Picture crypto markets without stablecoins – pure chaos. Bitcoin swinging 20% while you’re trying to buy lunch, Ethereum doing backflips when you need to pay suppliers.

The importance of stablecoins goes way beyond just “stable prices.” We at Web3 Enabler see them as the unsung heroes keeping crypto markets functional and businesses sane.

They’re the financial duct tape holding this wild west together.

How Do Stablecoins Actually Stay Stable

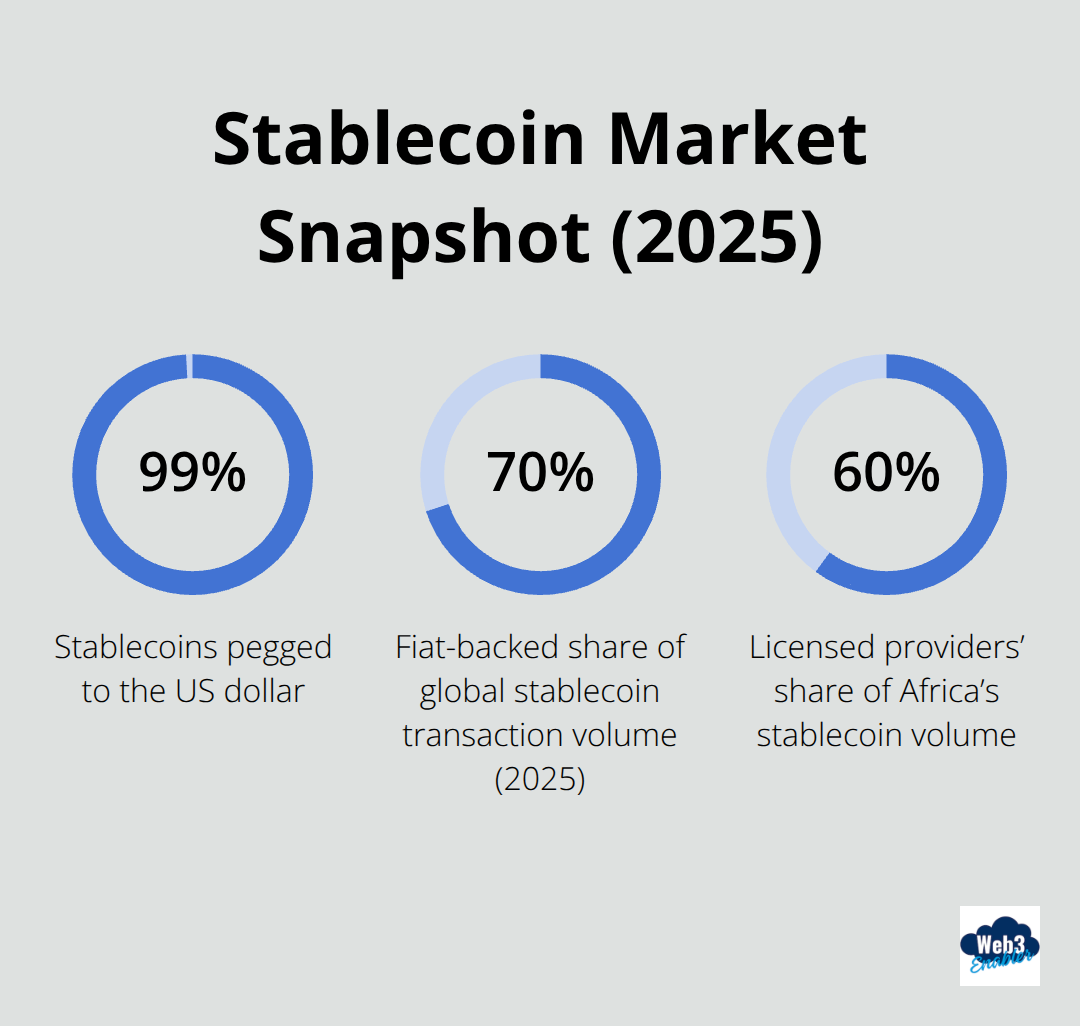

Stablecoins are cryptocurrencies that maintain a fixed value, typically pegged to the US dollar at a 1:1 ratio. The global stablecoin market reached $255 billion in June 2025 according to the Bank for International Settlements, with 99% pegged to the dollar.

Three main types dominate the market: fiat-backed stablecoins like USDC and USDT hold actual dollars or government securities in reserve, algorithmic stablecoins use smart contracts to adjust supply based on demand, and crypto-backed versions use other cryptocurrencies as collateral. Fiat-backed models represent over 70% of transaction volume in 2025 because they offer the most transparency and trust through regular audits.

