins could grow seven to fourteen times by around 2030, driven primarily by enterprises capturing these settlement efficiencies.

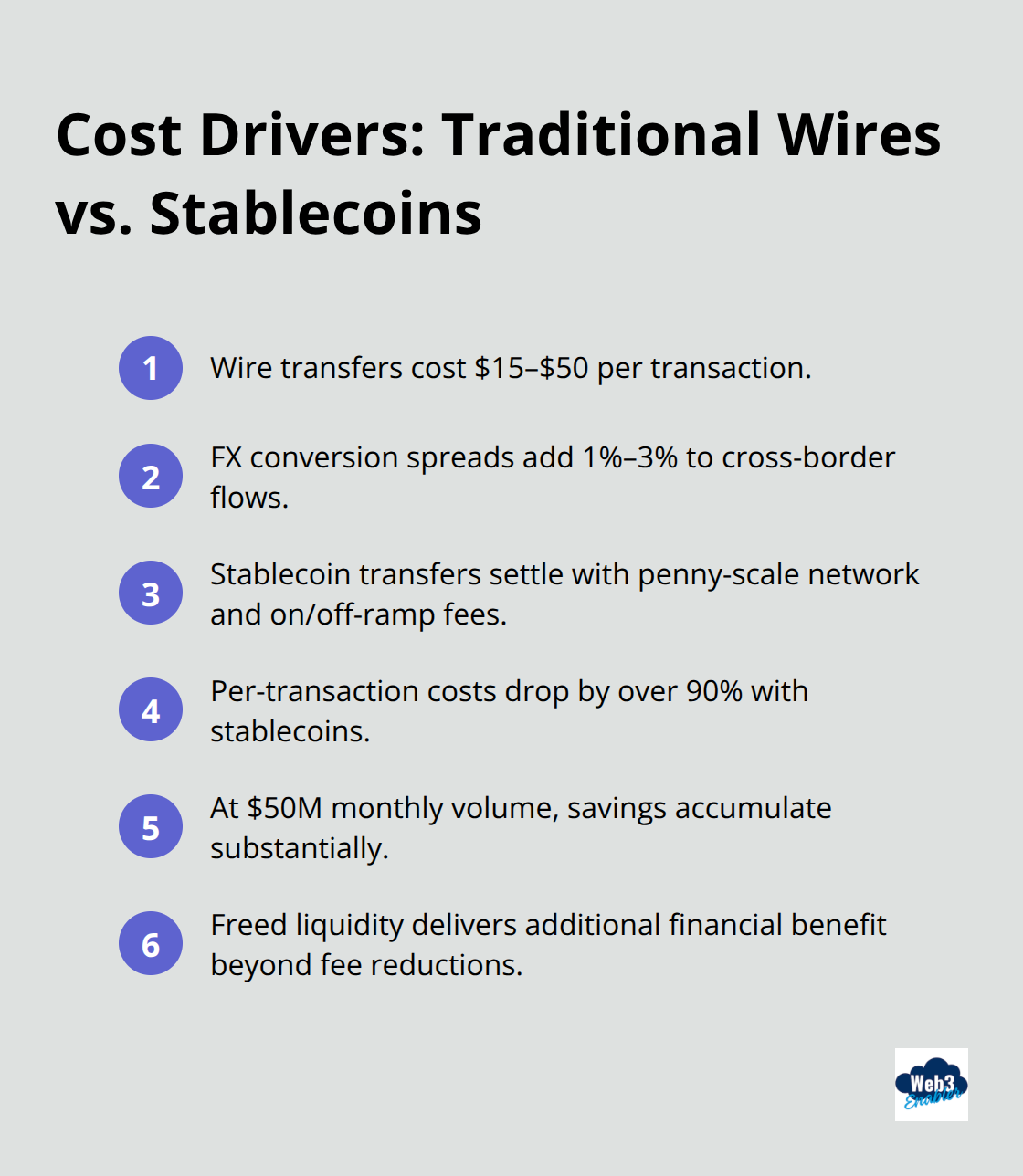

The cost savings are equally tangible. Traditional wire transfers charge between fifteen and fifty dollars per transaction, plus hidden spreads on currency conversion that can add another one to three percent to cross-border flows. Stablecoin payments on BASE Network settle for penny-scale fees on on-ramp and off-ramp transactions, cutting your per-transaction cost by over ninety percent. For a mid-sized enterprise moving fifty million dollars monthly across borders, that difference translates to thousands in savings annually before accounting for the value of freed-up liquidity.

