Global remittance is undergoing a revolutionary transformation. Blockchain technology is reshaping how businesses handle cross-border payments, offering solutions to long-standing challenges in the industry.

At Web3 Enabler, we’ve witnessed firsthand how this innovative technology is slashing transaction fees, speeding up processing times, and enhancing security for international money transfers. In this post, we’ll explore how blockchain is revolutionizing global remittance and why businesses should take notice.

Why Global Remittance Needs an Overhaul

The Costly Reality of International Transactions

Global remittance, the backbone of international business transactions, suffers from outdated systems that are slow, expensive, and opaque. These traditional methods hinder businesses from reaching their full potential in the global marketplace.

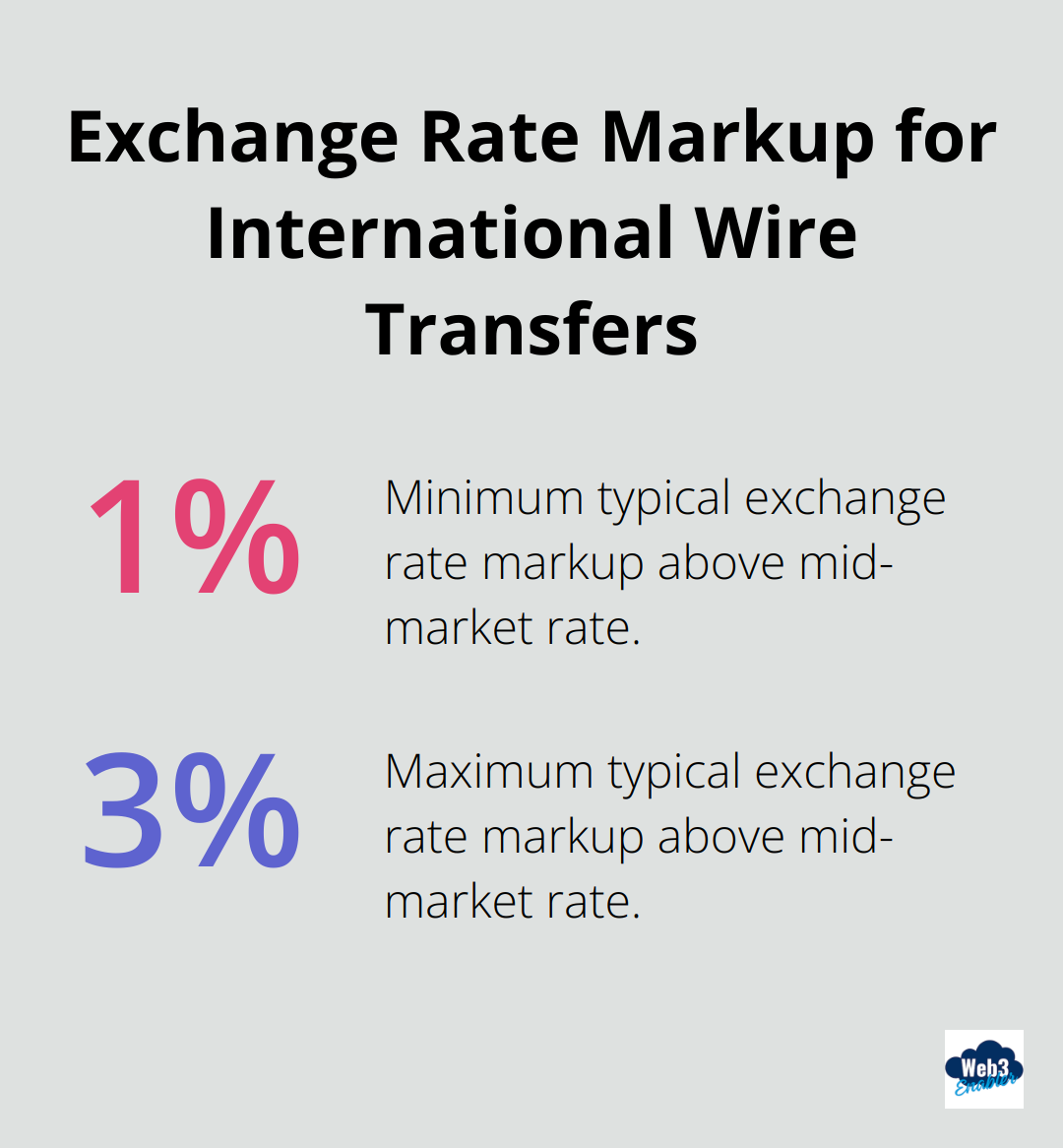

International wire transfers, the default choice for many businesses, come with a steep price tag. Recent data from major banks shows that the average cost of an international wire transfer ranges from $25 to $50 per transaction. But that’s not the whole story – businesses often face hidden fees in the form of unfavorable exchange rates (with markups typically ranging from 1-3% above the mid-market rate). For companies making frequent international payments, these costs can quickly snowball into significant amounts.

