Crypto visibility in traditional CRMs and financial tools? It’s like trying to find a digital needle in an analog haystack.

At Web3 Enabler, we’ve cracked the code on tracking client crypto holdings in Salesforce.

Say goodbye to compliance headaches and hello to real-time crypto data, all within your familiar CRM environment.

Why Traditional CRMs Struggle with Crypto

Tracking crypto in your trusty old CRM? It’s about as easy as teaching a cat to fetch. Let’s face it, most CRMs were built when crypto was still a twinkle in Satoshi’s eye. They excel at tracking fiat currencies and traditional assets, but throw some Bitcoin into the mix, and they start sweating like a politician during a tax audit.

The Crypto-Shaped Hole in Your CRM

First off, let’s address the elephant in the room – or should I say, the Bitcoin in the blockchain? Most CRMs have about as much native crypto support as a flip phone has 5G capabilities. They simply can’t handle the wild west of digital assets. This forces financial advisors to juggle multiple platforms, spreadsheets, and probably a few prayer circles to keep track of their clients’ crypto holdings.

Real-Time Data? More Like Real Slow Data

Now, let’s talk about getting real-time crypto data. In the world of traditional assets, getting up-to-date information is as easy as checking your phone for the weather. But in crypto? It’s like trying to predict the weather on Mars. Prices swing faster than a mood in a telenovela, and most CRMs refresh like it’s 1999. This lag time isn’t just annoying – it can mean the difference between a smart move and a facepalm moment for your clients.

Compliance: The Fun Police of Finance

And then there’s compliance (cue the collective groan). It’s the fun police of the financial world, but it’s also what keeps us all out of orange jumpsuits. When it comes to crypto, compliance is like trying to nail jello to a wall. The regulations evolve faster than memes on TikTok, and traditional CRMs struggle to keep up. Financial advisors play a high-stakes game of regulatory whack-a-mole, trying to tick all the right boxes without missing a beat.

A 2023 Thomson Reuters survey found that 65% of financial institutions cited keeping up with changing regulations as their biggest compliance challenge. Now imagine throwing crypto into that mix. It’s like adding ghost peppers to an already spicy curry – things are about to get interesting (and not necessarily in a good way).

The Perfect Storm of Inefficiency

The result? A perfect storm of inefficiency, inaccuracy, and increased risk. Financial advisors spend more time wrestling with tech and less time actually advising. Clients receive outdated information. And compliance officers? They probably consider a career change to something less stressful, like lion taming.

But don’t throw in the towel just yet. While traditional CRMs might stumble in the crypto race, innovative solutions are emerging. Companies rise to the challenge, creating tools that bridge the gap between the old financial world and the new. The future of finance knocks on your door, wearing a Bitcoin t-shirt. Are you ready to answer? Let’s explore how some forward-thinking companies are revolutionizing crypto tracking in CRMs.

For Enterprises to experience the financial benefits of blockchain, they need to integrate with their business systems, their CRMs and ERPs. This integration is crucial for bridging the gap between traditional financial systems and the emerging world of cryptocurrencies.

How Web3 Enabler Revolutionizes Crypto Tracking in Salesforce

At Web3 Enabler, we’ve whipped up a solution so delicious, it’ll transform your Salesforce instance from a crypto-confused mess into a blockchain beast. Our 100% Salesforce Native blockchain integration is the secret sauce that your CRM has been craving.

Real-Time Crypto Data: Faster Than a Speeding Bitcoin

Gone are the days when getting crypto data felt like watching paint dry. Our solution helps RIAs align HubSpot and Salesforce like two trains on parallel tracks, driving leads to clients with seamless integration. It’s like having a financial crystal ball right on your dashboard. Prices update quicker than you can say “To the moon!” (or “Oh no, not again!”), ensuring you always work with the freshest data.

