Choosing the right white label crypto payment gateway can make or break your fintech strategy. The decision affects everything from security and compliance to transaction speed and customer experience.

Choosing the right white label crypto payment gateway can make or break your fintech strategy. The decision affects everything from security and compliance to transaction speed and customer experience.

We at Web3 Enabler understand that evaluating these solutions requires looking beyond surface-level features. This guide walks you through the critical factors that matter when selecting a provider that aligns with your business goals.

What Is a White Label Crypto Payment Gateway

Definition and Core Functionality

A white label crypto payment gateway is a pre-built payment processing system that you rebrand and operate under your own name. The provider handles the technical infrastructure, security, compliance, and blockchain connectivity while you control the customer experience and business logic. This model eliminates the need to build payment rails from scratch, reducing development time from months to weeks and cutting infrastructure costs by 60 to 70 percent compared to proprietary development.

The gateway sits between your customers, the blockchain networks, and your banking or settlement partners, processing transactions in real time and converting between cryptocurrencies and fiat currencies when needed. You own the customer relationship and can customize workflows, pricing, branding, and features to match your business model, whether you operate a fintech platform, SaaS application, e-commerce site, or remittance service.

The Ledger-Centric Architecture

The architecture of a white label gateway typically centers on a real-time ledger that tracks all balances and transactions across multiple cryptocurrencies and blockchains. This ledger serves as the single source of truth, eliminating reconciliation delays and reducing operational complexity. The gateway connects to custody providers who hold customer assets securely, liquidity providers who enable instant conversions between assets, compliance tools that screen transactions for sanctions and money laundering risk, and settlement partners who move funds to bank accounts or mobile money platforms.

Integration and Flexibility

API-first design is critical because it lets you embed payments into your existing systems without replacing them entirely. Businesses using Salesforce can integrate crypto payments directly into their CRM workflows, automating invoicing, payment collection, and settlement tracking without switching platforms. The gateway should support multiple blockchains such as Ethereum, Bitcoin, BASE, and XRP Ledger to avoid liquidity fragmentation and give customers choice in how they transact.

Stablecoins like USDC should be native to the platform because they reduce volatility risk for merchants and enable predictable pricing for customers. The best gateways decouple the core ledger from external providers so you can swap custody, liquidity, or compliance partners without rebuilding the entire system. This flexibility matters because regulatory requirements, liquidity conditions, and customer preferences change constantly, especially in emerging markets across Africa where on-chain activity grew more than 50 percent year-over-year according to Chainalysis data.

Why Decoupling Matters for Growth

A white label solution that locks you into a single custody provider or blockchain network will constrain your growth and limit your ability to respond to market opportunities. When you evaluate providers, test whether they allow you to add new blockchains, swap liquidity partners, or integrate additional compliance vendors without major system changes. This architectural flexibility becomes your competitive advantage as regional regulations tighten and customer demand shifts across African markets and beyond.

What to Prioritize When Evaluating a Gateway

Security and Compliance Standards

Security and compliance form the foundation of any white label crypto payment gateway, and they should dominate your evaluation process. Regulators across Africa and Europe are tightening oversight, which means your provider must hold formal licenses and maintain real-time transaction monitoring across all flows. Ghana’s Virtual Asset Service Providers Bill gives the Bank of Ghana supervisory authority over crypto service providers, and Kenya’s Virtual Asset Providers Act follows a similar pattern.

If your gateway operates across these markets, verify that the provider maintains CASP licensing or direct regulatory partnerships with local authorities. Demand access to their audit trails, KYC/AML controls, and sanctions screening capabilities because regulators will hold you accountable for your provider’s failures. A gateway that cannot produce detailed compliance documentation or refuses to share their regulatory roadmap becomes a liability. Test their ability to handle evolving rules in multiple jurisdictions simultaneously, especially if you plan to scale across Sub-Saharan Africa, where regulatory frameworks are still solidifying.

