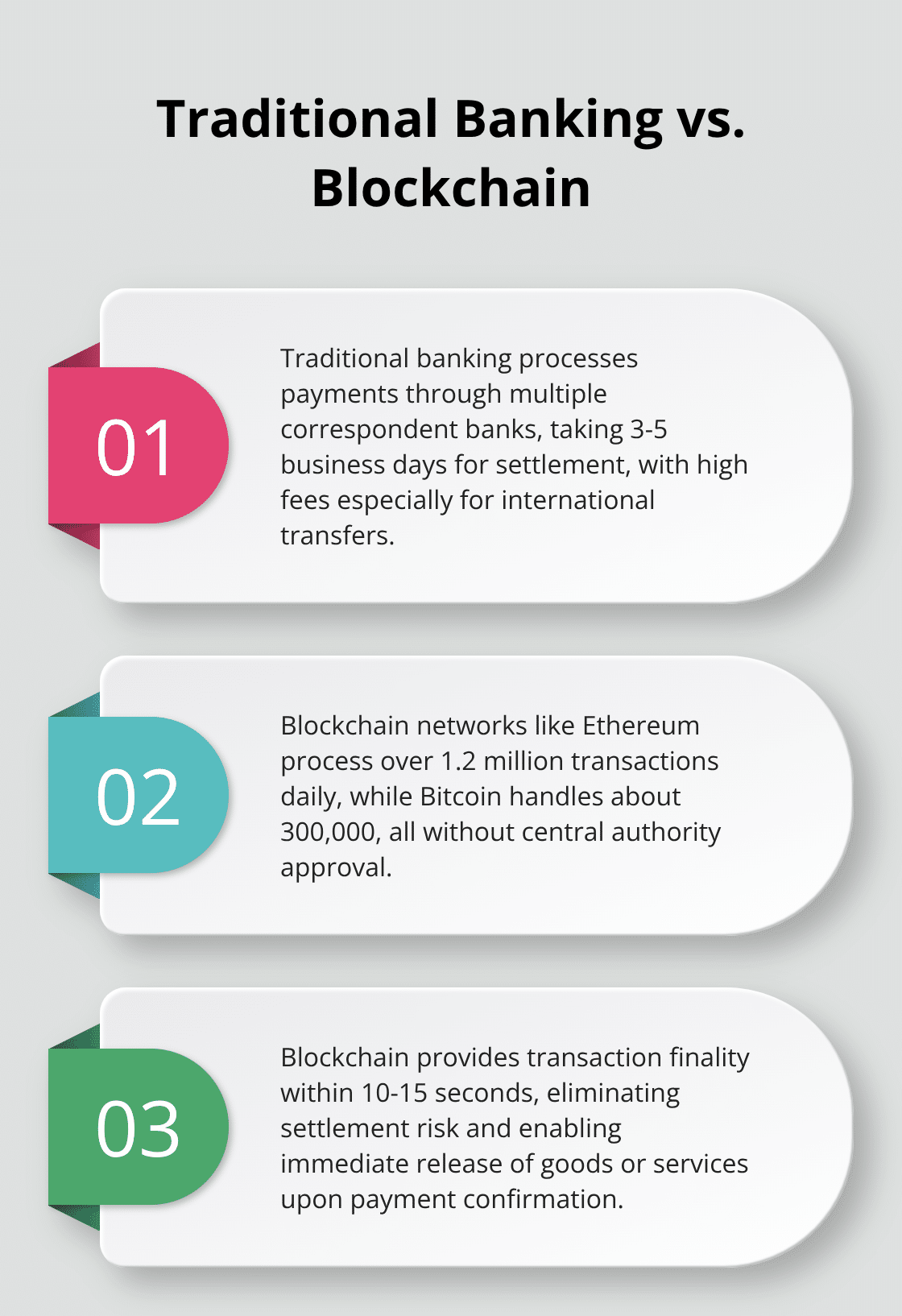

Traditional banking systems force businesses to wait days for payment settlement, creating cash flow bottlenecks that cost companies billions annually. Settlement times of 3-5 business days have become an accepted inefficiency in global commerce.

Traditional banking systems force businesses to wait days for payment settlement, creating cash flow bottlenecks that cost companies billions annually. Settlement times of 3-5 business days have become an accepted inefficiency in global commerce.

Blockchain technology changes this reality completely. We at Web3 Enabler help enterprises implement same-second settlement systems that eliminate waiting periods and transform financial operations.

