Traditional payment systems are bleeding businesses dry with sky-high fees and glacial processing times. Cross-border transactions can take days and cost a fortune in intermediary fees.

We at Web3 Enabler see companies ditching these outdated systems for stablecoin solutions that process payments instantly at a fraction of the cost. The shift is happening faster than most executives realize.

The Problems with Traditional Business Payments

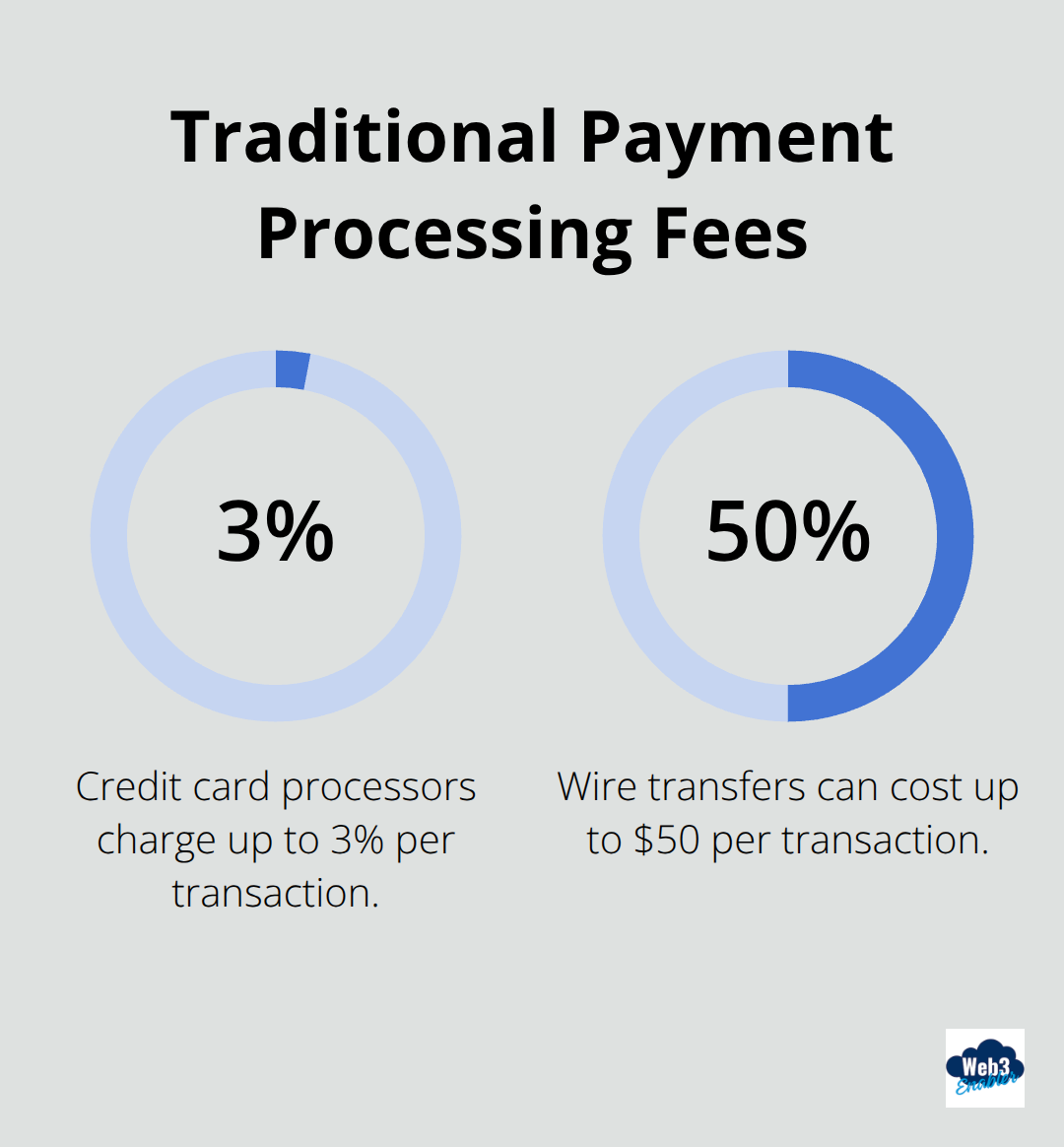

Traditional payment systems drain business resources through multiple fee layers that stack up quickly. Wire transfers charge companies between $25 and $50 per transaction, while credit card processors take 2% to 3% of every payment. Cross-border transactions face even steeper costs through correspondent banking networks that add fees at each step.

A simple international payment travels through three or four intermediary banks, with each institution taking their cut. Settlement times stretch from T+1 to T+3 days for domestic transactions, but international payments can take a week or more to complete.

