We at Web3 Enabler see blockchain technology transforming payment efficiency for enterprises worldwide. Smart contracts and distributed ledgers eliminate costly middlemen while accelerating transaction speeds from days to minutes.

Why Traditional Payments Cost Your Business More Than You Think

Traditional payment systems impose a financial burden that most businesses accept without question. Cross-border payments involve significant costs and regulatory complexities, while domestic ACH transfers require 3-5 business days to settle. These delays create cash flow pressures that force companies to maintain larger capital reserves.

Hidden Fees Compound Your Payment Costs

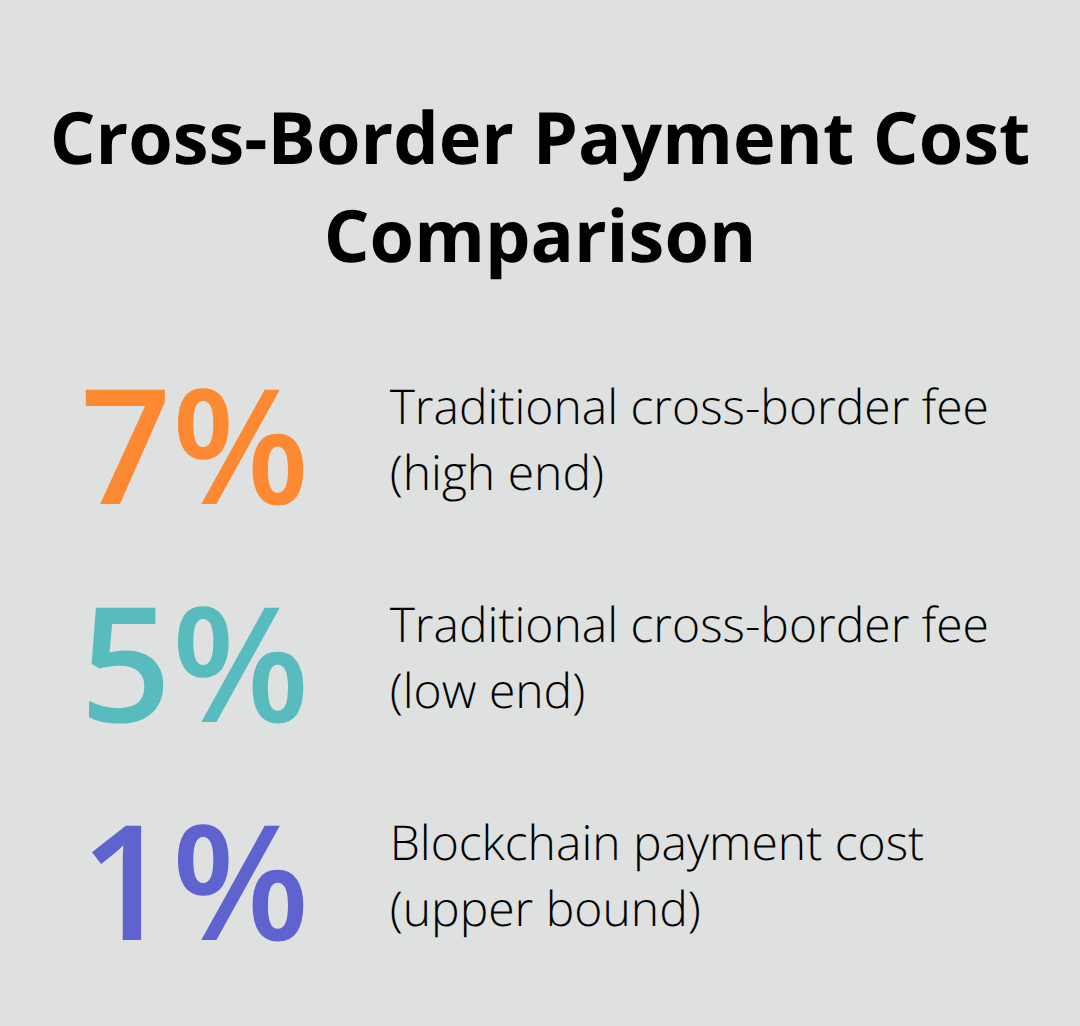

Banks layer multiple charges onto each transaction beyond the advertised rates. Foreign exchange markups often add 3-4% to international payments, while correspondent banks charge up to $50 per wire transfer. Processing fees, compliance charges, and nostro account maintenance costs accumulate throughout the year. A mid-sized company that processes $10 million annually in cross-border payments might spend $300,000 just on transaction fees and currency conversion spreads.

