Stablecoins are changing the game for businesses worldwide. At Web3 Enabler, we’ve seen firsthand how these digital assets are opening up new revenue streams and simplifying global transactions.

Stablecoin acceptance is on the rise, offering companies faster, cheaper, and more secure payment options. In this post, we’ll explore how your business can tap into this growing trend and boost its bottom line.

Understanding Stablecoins and Their Impact

What Are Stablecoins?

Stablecoins are digital currencies designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. Unlike traditional cryptocurrencies (such as Bitcoin or Ethereum) which experience significant price fluctuations, stablecoins provide the benefits of blockchain technology without the volatility.

How Stablecoins Work

Stablecoins maintain their value through various mechanisms. The most common type, fiat-collateralized stablecoins, are backed by reserves of the pegged currency. For example, USDC (USD Coin) is backed by US dollar reserves held in regulated financial institutions. This 1:1 backing ensures that for every USDC in circulation, there’s a corresponding US dollar in reserve. These are the stablecoins that are regulated under the new GENIUS Act.

Advantages Over Traditional Cryptocurrencies

Stablecoins offer several advantages over their more volatile counterparts:

- Price stability makes them ideal for everyday transactions and cross-border payments.

- Businesses can accept stablecoin payments without worrying about sudden value changes that could affect their bottom line.

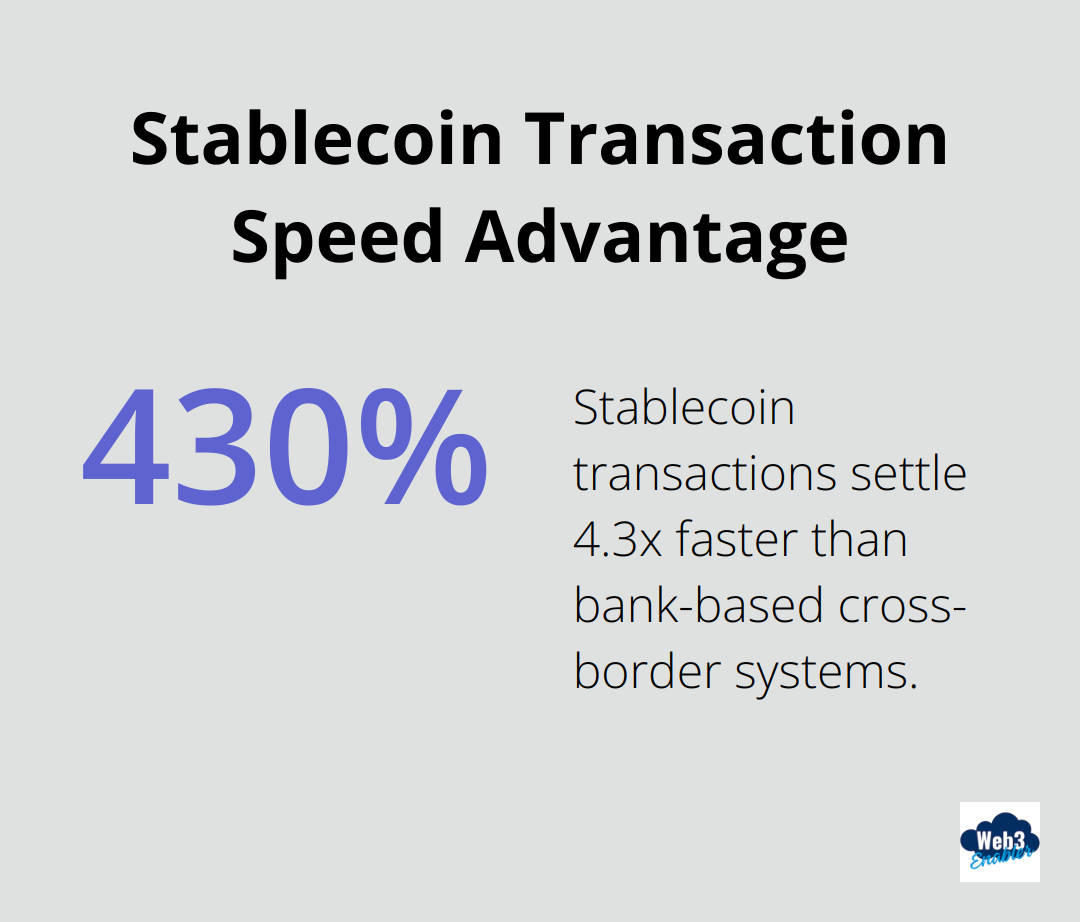

- Stablecoins provide faster settlement times compared to traditional bank transfers.

