Trading crypto feels like riding a rollercoaster blindfolded. One minute you’re up 20%, the next you’re down 30%, and your portfolio looks like it went through a blender.

Trading crypto feels like riding a rollercoaster blindfolded. One minute you’re up 20%, the next you’re down 30%, and your portfolio looks like it went through a blender.

Fiat backed stablecoins change this game completely. We at Web3 Enabler see them as the secret weapon for traders who want crypto’s speed without the heart attacks.

These digital dollars stay pegged to real currency, giving you all the blockchain benefits minus the wild price swings that make traditional crypto trading feel like gambling.

What Makes Fiat Backed Stablecoins Actually Work

Think of fiat backed stablecoins as digital twins of your regular dollars, euros, or pounds. For every digital token in circulation, actual cash or government securities sit in a bank vault somewhere. USDC leads this transparency game with monthly audits by Deloitte that show exactly what backs each token.

Tether holds roughly two-thirds of the stablecoin market at around $140 billion, though it faces scrutiny over reserve disclosures. The math stays simple: one token equals one dollar, maintained through direct reserves rather than complex algorithms.

The Big Players Worth Your Attention

USDC stands out as the compliance champion, backed solely by U.S. Treasury bills and cash in regulated institutions. Circle publishes monthly attestations that prove their reserves match outstanding tokens perfectly.

Tether remains the heavyweight despite transparency concerns, processing massive daily volumes that keep crypto markets liquid. PYUSD from PayPal targets mainstream adoption, while newer entries like RLUSD from Ripple aim at institutional use.

The key difference lies in reserve management: USDC shows you the receipts, while others operate with different levels of transparency (some more questionable than others).

Why Traditional Crypto Makes Terrible Money

Bitcoin dropped 30% in a single day during March 2020, while USDC stayed rock solid at $1.00. Ethereum’s price swings make it useless for business payments or short-term value storage.

Stablecoins eliminate the guesswork by pegging to stable assets. You get crypto’s speed without the volatility headaches that plague traditional cryptocurrencies. Bitcoin and Ethereum work as speculative investments, but stablecoins function as actual money for trading, payments, and treasury management.

The $225 billion stablecoin market exists because businesses need predictable value, not roller coaster rides. This stability foundation makes them perfect for the next step: understanding how they transform your trading strategy.