Transaction Speed and Settlement Efficiency

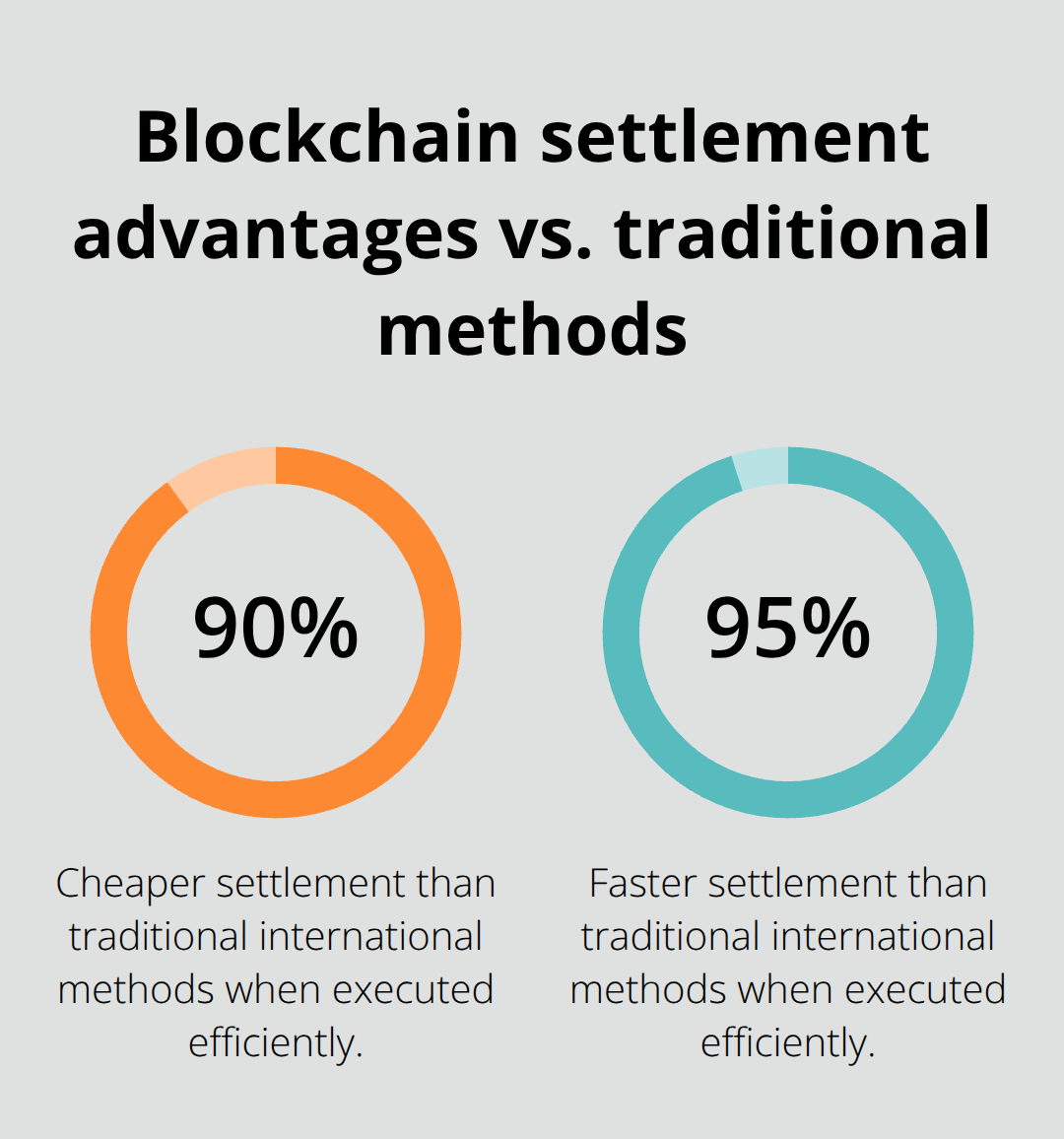

Transaction speed directly impacts your customer experience and operational costs. Blockchain payments settle 90 percent cheaper and 95 percent faster than traditional international methods, but only if your gateway executes efficiently. Measure settlement times end-to-end, not just blockchain confirmation times.

A transaction that confirms on-chain in 10 seconds but takes 3 days to clear to your bank account defeats the purpose of using blockchain.

