![Integrating Enterprise Crypto Wallets with Salesforce [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/crypto-wallets-hero-1761739739.jpeg) Enterprise leaders face a critical decision point when evaluating blockchain technology. The promise of decentralized systems often collides with real-world performance demands.

Enterprise leaders face a critical decision point when evaluating blockchain technology. The promise of decentralized systems often collides with real-world performance demands.

Blockchain scalability remains the primary barrier preventing widespread corporate adoption. At Web3 Enabler, we’ve analyzed hundreds of enterprise implementations to identify the exact factors that determine success or failure in scaling blockchain solutions for growing businesses.

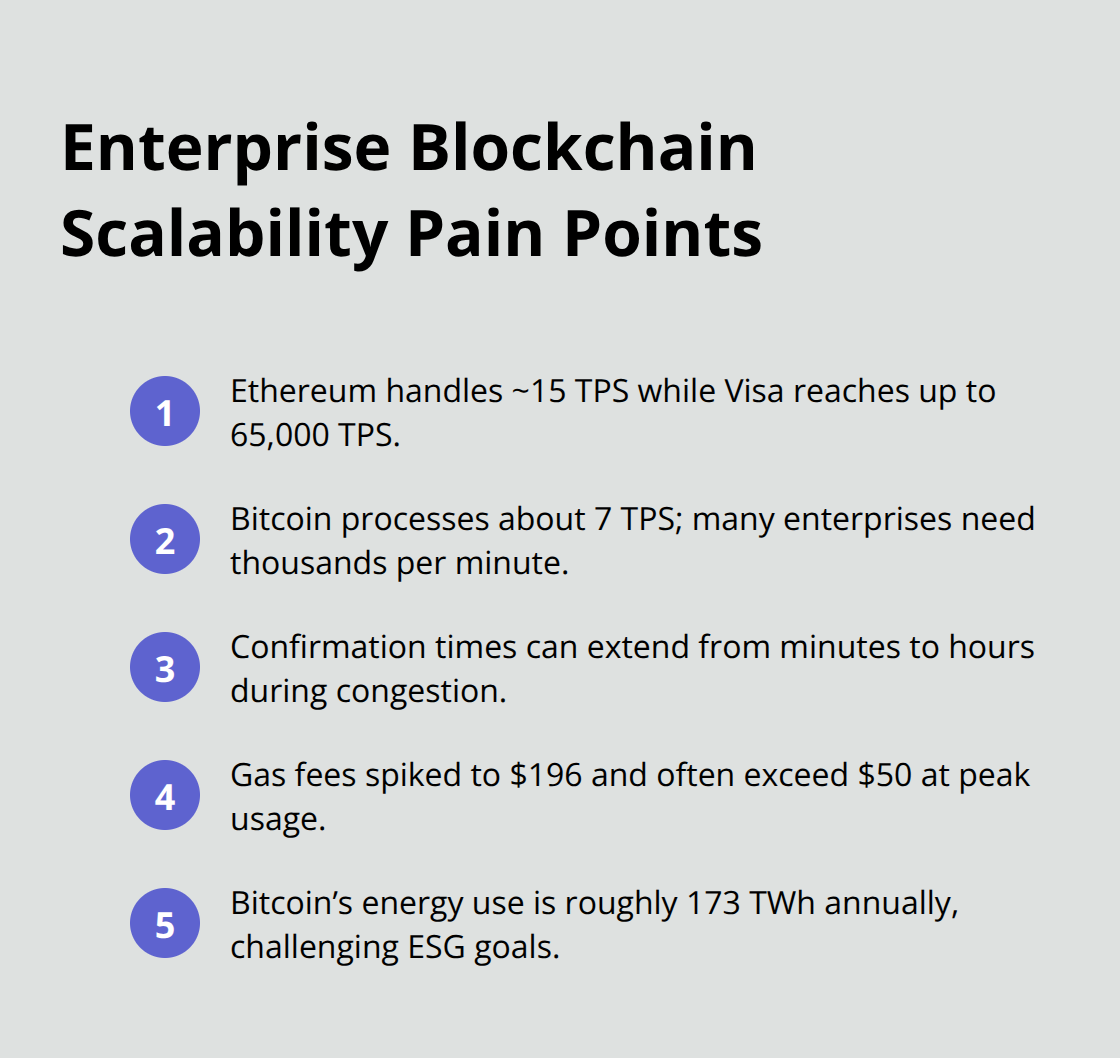

Current Blockchain Scalability Limitations

Ethereum processes only 15 transactions per second, while Visa handles 65,000 transactions per second during peak periods. This massive gap exposes the harsh reality that enterprise leaders face when they consider blockchain adoption. Popular networks like Ethereum and Bitcoin consistently deliver transaction speeds that fall short of corporate requirements, with confirmation times that range from minutes to hours when networks experience congestion.

Transaction Speed Bottlenecks Create Operational Barriers

Major blockchain networks struggle to match traditional payment systems in speed and reliability. Bitcoin processes approximately 7 transactions per second, while enterprise applications often require thousands of transactions per minute. These limitations force companies to abandon blockchain projects or accept severely compromised performance that disrupts normal business operations.