Settlement Delays Impact Your Operations

The correspondent network requires multiple intermediaries to process international payments. Each bank in the chain adds time and potential failure points. Weekend and holiday restrictions further extend settlement periods, with some payments that take up to 7 business days to complete. This creates inefficiencies where suppliers wait for payments while buyers lose power due to delayed settlements.

Intermediary Networks Create Compliance Complexity

Every payment intermediary maintains separate compliance requirements and documentation standards. Banks must verify beneficiary information across multiple jurisdictions while they manage different regulatory frameworks. This complexity increases operational costs and creates rejection risks that can delay urgent payments for weeks while teams correct documentation across the network.

These traditional payment limitations highlight why businesses need alternatives that eliminate intermediaries and reduce costs. Blockchain technology offers solutions that address each of these pain points through direct peer-to-peer transactions.

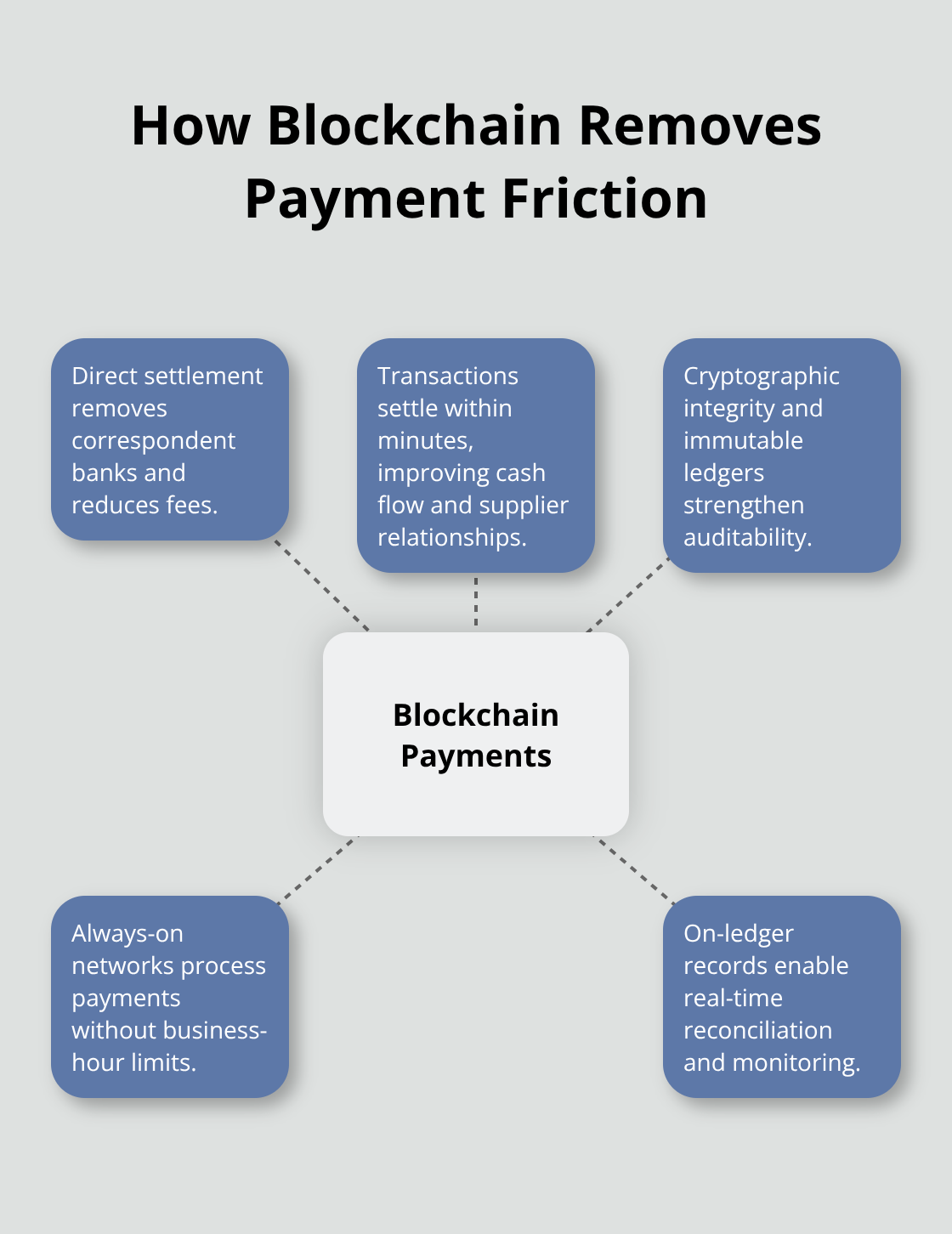

How Blockchain Eliminates Payment Inefficiencies

Direct Settlement Cuts Costs to Under 1%

Blockchain payments operate without traditional correspondent networks and reduce transaction costs from 2-7% to just 0.5-1% according to industry data. Stablecoins processed $32 trillion in transaction volumes during 2024, with $5.7 trillion specifically for payment transactions. Smart contracts execute payments automatically when conditions are met and eliminate manual fees while they reduce operational overhead. Companies that process international payments can save hundreds of thousands annually when they avoid foreign exchange markups and intermediary charges that traditional banks impose across multiple touchpoints.

Settlement Speed Transforms Cash Flow Management

Blockchain transactions settle within 3 minutes compared to 3-5 business days for traditional wire transfers. The technology operates continuously without weekend or holiday restrictions and enables businesses to process urgent payments at any time. Stablecoin payments provide immediate finality without chargebacks and protect businesses from revenue losses and fraud disputes. This speed advantage allows companies to optimize capital when they reduce the cash reserves needed to manage payment delays. Suppliers receive payments faster while buyers maintain better relationships through reliable settlement times.

Cryptographic Security Eliminates Data Exposure

Blockchain transactions use advanced cryptographic methods that protect sensitive financial information without exposure of account details to multiple intermediaries. Each transaction creates an immutable record on the distributed ledger and provides complete transparency for reconciliation and audit purposes. The decentralized architecture removes single points of failure that traditional payment networks face and reduces system-wide risks. Financial institutions can track suspicious activities more effectively through blockchain’s transparent transaction history (which improves compliance across all payment flows).

24/7 Operations Remove Time Constraints

Traditional banks operate within business hours and close during weekends and holidays, which creates payment bottlenecks for urgent transactions. Blockchain networks function continuously without downtime or maintenance windows that interrupt payment flows. Companies can execute time-sensitive payments at midnight or during holidays without delays (particularly valuable for international business operations across different time zones). This constant availability eliminates the need to plan payments around bank schedules and reduces the risk of missed payment deadlines.

The technical advantages of blockchain create clear operational benefits, but successful implementation requires careful planning and integration with existing business systems.