Banking Relationship Complexity

Companies must maintain multiple banking relationships across different countries, creating operational headaches that consume valuable resources. Each jurisdiction requires separate accounts with unique compliance requirements, minimum balance demands, and monthly maintenance fees.

Banks convert currency at unfavorable rates they set themselves, not market rates. Financial institutions also freeze accounts without warning for routine international transactions they flag as suspicious. The paperwork burden requires dedicated staff to handle KYC documentation, regulatory filings, and relationship maintenance across multiple institutions.

Currency Risk Threatens Profit Margins

International businesses face constant currency fluctuation risks that can quietly erode profit margins. Whether you’re selling across borders, sourcing materials globally, or expanding into new markets, currency volatility can eliminate expected returns overnight.

Companies spend thousands on hedging strategies and forward contracts to protect against these risks, adding another layer of complexity and cost. Merchants in unstable economies struggle to maintain consistent pricing when their local currencies swing wildly against major trading currencies (like the US dollar or euro).

These traditional payment challenges have pushed businesses to seek alternatives that offer speed, cost efficiency, and stability. Stablecoins present a compelling solution to these persistent problems.

How Stablecoins Fix Payment Problems

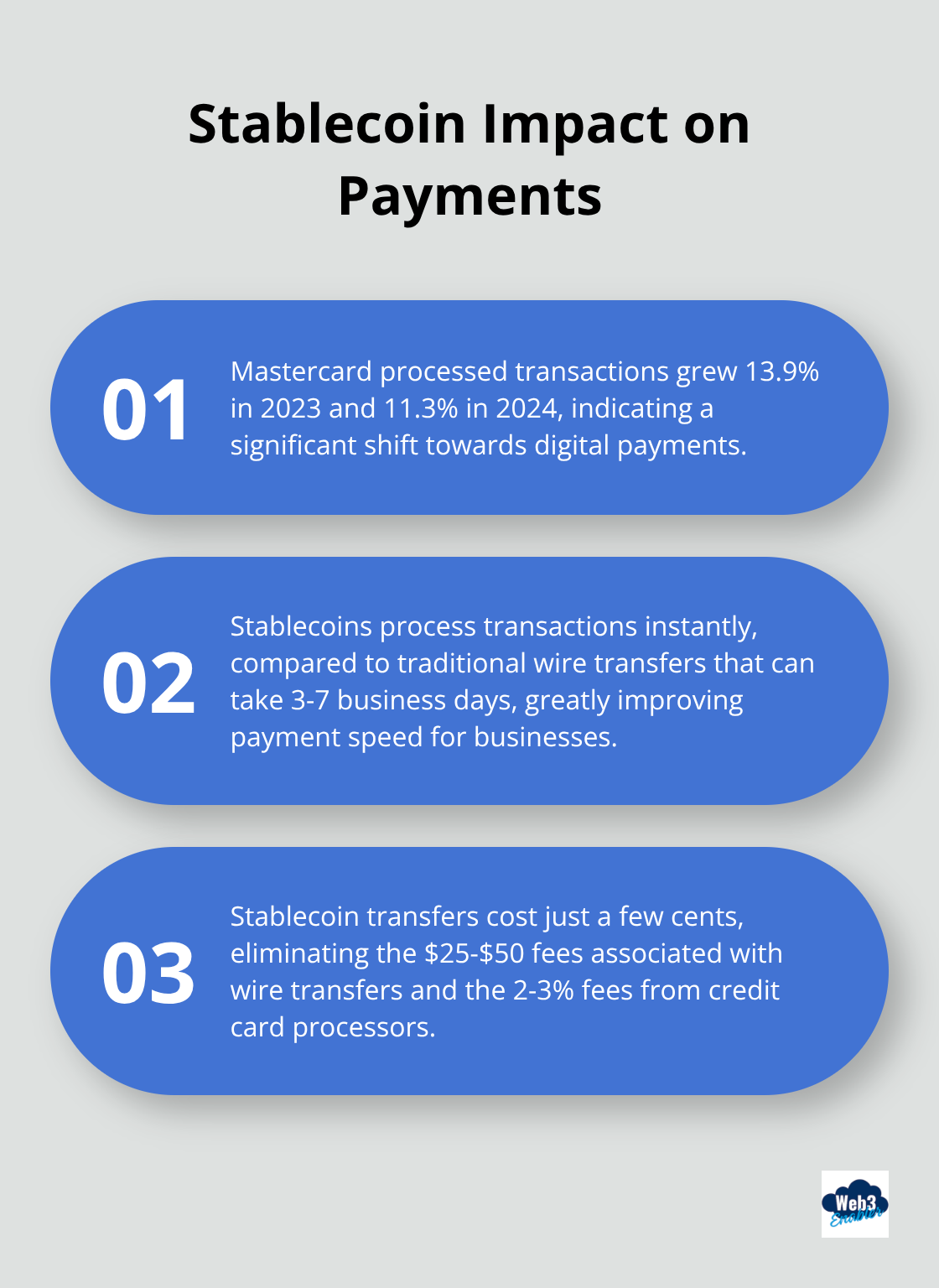

Stablecoins process transactions in seconds rather than days and operate around the clock without banking hour restrictions. Tether (USDT) and USD Coin (USDC) handle settlements instantly on blockchain networks, while traditional wire transfers crawl through correspondent banking chains for 3-7 business days. Companies like Toyosa S.A. now accept stablecoin payments for vehicle purchases and complete high-value transactions in minutes instead of waiting for bank clearing cycles.

Instant Settlement Transforms Business Operations

The 24/7 processing capability means businesses can settle invoices, pay suppliers, and receive customer payments without weekend delays or holiday interruptions that plague traditional banking systems. Smart contracts execute payments automatically when conditions are met, eliminating manual approval processes that slow down traditional transactions. This speed advantage becomes particularly valuable for time-sensitive payments like payroll or supplier settlements where delays can damage business relationships.

Transaction Costs Drop to Nearly Zero

Stablecoin transfers cost just a few cents compared to $25-$50 wire transfer fees that banks charge for international payments. Credit card processors grab 2-3% of every transaction, but stablecoin payments eliminate these middleman fees entirely. Stablecoin payment volumes have grown significantly, with Mastercard processed transactions growing 13.9% in 2023 and 11.3% in 2024.

Companies that switch to USDC or PYUSD for supplier payments save thousands monthly on transaction fees alone. Smart contracts automate payment releases based on delivery confirmations or milestone completions and remove escrow service fees that add up quickly in traditional workflows.