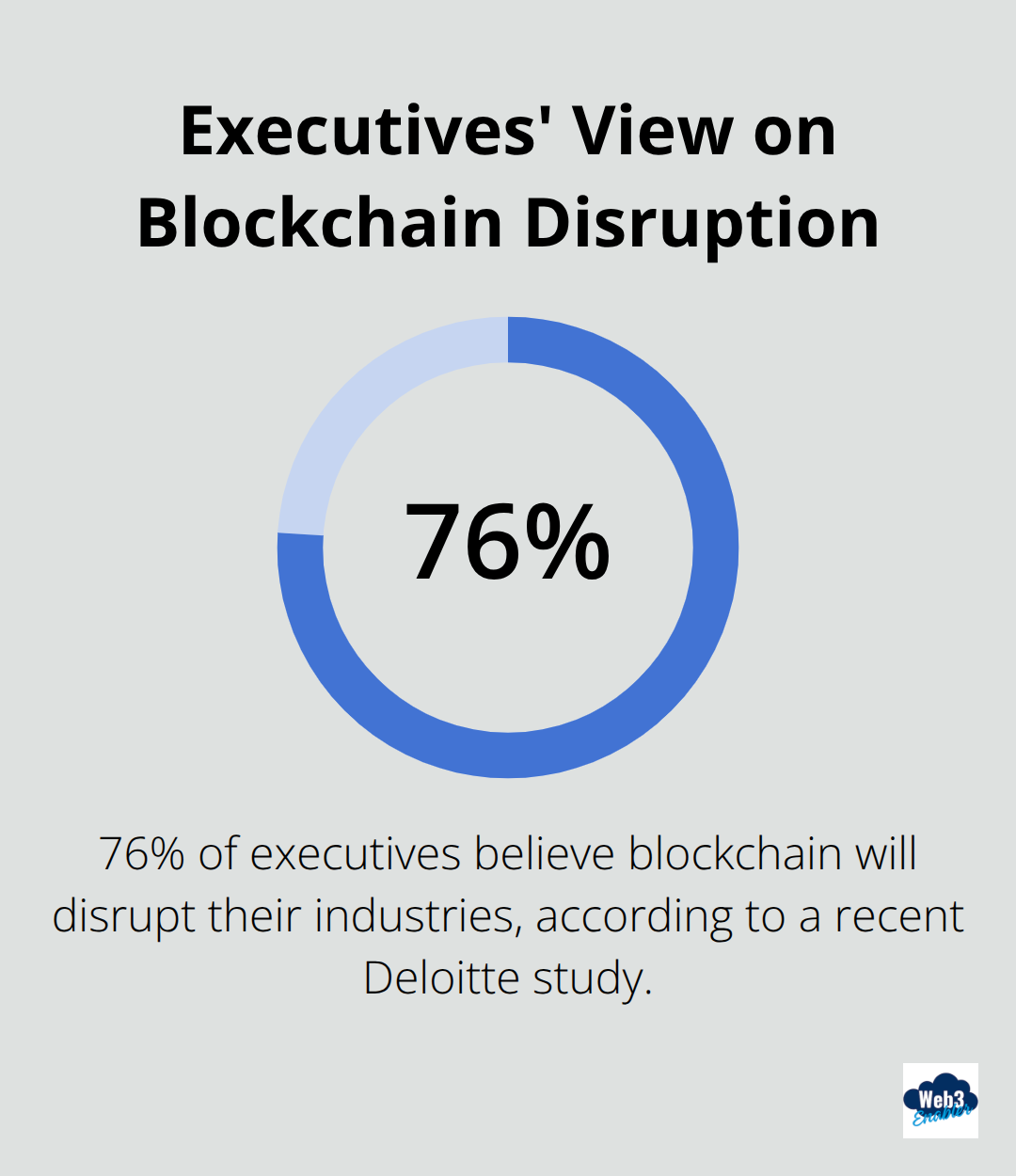

A recent study by Deloitte found that 76% of executives believe blockchain will disrupt their industries. With Web3 Enabler, you don’t just keep up – you lead the charge.

Compliance: From Nightmare to Sweet Dreams

Attention compliance officers: it’s time to put down those stress balls. Our automated compliance and reporting features will save your day (and your sanity). We’ve baked in all the regulatory goodness you need, from AML checks to KYC procedures. It’s like having a team of eagle-eyed compliance experts working 24/7, but without the coffee breaks or awkward water cooler chats.

According to a 2023 report by Thomson Reuters, financial firms spend an average of $5.6 million annually on KYC for each client. Our solution slashes those costs, letting you redirect that budget to something more fun – like an office crypto mining rig. (Just kidding, please don’t. Or if you do, invite us to the party.)

