Paying employees in cryptocurrency isn’t just a Silicon Valley fantasy anymore. Companies worldwide are embracing digital payments, but the process involves more complexity than traditional payroll.

We at Web3 Enabler see businesses struggling with how to pay employees in crypto while staying compliant. The regulatory landscape shifts constantly, and one wrong move can cost thousands in penalties.

This guide walks you through every step, from legal requirements to operational setup.

What Legal Hurdles Must You Navigate?

The IRS treats cryptocurrency as property, which means every crypto payment creates a taxable event for both you and your employees. Your employees must report the fair market value of their crypto wages as ordinary income on the day they receive payment, while you face the same withholding obligations as traditional payroll. The annual wage base for Social Security tax in 2025 sits at $184,500, and Medicare tax applies to the full crypto wage amount. You must also pay your matching share of Social Security (6.2%) and Medicare (1.45%) on all crypto compensation.

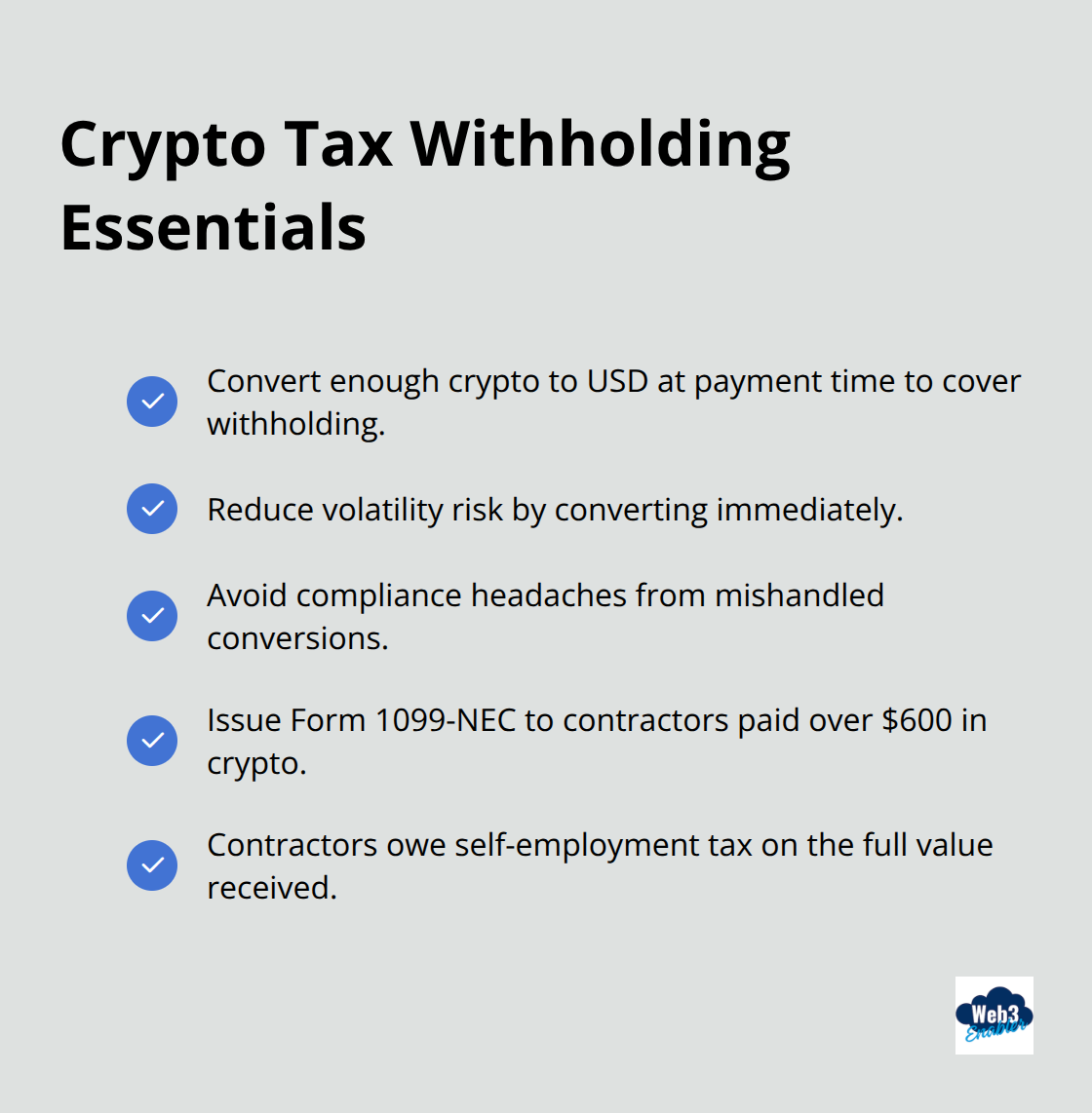

Tax Withholding Requirements

Smart employers convert enough cryptocurrency to dollars immediately upon payment to cover all tax withholding requirements. This strategy protects you from volatility while you meet IRS obligations. TokenTax research shows that improper conversion handling leads to significant compliance headaches.