The Reserve Game Changes Everything

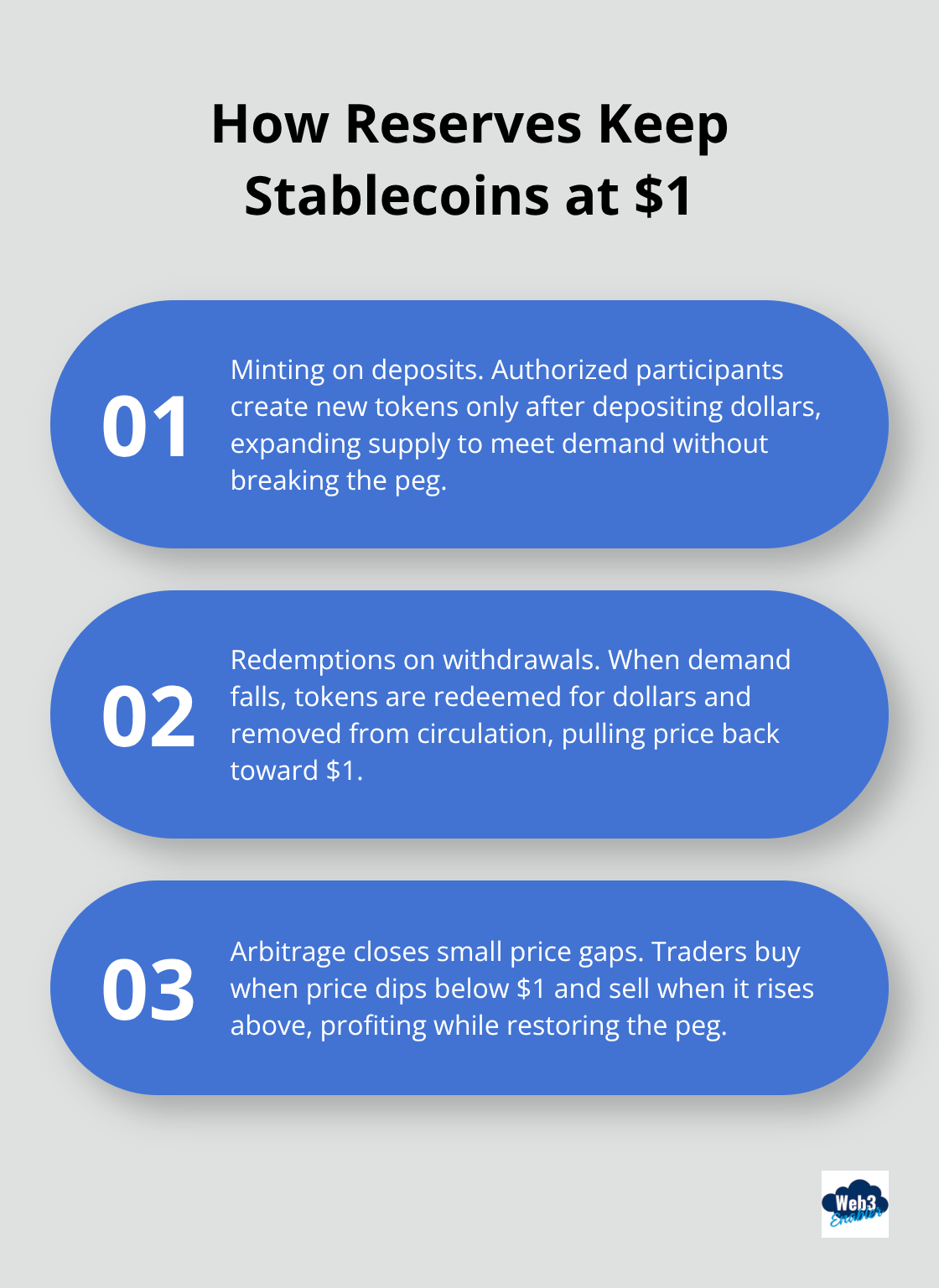

The magic happens in the reserves. USDC and USDT maintain their stability through cash and short-term Treasury assets that back every token issued. When demand spikes, authorized participants can mint new tokens after they deposit dollars with the issuer. When demand drops, they can redeem tokens for dollars, which reduces supply.

This mechanism keeps prices stable even during market turbulence. Tether processes approximately $30 billion in daily transactions, while algorithmic stablecoins like the collapsed TerraUSD proved that mathematical formulas without real assets can fail spectacularly (wiping out $40 billion in 2022).

Why Most Projects Pick Dollar Pegs

Dollar pegs dominate because the US dollar remains the world’s reserve currency and most stable reference point. Stablecoins eliminate the 2-5 day settlement delays of traditional banks while they offer 24/7 availability.

Licensed providers now handle over 60% of Africa’s stablecoin volume, which shows institutional trust in regulated frameworks. The recent US GENIUS Act of 2025 requires stablecoin reserves to consist only of highly liquid assets, which makes dollar-backed versions even more attractive for businesses that need predictable value storage.

