Introducing Web3 Enabler’s Digital Asset Wallet for Salesforce Financial Services Cloud Salesforce

Digital Asset Wallet for Financial Services Cloud is the latest innovation from Web3 Enabler, designed to transform how financial advisors and wealth managers handle digital currencies within Salesforce. With seamless integration into Salesforce’s Financial Services Cloud, this tool empowers financial professionals to manage crypto assets as intuitively as traditional investments, bridging the gap between conventional finance and the digital economy.

Digital Assets in Salesforce

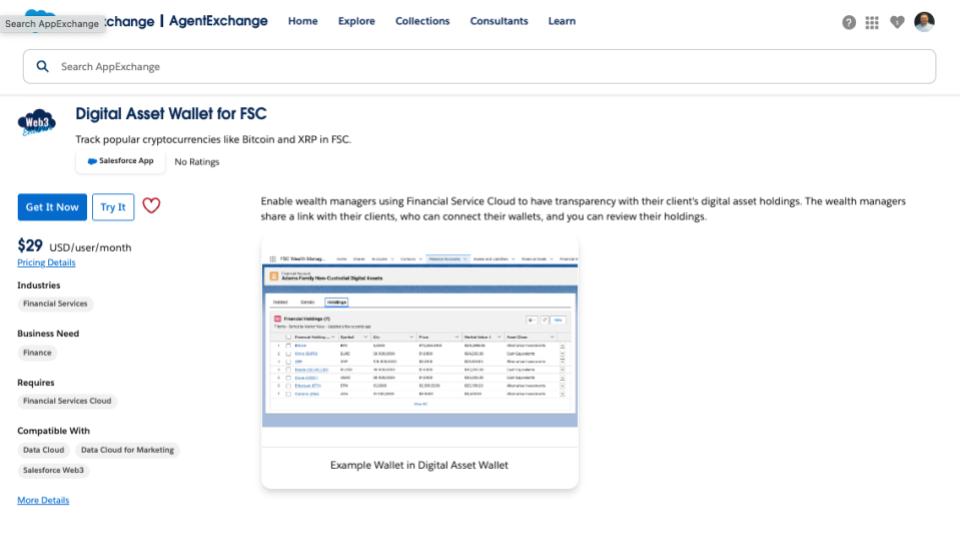

Digital Asset Wallet for Financial Services Cloud provides financial advisors and wealth managers with a 360 degree view of their client finances. Digital Asset Wallet allows clients to connect their wallets on a variety of blockchains, providing transparency for asset holdings without giving up their private keys.

This allows their advisors to see their holdings, market them to market, and include them in the overall financial portfolio of their company.

With Digital Asset Wallet for Financial Services Cloud, your Web3 Wallets are safely held with your hot or cold storage solutions, while providing visibility for your financial advisor to see the full picture.

Product Features

Focus on Global Reach

While U.S.-centric, the product is designed to cater to international markets, accommodating various currencies to enhance its global usability. Companies using the tech stack are globally recognized and have reach across many markets.

Native Portfolio Management

The wallet allows users to visualize their digital assets just like traditional stocks, enhancing analytic capabilities for financial advisors.

Growth of Digital Assets in Financial Services

The rise of cryptocurrencies and blockchain technology demands that financial institutions adapt to remain relevant. The Digital Asset Wallet positions itself uniquely by bridging traditional finance with the growing digital assets market. It appeals to digitally-savvy, and often younger investors, and can help financial advisors adjust their strategy accordingly. For example, Fidelity has a digital asset management department specifically to attract younger investors and replace their aging client base that clings to the familiarity of traditional securities.

Significance of the Salesforce Ecosystem

Ninety-one percent of Salesforce customers utilize tools created by an Independent Software Vendor like Web3 Enabler, spending $140 Billion on the AppExchange. Web3 Enabler’s decision to launch on the AppExchange signifies its strategic positioning aimed at optimizing reach. This move allows for easier adoption of crypto assets in a well-established ecosystem, facilitating broad-based acceptance and operational efficiency.

Customizable Solutions for Advisors

The appeal of the Digital Asset Wallet lies in its customizable nature for both individual advisors and organizations. It has a flexible business model that can expand its user base and enhance advisor-client interactions tailored to specific needs. For example, if a client is looking to create a less conservative risk profile and include cryptocurrency, then advisors can look at current holdings and suggest assets that would complement the portfolio as a whole.

Market Responsiveness with Diverse Currency Options

The wallet is strategically positioned to accommodate international clients with built-in support for both USD and Euro-denominated stablecoins and crypto assets. This drives discussions around diversified portfolios and intelligent investment strategies in foreign markets, boosting crypto asset relevance beyond geographic boundaries.