Why Stablecoins Beat Traditional Trading Methods

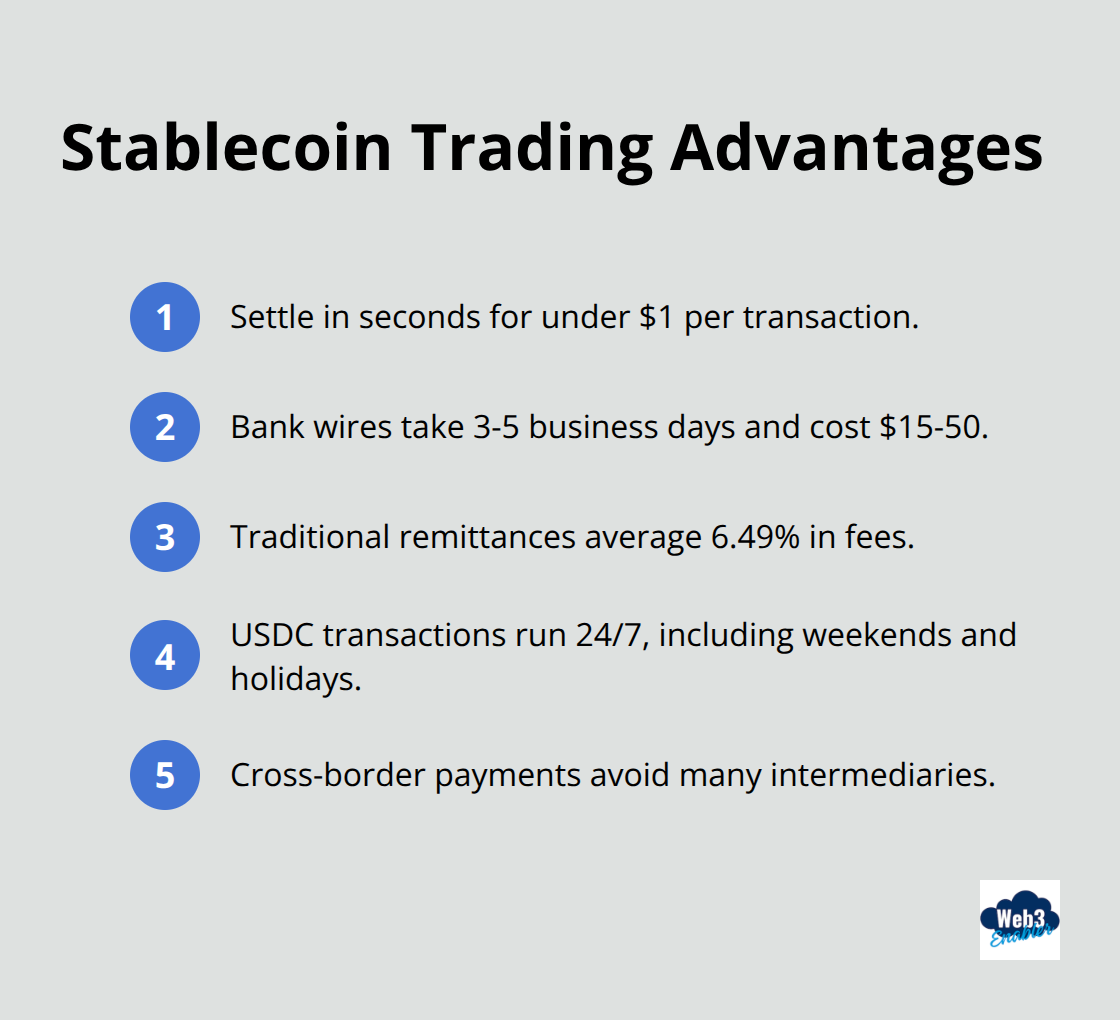

Stablecoin trading delivers three game-changing advantages that traditional methods can’t match. Settlement speed tops the list: while bank wires take 3-5 business days and cost $15-50 per transaction, stablecoins settle in seconds for under $1. Cross-border payments see even bigger improvements, with traditional remittances averaging 6.49% fees according to World Bank data, while stablecoins eliminate most intermediary costs entirely. USDC transactions on major exchanges process 24/7, including weekends and holidays when banks stay closed.

Speed Advantage Over Banking Systems

Traditional banking operates on decades-old infrastructure that shuts down nights and weekends. Stablecoin networks never sleep and process transactions instantly regardless of time zones or holidays. This speed difference becomes massive for active traders who need to move funds quickly between exchanges or capitalize on market opportunities. Major platforms like Coinbase and Kraken support instant USDC deposits, while traditional bank transfers require 1-3 business days minimum.

Cost Savings That Actually Matter

International wire transfers through banks cost $25-50 plus exchange rate markups of 2-4%. Stablecoin transfers cost $0.50-2.00 regardless of amount or destination. For businesses that send $10,000 overseas, traditional banks charge $200-400 in total fees, while stablecoins cost under $5. These savings compound quickly for frequent traders or companies that manage global payments. The math becomes even more compelling for smaller amounts (where traditional fees represent huge percentages of transaction value).

Volatility Protection Without Banking Delays

Bitcoin and Ethereum price swings make them terrible for traders who store capital between positions. USDC maintains its $1.00 peg through regulated reserves and gives traders stable value without traditional delays. This stability lets you park funds safely while you stay ready for immediate deployment. Unlike traditional savings accounts that lock up money in slow systems, stablecoins provide instant liquidity with predictable value.

Risk Management Made Simple

Smart traders know that timing matters more than perfect market predictions. Stablecoins let you exit volatile positions instantly and hold stable value until the next opportunity appears. Traditional banking forces you to choose between keeping money in slow-moving accounts or staying exposed to crypto volatility (neither option works well for active trading strategies).

These practical advantages set the foundation for secure implementation, but choosing the right platforms and security measures determines whether you actually capture these benefits.

