Enterprise blockchain development transforms how businesses handle payments, data sharing, and vendor relationships. Companies report 40% faster payment processing and 60% reduction in transaction costs after implementation.

Enterprise blockchain development transforms how businesses handle payments, data sharing, and vendor relationships. Companies report 40% faster payment processing and 60% reduction in transaction costs after implementation.

We at Web3 Enabler see organizations struggling with outdated payment systems that slow down operations. The right blockchain solution changes everything.

This guide walks you through building enterprise blockchain systems that actually work for your business needs.

What Do Enterprise Blockchain Systems Really Need

Your blockchain system must handle at least 10,000 transactions per second to compete with traditional payment processors. Most enterprises fail because they underestimate performance requirements from day one. Visa’s payment processing capabilities during peak periods require similar capacity for real business use.

Performance Standards That Matter

Transaction speed determines everything. Hyperledger Fabric processes 3,500 transactions per second while Ethereum handles only 15. Choose platforms that match your volume projections, not your current needs. McKinsey data shows companies that process over 50,000 monthly payments need dedicated blockchain infrastructure within six months of implementation.

Security Without Compromise

Financial regulators demand specific encryption standards. SOC 2 Type II compliance costs $50,000 annually but prevents million-dollar breaches.

Multi-signature wallets reduce theft risk by 99.7% compared to single-signature systems (according to Chainalysis reports). Your security architecture must include cold storage for 90% of funds and hot wallets only for immediate transactions.

System Integration Reality

Legacy ERP systems create the biggest headaches. SAP integration requires custom APIs that cost $200,000 on average but reduce manual data entry by 85%. Salesforce blockchain integrations eliminate duplicate vendor management and cut payment reconciliation time from hours to minutes. Your existing accounting software needs real-time blockchain transaction feeds, not daily batch uploads that create gaps in financial reporting.

Platform Selection Criteria

Enterprise platforms offer different advantages for specific use cases. Hyperledger Fabric provides privacy controls that financial institutions require, while Ethereum offers broader developer support. R3’s Corda platform focuses on regulated industries with built-in compliance features (making it popular among banks). Your platform choice affects development costs, maintenance requirements, and long-term scalability options.

The next step involves selecting the right components that will form the backbone of your blockchain architecture.

Which Components Build Your Enterprise Blockchain

Platform selection determines your project’s success or failure. Hyperledger Fabric dominates enterprise deployments with significant market presence in the blockchain technology space. The platform offers private channels that keep sensitive payment data isolated while maintaining network efficiency. Ethereum serves public-facing applications but costs $50 per transaction during network congestion. R3 Corda targets financial services with regulatory compliance built-in, making it the choice for 300+ banks worldwide. Your decision impacts development costs, ongoing maintenance, and staff training requirements for the next five years.