Verify that the gateway supports stablecoins natively because USDC and similar assets eliminate volatility risk and enable instant conversions without relying on external market makers. Evaluate how the provider handles liquidity across multiple blockchains and currencies, especially local African currencies like Nigerian naira, Ghanaian cedi, and Kenyan shilling. Ask whether they support cross-chain bridges so you can move liquidity between networks without fragmenting your reserves.

Integration Capabilities and System Compatibility

Integration capabilities matter enormously because a gateway that requires custom API work for each feature wastes months of your engineering time. API-first platforms that embed into your existing systems like Salesforce or ERP software reduce implementation friction significantly. Your provider should allow you to connect crypto payments directly to your current workflows without replacing your entire technology stack.

Test whether the gateway supports the blockchains and assets your business needs. Multi-blockchain support prevents you from becoming dependent on a single network and gives your customers flexibility in how they transact.

Pricing Transparency and Fee Structure

Pricing transparency separates legitimate providers from those hiding fees in variable commissions. Demand a clear breakdown of processing fees, settlement costs, liquidity spreads, and any hidden charges. A provider charging percentage-based fees on top of fixed per-transaction rates extracts value you should keep.

Compare total cost of ownership across providers, not just headline rates. Some gateways charge lower per-transaction fees but impose monthly minimums or settlement delays that increase your effective costs. Others offer transparent, volume-based pricing with no hidden charges.

Customer Support and Operational Reliability

Customer support quality determines how fast you resolve issues when transactions fail or compliance questions arise. Verify response times, escalation procedures, and whether the provider offers dedicated account management for your volume level. A provider with slow support or unclear SLAs will create operational friction as your transaction volume grows.

The gateway you select must also demonstrate stability across market conditions. Test their infrastructure during peak trading periods and verify their uptime guarantees. When you move to implementation and testing, you’ll need a provider that responds quickly to technical questions and helps you optimize performance metrics.

Implementation and Optimization Strategies

Planning Your Integration Timeline

Integration timelines fail when teams underestimate the complexity of connecting blockchain infrastructure to existing systems. Plan for 8 to 12 weeks minimum from vendor selection to production launch, with at least 2 weeks dedicated to testing before you process real customer transactions. Start by mapping every system your gateway must connect to: your CRM, accounting software, banking partner, compliance vendor, and any custom applications. Document data flows for each integration point, including how customer identity information moves from your KYC system to the gateway, how transaction confirmations feed back to your invoicing system, and how settlement notifications trigger bank transfers.

When evaluating providers, request a detailed integration checklist and ask for references from companies operating at your scale who can confirm actual implementation timelines. Many providers quote 4 weeks but deliver in 16 because they underestimate the testing required to ensure compliance data flows correctly and transaction records reconcile perfectly with your accounting system.

Testing and Quality Assurance Processes

Quality assurance on a crypto payment gateway demands more rigor than standard software testing because transaction failures directly impact customer funds and regulatory compliance. Test every blockchain network your gateway supports, including both mainnet and testnet environments, to verify that transactions settle correctly, stablecoin conversions execute at expected rates, and settlement to your bank account completes without delays. Run load testing to confirm the gateway handles peak transaction volumes without degradation; if you expect 1,000 transactions daily, test at 5,000 transactions to identify bottlenecks before customers experience them.