Independent contractors who receive over $600 in crypto payments annually require Form 1099-NEC reports, and they face self-employment tax on the full value they receive.

International Compliance Variations

Different countries create wildly different compliance landscapes. The UK requires PAYE withholding and National Insurance contributions on crypto employment income, while Australia applies Pay As You Go withholding regulations. Canada fully taxes crypto employment income with additional capital gains implications upon sale. Some jurisdictions mandate that wages be paid in local fiat currency, which makes crypto payroll legally impossible.

Labor Law Restrictions

Research local labor laws thoroughly before you implement crypto payments in any new market, as violations carry substantial penalties that can derail your entire payroll operation. Many countries maintain strict requirements about payment methods, and crypto doesn’t always qualify as acceptable compensation. These restrictions often change without warning, so you need systems that adapt quickly to new regulations and platform requirements.

Which Crypto Payroll Platform Should You Choose?

Rise leads the crypto payroll market and $2.50 transaction fees that drop to zero on Layer 2 networks. The platform supports 90 local currencies and 100+ cryptocurrencies while it automates compliance across 190 countries. Their RiseID system streamlines management, and smart contracts eliminate manual processing errors that plague traditional payroll systems. Bitwage offers traditional banking integration but charges higher fees, while Deel provides broader HR features at premium pricing (though at a cost). Choose Rise for pure crypto payroll efficiency or consider hybrid solutions if you need extensive HR functionality beyond payments.

Integration Strategy That Actually Works

Your existing HR system needs direct API connections to prevent double data entry nightmares. Platforms like Rise integrate with major payroll providers through webhooks that automatically sync employee data, pay schedules, and tax withholding information. Set up automated data flows between your HRIS, accounting software, and crypto platform before you process your first payment. Manual data entry creates compliance risks when employee information doesn’t match across systems.

Configure real-time sync schedules during off-peak hours to avoid disruption to daily operations. Most integration failures happen because companies rush the setup phase without proper testing protocols (a mistake that costs weeks of cleanup time).

Employee Wallet Setup Without the Drama

Skip the technical explanations and focus on wallet security during onboarding. Provide employees with approved wallet options like MetaMask or hardware wallets, then walk them through the setup process via video calls. Require backup phrase storage in secure locations and test small transactions before you process full salaries.

The biggest onboarding mistake involves overwhelming employees with blockchain education when they just want to receive their paycheck. Create step-by-step guides with screenshots for each supported wallet type. Establish dedicated support channels for wallet issues because traditional IT teams often lack crypto expertise to help struggling employees.

Once your platform selection and integration work smoothly, you’ll face the real operational challenges that separate successful crypto payroll from expensive experiments.

How Do You Keep Crypto Payroll Operations Running Smoothly?

Volatility management starts with strategic conversion timing. Convert cryptocurrency to stablecoins or dollars immediately after payroll processing to lock in values for tax reporting. Rise platform data shows companies lose an average of 3-7% monthly when they delay conversions during volatile periods. Set up automated conversion rules that trigger when price swings exceed 5% in either direction within 24 hours of payment. Dollar-cost averaging works for investments, but payroll demands immediate price stability to avoid employee frustration and compliance headaches.