Why Traditional Payments Drain Your Business

Processing Delays Cost Real Money

Traditional banking systems trap your money for 3-5 business days during settlement, which creates artificial cash flow constraints that hurt operational efficiency. Traditional banks can experience processing delays that impact transaction timing. This forces businesses to maintain larger cash reserves than necessary. A supplier payment that starts on Friday won’t settle until the following Wednesday, which prevents recipients from accessing funds they’ve already earned.

Hidden Fees Multiply Transaction Costs

Banks layer multiple charges onto every transaction, from origination fees to correspondent banking costs that can reach 3-7% of transaction value for international transfers. JPMorgan and Goldman Sachs acknowledge these inefficiencies as they explore blockchain alternatives to reduce cross-border payment processing costs. Wire transfers often include receiving bank fees, intermediate bank charges, and currency conversion markups that businesses discover only after completion (sometimes doubling the expected cost).

Cross-Border Payments Face Compounding Problems

International payments suffer from correspondent banking relationships that add 2-5 additional days to settlement times while they multiply fees through each intermediary bank. The World Bank reports that approximately 1.3 billion adults globally lack access to traditional banking. Currency volatility during extended settlement periods exposes businesses to exchange rate risks that can eliminate profit margins on international transactions. This proves particularly problematic for companies that pay overseas contractors or suppliers in emerging markets (where rate fluctuations can swing 5-10% during settlement windows).

The Real Cost of Waiting

These delays compound into massive opportunity costs that traditional finance rarely quantifies. Companies miss investment opportunities, suppliers delay shipments due to payment uncertainty, and cash-dependent operations stall while funds sit in banking limbo. The cumulative effect creates a drag on global commerce that blockchain technology can eliminate entirely.

How Blockchain Replaces Banking Delays

Blockchain eliminates traditional banking intermediaries through distributed ledger technology that processes transactions across thousands of network nodes simultaneously. Each transaction receives verification and permanent recording within seconds, compared to traditional systems that route payments through multiple correspondent banks over 3-5 business days. The Ethereum network processes over 1.2 million transactions daily through this decentralized verification system, while Bitcoin handles approximately 300,000 transactions per day without central authority approval.

Smart Contracts Execute Payments Automatically

Smart contracts on blockchain networks automatically execute payment terms when predetermined conditions are met. These programmable contracts remove human intervention and processing delays entirely. The contracts can verify invoice details, confirm delivery status, and release payments within the same transaction block. Walmart uses blockchain smart contracts to automate supplier payments based on delivery confirmations, which reduces their accounts payable processing time from weeks to minutes. The contracts eliminate disputes over payment timing because both parties can view the exact execution conditions and results in real-time.

Transaction Finality Happens Instantly

Blockchain networks provide immediate transaction finality through cryptographic consensus mechanisms that prevent payment reversals or chargebacks. Once a transaction receives network confirmation, the transfer becomes mathematically irreversible within 10-15 seconds on most modern blockchains (compared to the 3-5 day settlement risk in traditional banking). This instant finality eliminates the settlement risk that traditional banking systems create during their multi-day clearing processes. Companies can release goods or services immediately upon blockchain payment confirmation rather than wait days for traditional bank settlement to complete.