While international wire transfers can take days to clear, stablecoin transactions typically settle 4.3x faster than bank-based cross-border systems.

Popular Stablecoins in the Market

As of 2025, several stablecoins have gained significant traction in the market:

- USDC (issued by Circle): A favorite among businesses due to its regulatory compliance and transparency.

- Tether (USDT): Despite past controversies, it remains widely used in crypto trading.

- Binance USD (BUSD): A regulated stablecoin issued by Binance.

- Dai: A decentralized stablecoin maintained through smart contracts on the Ethereum blockchain.

USDC has become increasingly popular for business integrations due to its strong regulatory standing and wide acceptance.

The Future of Stablecoins in Business

The stablecoin market continues to evolve rapidly. As more businesses recognize the potential of these digital assets, we expect to see increased adoption across various industries. The next section will explore the specific benefits that stablecoin payments can bring to your business operations.

Why Stablecoin Payments Make Business Sense

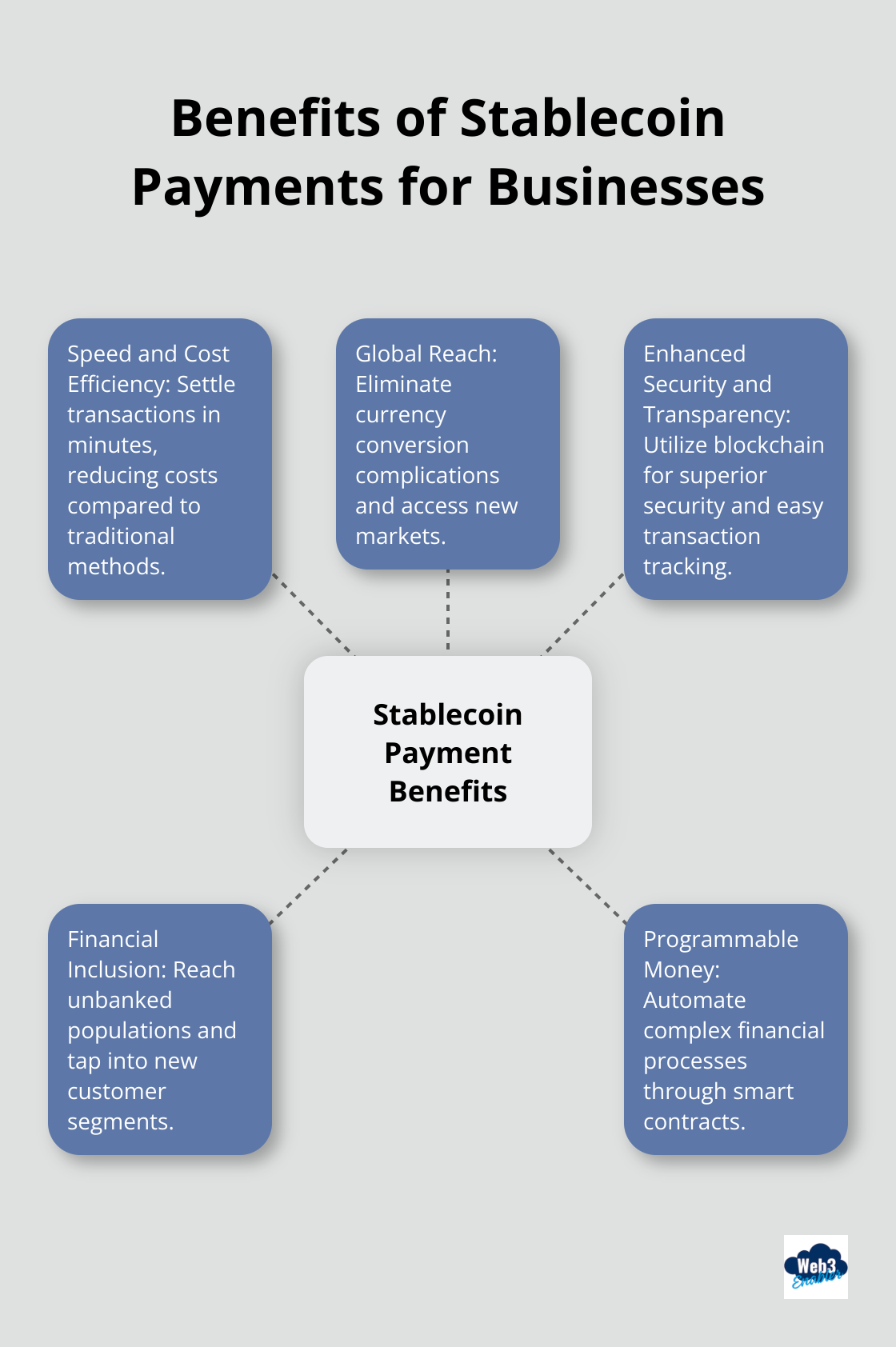

Speed and Cost Efficiency

Stablecoin payments transform business transactions. These digital assets settle in minutes, unlike international wire transfers that take days. This speed revolutionizes time-sensitive transactions and cash flow management.