Compliance Becomes Automatic When Transactions Live on Blockchain

Your compliance team currently spends weeks gathering documentation after month-end close. Bank statements arrive late, wire confirmations require manual matching, and reconstructing a transaction trail across multiple counterparties becomes an exercise in frustration. On-chain transactions eliminate this friction entirely. Every stablecoin payment creates an immutable record with timestamp, counterparty wallet address, amount, and settlement confirmation.

Web3 Enabler surfaces these records directly in Salesforce Financial Services Cloud objects, so your compliance team accesses auditable transaction history without leaving the CRM. Regulatory reporting becomes faster because the data already exists in structured form. Your audit team can verify settlement details, counterparty information, and transaction timing in real time rather than waiting for bank confirmations. BitRank Verified wallet risk scoring integrates into the platform, flagging suspicious counterparties or wallets before you execute a payment.

Real-Time Visibility Shifts Compliance From Reactive to Proactive

This real-time visibility transforms compliance from a month-end burden into an ongoing, automated process embedded in your payment workflows. Your finance team stops waiting for confirmations and starts acting on live data. Risk teams set threshold alerts that trigger when reserve positions shift unexpectedly, catching problems in minutes rather than discovering them during close. Transaction details (timestamps, counterparties, amounts) already exist in auditable form on-chain, making reconstruction of payment trails straightforward and verifiable. The operational shift from reactive to proactive is what separates treasury teams that compete on efficiency from those that don’t.

Building Your Treasury Stack in Salesforce

Connect Stablecoin Payments Directly to Your Reserve Data

Your treasury infrastructure lives in Salesforce already. Financial Services Cloud houses your client relationships, compliance records, and reserve data. Native blockchain payment integration connects your stablecoin transactions and on-chain activity directly into that ecosystem, eliminating the context-switching that costs your team hours every month. When you move USDC or RLUSD across blockchains, settlement confirmations flow into Salesforce objects automatically. Your advisors see client wallet balances and digital asset positions alongside traditional holdings in real time. Wallet risk scoring integrates into your payment workflows, flagging counterparty risk before you execute a transaction.