Time is Money: The Slow Pace of Traditional Settlements

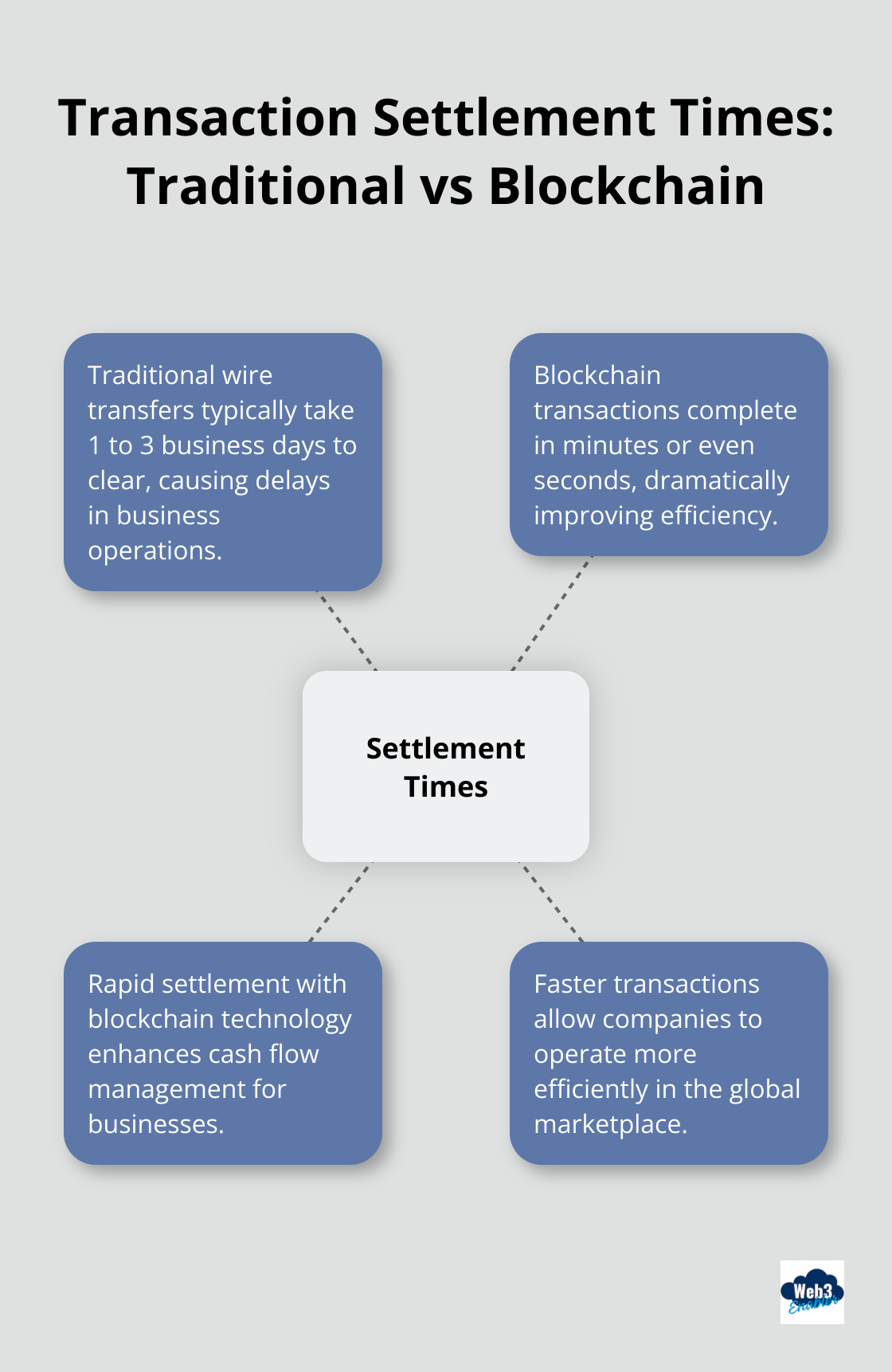

In today’s fast-paced business environment, waiting days for a payment to clear is unacceptable. Yet, that’s exactly what businesses face with traditional remittance methods. International wire transfers typically arrive within 1 to 3 business days. This delay doesn’t just affect cash flow; it can damage business relationships, push back project timelines, and result in missed opportunities.

The Opacity Problem: Lack of Transaction Visibility

One of the most frustrating aspects of traditional remittance systems is the lack of visibility into the transaction process. Once a payment starts, businesses often have no way to track its progress in real-time. This opacity leads to uncertainty, unnecessary follow-ups, and wasted time for finance teams. Moreover, it makes error resolution a nightmare, as pinpointing where a transaction went wrong in the maze of intermediary banks becomes nearly impossible.

The Need for a Better Solution

These inefficiencies can cripple businesses trying to operate on a global scale. The current state of global remittance screams for innovation and improvement. Blockchain technology offers a promising solution to address these pain points and revolutionize how businesses handle cross-border payments.

As we move forward, we’ll explore how blockchain is transforming the landscape of global remittance, offering faster, cheaper, and more transparent alternatives to traditional methods. The future of international transactions is on the horizon, and it’s built on the foundation of blockchain technology.