Price Stability Protects Business Operations

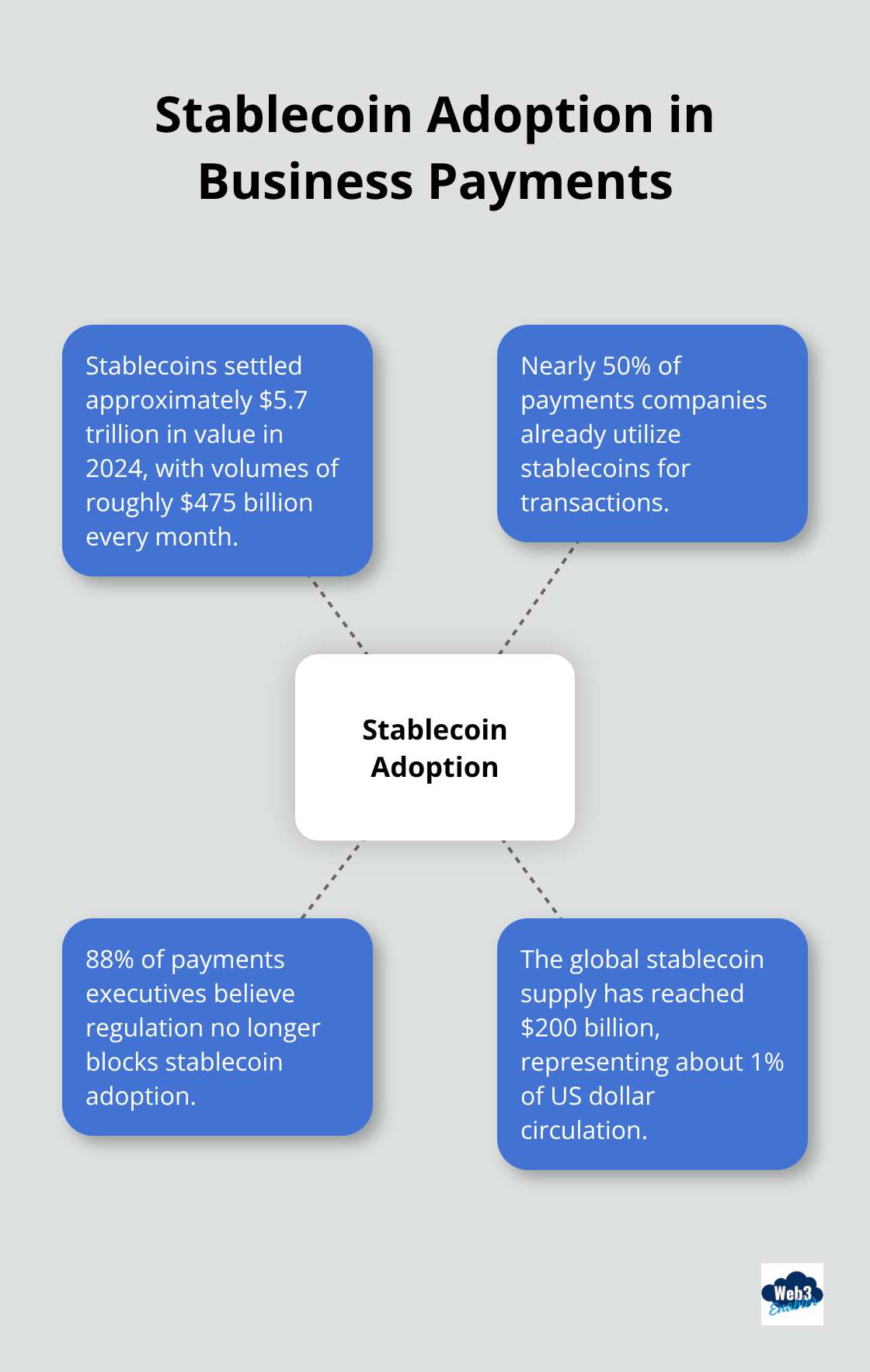

Fiat-backed stablecoins maintain 1:1 reserves with US dollars or government treasuries and provide price stability that volatile cryptocurrencies cannot match. The $200 billion global stablecoin supply represents approximately 1% of US dollar circulation, with 99% denominated in USD (according to J.P. Morgan research). This backing structure shields businesses from wild price swings that make Bitcoin unsuitable for everyday transactions.

Companies operating in unstable economies use dollar-pegged stablecoins to maintain consistent pricing without opening US bank accounts or navigating complex correspondent banking relationships. These advantages make stablecoins particularly attractive for B2B payments and cross-border payment challenges where speed and cost efficiency matter most.

Where Companies Actually Use Stablecoins

Supply chain operations have become the testing ground for stablecoin adoption, with manufacturers using USDC and PYUSD to pay suppliers instantly without traditional banking settlements. Stablecoins settled approximately $5.7 trillion in value in 2024, challenging payment giants like Visa with volumes of roughly $475 billion every month. Manufacturing firms now release supplier payments automatically through smart contracts when shipments arrive, eliminating manual approval processes that typically delay payments for weeks.

Global Workforce Payments Go Instant

International payroll has transformed from a monthly headache into real-time capability through stablecoin rails. Companies with remote teams across Southeast Asia, Latin America, and Eastern Europe send salary payments in minutes rather than dealing with correspondent banking delays that can stretch payroll delivery to two weeks.

Freelance platforms and contractor management systems integrate stablecoin wallets directly, allowing instant payment releases when project milestones complete. PayPal and Stripe have incorporated stablecoins into their payment infrastructures, making it easier for businesses to pay international contractors without expensive wire transfer fees or unfavorable currency conversion rates.

B2B Invoice Settlement Accelerates Cash Flow

