Stablecoin volatility isn’t really a concern if you are using reliable and regulated stablecoins. Cryptocurrencies are known for their wild price swings, but stablecoins are pegged to the dolalr (or Euro) and offer a haven of stability in this turbulent market. They also make it easy to transfer value quickly. At Web3 Enabler, we’ve seen firsthand how these digital assets maintain a consistent value, even when other cryptocurrencies experience significant fluctuations.

Even when priced into your local currency, stablecoin volatility is remarkably low compared to traditional cryptocurrencies, making them an attractive option for investors and businesses alike. In this post, we’ll explore why stablecoins are becoming increasingly important in the ever-evolving world of digital finance.

What Are Stablecoins?

Stablecoins represent digital assets engineered to maintain a consistent value, often pegged to fiat currencies like the US dollar. The business world has witnessed a notable increase in stablecoin adoption, primarily due to their stability and efficiency in cross-border transactions.

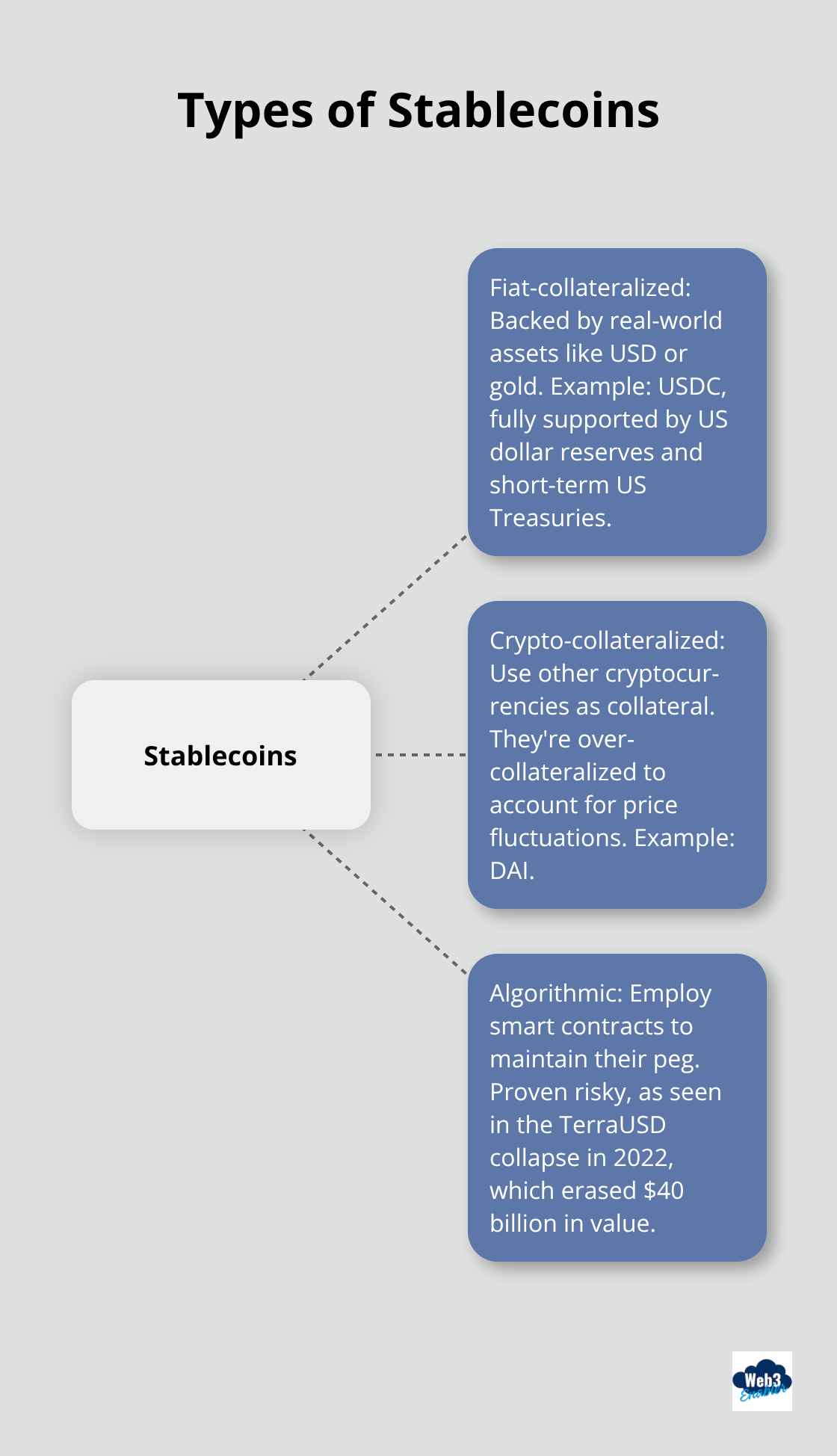

Types of Stablecoins

Stablecoins come in three primary varieties:

- Fiat-collateralized stablecoins: These stablecoins are backed by real-world assets (such as USD or gold). USDC, issued by Circle, exemplifies this category. It’s fully supported by US dollar reserves and short-term US Treasuries.

- Crypto-collateralized: These use other cryptocurrencies as collateral. They’re over-collateralized to account for price fluctuations. DAI stands out as a well-known crypto-collateralized stablecoin.

- Algorithmic: These employ smart contracts to maintain their peg. However, they’ve proven risky, as evidenced by the TerraUSD collapse in 2022 (which erased $40 billion in value).

Stability Mechanisms

Fiat-collateralized stablecoins (like USDC) preserve their value through a 1:1 backing with real-world assets. This means for every USDC in circulation, $1 exists in a bank account or short-term US Treasury to support it.

Crypto-collateralized stablecoins utilize over-collateralization. For instance, to create $100 worth of DAI, you might need to lock up $150 worth of Ethereum in a smart contract.

Stablecoins vs Traditional Cryptocurrencies

Stablecoins differ significantly from cryptocurrencies like Bitcoin or Ethereum, which can experience daily price swings of 10% or more. Stablecoins try to minimize volatility. USDC, for example, typically doesn’t stray more than a fraction of a cent from its $1 peg.