One CRM to Rule Them All

Say goodbye to the days of juggling multiple platforms and praying your Excel formulas don’t break. With Web3 Enabler, everything you need sits right there in Salesforce. Client fiat balances? Check. Crypto holdings? Double-check. A comprehensive view of assets that would make even Warren Buffet jealous? Triple-check.

This isn’t just convenient – it’s a game-changer. A 2023 survey by PwC found that 61% of financial services organizations actively work on blockchain projects. By integrating crypto tracking directly into Salesforce, you don’t just keep up with the Joneses – you leave them in your digital dust.

So, are you ready to turn your Salesforce into a crypto-tracking powerhouse? With Web3 Enabler, you don’t just adapt to the future of finance – you shape it. And trust us, it’s a lot more fun than trying to explain blockchain to your grandma.

Now, let’s explore how this revolutionary solution benefits financial advisors and institutions. Spoiler alert: it’s not just about looking cool at fintech conferences (although that’s definitely a perk).

What’s in It for Financial Pros?

A 360-Degree View That’ll Make Your Head Spin

Financial advisors and institutions, fasten your seatbelts! The crypto rollercoaster just got a whole lot smoother. With cutting-edge solutions, you won’t just keep up with the Joneses – you’ll leave them eating your digital dust.

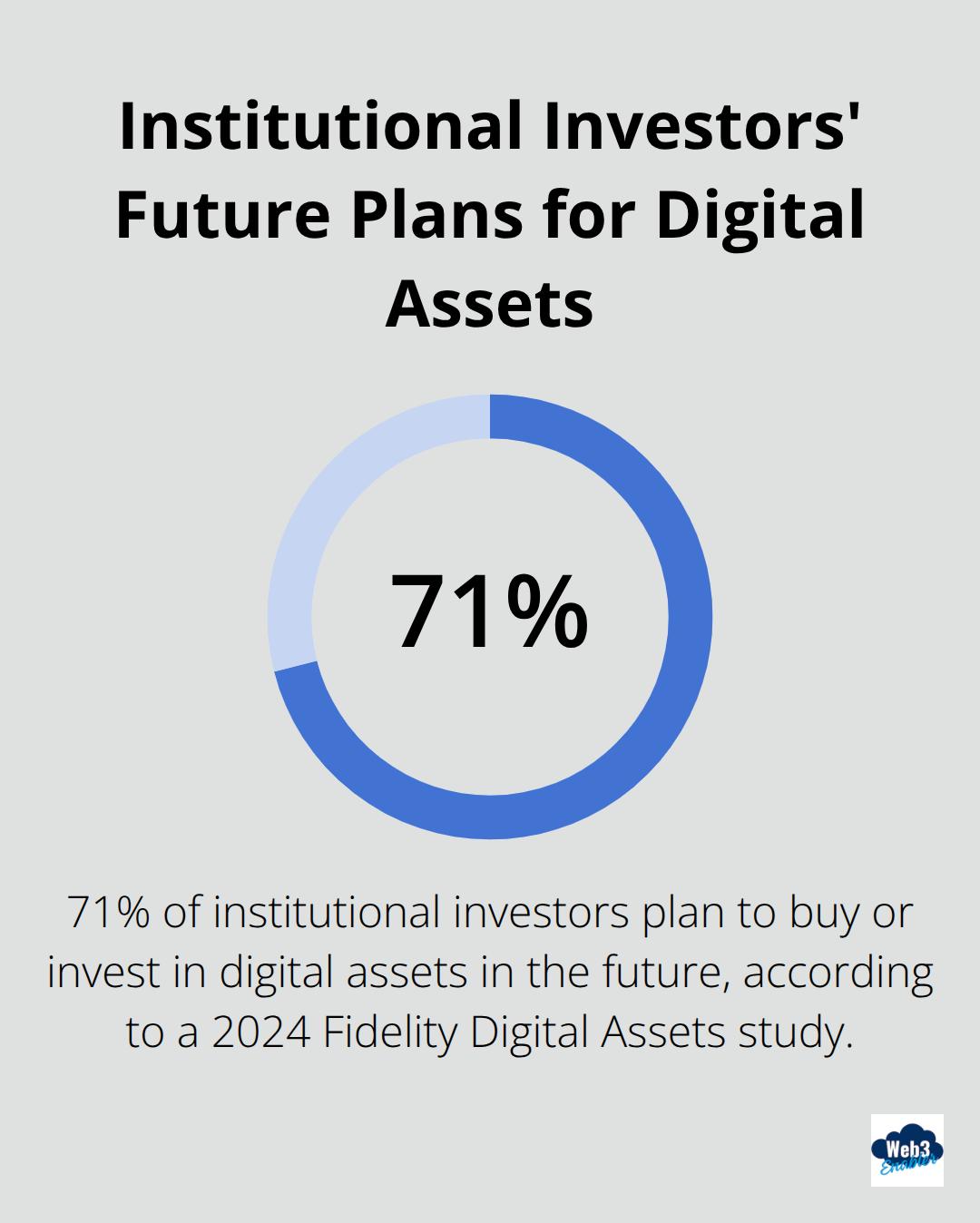

Picture this: all your client’s assets – from snooze-worthy stocks to the zestiest of altcoins – in one place. No more tab-hopping or spreadsheet juggling. A 2024 study by Fidelity Digital Assets found that 71% of institutional investors plan to buy or invest in digital assets in the future. (Talk about a trend you can’t ignore!)

This unified view allows for more accurate risk assessments and better-tailored investment strategies. It’s like having financial X-ray vision – you see everything, and your clients will think you’re a superhero (cape optional).

Client Service So Good, It’s Almost Unfair

With real-time crypto data at your fingertips, you’ll provide personalized advice faster than you can say “blockchain”. A 2023 J.D. Power study revealed that 78% of investors want more personalized communication from their advisors. Well, how’s this for personal: “Hey John, Bitcoin just spiked. Want to rebalance your portfolio?”

This level of service isn’t just impressive – it’s addictive. Clients will wonder how they ever lived without it. You’ll spot opportunities, manage risks, and make informed decisions on the fly. It’s like having a financial crystal ball (minus the creepy fortune-teller vibes).

Compliance: From Headache to High-Five