Invoice factoring and payment delays drain working capital from businesses waiting 30-90 days for customer payments, but stablecoin settlements execute immediately upon delivery confirmation. Treasury management becomes more efficient when companies hold dollar-backed stablecoins that maintain purchasing power without currency risk exposure.

Nearly 50% of payments companies already utilize stablecoins for transactions, with 88% of payments executives believing regulation no longer blocks adoption. Smart contracts automatically release payments when goods arrive or services complete, removing the manual verification steps that slow traditional invoice processing.

Cross-Border Trade Finance Simplifies

International trade finance has adopted stablecoins to streamline letter of credit processes and documentary collections. Banks like JPMorgan issue their own stablecoins (JPM Coin) for interbank settlements, reducing the complexity of correspondent banking relationships. Export-import businesses use stablecoins to avoid currency conversion fees and settlement delays that traditionally plague international trade transactions.

Final Thoughts

Stablecoin solutions have proven their worth by solving the most expensive problems in business payments. Companies save thousands monthly when they eliminate $25-$50 wire transfer fees and 2-3% credit card processing costs. Instant settlements replace week-long banking delays, while 24/7 processing capabilities keep business operations running without weekend interruptions.

The numbers tell the story of rapid adoption. Stablecoins facilitated $27.6 trillion in payments during 2024 (surpassing Visa and Mastercard combined). Nearly 50% of payments companies already use stablecoins, with 88% of executives confirming that regulation no longer blocks implementation. The $200 billion stablecoin market continues to expand as more businesses recognize the operational advantages.

Smart businesses should start to prepare now rather than wait for competitors to gain first-mover advantages. Consult legal and accounting advisors about compliance requirements, then explore pilot programs with trusted partners. Web3 Enabler helps businesses accept stablecoin payments and send global payments faster while maintaining full compliance and audit trails.