Your billing system is probably costing you more than you think. Traditional payment processing drains resources with slow settlements, hefty fees, and geographic limitations that frustrate global customers.

Your billing system is probably costing you more than you think. Traditional payment processing drains resources with slow settlements, hefty fees, and geographic limitations that frustrate global customers.

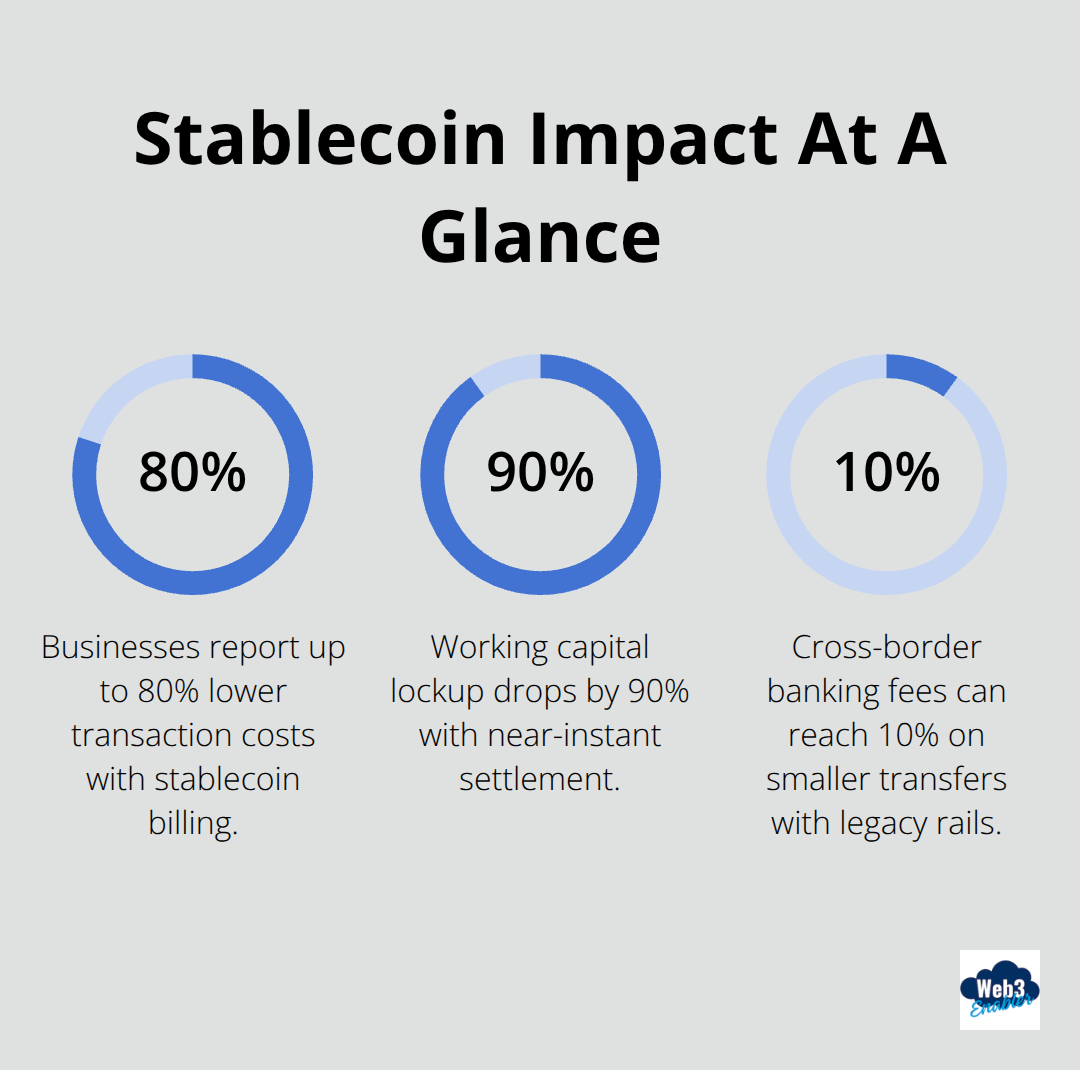

Stablecoin billing changes everything. We at Web3 Enabler have seen businesses slash transaction costs by 80% while achieving instant global payments that work 24/7.

Ready to modernize your billing operations?