Rising Gas Fees During Peak Usage

Transaction fees on Ethereum reached $196 per transaction during the 2021 market peak, according to BitInfoCharts data. These gas fee spikes occur unpredictably, which makes budget planning impossible for finance teams. Companies that attempt to process payroll or supplier payments face scenarios where transaction costs exceed the actual payment amounts. The Ethereum network regularly experiences congestion that pushes average transaction fees above $50 (creating unsustainable economics for routine business operations).

Energy Consumption Concerns for Enterprise Operations

Bitcoin’s energy consumption equals that of entire countries like Argentina, consuming approximately 173 TWh annually. Corporate sustainability officers reject blockchain implementations that conflict with environmental commitments. Proof-of-work networks require massive computational resources that directly contradict ESG initiatives, which forces companies to choose between blockchain benefits and environmental responsibility.

Performance Degradation Under Enterprise Load

Real-world testing reveals that popular blockchain networks experience severe performance degradation when they process enterprise-level transaction volumes. Networks that claim theoretical capabilities of thousands of transactions per second often deliver single-digit performance under actual business conditions. The gap between marketing claims and operational reality creates planning disasters for technical teams that implement blockchain solutions at scale.

These fundamental limitations have sparked innovation in blockchain architecture, leading to breakthrough solutions that address enterprise scalability requirements head-on.

