Digital currency is no longer the wild west of finance. Governments worldwide are launching their own digital currencies while businesses ditch traditional banking for faster, cheaper alternatives.

We at Web3 Enabler see the digital currency future unfolding right now. The question isn’t whether digital money will replace traditional payments – it’s how quickly your business will adapt to this inevitable shift.

Central Bank Digital Currencies Are Reshaping Money

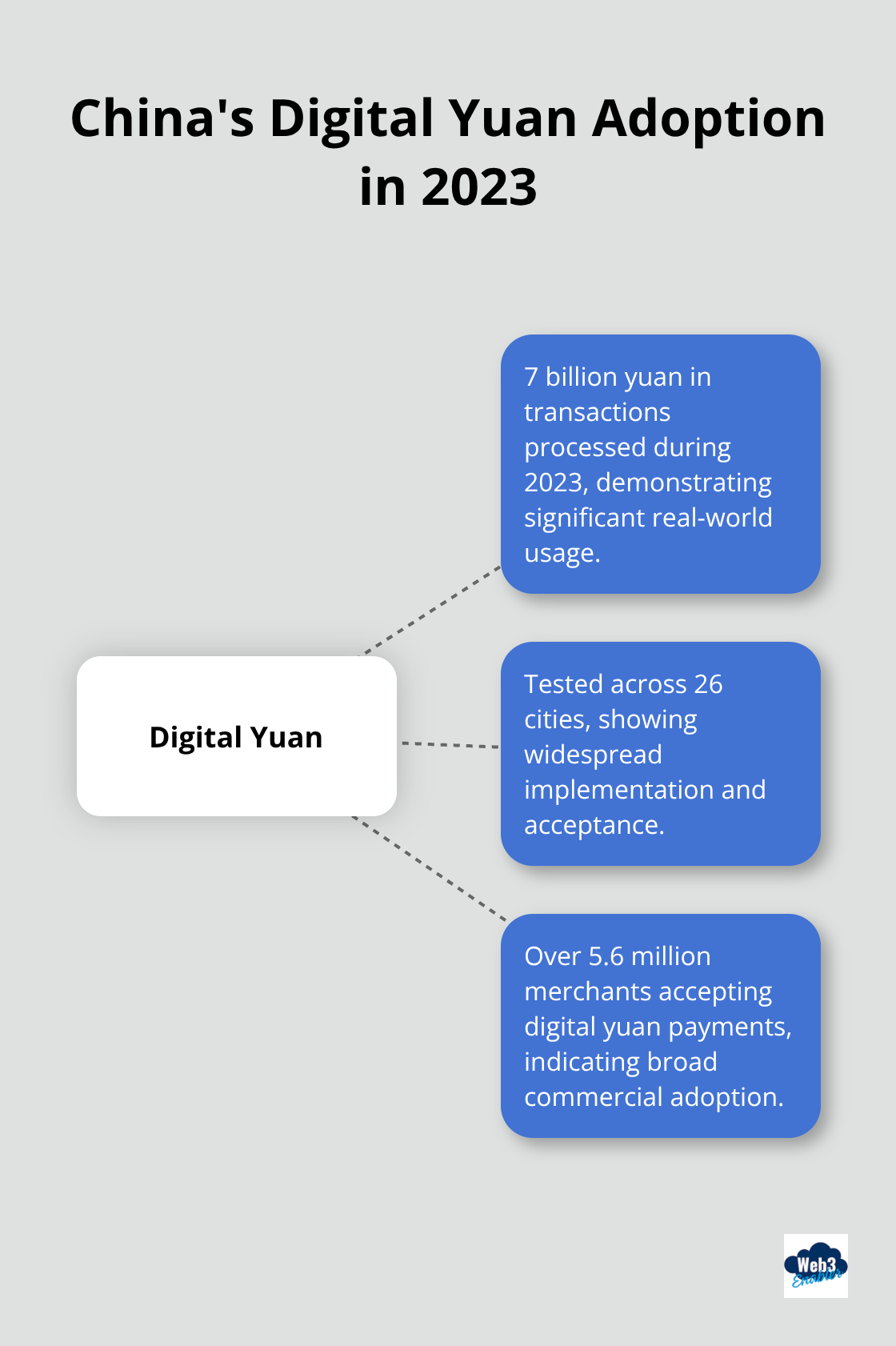

China’s digital yuan reached 7 billion yuan in transactions during 2023, making it the world’s most advanced central bank digital currency in actual use. The People’s Bank of China tested their e-CNY across 26 cities, with over 5.6 million merchants accepting digital yuan payments. This isn’t a pilot program anymore – it’s live commerce happening right now. Major Chinese retailers like JD.com and Meituan process millions of digital yuan transactions monthly, proving that government-issued digital money works at scale.

Federal Reserve Moves Toward Digital Dollar Reality

The Federal Reserve published their digital dollar research in March 2023, signaling serious intent to launch a US CBDC within the next five years. Jerome Powell stated that a digital dollar could eliminate the two-day settlement period for business payments, reducing corporate cash flow delays that cost American businesses significant amounts annually. European Central Bank president Christine Lagarde announced the digital euro will enter its preparation phase in 2025, with full deployment expected by 2028.

Business Payment Infrastructure Gets Government Backing

CBDCs solve the correspondent banking problem that makes international B2B payments expensive and slow. Singapore’s Project Ubin demonstrated how digital currencies can settle cross-border payments in under 20 seconds compared to the current 3-5 business days. The Bank for International Settlements reported that CBDC adoption could reduce global payment costs significantly while eliminating counterparty risk entirely (smart businesses should start planning their CBDC integration strategies now).

Government-backed digital money will dominate commercial payments within this decade, but private sector solutions are already transforming how businesses handle transactions today.