The days when compliance was the bane of your existence? Gone. With automated compliance features, you can say goodbye to sleepless nights and hello to peace of mind. The 2023 Thomson Reuters Cost of Compliance report showed that 61% of firms expect the cost of senior compliance staff to increase. But with the right tools, you can buck that trend.

Streamlined reporting means you’ll generate compliance reports faster than you can say “Know Your Customer”. AML checks? Automated. Suspicious activity monitoring? Done. It’s like having a team of eagle-eyed compliance officers working 24/7 (without the coffee breaks or office politics).

Staying Ahead of the Crypto Curve

In this fast-paced world of digital assets, staying ahead is key. With comprehensive crypto tracking solutions, you’ll position yourself as a forward-thinking advisor who’s ready for whatever the crypto world throws your way.

You’ll offer insights that your competitors can only dream of. Your clients will see you as their go-to guru for all things crypto (and traditional finance, of course). It’s not just about adapting to the future of finance – it’s about shaping it.

As blockchain solutions become more integrated with major CRM and ERP providers, financial professionals are better equipped than ever to handle the evolving landscape of digital assets. The integration of these systems enables data-driven agility, allowing for more efficient budget reallocation and improved financial management.

Wrapping Up

Tracking crypto holdings in Salesforce isn’t just a fancy add-on – it’s essential for financial institutions that want to stay ahead. The crypto market plays a significant role, and ignoring it resembles pretending smartphones are a passing fad. At Web3 Enabler, we’ve created a solution that transforms your Salesforce into a crypto-tracking powerhouse (it’s not magic – it’s just really good tech).

Financial advisors, this is your chance to shine. You can provide personalized advice based on up-to-the-minute crypto data, streamline compliance processes, and offer insights that make your competitors look outdated. This level of service turns clients into raving fans and positions you as a forward-thinking advisor ready for the future of finance.

The future knocks, wearing a Bitcoin t-shirt. Don’t let crypto visibility in your CRM remain elusive. It’s time to embrace blockchain technology and upgrade your Salesforce. Ready to revolutionize your crypto tracking game? Check out our blockchain solutions for Salesforce and join the ranks of innovative financial institutions.

![Flexible Payment Terms Using Stablecoin Technology [2025]](https://web3enabler.com/wp-content/uploads/emplibot/stablecoin-terms-hero-1764936594.jpeg)