Monitoring Performance Metrics and KPIs

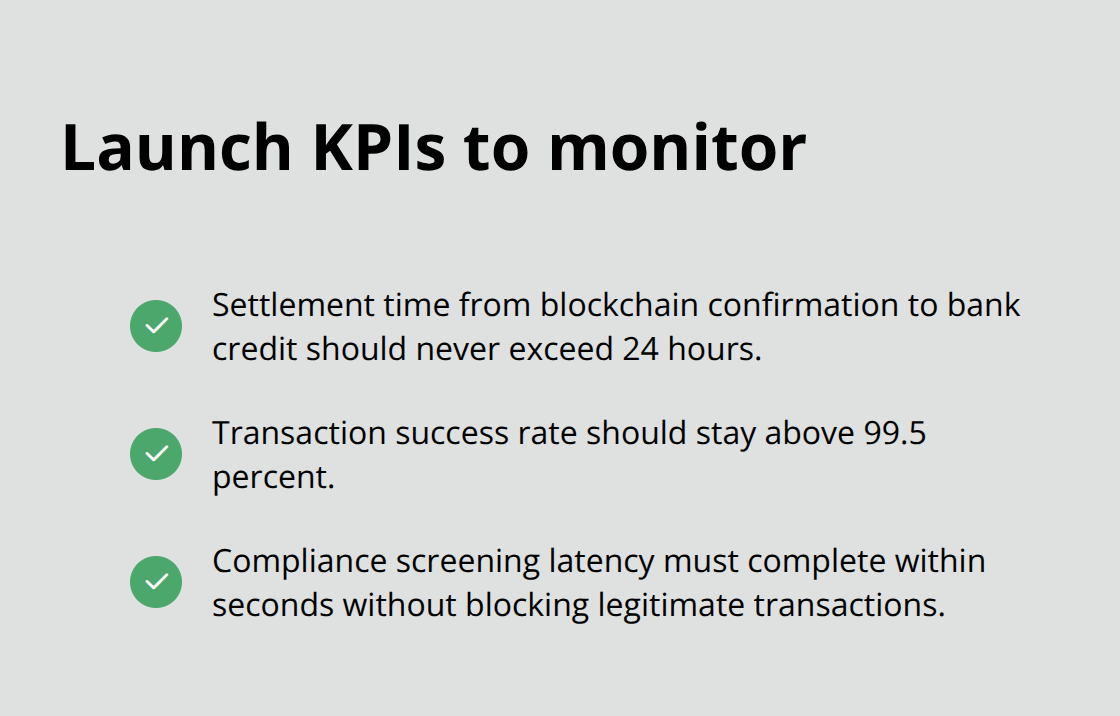

Monitor three critical performance metrics continuously once you launch: settlement time from blockchain confirmation to bank account credit (which should never exceed 24 hours), transaction success rate (which should stay above 99.5 percent), and compliance screening latency (which must complete within seconds without blocking legitimate transactions). These metrics reveal whether your gateway operates efficiently under real-world conditions and whether your provider maintains the infrastructure needed to support your business.

Scaling Operations as Transaction Volume Grows

As transaction volume grows, establish clear scaling thresholds that trigger conversations with your provider about infrastructure upgrades, liquidity expansion, and additional compliance resources. Document your scaling plan now, including the transaction volumes that trigger each upgrade phase, so you can add capacity proactively instead of reactively when your business is already constrained. Many gateways degrade under load because they lack sufficient liquidity reserves or their compliance screening tools become bottlenecks at higher volumes.

Final Thoughts

Selecting a white label crypto payment gateway requires you to balance security, compliance, speed, and integration capabilities against your specific business needs. The provider you choose becomes part of your operational infrastructure, so the decision demands careful evaluation across multiple dimensions. Security and compliance standards must come first because regulators hold you accountable for your provider’s failures, while transaction speed and settlement efficiency determine whether blockchain payments actually deliver the cost and speed advantages that justify the switch from traditional methods.

Integration capabilities matter because a gateway that forces months of custom development work negates the time savings of choosing a white label solution, and pricing transparency prevents hidden costs from eroding your margins as transaction volume grows. Your evaluation process should include testing the provider’s infrastructure under load, verifying their regulatory roadmap across the jurisdictions where you operate, and confirming their ability to scale as your transaction volume increases. Request references from companies operating at your scale and ask them about actual implementation timelines rather than the optimistic estimates providers quote during sales conversations.

The long-term value of choosing the right white label crypto payment gateway extends beyond transaction processing because a well-architected solution that decouples from external providers gives you flexibility to adapt as regulations evolve and customer preferences shift. This architectural flexibility becomes your competitive advantage, especially across African markets where regulatory frameworks continue to solidify and on-chain activity accelerates. Web3 Enabler offers native Salesforce integration that connects blockchain transactions directly to your existing corporate infrastructure, enabling faster and cheaper global payments that settle in seconds at a fraction of traditional costs.

![Flexible Payment Terms Using Stablecoin Technology [2025]](https://web3enabler.com/wp-content/uploads/emplibot/stablecoin-terms-hero-1764936594.jpeg)