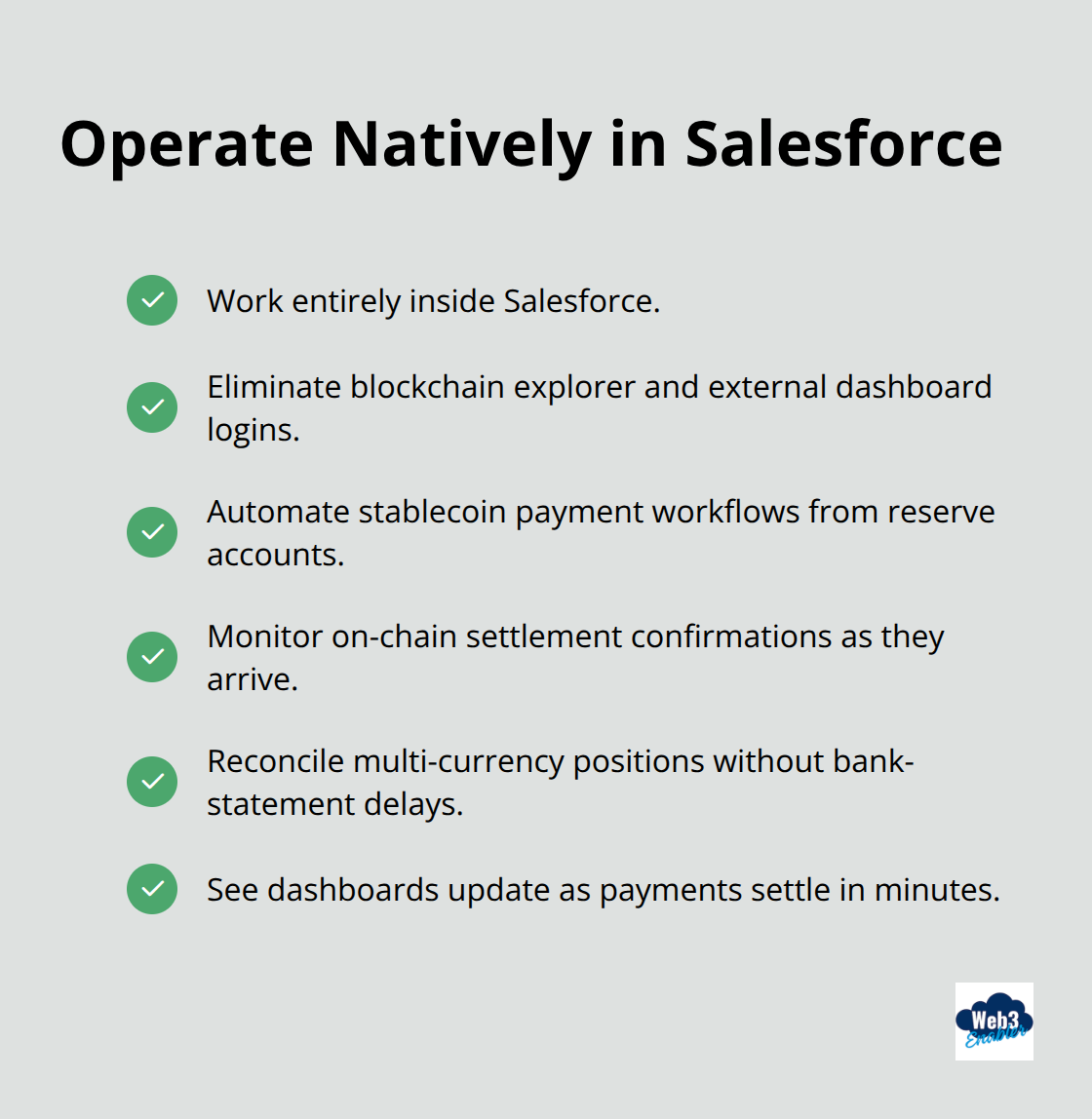

Eliminate External Dashboards and Blockchain Explorers

This native integration means your finance team stops logging into blockchain explorers and external dashboards. They work inside Salesforce, where compliance trails are auditable, threshold alerts trigger automatically, and settlement data syncs without manual intervention. Your treasury team configures automated workflows that initiate stablecoin payments from reserve accounts, monitor settlement confirmations as they arrive on-chain, and reconcile multi-currency positions without waiting for bank statements.

When a cross-border payment settles in minutes instead of days, your reserve position updates instantly in your dashboards.

Set Automated Alerts for Reserve Thresholds and Risk Events

Risk teams set threshold alerts that notify you when reserves fall below targets or when suspicious wallet activity appears on-chain. Compliance teams export transaction records directly from Salesforce objects, complete with timestamps, counterparty addresses, and settlement confirmations. Organizations managing cross-border reserves across multiple currencies see the biggest operational lift-your team stops maintaining separate spreadsheets for blockchain activity and banking activity. Everything lives in one place.

Consolidate Reconciliation Workflows Across Currencies and Geographies

For mid-sized enterprises processing fifty million dollars monthly across borders, this consolidated workflow cuts reconciliation time from weeks to days. Your finance team focuses on strategic cash positioning instead of manual matching. Settlement data (timestamps, counterparty information, amounts) already exists in structured form within Salesforce, making month-end close faster and audit preparation straightforward. Your compliance team accesses auditable transaction history without leaving the CRM, and regulatory reporting becomes faster because the data already exists in the format auditors expect.