How Do You Trade Stablecoins Safely

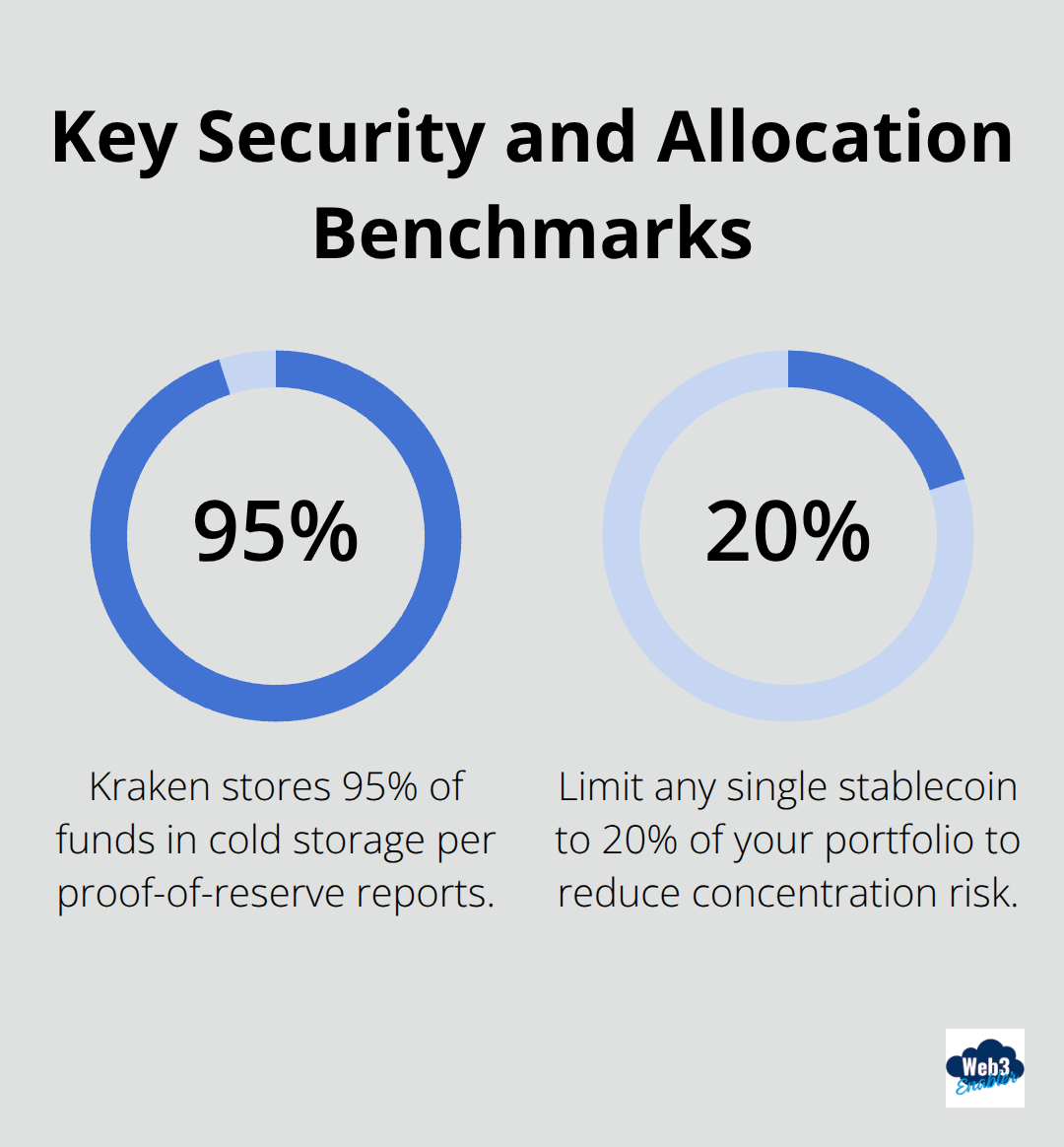

Exchange selection determines your success more than any other factor. Coinbase leads with FDIC insurance up to $250,000 on USD balances and SOC 2 compliance audits. Kraken offers cold storage for 95% of funds and maintains full reserves according to quarterly proof-of-reserve reports. Avoid smaller exchanges that lack regulatory oversight or transparent reserve policies.

Tastytrade supports USDC, USDT, PYUSD, and RLUSD deposits with institutional-grade security measures. For wallets, hardware options like Ledger and Trezor provide offline storage that hackers cannot access remotely. MetaMask works for smaller amounts but requires careful seed phrase management.

Security Setup That Actually Works

Two-factor authentication through Google Authenticator or Authy prevents 99.9% of account takeovers according to Google security research. Enable withdrawal confirmations via email and SMS for additional protection layers. Set up API key restrictions that limit trade permissions and whitelist specific IP addresses for account access.

Most exchanges offer withdrawal address whitelists that require 24-48 hour delays for new destinations. This delay stops attackers from draining accounts even if they breach your login credentials. Store large amounts in hardware wallets and only keep capital on exchanges for active trades. Cold storage eliminates online attack vectors completely.

Risk Management Beyond Basic Diversification

Never hold more than 20% of your portfolio in any single stablecoin despite their stability. USDC depegged briefly to $0.87 in March 2023 after Silicon Valley Bank issues affected Circle’s reserves (proving that even the most stable tokens face risks). Spread holdings across USDC, USDT, and PYUSD to avoid concentration risk from any single issuer.

Monitor reserve transparency reports monthly and watch for regulatory changes that could affect specific tokens. Set stop-loss orders at 2-3% below peg value to exit positions automatically if depegs occur. Keep emergency fiat reserves equal to 30 days of capital in traditional bank accounts.

Portfolio Protection Strategies

Diversify across multiple stablecoin issuers rather than concentrating in one token. Circle’s USDC offers monthly audits, while Tether’s USDT provides massive liquidity despite transparency concerns. PayPal’s PYUSD targets mainstream adoption with different regulatory backing.

Test withdrawal processes regularly to verify your access works properly. Many traders discover frozen accounts or technical issues only when they need funds urgently. Practice small test transactions before moving large amounts between platforms or wallets.

Final Thoughts

Fiat backed stablecoins transform trading by delivering instant settlements, minimal fees, and predictable value without traditional banking delays. The $225 billion market proves businesses need stable digital currencies that work 24/7 across borders. USDC’s transparency and USDT’s liquidity provide reliable options for traders who seek crypto efficiency without volatility risks.

Security remains paramount when you trade stablecoins. Use reputable exchanges with cold storage, enable two-factor authentication, and diversify across multiple issuers to avoid concentration risk. Hardware wallets protect large holdings while exchange whitelists prevent unauthorized withdrawals (even if hackers breach your login credentials).

The regulatory landscape continues to evolve with frameworks like the GENIUS Act that establish reserve requirements and transparency standards. Major corporations increasingly adopt stablecoins for treasury management and cross-border payments, which signals mainstream acceptance. We at Web3 Enabler help businesses integrate stablecoin payment solutions that enable secure global transactions and automated compliance tracking.