Venmo just made a major move by adding PyUSD support, and it’s opening doors for businesses everywhere. If you’re accepting Venmo globally in Salesforce, you now have access to stablecoin payments that settle directly to your bank account without middlemen taking a cut.

Venmo just made a major move by adding PyUSD support, and it’s opening doors for businesses everywhere. If you’re accepting Venmo globally in Salesforce, you now have access to stablecoin payments that settle directly to your bank account without middlemen taking a cut.

We at Web3 Enabler built Blockchain Payments for Salesforce specifically to make this seamless. Your customer base just expanded to include Venmo’s 84 million users, and the payment processing is faster and cheaper than traditional methods.

Why PyUSD Changes Everything for Global Venmo Payments

Venmo Users Now Access Stablecoins Across Borders

Venmo’s integration of PayPal USD (PyUSD) transforms how your customers pay you across borders. Previously, Venmo users faced a hard limit: they could only send USD transfers within the US, making international transactions impossible without switching platforms entirely. Now those 92 million Venmo users can hold and send PyUSD, a stablecoin that operates on blockchain rails rather than traditional banking infrastructure. This shift matters because PyUSD payments settle in minutes instead of days, and they move directly to your bank account without intermediaries extracting fees at each step.

PyUSD Transactions Cost Far Less Than Traditional Payments

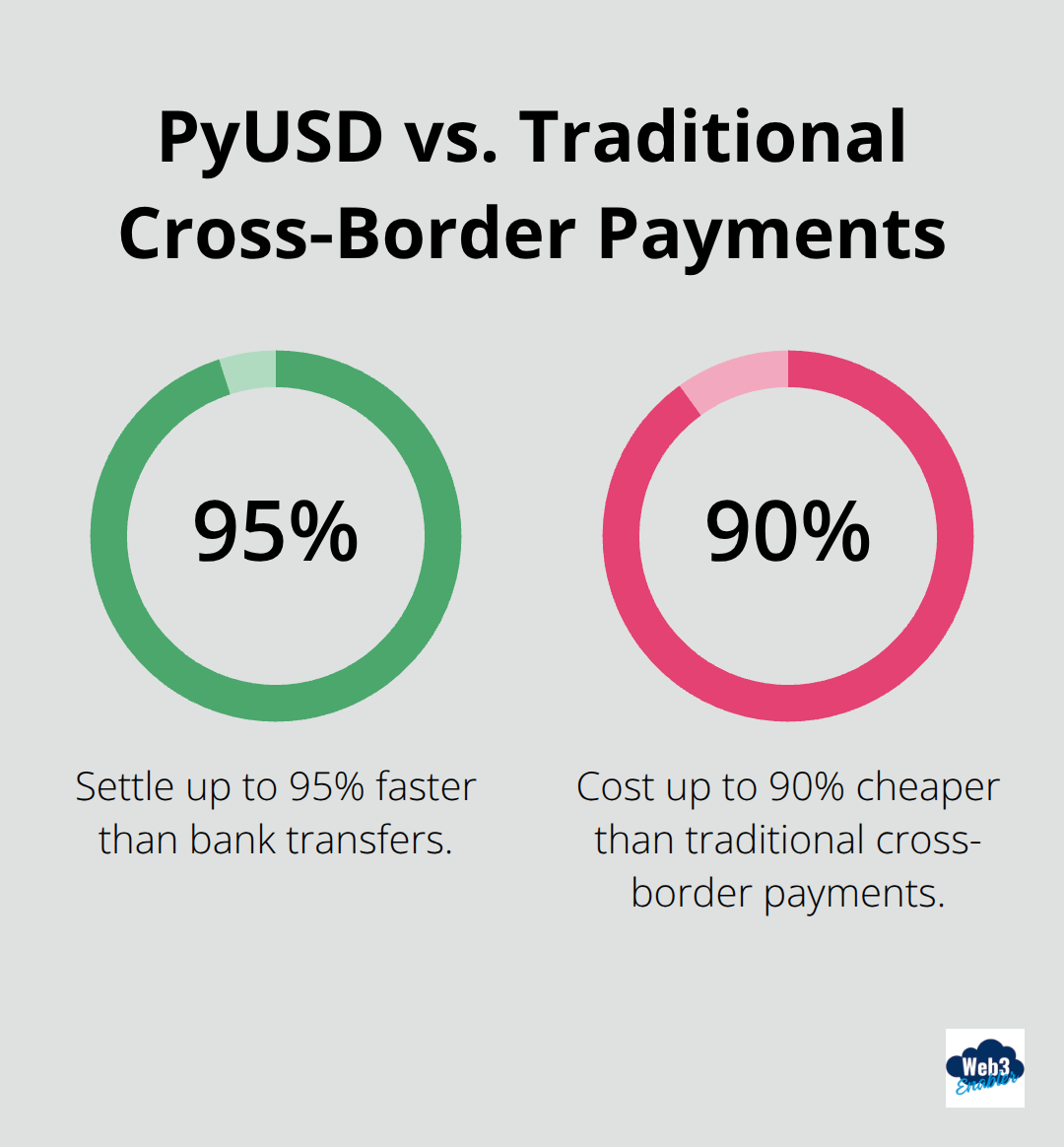

The practical advantage is straightforward: PyUSD transactions cost significantly less than traditional cross-border payments. Blockchain payments settle up to 95% faster than bank transfers and cost up to 90% cheaper, according to industry benchmarks. When a Venmo user sends you PyUSD from anywhere in the world, that stablecoin reaches your Salesforce environment instantly, ready for settlement.

Your bank receives the funds directly-no wire fees, no correspondent banking delays, no currency conversion markups eating into your margin.

Real-Time Visibility Transforms Your Cash Flow Management

Web3 Enabler’s Blockchain Payments for Salesforce handles this entire flow natively within your CRM, meaning your finance team sees the transaction, reconciles it, and records it without jumping between platforms. You gain real-time visibility into every PyUSD payment the moment it arrives, which fundamentally changes how you manage global cash flow. Reconciliation time drops from hours to seconds, freeing your team to focus on growth rather than administrative overhead. This native integration means your Salesforce environment becomes your single source of truth for all Venmo PyUSD transactions, eliminating manual data entry and reducing errors across your payment operations.