The cost savings are substantial. Traditional cross-border payments can be expensive. Stablecoins payments infrastructure and tokenized cash blockchain technology drive cross-border payments modernization and digital asset adoption.

Global Reach Without Currency Complications

Stablecoins eliminate the need for currency conversion in many scenarios. This benefits businesses operating across multiple countries. Employing stablecoins can resolve real-world problems, such as efficient business-to-business payments, low-cost remittances, and investable stable reserve assets.

Stablecoins also unlock new markets previously inaccessible due to banking restrictions or volatile local currencies. Companies can now easily transact with partners and customers in emerging markets, expanding their global presence.

Enhanced Security and Transparency

The blockchain technology underlying stablecoins offers superior security and transparency. Every transaction appears on a public ledger, facilitating easy tracking and verification of payments. This transparency proves invaluable for businesses managing complex supply chains or operating in highly regulated industries.

The immutable nature of blockchain significantly reduces fraud risk. Once recorded, a transaction cannot change without network consensus. This feature instills greater confidence in financial operations and reduces the need for costly intermediaries.

Improved Financial Inclusion

Stablecoins promote financial inclusion by providing access to digital financial services for the unbanked and underbanked populations. Businesses can reach new customer segments previously excluded from traditional banking systems, opening up untapped markets and revenue streams.

Programmable Money

Stablecoins enable the creation of programmable money through smart contracts. This feature allows businesses to automate complex financial processes (such as escrow services, recurring payments, or conditional transactions). The result is increased efficiency and reduced operational costs.

Stablecoin payments offer practical solutions to many challenges businesses face with traditional payment systems. As more companies recognize these benefits, widespread global adoption of stablecoin payments across various industries seems inevitable. The next section will guide you through the process of implementing stablecoin payments in your business operations, ensuring you can capitalize on this transformative technology.