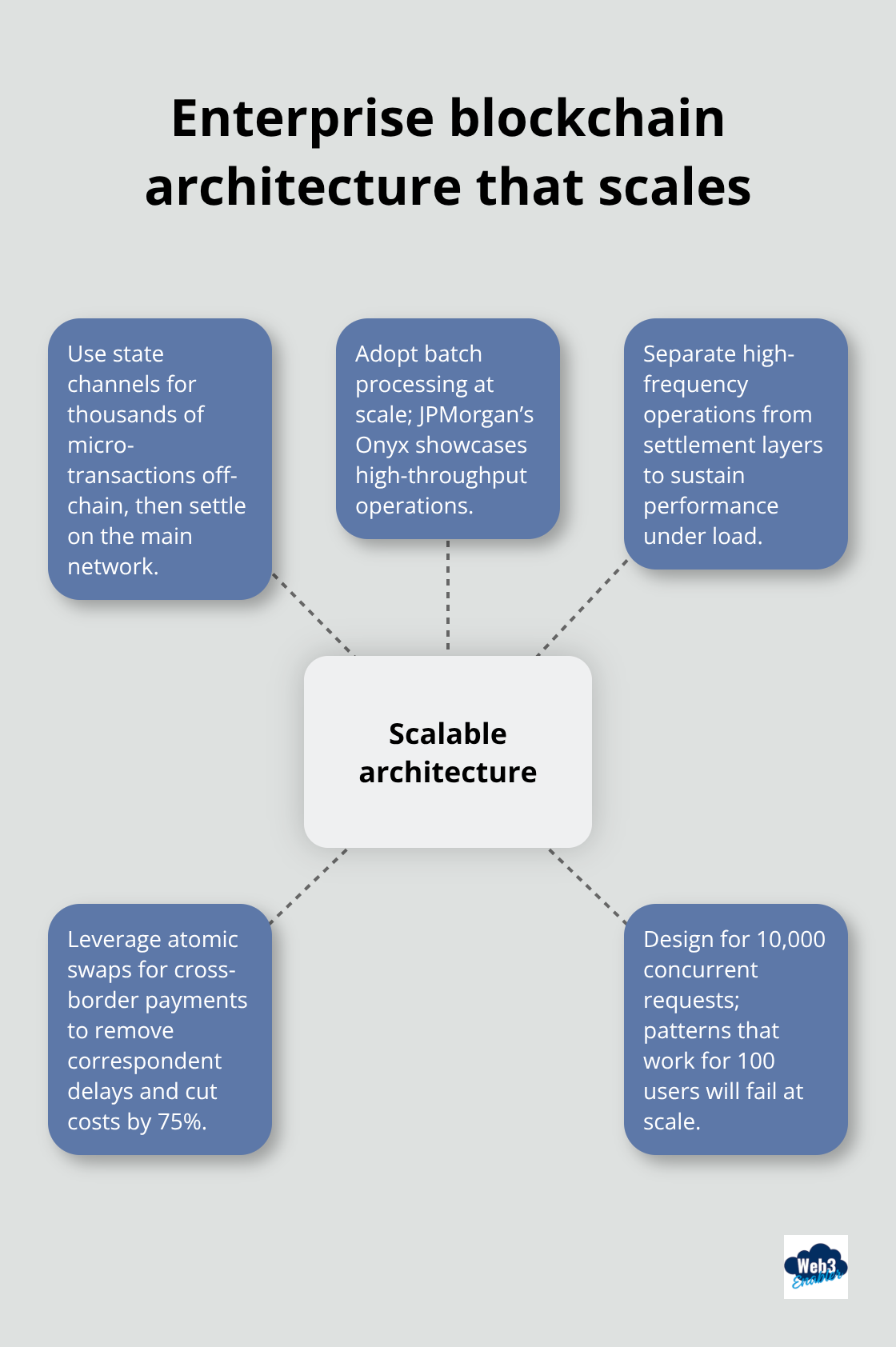

Architecture Decisions That Scale

Payment processing requires specific architectural patterns that traditional databases cannot handle. Multi-party workflows need state channels that process thousands of micro-transactions off-chain before settling on the main network. JPMorgan’s Onyx platform demonstrates this approach and handles $300 billion in daily transactions through batch processing. Your system architecture must separate high-frequency operations from settlement layers to maintain performance. Cross-border payments benefit from atomic swaps that eliminate correspondent banking delays and reduce costs by 75%.

Design patterns that worked for 100 users will crash when they handle 10,000 concurrent payment requests.

Interface Design for Business Users

Enterprise users abandon complex interfaces within 30 seconds (according to Forrester research). Your blockchain interface must hide technical complexity while it provides payment status visibility. Single-click vendor payments with automatic currency conversion increase adoption rates by 400% compared to multi-step processes. Dashboard design should prioritize payment history, pending transactions, and account balances without requiring blockchain knowledge. Mobile interfaces become essential as 60% of business payments now originate from smartphones. Integration with existing business tools like QuickBooks and SAP reduces training time from weeks to hours while it maintains familiar workflows that finance teams already understand.

Security Framework Implementation

Multi-signature wallets protect enterprise funds through distributed authorization requirements. Hardware security modules (HSMs) store private keys in tamper-resistant devices that prevent unauthorized access. Cold storage solutions keep 90% of funds offline while hot wallets handle immediate transaction needs. Role-based access controls limit system permissions based on employee responsibilities and payment authority levels. Regular security audits identify vulnerabilities before attackers exploit them, with quarterly assessments becoming standard practice among financial institutions.

The implementation phase requires careful planning to avoid common deployment mistakes that derail enterprise blockchain projects.