Why Traditional Billing Systems Are Failing Businesses

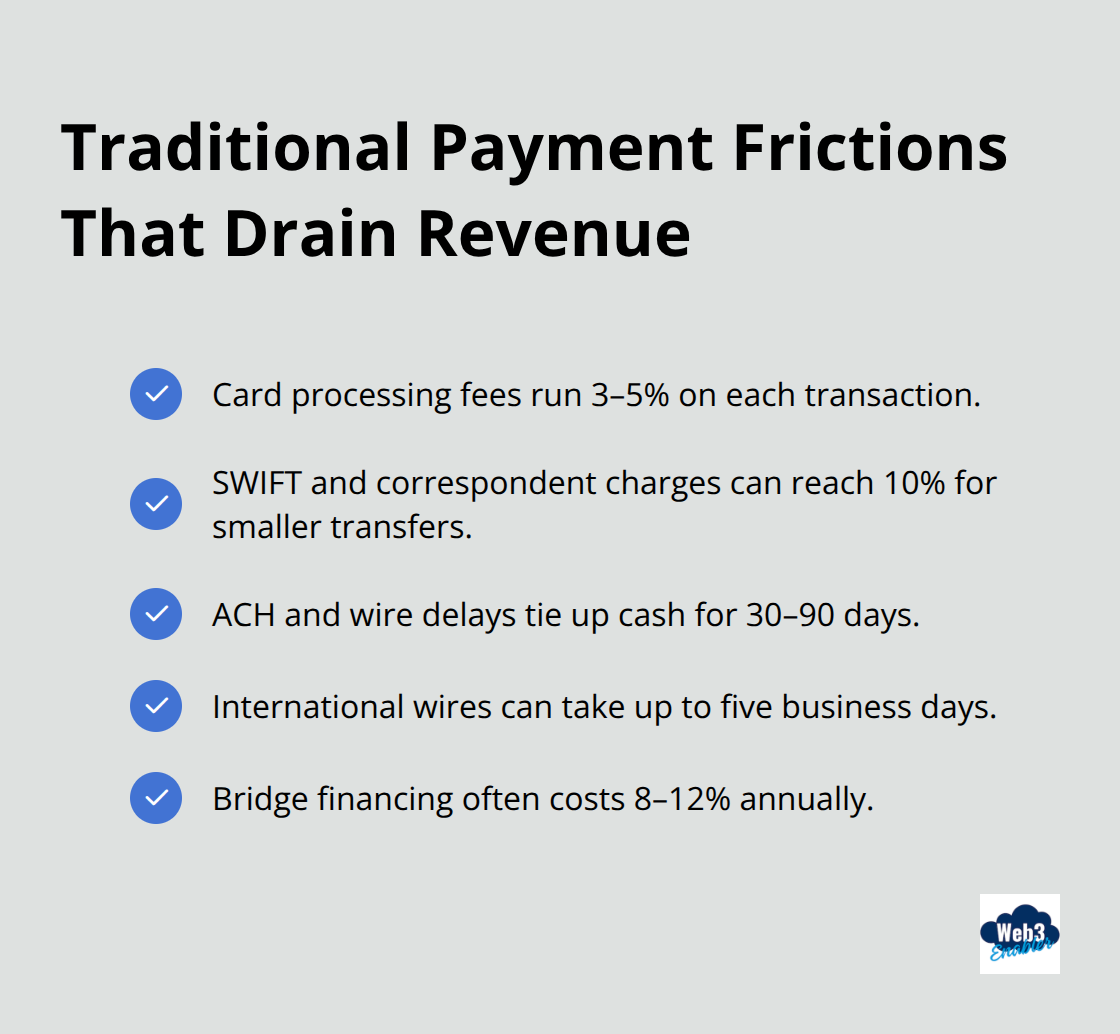

Your current billing system burns cash faster than a crypto crash. Payment processing delays tie up working capital for 30 to 90 days while you wait for ACH transfers and international wires to crawl through banking networks. Those 3% to 5% transaction fees add up fast when you process millions in revenue annually. Cross-border payments hit you with currency conversion markups, correspondent banking fees, and SWIFT charges that can reach 10% of transaction value for smaller amounts.

The Hidden Cost of Slow Money

Traditional payment rails force businesses into cash flow gymnastics. B2B transactions face significant payment delays, creating cash flow challenges for businesses across global markets. Your finance team spends hours to reconcile payments across multiple banking partners while customers abandon purchases due to payment friction. International freelancers and contractors wait weeks for payments, which drives talent to competitors who pay faster. Banking hours restrict when payments process, which leaves urgent transactions stuck over weekends.

Geographic Payment Barriers Kill Growth

Payment processors reject transactions from entire countries and block potential revenue streams. Currency volatility in emerging markets makes pricing unpredictable while local banking infrastructure limits market access. Setting up merchant accounts in new regions takes months and requires local entities. Payment failures spike during currency crises and leave customers unable to complete transactions even when they want to pay.