The Infrastructure That Powers Stability

Behind every stable price sits a complex web of market makers, arbitrageurs, and authorized dealers who profit from tiny price differences. When USDC trades at $1.01, smart traders buy dollars and sell USDC until the price returns to $1.00. When it drops to $0.99, they do the opposite.

This creates what economists call “natural market forces” – but it only works when people trust the reserves actually exist. That’s why transparency matters more than fancy algorithms, and why this infrastructure becomes the foundation for everything else crypto markets need to function properly.

Why Stablecoins Run the Show

Stablecoins function as the operational backbone of crypto markets because they solve the fundamental problem of constant price swings. Major exchanges like Binance and Coinbase use USDC and USDT as primary pairs for over 80% of crypto assets, which creates the liquidity pools that make instant trades possible.

When you want to move from Bitcoin to Ethereum, you don’t actually trade them directly – you use stablecoins as the middleman that processes $30 billion in daily transactions. This system works because stablecoins maintain consistent value while other crypto assets fluctuate wildly, which gives traders a reliable reference point for price discovery across all assets.

Speed Beats Traditional Banking Every Time

Traditional bank settlements take 3-5 days and shut down on weekends, but stablecoin transactions settle in under 3 minutes around the clock. Institutional traders save up to 70% on foreign exchange costs when they use stablecoins for cross-border arbitrage between different exchanges.

This speed advantage becomes critical during volatile market conditions when price differences between exchanges can reach 5-10% within hours. Smart firms exploit these gaps by moving capital instantly through stablecoin rails, which captures profits that would disappear during traditional delays. The result? More efficient price discovery across global markets and tighter spreads that benefit all traders.

Risk Management Without the Drama

Professional firms use stablecoins as safe havens during market uncertainty, which avoids the emotional roller coaster of volatile assets when they need predictable value. McKinsey data shows stablecoin circulation doubled in the past 18 months to $250 billion, with institutional adoption driving most growth.

Corporate treasuries now hold stablecoins as working capital protection against local currency devaluation (particularly in high-inflation regions where traditional hedging costs more than stablecoin infrastructure fees). This practical approach to volatility management has made stablecoins essential tools for any business that operates in global markets where currency stability matters more than speculative gains.