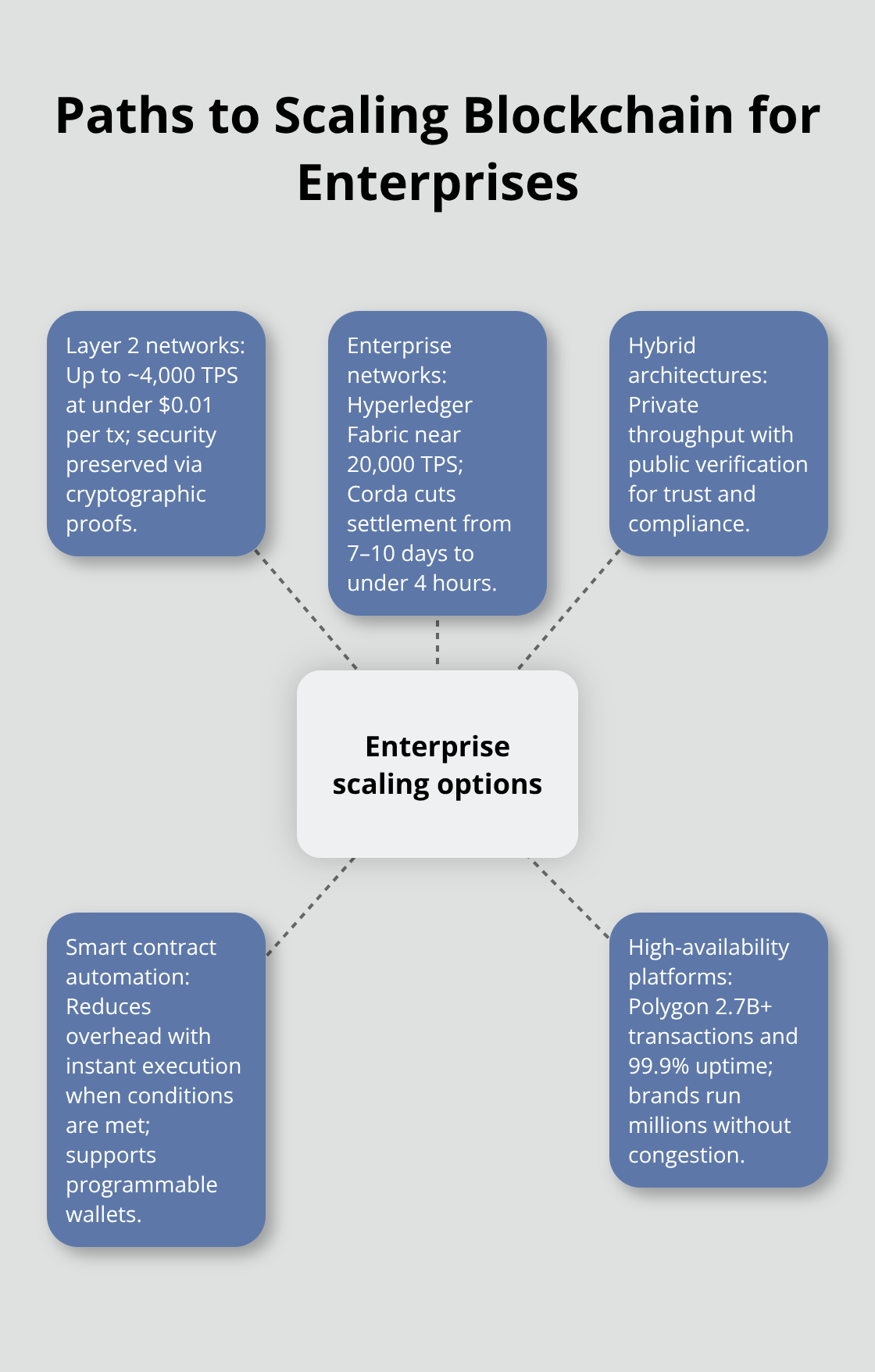

Proven Scalability Solutions for Business Applications

Layer 2 networks like Polygon and Arbitrum process up to 4,000 transactions per second at costs below $0.01 per transaction, according to L2Beat data. These solutions run parallel to main blockchain networks while they maintain security guarantees through cryptographic proofs. Polygon has processed over 2.7 billion transactions with 99.9% uptime, which proves that enterprise-grade performance exists today. Companies like Starbucks and Nike successfully process millions of customer interactions through Polygon without network congestion issues.

Enterprise Networks Deliver Predictable Performance

Hyperledger Fabric processes 20,000 transactions per second in controlled enterprise environments while it maintains complete data privacy through permissioned access controls. R3 Corda enables JPMorgan to settle trade finance transactions in under 4 hours compared to traditional 7-10 day settlement periods. These networks sacrifice decentralization for performance guarantees that enterprise operations require. Hedera Hashgraph achieves 10,000 transactions per second with finality in 3-5 seconds, while Cardano’s Hydra protocol allows for millions of transactions per second making it ideal for enterprise applications like supply chain tracking.

Hybrid Architectures Solve Real Business Problems

Walmart’s food traceability system combines private blockchain infrastructure with public network verification, which reduces contamination investigation time from weeks to 2.2 seconds. This hybrid approach processes internal supply chain data on private networks while it publishes verification hashes to public blockchains for transparency. Companies achieve the speed of private networks with the trust guarantees of public verification. The approach enables regulatory compliance while it maintains competitive operational data privacy that pure public blockchain implementations cannot provide.