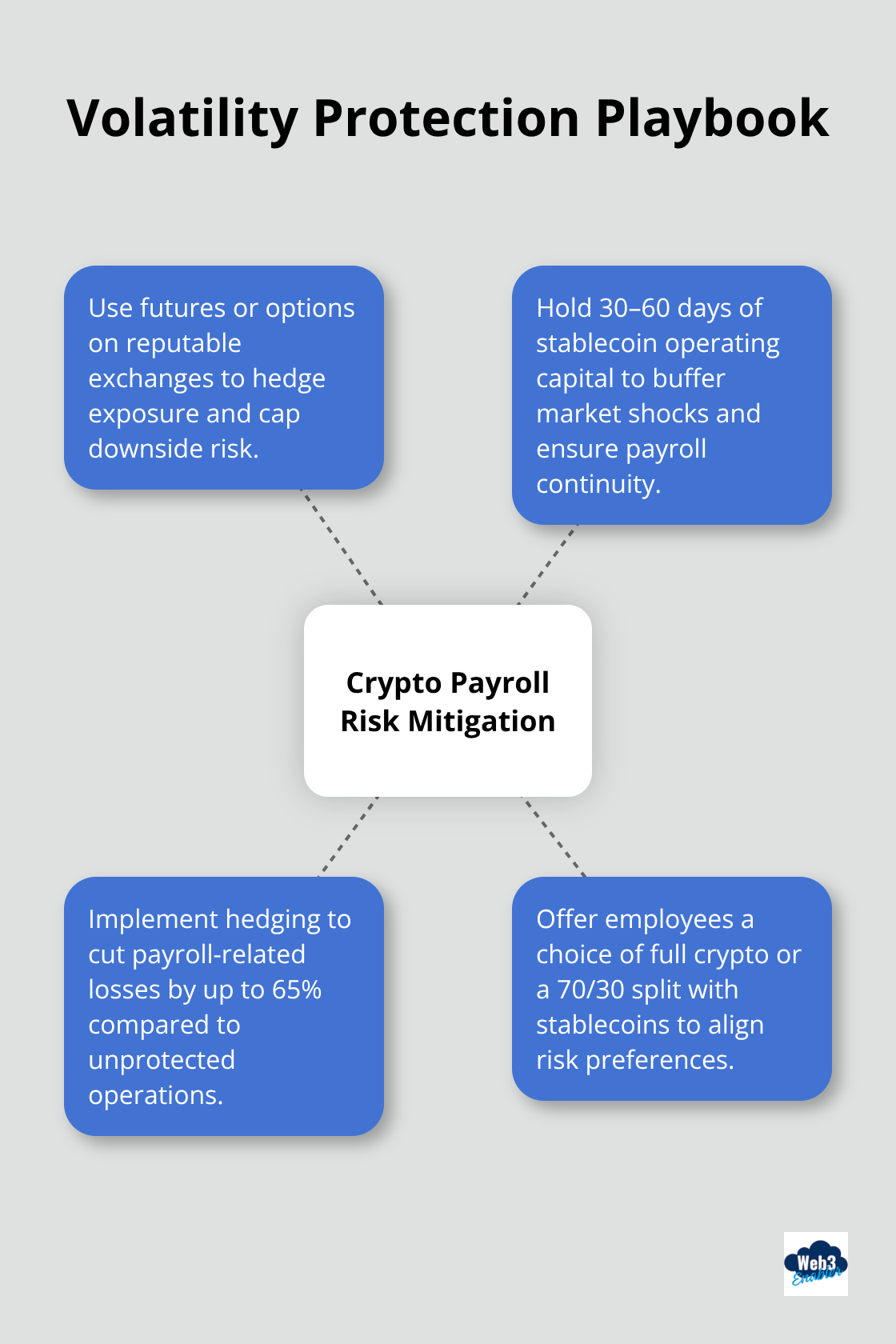

Volatility Protection Strategies

Hedge your crypto payroll exposure through futures contracts or options on major exchanges like CME or Deribit. Companies processing over $100,000 monthly in crypto salaries should maintain 30-60 days of operating capital in stablecoins to buffer against market crashes. TokenTax research indicates that businesses with hedging strategies reduce payroll-related losses by 65% compared to unprotected operations. Smart employers also offer employees the choice between full crypto payments or a 70/30 split between stablecoins and their preferred cryptocurrency to balance risk preferences.

Documentation Standards You Cannot Skip

Track every transaction with timestamps, exchange rates, wallet addresses, and employee identification numbers for IRS compliance. Final regulations require brokers to report gross proceeds from dispositions of digital assets, making meticulous record-keeping essential for fair market value calculations at the exact moment of payment. Store transaction records for seven years in multiple formats (blockchain confirmations, exchange statements, and internal payroll logs). Most crypto payroll failures happen because companies treat documentation as an afterthought rather than build robust systems from day one.

Employee Support and Communication

Employee support issues multiply when workers worry about tax implications or wallet security. Establish clear communication channels and educational resources before problems arise. Create FAQ documents that address common concerns about crypto volatility, tax reporting requirements, and wallet security best practices. Schedule monthly Q&A sessions where employees can ask questions about their crypto payments without judgment or technical jargon that confuses rather than clarifies.