This stability makes stablecoins attractive for businesses that want to leverage blockchain technology without exposure to crypto market volatility. Many companies have successfully integrated stablecoin payments, which has reduced transaction costs and settlement times compared to traditional banking methods.

While Bitcoin’s primary use case revolves around store of value or speculative asset, stablecoins excel in practical applications. These include cross-border payments, remittances, and everyday transactions. They combine the efficiency of blockchain technology with the stability of fiat currencies.

Real-World Applications

Stablecoins have found numerous applications in the business world. Companies use them for:

- International payments: Stablecoins enable fast, low-cost cross-border transactions.

- Payroll: Some businesses pay their remote workers in stablecoins to avoid high international transfer fees.

- E-commerce: Online retailers accept stablecoins to reduce transaction costs and expand their customer base.

As we move forward, let’s explore how these stable digital assets provide a much-needed anchor in the often turbulent waters of the cryptocurrency market.

How Stablecoins Benefit Traders in Volatile Markets

Stablecoins offer a crucial anchor for traders and investors in the unpredictable world of cryptocurrency. Their unique properties make them invaluable tools for navigating market turbulence.

A Safe Harbor During Market Storms

Stablecoins provide a refuge when cryptocurrency markets become choppy. During the crypto market crash of 2022, Bitcoin fell to $15,000, while stablecoins like USDC maintained their value. This stability allowed traders to quickly move their assets into stablecoins, preserving their capital without exiting the crypto ecosystem entirely.

Streamlining Trading Strategies

For day traders and arbitrage seekers, stablecoins offer significant advantages. They enable rapid position changes without the need to convert back to fiat currencies. This speed is crucial in volatile markets where seconds can make the difference between profit and loss.

A study by Chainalysis in 2024 found that traders using stablecoins as their base currency executed 30% more trades on average compared to those relying on fiat. This increased activity translates to more opportunities for profit in fast-moving markets.