How Blockchain Revolutionizes Global Remittance

Dramatic Cost Reduction

Blockchain reduces wire transfer fees by eliminating the need for intermediary correspondent banks. Traditional wire transfers can involve multiple banks, each adding their own fees. In contrast, blockchain transactions often cost mere cents. This cost reduction significantly impacts businesses that make frequent international payments.

Rapid Settlement Times

Speed sets blockchain apart from traditional remittance methods. International wire transfers typically take 1-3 business days to clear. In contrast, blockchain transactions complete in minutes or even seconds. This rapid settlement improves cash flow management and allows businesses to operate more efficiently in the global marketplace.

Enhanced Security and Transparency

Blockchain’s immutability and transparency provide unmatched security. Every transaction records on a distributed ledger, making it nearly impossible to alter or falsify records. This feature reduces fraud risk and simplifies auditing and compliance processes.

Real-time transaction tracking is another advantage of blockchain. Businesses can monitor their payments at every step, eliminating the uncertainty associated with traditional remittance methods. This transparency proves particularly valuable for companies dealing with complex supply chains or time-sensitive payments.

Expanded Financial Inclusion

Blockchain technology opens new possibilities for businesses operating in regions with limited banking infrastructure. By enabling peer-to-peer transactions without traditional bank accounts, blockchain-based remittance services reach previously unbanked populations. This expanded accessibility creates new markets and opportunities for businesses worldwide.

Integration and Innovation

Platforms like Web3 Enabler’s Blockchain Payments offer seamless integration of blockchain technology into existing systems. These solutions allow companies to accept stablecoin payments and send global payments faster and cheaper, all while maintaining regulatory compliance.

The evolution of blockchain continues to drive innovation in the remittance space. From smart contracts that automate complex international transactions to the integration of central bank digital currencies (CBDCs), blockchain technology shapes the future of global remittance.

As we explore the real-world applications of blockchain in global remittance, we’ll see how businesses are already reaping the benefits of this transformative technology.

Blockchain Remittance in Action

Ripple’s On-Demand Liquidity (ODL) Solution

Ripple’s ODL solution transforms the remittance sector. It uses XRP as a bridge currency, enabling near-instant cross-border payments without pre-funded accounts. This innovation attracts major financial institutions worldwide.

MoneyGram, a global money transfer company, partnered with Ripple to use ODL for remittances between the U.S. and Mexico. The results impressed: MoneyGram reported a reduction in foreign exchange costs and settlement times dropped from hours to seconds. This partnership proves how blockchain improves efficiency and reduces costs in the remittance industry.

Circle’s USDC for Cross-Border Payments

Circle’s USD Coin (USDC) stands out as a popular stablecoin for cross-border transactions. Its 1:1 backing with the U.S. dollar provides stability, while its blockchain foundation ensures fast and low-cost transfers.

Visa’s adoption of USDC for settlement exemplifies this trend. In 2021, Visa announced it would settle transactions using USDC on the Ethereum blockchain. This move significantly reduced settlement times and costs for Visa’s partners, showcasing how traditional financial giants embrace blockchain for remittance solutions.

IBM’s World Wire: A Global Financial Network

IBM’s World Wire, built on the Stellar blockchain, aimed to revolutionize cross-border payments for financial institutions. Although discontinued in 2020, it demonstrated blockchain’s potential in connecting diverse financial systems globally.

During its operation, World Wire connected banks across numerous countries, supporting multiple currencies and banking endpoints. The platform showcased how blockchain could create a unified network for global remittance, significantly reducing the complexity and cost of international transactions.

Web3 Enabler: Integrating Blockchain with Enterprise Systems

Web3 Enabler leads the integration of blockchain technology with existing enterprise systems. Our platform enables businesses to incorporate blockchain-based remittance solutions into their workflows, particularly within the Salesforce ecosystem.

A multinational corporation (one of our clients) implemented our solution to manage cross-border payments to suppliers. They leveraged stablecoins and smart contracts, which reduced transaction fees and settlement times. This integration improved their operational efficiency and enhanced their relationships with international partners.

The Future of Blockchain Remittance

Real-world applications of blockchain in global remittance continue to grow. Companies reduce costs, speed up settlements, improve transparency, and increase accessibility through blockchain solutions. As more businesses recognize these benefits, we expect wider adoption and more innovative use cases in the near future.

Final Thoughts

Blockchain technology transforms global remittance, offering businesses faster, cheaper, and more secure cross-border payments. It slashes transaction fees, reduces settlement times to minutes, and provides unparalleled transparency. The future of blockchain in international payments looks promising, with wider adoption and innovative applications expected.

Businesses that leverage blockchain for their remittance needs will gain a significant competitive advantage in the global marketplace. They will reduce costs, improve efficiency, and expand their reach to previously underserved markets. Companies can unlock new growth opportunities and streamline their global operations with this technology.

The time to act is now for businesses looking to harness blockchain for their remittance needs. Web3 Enabler offers cutting-edge solutions that integrate blockchain technology into existing business workflows (particularly within the Salesforce ecosystem). Our platform enables businesses to accept stablecoin payments and send global payments faster and cheaper, all while maintaining regulatory compliance.