Intelligent Investment Conversations

By allowing advisors to view digital asset holdings alongside traditional investments, the wallet encourages more informed discussions with clients about asset allocation and risk management, improving client relationships and satisfaction levels. Making this feature available to Main Street firms at a reasonable price point will allow them to differentiate their firms’ offerings as crypto becomes a more commonly held asset. It will also attract new clients, particularly those choosing financial advisors for the first time.

Anticipation of Product Deployment

The scheduled launch in Q2 illustrates a clear timeline for customer expectations, fostering excitement within the market and enabling advisors and potential users to prepare for adoption and implementation of the new technology.

Supported Networks

- Connect Popular Wallets (Wallet Connect, xPub, or Similar)

- Retrieve Current Assets for Wallets (Native Coin + Crypto Assets)

- Provide a Listing of ALL Current Assets

- Provide a Valuation (Mark to Market) of current verified assets

Supported Assets

- Ticker and Name are Stored

- URL to lookup the backer (if applicable)

- Verification of Contracts or similar

- Mark to Market (Coingecko or otherwise)

- Ability to aggregate total amount across networks (if applicable)

Supported Exchange

- Customer can connect account (OAuth or Similar)

- Customer can authorize read only access

- With that authorization, Financial Services Cloudcan retrieve the assets on hand

- Financial Services Cloud can mark to market

Availability on the Salesforce AppExchange

Web3 Enabler positions itself as a vital player in the enterprise adoption of crypto solutions, being the sole Salesforce Independent Software Vendor (ISV) that focuses on blockchain payment systems available within the AppExchange.

Check out our Blockchain Payments App Exchange listing.

Learn more by scheduling a time with the Web3 Enabler team.

Digital Wallet Frequently Asked Questions

Digital Asset Wallet for Salesforce Financial Services Cloud

What is the Digital Asset Wallet for Salesforce Financial Services Cloud?

The Digital Asset Wallet is a Web3 Enabler solution built specifically for Salesforce Financial Services Cloud. It allows financial advisors and wealth managers to view and manage clients’ digital asset holdings, including cryptocurrencies and stablecoins, alongside traditional investments directly within Salesforce.

Does the Digital Asset Wallet store client private keys?

No. Clients maintain full custody of their digital assets at all times. The Digital Asset Wallet provides read-only visibility, ensuring private keys remain securely with the client while advisors gain transparency into holdings and valuations.

Which wallets and blockchains are supported?

The Digital Asset Wallet supports connections to popular wallets using WalletConnect, xPub, or similar methods. It works across multiple blockchains and retrieves both native coins and crypto assets while aggregating holdings across supported networks.

Can financial advisors see real-time valuations of digital assets?

Yes. The wallet provides mark-to-market valuations for verified digital assets using trusted market data sources such as CoinGecko, allowing advisors to view up-to-date asset values alongside traditional investments.

How does the Digital Asset Wallet integrate with Salesforce?

The solution integrates natively with Salesforce Financial Services Cloud. Digital assets appear as part of a client’s holistic financial profile, enabling advisors to include crypto holdings in portfolio analysis, reporting, and investment conversations.

Is the Digital Asset Wallet available on Salesforce AppExchange?

Yes. Web3 Enabler is currently the only Salesforce Independent Software Vendor offering blockchain payment and digital asset solutions available on the Salesforce AppExchange, making adoption seamless for Salesforce users.

Can clients connect cryptocurrency exchange accounts?

Yes. Clients can securely connect supported cryptocurrency exchange accounts using OAuth or similar authorization methods. Access is read-only, allowing Financial Services Cloud to retrieve asset balances and calculate real-time valuations without enabling transactions.

Does the Digital Asset Wallet support international clients and currencies?

Yes. The Digital Asset Wallet is designed for global use and supports USD and Euro-denominated stablecoins and crypto assets. This allows advisors to serve international clients and discuss diversified investment strategies across markets.

How does the Digital Asset Wallet help financial advisors attract younger investors?

Digital assets are increasingly popular among younger, digitally savvy investors. By offering crypto visibility within Salesforce, advisors can modernize their services, differentiate their firm, and attract new clients seeking advisors who understand digital assets.

Is the Digital Asset Wallet customizable for advisors and firms?

Yes. The solution is highly customizable for both individual advisors and organizations. It supports flexible workflows and tailored portfolio strategies based on each client’s risk tolerance, goals, and investment preferences.

When will the Digital Asset Wallet be available?

The Digital Asset Wallet for Salesforce Financial Services Cloud is scheduled to launch in Q2, giving firms time to prepare for onboarding and implementation.