Crypto wealth management is reshaping the financial landscape, and savvy advisors are taking notice.

Crypto wealth management is reshaping the financial landscape, and savvy advisors are taking notice.

At Web3 Enabler, we’ve seen a surge in financial professionals seeking guidance on incorporating digital assets into client portfolios.

This blog post will explore how advisors can effectively leverage cryptocurrencies, balancing potential returns with risk management strategies.

What Makes Crypto Unique as an Asset Class?

The Fundamentals of Crypto Assets

Cryptocurrencies operate on blockchain technology, a decentralized ledger system that offers significant benefits, including enhanced security, improved transparency, and increased efficiency. Unlike traditional currencies, crypto assets are not issued or controlled by any central authority, making them resistant to government manipulation and inflation.

Bitcoin, the most well-known cryptocurrency, has a fixed supply of 21 million coins, creating scarcity that can drive value. This contrasts sharply with fiat currencies, which central banks can print at will.

Key Features That Set Crypto Apart

Crypto assets offer several unique advantages:

- High liquidity: Major cryptocurrencies can be bought and sold 24/7 on global exchanges.

- Fractional ownership: Investors can purchase small fractions of a coin, lowering the barrier to entry.

- Programmability: Smart contracts enable automated, trustless transactions and complex financial products.

These features have contributed to the rapid growth of the crypto market. As of July 2025, the total market capitalization of cryptocurrencies stands at $4.2 trillion (according to CoinMarketCap).

Comparing Crypto to Traditional Assets

When considering crypto as part of a diversified portfolio, it’s important to understand how it compares to traditional asset classes:

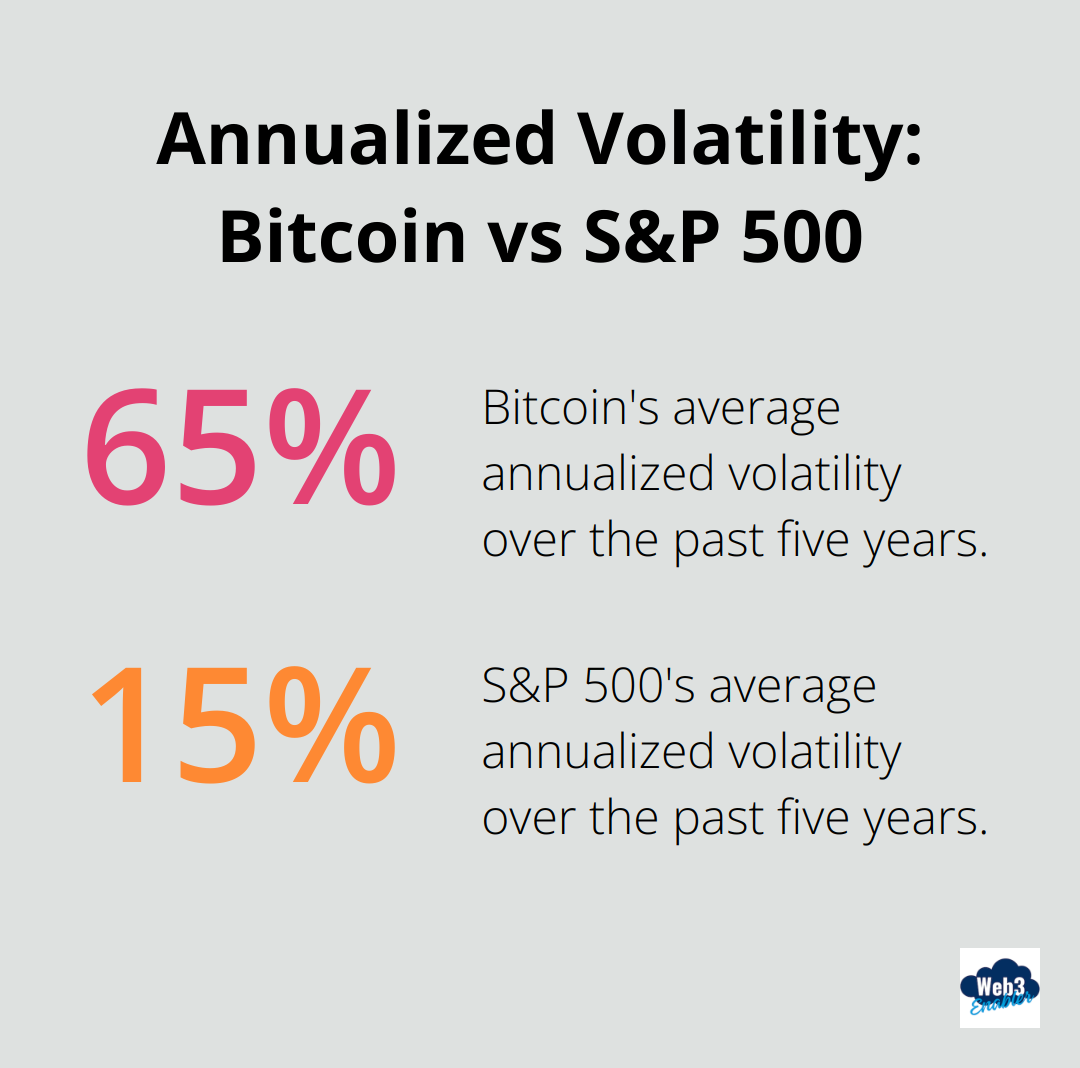

Volatility: Cryptocurrencies are known for their price volatility. Bitcoin’s annualized volatility has averaged around 65% over the past five years, compared to about 15% for the S&P 500.