Final Thoughts

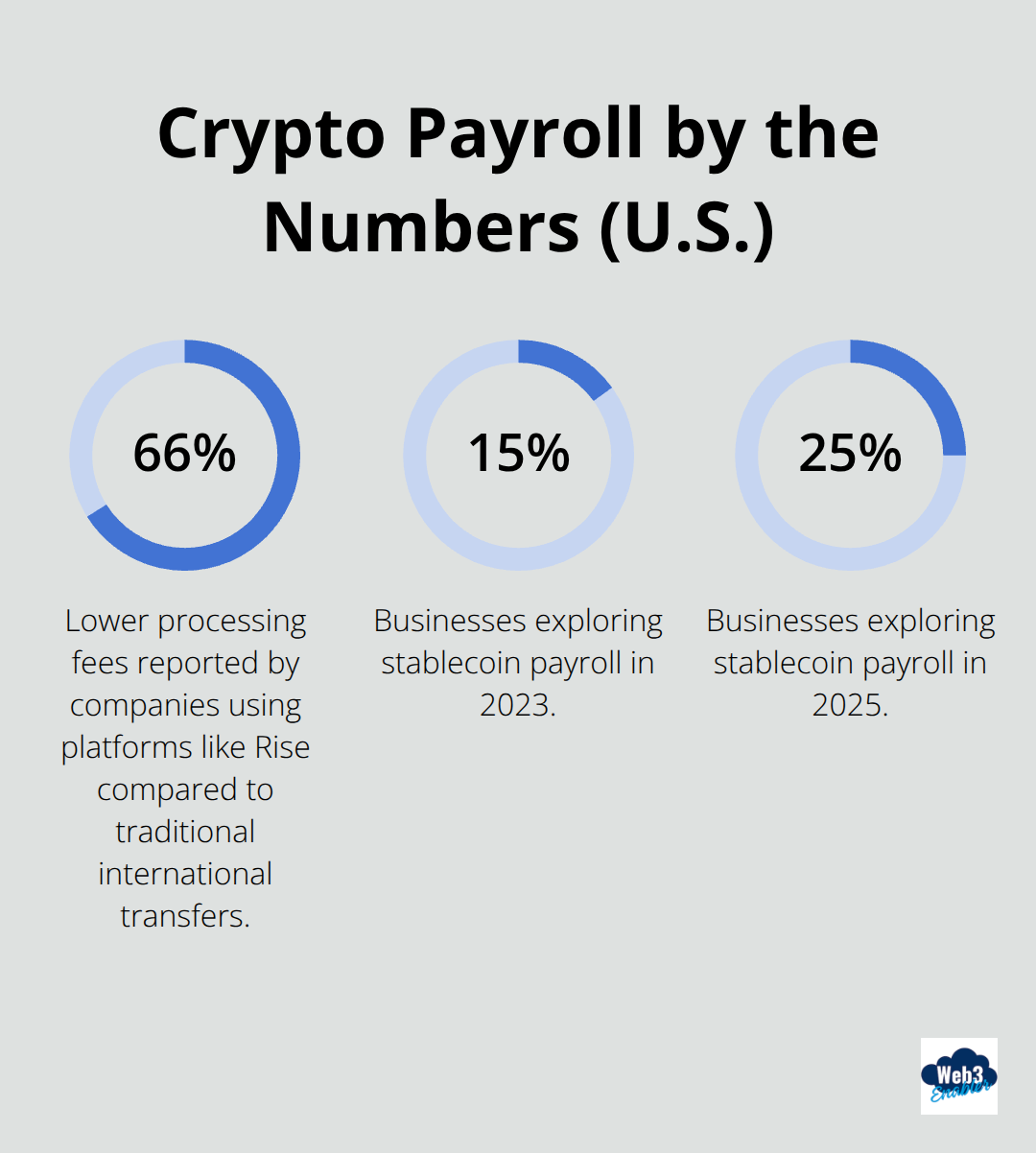

Crypto payroll transforms how businesses compensate employees, but success requires careful planning and execution. The benefits are compelling: instant global payments, reduced transaction costs, and enhanced employee satisfaction. Companies that use platforms like Rise report 66% lower processing fees compared to traditional international transfers, while employees access their earnings within minutes rather than days.

The challenges remain significant. Tax compliance complexity, volatility management, and employee education demand substantial resources. Between 2023 and 2025, companies that explore stablecoin payroll grew from 15% to 25%, yet many still struggle with regulatory requirements across different jurisdictions (especially when operating internationally).

Best practices center on stable payment methods, meticulous records, and comprehensive employee support. Start with stablecoins to minimize volatility risks, implement automated conversion systems, and establish clear documentation protocols from day one. Understanding how to pay employees in crypto positions your business ahead of this trend while meeting worker expectations for flexible compensation. We at Web3 Enabler help businesses navigate this transition with Salesforce-native blockchain solutions that integrate seamlessly with existing corporate infrastructure.