Getting Venmo PyUSD Payments Into Salesforce

Configure PyUSD as a Payment Method in Salesforce

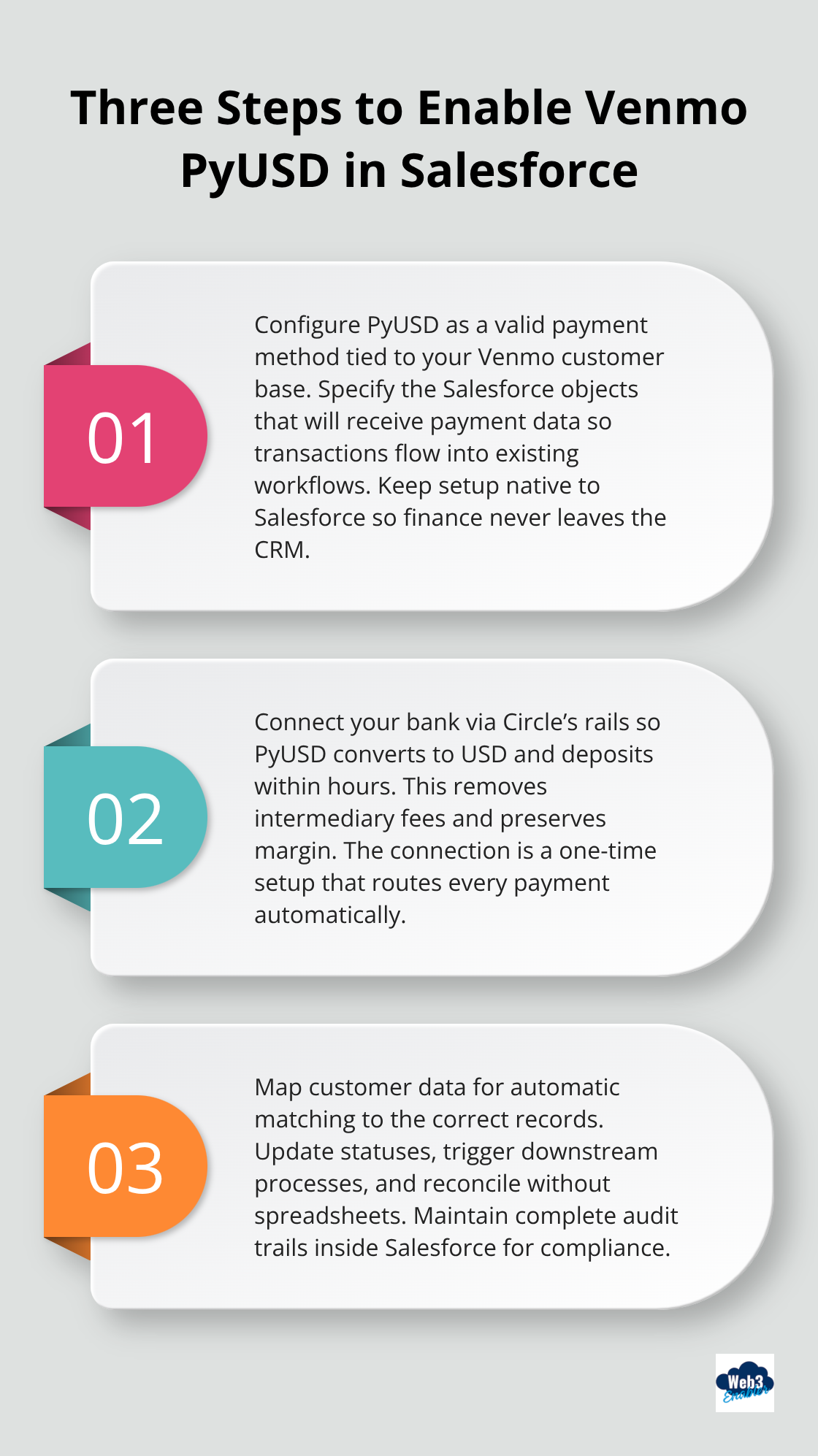

Setting up PyUSD acceptance in Salesforce requires three concrete steps that most teams complete within a week. First, you configure your system to recognize PyUSD as a valid payment method tied to your Venmo customer base. During setup, you specify which Salesforce objects receive payment data-typically your Accounts, Opportunities, or Invoices-so transactions flow directly into your existing workflows without manual intervention. Web3 Enabler’s platform handles this configuration natively within Salesforce, meaning your finance team never leaves the CRM to activate stablecoin payments.

Connect Your Bank Account for Direct USD Settlement

Second, you connect your bank account through integration with Circle’s payment rails, which converts PyUSD to USD and deposits funds directly to your checking account within hours, not days. This eliminates the intermediary fees that traditional payment processors charge; you keep more of every transaction. The connection happens once during initial setup, and then every PyUSD payment your customers send automatically routes to your bank without additional steps or manual approvals.

Map Customer Data for Automatic Transaction Matching

Third, you map your customer data so that when a Venmo user sends PyUSD, the system automatically matches it to the correct customer record in Salesforce, updates their payment status, and triggers downstream processes like invoice closure or shipment. The entire flow lives inside Salesforce, meaning your finance team never logs into a separate portal, never exports data to a spreadsheet, and never manually reconciles payments. Web3 Enabler’s native integration ensures PyUSD transactions appear in your CRM exactly as they arrive on-chain, with full audit trails and compliance documentation built in.

Watch Payments Arrive in Real Time

Your team gains real-time visibility the moment a Venmo customer initiates a PyUSD payment. PyUSD settlements complete in minutes and cost virtually nothing because they move on blockchain rails rather than banking infrastructure. You see the transaction status in Salesforce, know exactly which customer sent it, and watch the USD deposit hit your bank account before your customer receives a shipping confirmation. This speed transforms your cash flow forecasting; you no longer assume funds will arrive someday, because they’re already there.