Correlation: Historically, crypto has shown low correlation with traditional assets. A 2024 study by Fidelity Digital Assets found that Bitcoin’s correlation with stocks and bonds remained below 0.5, indicating potential diversification benefits.

Regulatory environment: The regulatory landscape for cryptocurrencies continues to evolve. The SEC’s approval of spot Bitcoin ETFs in January 2024 marked a significant milestone for mainstream adoption.

Practical Considerations for Advisors

Financial advisors who explore crypto integration should consider these actionable steps:

- Start small: Allocate a small percentage (1-5%) of a client’s portfolio to crypto assets to gain exposure while managing risk.

- Focus on education: Both advisors and clients need to understand the technology, risks, and potential benefits of crypto investments.

- Stay compliant: Familiarize yourself with the latest regulatory guidelines. The CLARITY Act (introduced in May 2025) may require additional registration for advisors dealing with digital assets.

Understanding the unique properties of cryptocurrencies allows financial advisors to make informed decisions about incorporating these assets into client portfolios. As we move forward, let’s explore how to effectively integrate crypto into client portfolios while balancing risk and potential returns.

How to Tailor Crypto Investments to Client Needs

Assessing Risk Tolerance in the Crypto Space

Financial advisors must gauge each client’s risk appetite when incorporating crypto assets. Traditional risk assessment tools often fall short for digital assets. We recommend specialized crypto risk assessment questionnaires that address:

- Familiarity with blockchain technology

- Previous experience with crypto investments

- Reaction to crypto market volatility

- Long-term investment horizon

Tailoring Allocation Strategies

After risk assessment, advisors should determine appropriate allocation percentages. While no universal approach exists, here are guidelines based on risk profiles:

Conservative: 1-3% allocationModerate: 3-7% allocationAggressive: 7-10% allocation

Advisors should adjust these percentages based on market conditions and individual circumstances.