How to Implement Stablecoin Payments

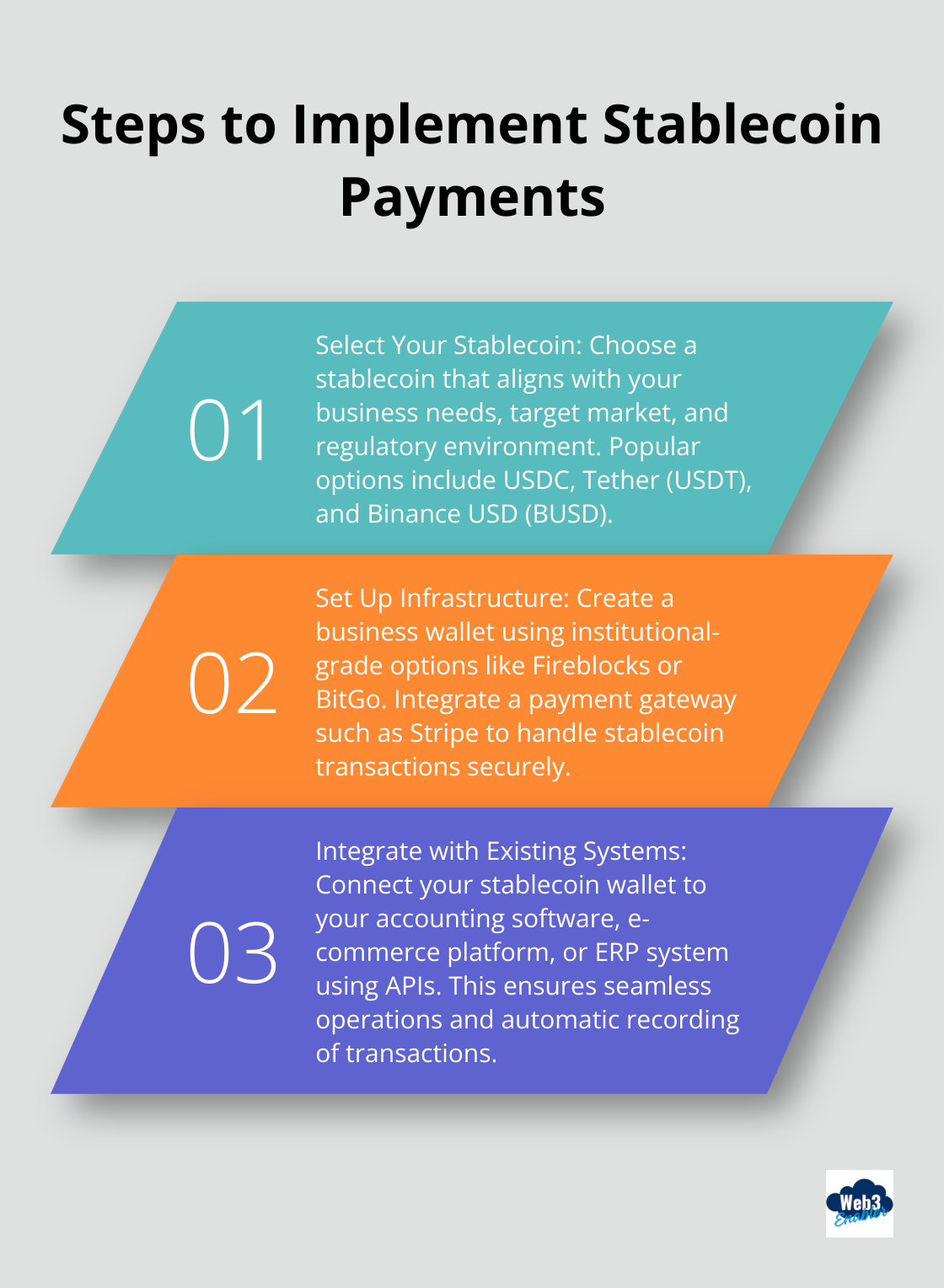

Selecting Your Stablecoin(s)

The first step involves choosing the right stablecoin or stablecoins that you want to work with. USDC stands out as a top choice due to its regulatory compliance and wide acceptance. In 2025, USDC has been accepted as a compliant stablecoin in the EU’s MiCA framework, giving it access to regulated European crypto markets. Tether (USDT) is another popular option, especially in crypto trading circles. However, its past controversies make it less ideal for businesses prioritizing regulatory clarity.

For companies operating primarily in the Binance ecosystem, BUSD might be a suitable choice. If you’re looking for a decentralized option, consider DAI, which is maintained through smart contracts on the Ethereum blockchain.

Web3 Enabler’s Blockchain Payments let’s you enable multiple stablecoins on multiple blockchains that comply with your regulatory needs.

Setting Up Your Infrastructure – Liquidation Wallets

After you choose your stablecoin, you must set up the necessary infrastructure. Traditionally, this involves creating a business wallet and integrating a payment gateway. But Web3 Enabler’s Blockchain Payments stops this. For a company newly accepting stablecoins, liquidation wallets will be the best solution. You can create a liquidation wallet on Blockchain Payments, and the money is automatically converted to fiat.

If you are interested in large scale stablecoin balances, you may want to consider institutional-grade options like Fireblocks or BitGo (which offer enhanced security features and multi-signature capabilities). These are essential for protecting your funds and ensuring smooth operations.

Integration with Existing Systems

Integrating stablecoin payments with your current systems is essential for seamless operations. If you’re using Salesforce, Web3 Enabler’s native blockchain solution on the Salesforce AppExchange can streamline this process significantly.

For other systems, look for APIs that can connect your stablecoin wallet to your accounting software, e-commerce platform, or ERP system. This integration ensures that stablecoin transactions are automatically recorded and reconciled, reducing manual work and potential errors. Web3 Enabler also builds bespoke implementations, so reach out for help.

Educating Your Team and Customers

The final step is education. Your staff needs to understand how stablecoin payments work, their benefits, and how to handle potential issues. Create clear guidelines and provide training sessions to ensure everyone is on the same page.

For customers, transparency is key. Explain the benefits of stablecoin payments (such as faster transactions and lower fees). Address common concerns about security and volatility. Consider offering incentives, like small discounts, to encourage adoption.

Final Thoughts

Stablecoin payments reshape the business landscape. Companies streamline operations, reduce costs, and tap into new markets with these digital assets. Faster transactions, lower fees, and enhanced security make stablecoin acceptance attractive for businesses of all sizes.

The role of stablecoins in business will grow exponentially. Regulatory frameworks provide clearer guidelines, which will increase adoption across industries. Stablecoins will become a fundamental part of global payment systems, potentially rivaling traditional financial networks in processing volumes.

Web3 Enabler helps businesses navigate this exciting landscape. Our native blockchain solution on the Salesforce AppExchange integrates stablecoin payments into existing workflows. The future of business payments is here, powered by stablecoins.