The Real Price of Payment Friction

These delays cost more than just time. Late payments force businesses to seek expensive bridge financing (often at 8-12% annual rates) while waiting for customer payments to clear. International wire transfers can take up to five business days, during which currency fluctuations can wipe out profit margins. Your accounting team wastes valuable hours chasing down failed payments and reconciling discrepancies across different banking systems.

Stablecoin payments offer a completely different approach to these persistent problems.

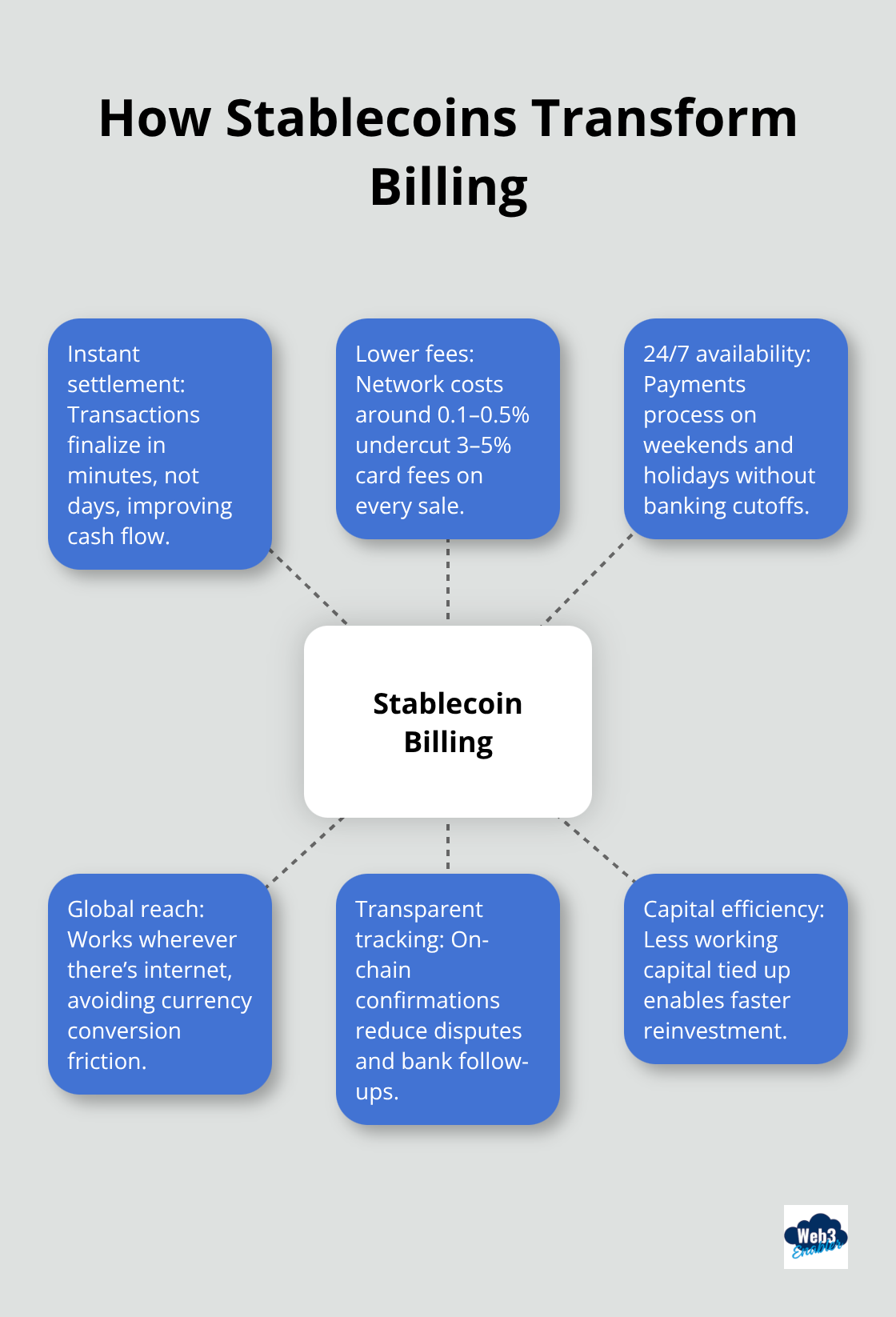

How Stablecoins Transform Billing Operations

Stablecoins turn payment processing from a weeks-long nightmare into a minutes-long breeze. USDC and USDT transactions settle in under 10 minutes compared to traditional ACH transfers that drag on for 3-5 business days. Your working capital stays locked up 90% less time, which means you can reinvest profits immediately instead of waiting for banks to shuffle paperwork. Transaction costs plummet to 0.1-0.5% versus the 3-5% that credit card processors steal from every sale. Stripe and other payment giants charge hefty fees for international transfers, but stablecoin networks operate at a fraction of those costs because they skip the middleman entirely.