Smart Contract Automation Reduces Operational Overhead

Smart contracts automate trade finance and supplier agreements, which significantly reduces operational overhead and improves supply chain coordination. The smart contracts market will grow from roughly $2.1 billion in 2024 to about $12.6 billion by 2032 (highlighting increased automation demand). These automated agreements execute payments instantly when predefined conditions are met, which eliminates manual processing delays. Financial institutions connect directly with clients through blockchain, potentially reaching unbanked populations due to reduced costs and enhanced transaction speeds enabled by programmable wallets.

The question becomes whether your specific business requirements align with these proven solutions and their associated implementation complexities.

Evaluating Blockchain Readiness for Your Business Scale

Enterprise blockchain readiness requires precise measurement of three critical factors that determine implementation success. Your business processes 50,000 transactions monthly, but Ethereum handles only 432,000 transactions daily across all users globally. This calculation reveals whether public networks can support your operations or if you need enterprise-grade solutions. Companies that process fewer than 10,000 transactions monthly can operate on Layer 2 networks like Polygon at $0.01 per transaction, while businesses that exceed 100,000 monthly transactions require private blockchain infrastructure that costs $50,000-200,000 annually according to Deloitte research.

Transaction Volume Assessment Against Network Capacity

Accurate volume assessment prevents costly implementation failures. Calculate your peak transaction periods, not average volumes, because blockchain networks fail during demand spikes. A mid-sized manufacturer that processes 5,000 supplier payments monthly can use Cardano or Solana networks, but a logistics company that handles 500,000 tracking updates daily needs Hyperledger Fabric infrastructure. Your current payment processor handles transaction bursts automatically, but blockchain networks require capacity planning that matches exact business requirements.

Implementation Costs Exceed Technology Fees

Blockchain implementation costs include network fees, integration development, staff training, and compliance auditing that totals $500,000-2 million for enterprise deployments. Network transaction fees represent only 15-20% of total implementation costs, while system integration and staff training consume 60-70% of budgets. Companies spend $150,000-400,000 annually on blockchain developers who command salaries 40% higher than traditional software engineers. Smart contract auditing costs $50,000-200,000 per deployment, and regulatory compliance adds another $100,000-300,000 in legal fees for financial services companies.

Integration Complexity Determines Timeline Success

Legacy ERP systems require 12-18 months for blockchain integration, while cloud-native platforms complete integration in 3-6 months. SAP and Oracle systems need custom API development that costs $200,000-500,000, but Salesforce-based companies can leverage native blockchain integration through platforms that connect directly to existing workflows. Your IT team needs blockchain expertise that takes 6-12 months to develop internally (or you can partner with specialists who accelerate deployment timelines by 50-70% through proven integration frameworks that improve financial decision-making).

Final Thoughts

Blockchain scalability success depends on precise alignment between network capabilities and your specific transaction volumes. Companies that process fewer than 10,000 monthly transactions can leverage Layer 2 solutions at minimal cost, while enterprises that exceed 100,000 transactions need private blockchain infrastructure. Strategic adoption requires phased implementation that starts with non-critical processes before you scale to core business operations.

Your timeline extends 12-18 months for legacy system integration, but cloud-native platforms complete deployment in 3-6 months with proper planning. Implementation costs total $500,000-2 million for enterprise deployments, with integration and training that consume 60-70% of budgets. Smart contract auditing adds $50,000-200,000 per deployment (while regulatory compliance requires additional legal investment).

We at Web3 Enabler provide native Salesforce blockchain integration that connects digital assets to your existing corporate infrastructure. Our platform enables faster global payments with transactions that settle in seconds at reduced costs. Contact our team to explore how blockchain solutions can scale with your business growth while you manage digital assets and international contractor payments within your Salesforce environment.