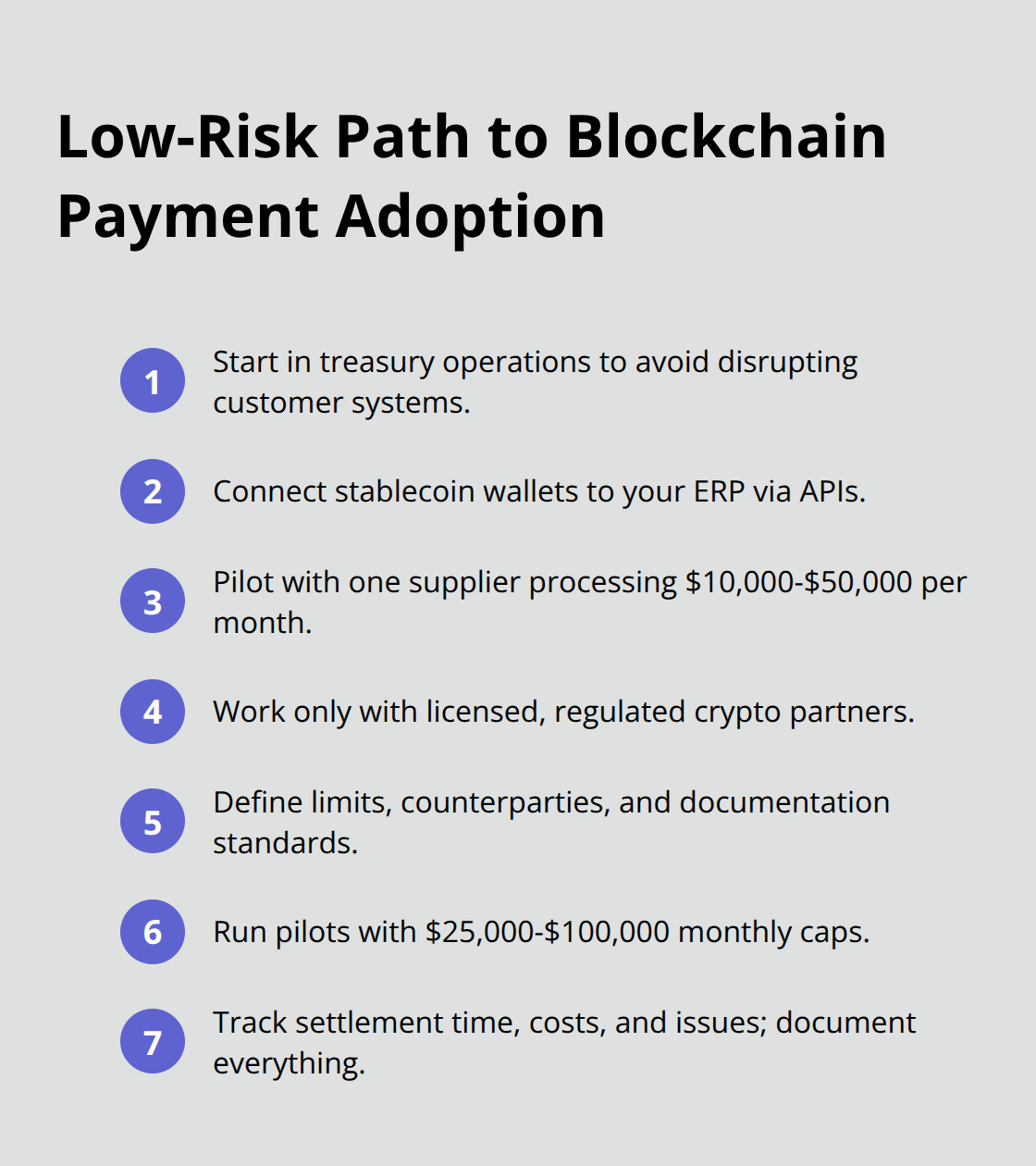

How to Deploy Blockchain Payments Without Disrupting Operations

Start with Treasury Operations Integration

Finance teams should begin blockchain integration through treasury management rather than customer-facing systems. Connect stablecoin wallets to your existing ERP system with API integrations that automatically convert digital assets to fiat currencies. This approach minimizes volatility exposure while your team learns the technology. Major accounting platforms like NetSuite and QuickBooks now support cryptocurrency transactions through specialized plugins.

Test blockchain payments with a single supplier relationship first. Process $10,000-50,000 monthly to evaluate settlement speed and cost savings. Document every transaction for audit purposes and compare actual costs against traditional wire transfer fees to build internal business cases for broader adoption.

Navigate Regulatory Requirements Through Licensed Partners

Work exclusively with regulated cryptocurrency service providers that maintain proper licenses in your jurisdiction. Licensed partners handle compliance obligations that include anti-money laundering monitoring and suspicious activity reporting that regulators require. The regulatory landscape changes rapidly, with new guidance emerging quarterly from agencies like FinCEN and the SEC.

Establish clear policies for transaction limits, approved counterparties, and documentation standards before you process any blockchain payments. Train your compliance team on cryptocurrency regulations specific to your industry (as healthcare and financial services face additional restrictions). Maintain detailed records of all digital asset transactions that include wallet addresses, transaction hashes, and conversion rates for tax reporting purposes.

Implement Pilot Programs for Risk Management