Expand Your Addressable Market Globally

For businesses accepting payments from Venmo’s users worldwide, your addressable market just expanded dramatically. A customer in London, Tokyo, or São Paulo can now pay you instantly using the same Venmo app they use for domestic transfers, and you receive the funds in your US bank account without currency conversion risk or cross-border delays. Your operations team spends zero time chasing payments or troubleshooting failed transfers. Instead, they focus on fulfilling orders and growing revenue-which means you’re ready to explore how this global payment capability transforms your customer acquisition strategy.

What Happens to Your Bottom Line When You Accept Venmo PyUSD Globally

Accepting PyUSD from Venmo’s 92 million users transforms your financial metrics immediately. Your payment processing costs drop significantly because blockchain settlements eliminate the intermediaries that traditional payment processors rely on. A wire transfer from Europe costs $15–50 and takes 3–5 business days; a PyUSD payment from the same customer arrives in minutes and costs pennies. Stripe charges 2.9% plus $0.30 per transaction for cross-border payments, while Venmo PyUSD transactions settle at virtually zero cost once you configure them in Salesforce. Your cash flow accelerates when funds hit your bank account within hours instead of waiting for correspondent banking delays. Processing $100,000 monthly in international payments saves you $2,900 in Stripe fees alone, plus recovers working capital from 3–5 day settlement delays-that’s $34,800 annually in direct savings, not counting the operational hours your finance team no longer spends chasing failed transfers or reconciling currency conversion discrepancies.

Your Global Customer Base Expands Without New Friction

Customers in the UK, Singapore, or Mexico now pay you using their Venmo wallet without currency conversion risk or international wire complications. PyUSD support means those users send you stablecoin payments directly from their phones. Your sales team gains access to a payment method that eliminates the friction preventing international customers from completing purchases. A customer in Toronto who previously abandoned checkout because wire transfers felt too complicated now completes the transaction instantly with Venmo PyUSD. Your checkout flow asks which payment method the customer prefers-Venmo PyUSD appears alongside credit cards, and the transaction routes directly into your CRM without manual intervention. You capture revenue from customers who previously converted to competitors because your payment options felt too cumbersome for international transactions. This expansion happens without hiring new staff, building new infrastructure, or managing separate payment platforms outside Salesforce.