How Should You Roll Out Enterprise Blockchain

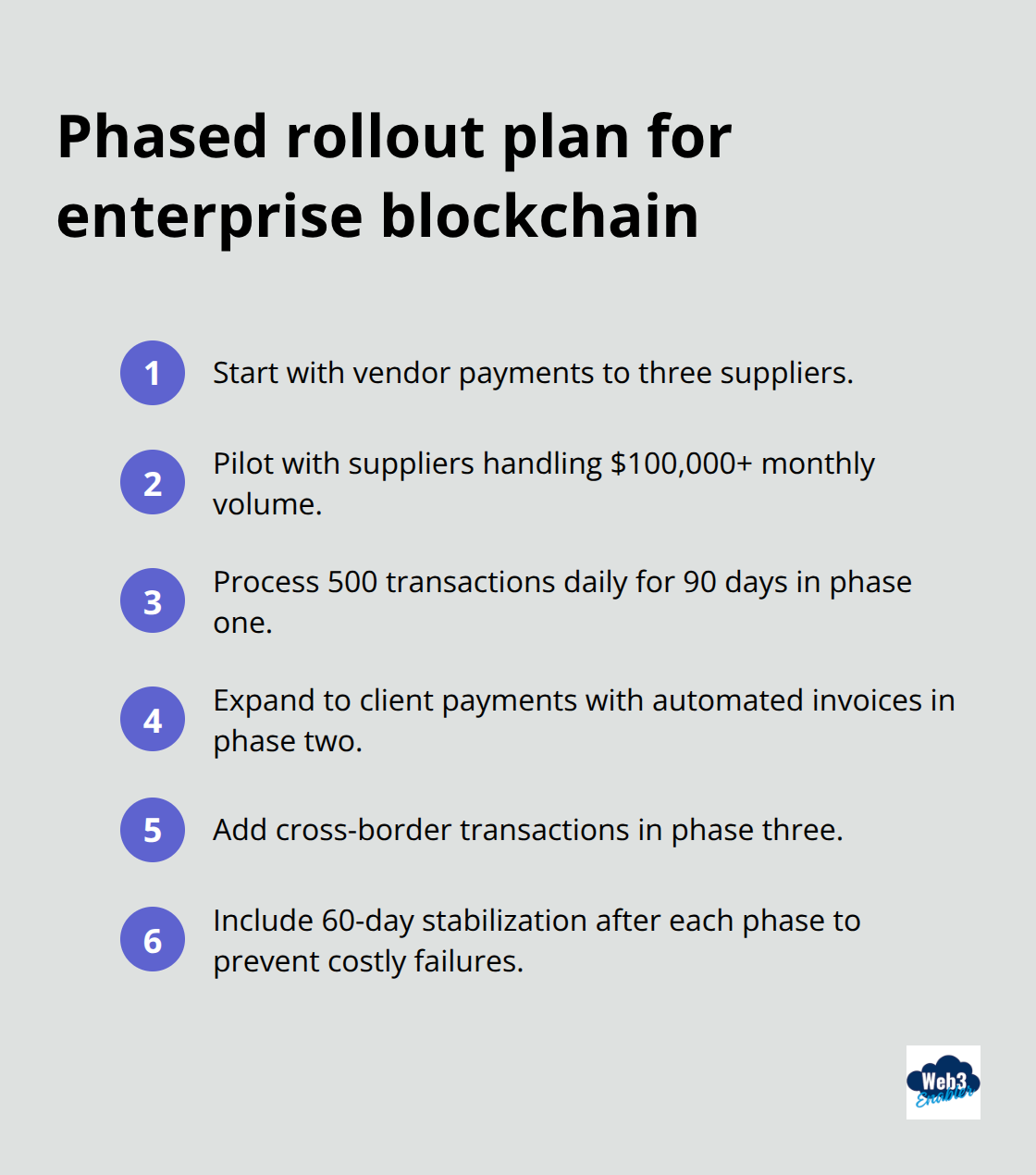

Start with vendor payments to three suppliers before you expand system-wide. Ford Motor Company reduced their blockchain rollout timeline from 18 months to 8 months with this approach. Test payment processes with suppliers who handle $100,000+ monthly volume to identify performance bottlenecks early. Enterprise blockchain implementations face challenges from attempts at full deployment without pilot validation. Your first phase should process 500 transactions daily for 90 days while you monitor system stability and user feedback. Phase two expands to client payments with automated invoices, followed by cross-border transactions in phase three. Each phase requires 60-day stabilization periods before you advance to prevent system failures that cost $2.3 million on average to resolve.

Staff Training That Actually Works

Finance teams need hands-on practice with real transactions, not theoretical blockchain concepts. JPMorgan trained 400 employees with live payment scenarios that reduced onboard time from 6 weeks to 10 days. Create role-specific modules that focus on daily tasks rather than technical architecture. Payment processors need wallet management skills, while accounts staff require transaction reconciliation abilities. Establish blockchain champions within each department who provide support after formal sessions end. IBM reports that peer-to-peer learning increases blockchain adoption rates by 85% compared to traditional classroom instruction.

Monitor Systems That Prevent Disasters

Transaction monitors must trigger alerts when process times exceed 30 seconds or costs rise above predetermined thresholds. Automated tools track network congestion, failed transactions, and security anomalies in real-time. Set up redundant systems because blockchain networks can fail without warning (as Solana demonstrated with multiple outages in 2022). Monthly security audits identify vulnerabilities before they become breaches, while quarterly performance reviews optimize system efficiency. Your dashboard should display payment success rates, average transaction costs, and network uptime metrics that business leaders can understand without technical expertise.

Maintenance Protocols That Work

Weekly backup procedures and monthly software updates maintain security standards without payment operation disruption. Schedule maintenance windows during low-traffic periods to minimize business impact. Document all system changes and maintain rollback procedures for critical updates. Test backup systems monthly to verify data integrity and recovery capabilities. Establish clear escalation procedures when system issues arise during business hours.

Final Thoughts

Enterprise blockchain development demands methodical execution and realistic timelines. Companies that rush full deployment face $2.3 million average recovery costs from system failures. Start with vendor payments, expand gradually, and prioritize staff training over technical complexity.

Three critical mistakes destroy blockchain projects: underestimating performance requirements, skipping pilot phases, and neglecting user interface design. Your blockchain system must handle 10,000+ transactions per second while it maintains security standards that satisfy financial regulators. Success depends on choosing the right platform for your specific needs (Hyperledger Fabric works for private enterprise networks, while R3 Corda serves regulated financial institutions).

The blockchain payments market will reach $146 billion by 2030. Organizations that implement solutions now gain competitive advantages through faster payments and reduced transaction costs. Web3 Enabler helps Salesforce users integrate blockchain payments into their existing workflows, making global transactions simpler and more efficient.