Market Makers Love the Predictability

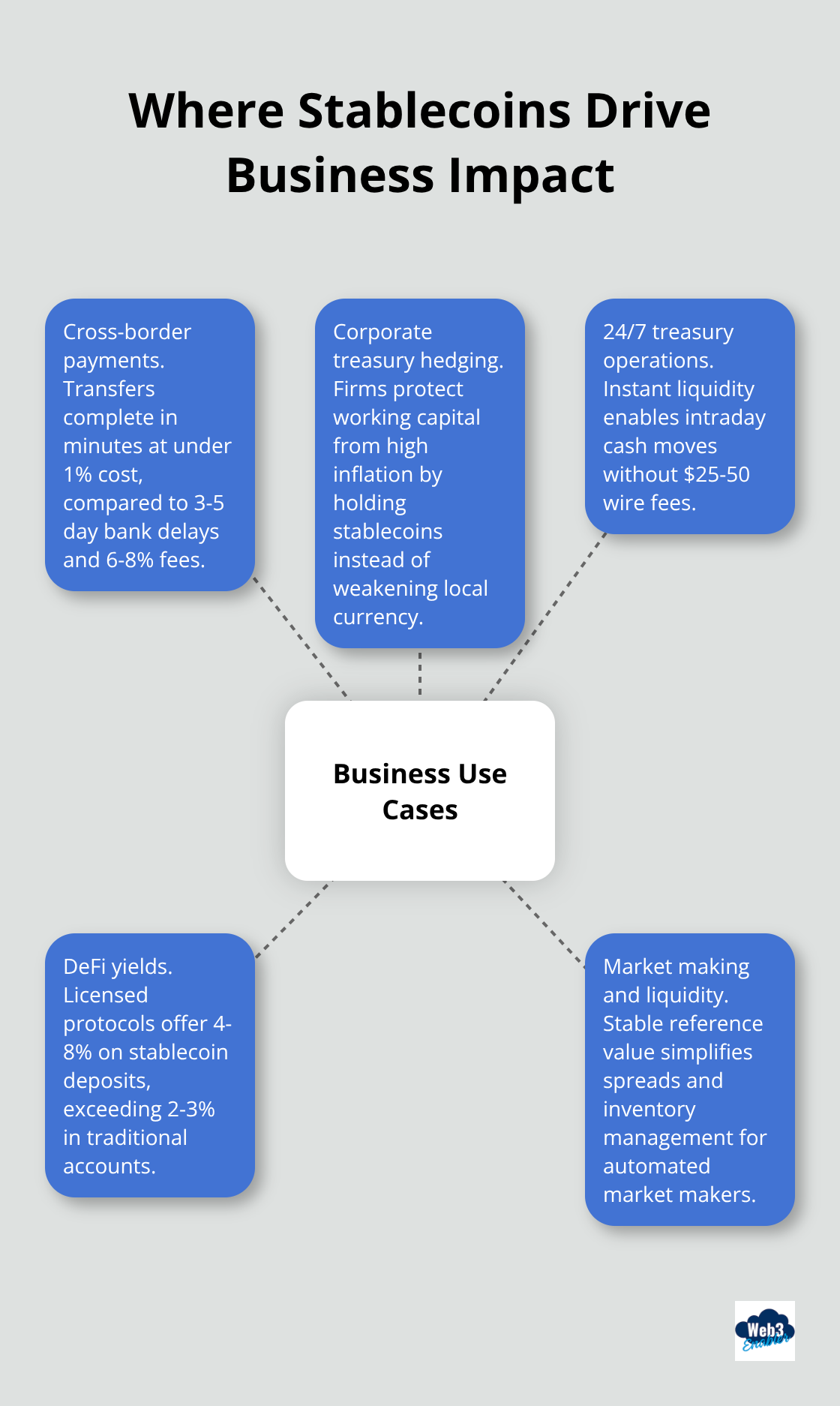

The consistent value of stablecoins creates perfect conditions for automated market makers and liquidity providers who need stable reference points. These systems can calculate spreads and manage inventory without worrying about their base currency losing 20% overnight.

This predictability extends beyond just trading – it enables the complex financial products and services that businesses actually need when they step into crypto markets for practical purposes rather than speculation.

Where Stablecoins Actually Work in Business

Cross-Border Payments Get a Reality Check

Remittance corridors reveal the clearest advantage of stablecoin adoption. Traditional money transfers from the US to Latin America cost 6-8% in fees and take 3-5 days, while stablecoin transfers complete in minutes at under 1% cost. Companies like Stripe now process stablecoin payments for global payouts, which eliminates the need for multiple bank accounts across different countries.

Dubai recorded $19 billion in stablecoin transaction volume during 2024. Businesses used USDC for supplier payments and employee remittances to avoid traditional bank delays and currency conversion fees that eat into profit margins.

Corporate Treasury Gets an Upgrade

Smart treasurers hold stablecoins as working capital hedges against local currency devaluation. Turkish and Argentine companies moved over $30 billion into stablecoin flows to protect against inflation that exceeded 50% annually (according to regional fintech data). This strategy preserves purchasing power when local currencies collapse faster than weekend plans.

Multinational firms use programmable stablecoins for automated payroll systems that release funds based on delivery milestones. This approach eliminates manual approval processes that slow down operations and frustrate remote teams who need predictable payment schedules.

Treasury Operations Go 24/7

Major corporations leverage round-the-clock stablecoin liquidity for intraday cash management. They move funds between subsidiaries instantly instead of waiting for bank wire transfers that cost $25-50 per transaction. This speed advantage becomes critical when currency markets shift overnight and companies need to rebalance positions before traditional banks open.

Real-time settlement capabilities allow businesses to optimize working capital across time zones, which reduces the cash buffers they previously needed to maintain for operational uncertainty.

DeFi Delivers Real Returns

Yield opportunities through licensed DeFi protocols generate 4-8% annual returns on stablecoin deposits, which beats traditional corporate money market accounts that offer 2-3%. Institutional DeFi platforms provide automated credit with smart contract risk management, which allows businesses to earn interest on idle cash reserves while they maintain liquidity access.

Companies can stake stablecoins in liquidity pools for additional revenue streams. This requires proper compliance frameworks and risk assessment protocols that most traditional finance teams lack experience with, but the returns justify the learning curve for forward-thinking treasurers.

Final Thoughts

The importance of stablecoins extends far beyond crypto markets into real business operations. Major corporations like PayPal and JPMorgan launch stablecoin initiatives because they recognize operational advantages over legacy payment systems. Financial institutions integrate stablecoins into treasury operations at unprecedented rates, with the $255 billion market projected to exceed $400 billion by year-end and reach $2 trillion by 2028 (McKinsey data shows genuine business adoption rather than speculative investment).

Regulatory frameworks like the US GENIUS Act and EU MiCAR provide compliance structures that enterprises require for mainstream adoption. Licensed stablecoin infrastructure now handles institutional-grade security and transparency requirements that traditional finance demands. These developments create the foundation for programmable money systems that automate complex financial operations without the friction of legacy banking.

Smart businesses already build competitive advantages through faster settlements, lower costs, and 24/7 liquidity access that traditional banking cannot match. We at Web3 Enabler help companies integrate stablecoin payment solutions into existing corporate infrastructure through our blockchain technology platform. The future belongs to companies that embrace stablecoins as operational tools rather than investment vehicles.