Instant Settlement Changes Everything

Traditional wire transfers crawl through correspondent banking networks while stablecoin payments zip across blockchain rails at light speed. Your finance team stops playing phone tag with banks about delayed payments because blockchain transactions provide instant confirmation and transparent tracking. Cash flow improves dramatically when customer payments hit your wallet within minutes rather than days. Artemis Analytics data shows stablecoin transaction volumes reached $7.6 trillion in 2023 and projects $18.4 trillion for 2024 – businesses choose speed over legacy banking delays.

24/7 Payment Processing Becomes Reality

Weekend and holiday payment processing becomes standard since blockchain networks never sleep (unlike traditional banking systems that shut down when you need them most). Your customers can pay invoices at midnight on Sunday while your competitors wait until Monday morning for bank systems to wake up. This always-on availability means faster cash conversion and happier customers who don’t face payment restrictions based on banking hours.

Global Payments Without Geographic Headaches

Stablecoins eliminate currency conversion fees that banks use to pad their profits on international transactions. Your customers in emerging markets can pay instantly without worrying about local banking infrastructure or currency volatility that wipes out their purchasing power. Payment failures disappear because stablecoins work everywhere with internet access – no more lost sales from geographic payment restrictions. Companies like SpaceX already use stablecoins for efficient international transactions to avoid currency conversion friction and banking delays.

The technical foundation exists, but how do you actually implement these payment systems within your existing business infrastructure?

How Do You Actually Implement Stablecoin Payments?

Implementation starts with the right payment processor that handles stablecoin-to-fiat conversion automatically. Stripe supports USDC payments with instant conversion to your local currency, while Coinbase Commerce offers direct stablecoin acceptance with lower fees. Your Salesforce CRM needs native blockchain integration to track payments and maintain customer records. The technical setup takes 2-3 weeks compared to months for traditional merchant account approvals in new markets.

Choose Your Payment Infrastructure

Payment processors like Rapyd offer 24/7 stablecoin processing with flexible settlement options that let you receive funds in fiat, stablecoin, or both. Most businesses choose hybrid approaches where customers select payment methods at checkout rather than force stablecoin adoption. Your existing payment gateway can integrate stablecoin options through API connections that work with current billing systems. Configure automatic reconciliation between stablecoin payments and traditional bank deposits to streamline accounting workflows.

Build Your Compliance Framework

The GENIUS Act became U.S. federal law in July 2025 and mandates that stablecoins must be fully backed by high-quality, liquid reserves, which means USDC and similar regulated tokens meet institutional compliance standards. Your finance team needs clear accounting procedures for digital asset transactions (treat stablecoins like foreign currency holdings for GAAP reporting purposes). European businesses benefit from MiCA regulations that allow stablecoin passporting across EU member states once issued in one jurisdiction. Set up dual redemption routes through multiple exchanges to maintain liquidity access and avoid single points of failure during market volatility.

Execute Your Integration Strategy

Start with invoice-only payments before you expand to subscription billing – this limits complexity while you build internal expertise. Your accounting system can automatically reconcile stablecoin payments through API connections that sync with existing financial workflows. Customer support teams need training on wallet troubleshooting and transaction tracking since blockchain payments work differently than credit card disputes. Test payment flows with small amounts before you process larger transactions to identify potential issues early in the implementation process.

Final Thoughts

Stablecoin billing transforms payment operations with instant settlement that boosts cash flow by 90% and slashes transaction fees from 3-5% to just 0.1-0.5%. Global payments work around the clock without banking delays or currency conversion markups that drain profit margins. These improvements create competitive advantages that traditional payment systems simply cannot match.

The payment industry shifts toward blockchain solutions as regulatory frameworks build institutional confidence. Stablecoin transaction volumes hit $7.6 trillion in 2023 with analysts projecting $100 trillion within five years (making early adoption a strategic necessity).

Companies that modernize payment infrastructure now capture market share while competitors wrestle with legacy banking friction.

Web3 Enabler connects stablecoin payments directly to your existing CRM infrastructure through Salesforce Native blockchain solutions. Our platform handles compliance and automation without crypto speculation, backed by established industry partners. Your modernization starts with a single test transaction – process small amounts first, train your finance team on blockchain reconciliation, then expand to full subscription billing as expertise develops.