Network Efficiency Reduces Costs

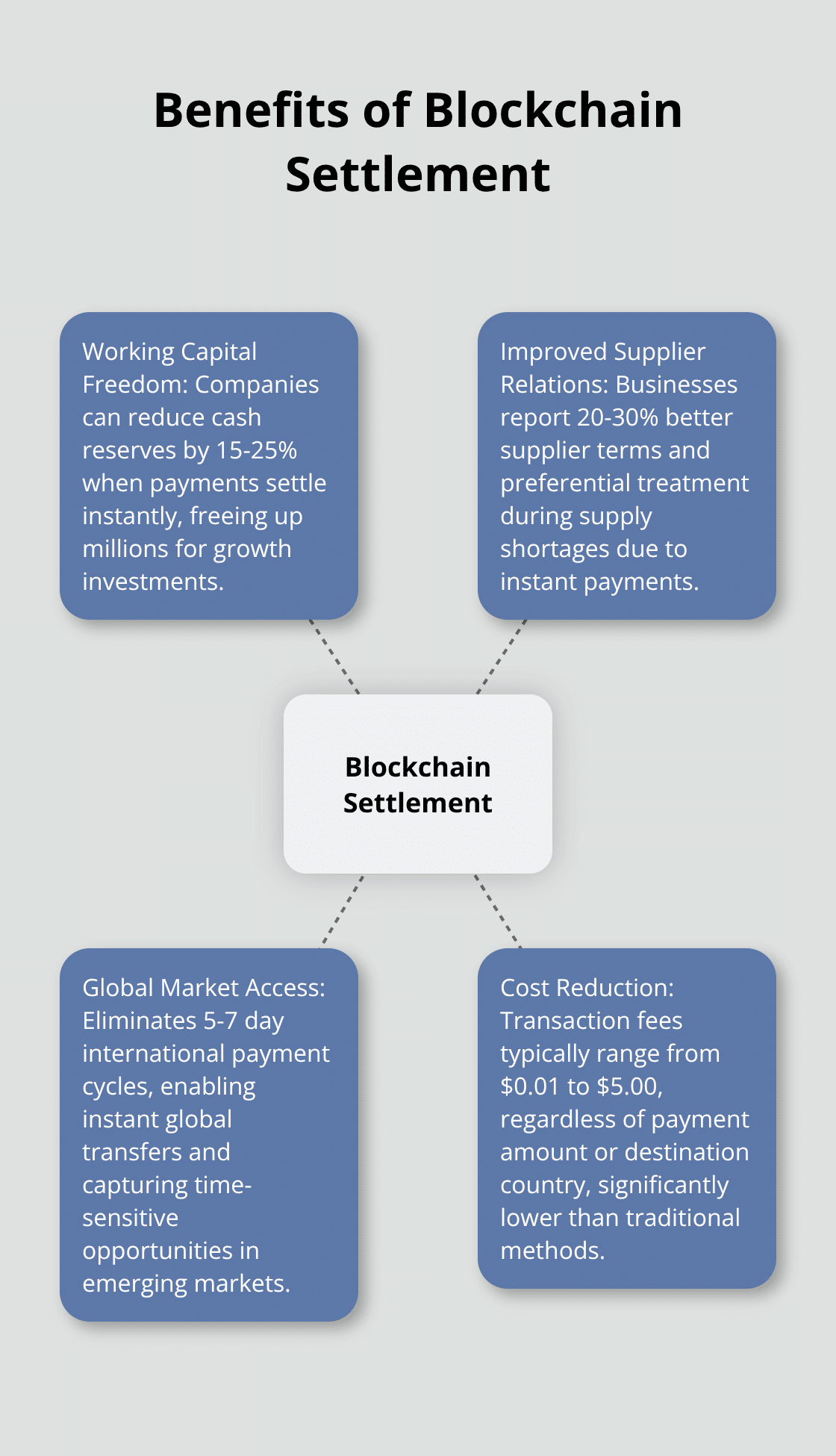

Blockchain networks operate with transaction fees that typically range from $0.01 to $5.00, regardless of payment amount or destination country. Traditional international wire transfers cost $25-50 plus percentage-based fees that can reach 7% of transaction value. The decentralized network structure eliminates correspondent banking relationships and their associated markup fees, while automated processing removes manual handling costs. Card networks and correspondent banks add hops, fees, and delays compared to blockchain payments that process directly between parties.

These technical advantages translate directly into measurable business benefits that transform how companies manage their financial operations and competitive positioning.

What Business Results Can You Expect?

Working Capital Freedom Changes Everything

Same-second settlement transforms working capital management by eliminating the 3-5 day float that traditional banks create. Companies can reduce their cash reserves by 15-25% when payments settle instantly, which frees up millions of dollars for growth investments rather than operational buffers. A manufacturer that pays suppliers through blockchain can immediately reinvest the freed working capital into inventory or equipment purchases. The Federal Reserve tracks comprehensive data on transaction accounts across all sectors, showing the significant capital that businesses maintain for operational purposes. Instant settlement means treasury teams can optimize cash positions with precision rather than maintain safety margins for payment delays.

Supplier Relations Become Strategic Advantages

Instant payment capability transforms vendor relationships from transactional exchanges into strategic partnerships. Suppliers offer better terms, priority service, and volume discounts to customers who pay immediately rather than force them to wait weeks for settlement. BMW leverages blockchain for supply chain payments, which strengthens their supplier network through reliable instant compensation. Small suppliers particularly value immediate payment since they often lack the working capital buffers that larger companies maintain. Companies that adopt blockchain settlement report 20-30% better supplier terms and preferential treatment during supply shortages. The ability to pay contractors globally within seconds creates competitive advantages in talent acquisition and project delivery timelines.