Diversification Tactics for Crypto Portfolios

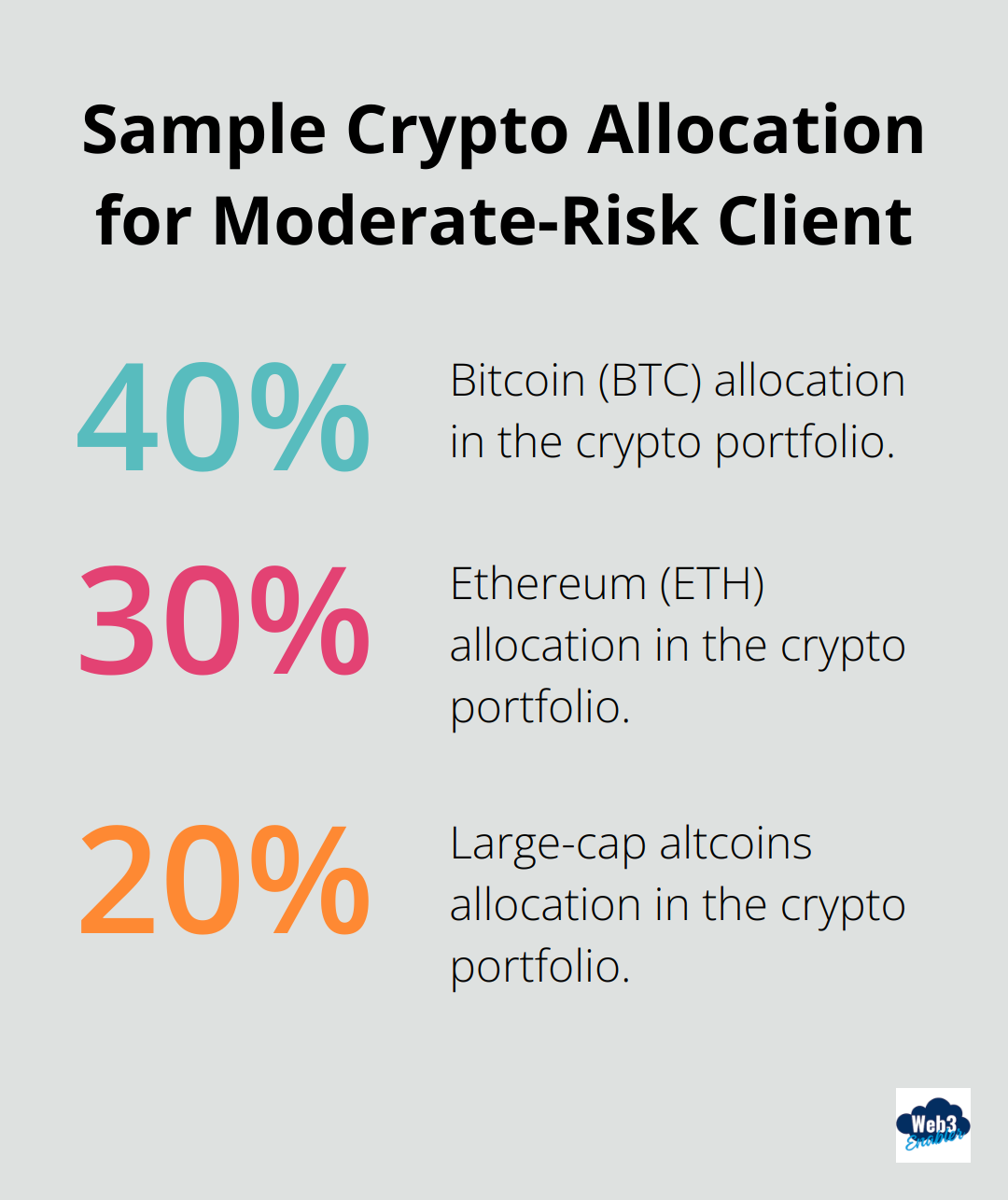

Diversification within the crypto space is essential. Here’s a sample allocation strategy for a moderate-risk client with a 5% overall crypto allocation:

Bitcoin (BTC): 40% (2% of total portfolio)Ethereum (ETH): 30% (1.5% of total portfolio)Large-cap altcoins: 20% (1% of total portfolio)DeFi tokens: 10% (0.5% of total portfolio)

This approach provides exposure to established cryptocurrencies while also tapping into the potential of emerging sectors like decentralized finance (DeFi).

Rebalancing and Monitoring

Crypto markets move fast, making regular rebalancing essential. We suggest quarterly reviews at a minimum, with more frequent checks during periods of high volatility. Automated rebalancing tools can maintain target allocations without constant manual intervention.

Tax Considerations

Cryptocurrency transactions can have significant tax implications. The IRS treats crypto as property, meaning each trade could be a taxable event. Advisors should work closely with tax professionals to optimize crypto investments for tax efficiency. Tools like CoinTracker or TaxBit can track and report crypto transactions for tax purposes.

As we move forward, it’s important to consider the tools and resources available to financial advisors for managing crypto portfolios effectively. Let’s explore some of the cutting-edge platforms and educational resources that can help advisors navigate this exciting new asset class.

Essential Tools for Crypto-Savvy Advisors

Financial advisors who venture into the crypto space need a robust toolkit to manage digital assets effectively and maintain compliance. We’ve identified key resources that can streamline crypto advisory services.

Advanced Portfolio Management Platforms

Crypto portfolio management requires specialized tools. Platforms like Shrimpy and 3Commas offer features tailored for digital assets. These tools enable advisors to:

- Track real-time portfolio performance across multiple exchanges

- Implement automated trading strategies

- Conduct detailed risk analysis specific to crypto markets

Shrimpy’s rebalancing feature maintains target allocations automatically, which saves time and keeps portfolios on track despite market volatility.

Comprehensive Educational Resources

The fast-paced crypto world demands constant learning. We recommend these educational resources:

- CoinDesk’s Crypto Explainer Series: This series offers in-depth articles on blockchain fundamentals and emerging trends.

- Messari’s research reports: These reports provide detailed analysis of specific cryptocurrencies and market sectors.

- Blockchain Council’s Certified Crypto Financial Advisor program: This comprehensive course covers crypto investment strategies and regulatory considerations.

Advisors should use these resources to educate clients, which fosters a deeper understanding of crypto investments and their role in a diversified portfolio.

Data Analytics and Market Intelligence

To make informed decisions, advisors need access to high-quality data and market insights. Consider these options:

- Glassnode: This platform provides on-chain data and analytics for major cryptocurrencies.

- CryptoQuant: This tool offers institutional-grade crypto market data and analysis.

- Santiment: This service provides behavior analytics and market insights for crypto assets.

These platforms equip advisors with the data needed to make strategic investment decisions in the volatile crypto market.

Final Thoughts

Crypto wealth management presents exciting opportunities and unique challenges for financial advisors. The potential for high returns and portfolio diversification makes crypto an attractive asset class. However, its volatility and evolving regulatory landscape require careful consideration.

Education forms the foundation for advisors who want to venture into the crypto space. Financial professionals should deepen their understanding of blockchain technology and the crypto ecosystem. They can start small with established cryptocurrencies and gradually expand their offerings as they gain expertise.

Web3 Enabler offers solutions to incorporate crypto services into existing workflows (including visibility into clients’ cryptocurrency holdings within Salesforce). Their expertise in blockchain technology makes them a valuable resource for advisors entering the crypto space. The future of wealth management is digital, and advisors who embrace this new asset class can provide added value to their clients.

![Why Payment Automation is Essential for Salesforce Users [2025]](https://web3enabler.com/wp-content/uploads/emplibot/payment-automation-hero-1763035751.jpeg)