Launch blockchain payment pilots with low-risk transactions to validate system performance before full deployment. Select vendors who already accept cryptocurrency payments or express willingness to participate in pilot programs. Set monthly transaction limits between $25,000-100,000 to test operational workflows without exposing significant capital to new technology risks.

Monitor settlement times, conversion rates, and technical issues during pilot phases. Compare blockchain transaction costs against traditional payment methods to quantify savings (traditional cross-border payments can cost 5-7% per transaction, while stablecoins dramatically reduce these fees). Document all operational challenges and solutions to create standard procedures for broader implementation across your organization.

Final Thoughts

Blockchain technology transforms payment efficiency by reducing transaction costs from 2-7% to under 1% while it settles payments in minutes instead of days. The elimination of intermediaries removes hidden fees and compliance complexities that burden traditional payment systems. Companies that process international payments can save hundreds of thousands annually through direct peer-to-peer transactions.

Successful implementation requires strategic planning through treasury operations integration and regulatory compliance with licensed partners. Pilot programs allow businesses to validate blockchain payment systems without exposure of significant capital to new technology risks. The continuous operation of blockchain networks removes time constraints that traditional banking hours impose on urgent transactions (particularly valuable for global operations across different time zones).

The stablecoin market processed $32 trillion in transactions during 2024, which demonstrates the rapid enterprise adoption of blockchain payment solutions. As regulatory frameworks mature and integration tools improve, blockchain payments will become standard practice for businesses that seek operational efficiency. Web3 Enabler helps enterprises integrate blockchain payment solutions into their existing infrastructure for faster global transactions.