Global Market Access Accelerates Revenue

Same-second settlement removes geographic barriers to business expansion by eliminating cross-border payment friction. Companies can serve international customers without worries about currency conversion delays or correspondent bank relationships. The traditional 5-7 day international payment cycle becomes irrelevant when blockchain enables instant global transfers. This speed advantage allows businesses to capture time-sensitive opportunities in emerging markets where payment delays often kill deals. Export businesses can require immediate payment upon shipment confirmation, which reduces trade finance costs and eliminates buyer payment risk entirely (particularly valuable for high-value transactions or volatile markets).

Final Thoughts

Blockchain settlement represents the most significant advancement in business payments since digital banking emerged. Settlement times that once stretched across multiple business days now complete in seconds, while transaction costs drop from percentage-based fees to fixed amounts under $5. Companies gain immediate access to their funds, eliminate currency conversion delays, and remove correspondent banking relationships that add complexity to international transactions.

Strategic implementation of blockchain settlement requires careful integration with existing financial systems. We at Web3 Enabler bridge this gap by providing native Salesforce integration that connects blockchain transactions directly to your corporate infrastructure. Our platform enables businesses to manage digital assets, process international contractor payments, and track investment returns within their familiar Salesforce environment.

The future belongs to organizations that embrace instant settlement capabilities. Traditional banking delays will become competitive disadvantages as blockchain adoption accelerates across industries (particularly in sectors where cash flow timing determines market success). Companies that implement same-second settlement today position themselves to capture market opportunities that slower competitors will miss entirely.

Frequently Asked Questions About Same-Second Settlement with Blockchain

These FAQs answer the most common questions about payment settlement times, blockchain transaction finality, and how enterprises can implement faster settlement without disrupting existing finance workflows.

What does “settlement” mean in payments?

Settlement is the point when money actually moves between institutions and becomes available to the recipient. Authorization and confirmation can happen quickly, but settlement is the back-end clearing and final transfer that determines when funds are usable.

Why do traditional bank payments take 3–5 business days to settle?

Many bank rails rely on batch processing, cut-off times, intermediary routing, and compliance checks that introduce delays. Cross-border payments add correspondent banks, different operating hours, and currency conversion steps, which can extend settlement even further.

What is “same-second settlement” with blockchain?

“Same-second settlement” refers to on-chain payments that confirm in near real time, typically within seconds, depending on the network. Instead of waiting days for clearing, the transaction is recorded on a shared ledger and becomes verifiable almost immediately.

Are blockchain payments final, can they be reversed like chargebacks?

Most on-chain transfers are effectively irreversible once confirmed, which is often described as transaction finality. Unlike card payments, there is typically no built-in chargeback mechanism, so businesses should use strong controls and verified payment instructions before sending funds.

Do stablecoins settle faster than wire transfers?

Stablecoins can settle much faster because they move on blockchain networks that operate 24/7, including weekends and holidays. Speed depends on the network used and the confirmation requirements your business sets for operational risk.

How do blockchain transaction fees compare to traditional payment fees?

Traditional payments often include percentage-based fees, fixed processing fees, and cross-border FX markups. Blockchain fees are usually network-based and can be low and predictable on certain networks, but they can vary during congestion, so choosing the right network matters.

What business outcomes improve when settlement happens in seconds?

Faster settlement improves cash flow visibility, reduces time spent waiting on confirmations, and can speed up order release, supplier payments, and cross-border operations. Many teams also see fewer reconciliation delays because settlement status is verifiable quickly.

How do smart contracts relate to faster settlement?

Smart contracts can automate payment release when predefined conditions are met, such as delivery confirmation or invoice approval. This reduces manual handling and can remove approval bottlenecks that slow down traditional settlement workflows.

How can enterprises implement blockchain settlement without replacing their finance stack?

Most companies start by adding blockchain rails alongside existing payment methods, then expanding use cases once controls, reporting, and reconciliation are proven. The best implementations connect settlement data to existing systems of record so finance teams keep their normal approvals, audit trails, and reporting.

How does Web3 Enabler support same-second settlement workflows in Salesforce?

Web3 Enabler connects on-chain settlement events to Salesforce objects so teams can track payment status, timing, and audit trails inside their existing workflows. This supports faster reconciliation and visibility while maintaining enterprise controls within Salesforce.