Reducing Friction in Global Trading

Stablecoins eliminate many of the barriers associated with international trading. They bypass traditional banking hours and avoid the high fees often associated with cross-border transactions. For instance, a trader in Singapore can instantly send USDC to a counterparty in Brazil without worrying about bank transfer times or exorbitant fees.

This global accessibility has led to a surge in 24/7 trading volumes. According to data from CoinGecko, the daily trading volume of stablecoin pairs increased by 150% in 2024 compared to the previous year, highlighting their growing importance in facilitating global trade.

Optimizing Trading Operations

Businesses leverage stablecoins to optimize their trading operations. Platforms like Web3 Enabler enable seamless integration of stablecoin payments, allowing companies to capitalize on these benefits while maintaining robust compliance and security measures.

As the crypto market continues to mature, stablecoins will likely play an increasingly central role in trading strategies. Their ability to provide stability, efficiency, and global accessibility makes them indispensable tools for traders navigating the volatile waters of the cryptocurrency markets.

Now that we understand how stablecoins benefit traders, let’s explore their practical applications in various sectors of the economy.

How Stablecoins Transform Business Operations

Revolutionizing Cross-Border Payments

International money transfers have long suffered from high fees and slow processing times. Stablecoins change this narrative. The World Bank reported that the average cost of sending remittances globally was 6.5% in Q4 2024. Stablecoin transfers, in contrast, often cost less than 1% of the transaction value.

A US-based company can now pay its contractors in the Philippines by sending USDC directly to their digital wallets. This process takes minutes instead of days and cuts fees significantly.

Fueling DeFi Innovations

Decentralized Finance (DeFi) applications use stablecoins to create new financial products. DeFi utilizes smart contracts based on blockchain technology to automate the lending and borrowing processes. This automation leads to instant loan disbursement.

In 2024, the total value locked (TVL) in DeFi protocols reached $150 billion, with stablecoins accounting for over 60% of this value. This growth opens up new opportunities for businesses to access capital and earn yields on their idle funds.

Reshaping E-commerce and Retail

Stablecoins make inroads into everyday transactions, particularly in e-commerce. Major retailers like Walmart and Amazon explore stablecoin payments to reduce transaction costs and increase efficiency.

A Deloitte survey in 2024 found that 75% of merchants plan to accept crypto or stablecoin payments within the next two years. This shift stems from the potential for lower fees, faster settlement times, and expanded customer reach.

Enhancing Business Efficiency

Stablecoins streamline various business processes. They enable instant settlements, reduce the need for intermediaries, and provide better transparency in financial transactions. Companies can manage their cash flows more effectively and reduce the risks associated with currency fluctuations.

For instance, a multinational corporation can use stablecoins to manage its global treasury operations more efficiently. This approach minimizes forex exposure and allows for quicker reallocation of funds across different markets.

Enabling New Business Models

The rise of stablecoins facilitates the creation of new business models. Micropayment systems, previously unfeasible due to high transaction costs, now become viable. Content creators, for example, can receive small payments directly from their audience without losing a significant portion to fees.

Moreover, stablecoins enable fractional ownership models in real estate and other high-value assets. This democratizes investment opportunities and allows businesses to tap into a broader pool of potential investors.

Final Thoughts

Stablecoins have become a powerful tool in the volatile cryptocurrency landscape. They offer a unique blend of stability and efficiency, maintaining consistent value even in turbulent market conditions. Stablecoin volatility remains remarkably low compared to traditional cryptocurrencies, providing a reliable anchor for financial operations in the digital asset space.

The future of stablecoins looks promising as they take a central role in the crypto ecosystem. More businesses will adopt them for faster, cheaper cross-border transactions and streamlined treasury management. Their integration into e-commerce platforms and growth in DeFi applications will solidify their position as a cornerstone of the digital economy.

Web3 Enabler offers comprehensive blockchain integration solutions for businesses looking to harness the power of stablecoins. As a native blockchain solution on the Salesforce AppExchange, we empower companies to incorporate stablecoin payments into their existing workflows (reducing transaction costs and accelerating settlement times). Embracing these digital assets now will position businesses at the forefront of this financial revolution.