Final Thoughts

Real-time treasury stablecoins deliver measurable efficiency gains that traditional banking cannot match. Your treasury team cuts settlement times from days to minutes, frees up capital trapped in transit, and reduces operational overhead by eliminating manual reconciliation. When you move USDC or RLUSD across blockchains, your reserve position updates instantly while your compliance team acts on live data instead of waiting for bank statements.

The operational shift from reactive to proactive separates treasury teams that compete on efficiency from those that don’t. Threshold alerts trigger automatically when reserves shift unexpectedly, and transaction records exist in auditable form on-chain, making regulatory reporting faster and audit preparation straightforward. For mid-sized enterprises processing millions of dollars monthly across borders, this consolidated workflow cuts reconciliation time significantly and lowers per-transaction costs by over ninety percent.

Web3 Enabler brings blockchain-powered payments directly into Salesforce Financial Services Cloud, eliminating the middleware costs and integration complexity that plague point solutions. Your advisors see client wallet balances and digital asset positions in real time, your compliance team accesses transaction history without leaving the CRM, and your finance team configures automated workflows that initiate payments and reconcile positions without manual intervention. Real-time visibility across reserves is no longer a future capability-it’s a competitive advantage your team can implement today.

Frequently Asked Questions: Real-Time Treasury Stablecoins

What does “real-time treasury” mean with stablecoins?

Real-time treasury means your reserve position updates as transactions settle on-chain, instead of waiting hours or days for bank settlement and statements. When treasury teams move stablecoins like USDC or RLUSD, settlement can occur in seconds to minutes, which gives faster visibility into cash and reserves across currencies and time zones.

How do stablecoins create live visibility across reserves?

Stablecoins create live visibility because every payment generates an on-chain record with a transaction hash, timestamp, amounts, and confirmation status. As soon as the transaction confirms, your reserve balances can update automatically. This reduces the lag and uncertainty treasury teams deal with when using cross-border wires and multi-bank workflows.

How can we run stablecoin treasury operations inside Salesforce Financial Services Cloud?

With a native integration, stablecoin activity and reserve data can surface directly in Salesforce Financial Services Cloud dashboards. Instead of switching between bank portals, blockchain explorers, and spreadsheets, your team can view wallet balances, settlement confirmations, and transaction details as Salesforce objects that support reporting, workflows, and audit trails.

What problems do real-time treasury stablecoins solve for finance teams?

Real-time treasury stablecoins reduce manual reconciliation, shorten settlement cycles, and improve cash positioning. Teams spend less time matching payments across systems, less time waiting for confirmations, and more time making decisions based on current reserve data rather than yesterday’s balances.

How do stablecoins reduce cross-border payment costs and settlement time?

Traditional cross-border wires often involve multiple intermediaries, banking hour delays, and higher fees plus FX spreads. Stablecoin rails can settle faster on-chain and may reduce costs depending on the network used. For treasury teams, faster settlement can also free up liquidity that would otherwise be stuck “in transit.”

How does on-chain settlement help compliance and audits?

On-chain transactions create an immutable trail of settlement details, including timestamps, counterparties (wallet addresses), and amounts. When this data is captured in structured records (for example, inside Salesforce objects), compliance teams can access audit-ready documentation without reconstructing trails from bank PDFs, emails, and manual spreadsheets.

What are reserve threshold alerts and why do they matter?

Reserve threshold alerts notify teams when balances fall below targets or when reserve positions shift unexpectedly. This turns treasury operations from reactive to proactive by helping teams spot liquidity gaps or risk events quickly, instead of discovering issues during month-end close.

What is wallet risk scoring and how does it reduce counterparty risk?

Wallet risk scoring helps identify potentially risky counterparties before a payment is executed. By evaluating wallet behavior and signals, risk teams can flag anomalies early and apply additional review steps when needed. This is especially valuable for treasury operations handling higher volumes or cross-border flows.

Who is this approach best for?

Real-time stablecoin treasury workflows are often a strong fit for organizations managing cross-border reserves, multi-currency settlement, and high transaction volumes, especially when teams want live visibility and faster reconciliation. It’s also useful for businesses that already run their treasury workflows in Salesforce and want to keep payments, compliance, and reporting in one system.