Real-Time Settlement Transforms Your Treasury Operations

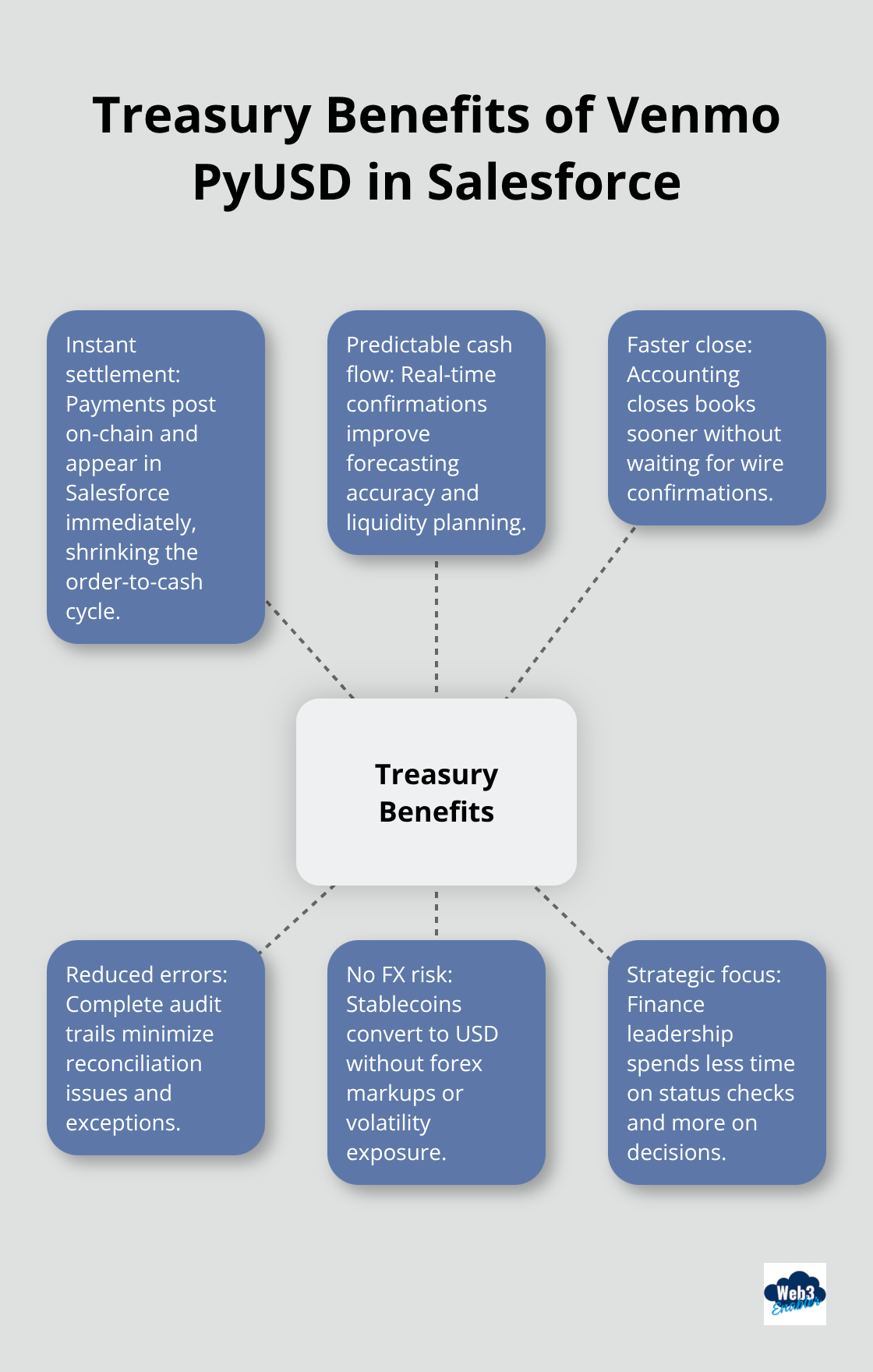

Your finance team gains complete visibility into every Venmo PyUSD transaction the moment it settles on-chain, which fundamentally changes how you forecast cash flow and manage liquidity. Traditional payments force your team to wait for settlement confirmation, reconcile banking statements against CRM records, and handle exceptions when amounts don’t match. PyUSD transactions settle instantly and arrive in Salesforce with complete audit trails, eliminating reconciliation errors and reducing the time between payment receipt and revenue recognition. Your accounting team closes books faster because they no longer wait for wire confirmations or investigate currency conversion discrepancies. If you process international payments across multiple currencies, PyUSD eliminates forex risk entirely because customers pay you in stablecoins that convert to USD at your bank without middleman markups.

Your treasury operations become predictable instead of chaotic, which means your finance leadership focuses on strategic decisions rather than payment status updates.

Final Thoughts

Venmo’s PyUSD support transforms what your business can accomplish with global payments. Your customers now send you stablecoins that settle instantly and cost virtually nothing compared to traditional wire transfers or credit card processors. When you accept Venmo globally in Salesforce, you tap into a payment method that eliminates the delays, fees, and currency conversion risks that have plagued international transactions for decades.

The revenue opportunity arrives immediately and measurably. Venmo’s 92 million users can now send you PyUSD payments from anywhere in the world, and those funds reach your bank account within hours instead of days. Your finance team gains real-time visibility into every transaction without leaving Salesforce, which means reconciliation happens automatically and your cash flow forecasting becomes predictable. You capture customers who previously abandoned checkout because international payments felt too complicated, and you reduce processing costs by up to 90% compared to traditional payment gateways.

Web3 Enabler makes this entire workflow seamless by bringing blockchain payments natively into Salesforce. We built Blockchain Payments for Salesforce specifically to handle PyUSD transactions from Venmo users without requiring your team to manage separate platforms or manual reconciliation processes. Visit Web3 Enabler to see how accepting Venmo PyUSD payments transforms your global payment operations and captures revenue from customers you couldn’t reach before.