Stablecoins Become the Business Payment Standard

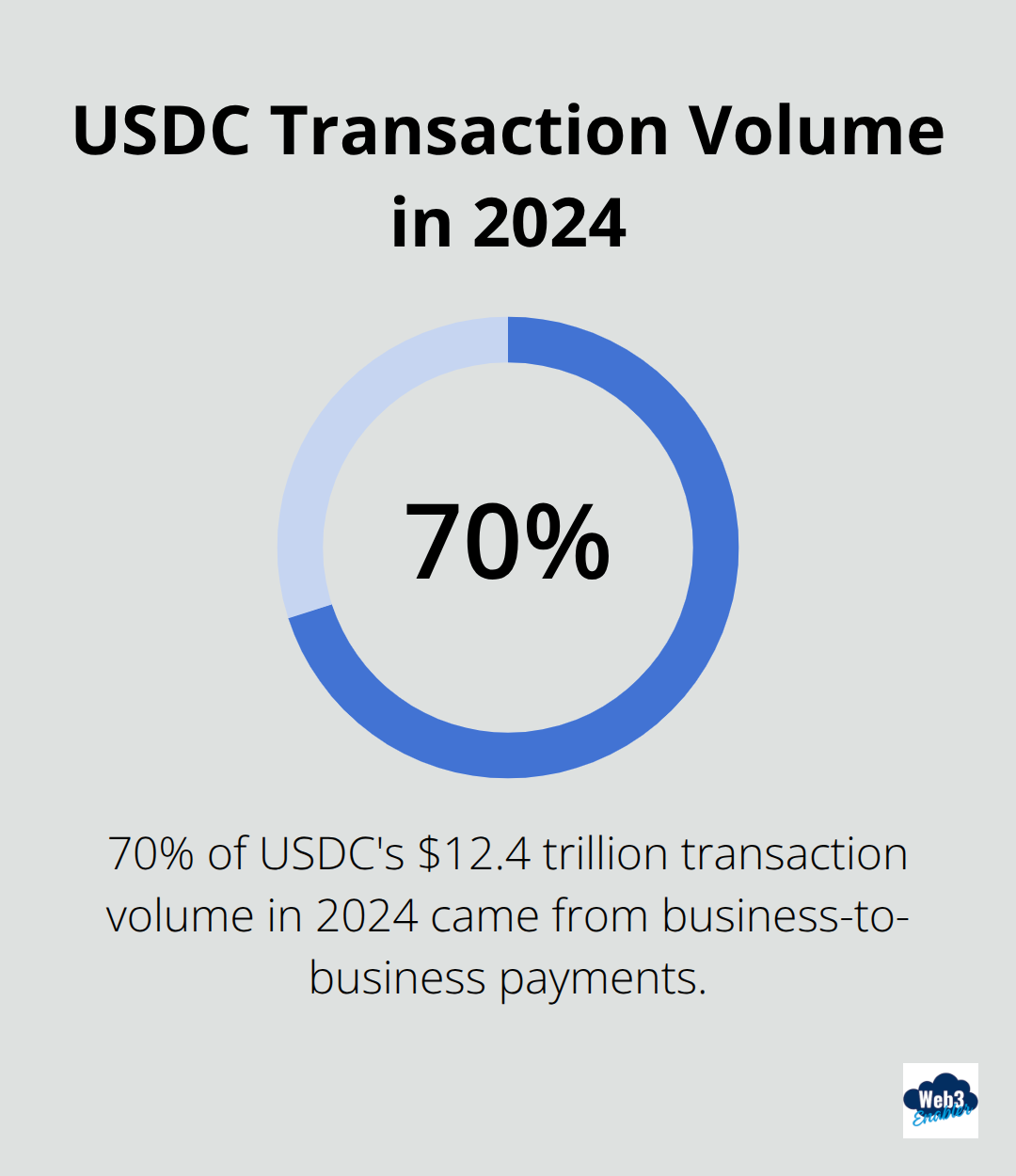

Mastercard processed $47 billion in stablecoin transactions during 2024, while Visa expanded its stablecoin settlement program to Solana after successful Ethereum tests. Corporate treasurers at companies like Shopify and Tesla now use USDC for international payments because wire transfers take 3-5 business days while stablecoin transfers complete in under 10 minutes. Circle reported that USDC transaction volume reached $12.4 trillion in 2024, with 70% from business-to-business payments rather than retail trades.

Settlement Speed Transforms Cash Flow Management

Traditional international wire transfers cost businesses $25-50 per transaction plus correspondent fees that can reach 3% of transaction value. USDC transfers cost under $0.50 on Polygon network and $3-8 on Ethereum during peak times. Tether processed over $190 trillion in transaction volume during 2024, which made USDT the most-used stablecoin for cross-border commerce. Companies that use stablecoins for vendor payments report 40-60% cost savings compared to SWIFT network transfers, according to JPMorgan’s blockchain research division.

Corporate Adoption Accelerates Past Traditional Infrastructure

PayPal Holdings allows business accounts to send up to $100,000 daily in USDC transfers, while traditional wire limits often cap at $25,000 without additional approvals. Major firms like PwC and Deloitte now audit stablecoin reserves monthly, which gives corporate finance teams the transparency they need for treasury management. The tokenized real-world asset market exceeded $29 billion in value across public blockchains during 2024 (with stablecoins as the largest category for business applications).

Regulatory Compliance Drives Enterprise Confidence

Financial institutions now treat regulated stablecoins like USDC as legitimate payment rails rather than speculative assets. The Federal Reserve approved several banks to custody stablecoins in 2024, while the Office of the Comptroller of the Currency clarified that national banks can hold stablecoin reserves. This regulatory acceptance removes the compliance barriers that previously prevented Fortune 500 companies from adopting digital payment solutions.

Smart businesses already embrace stablecoins, but the regulatory landscape that governs all digital currencies continues to evolve rapidly across different jurisdictions.

Which Jurisdictions Win the Digital Currency Race

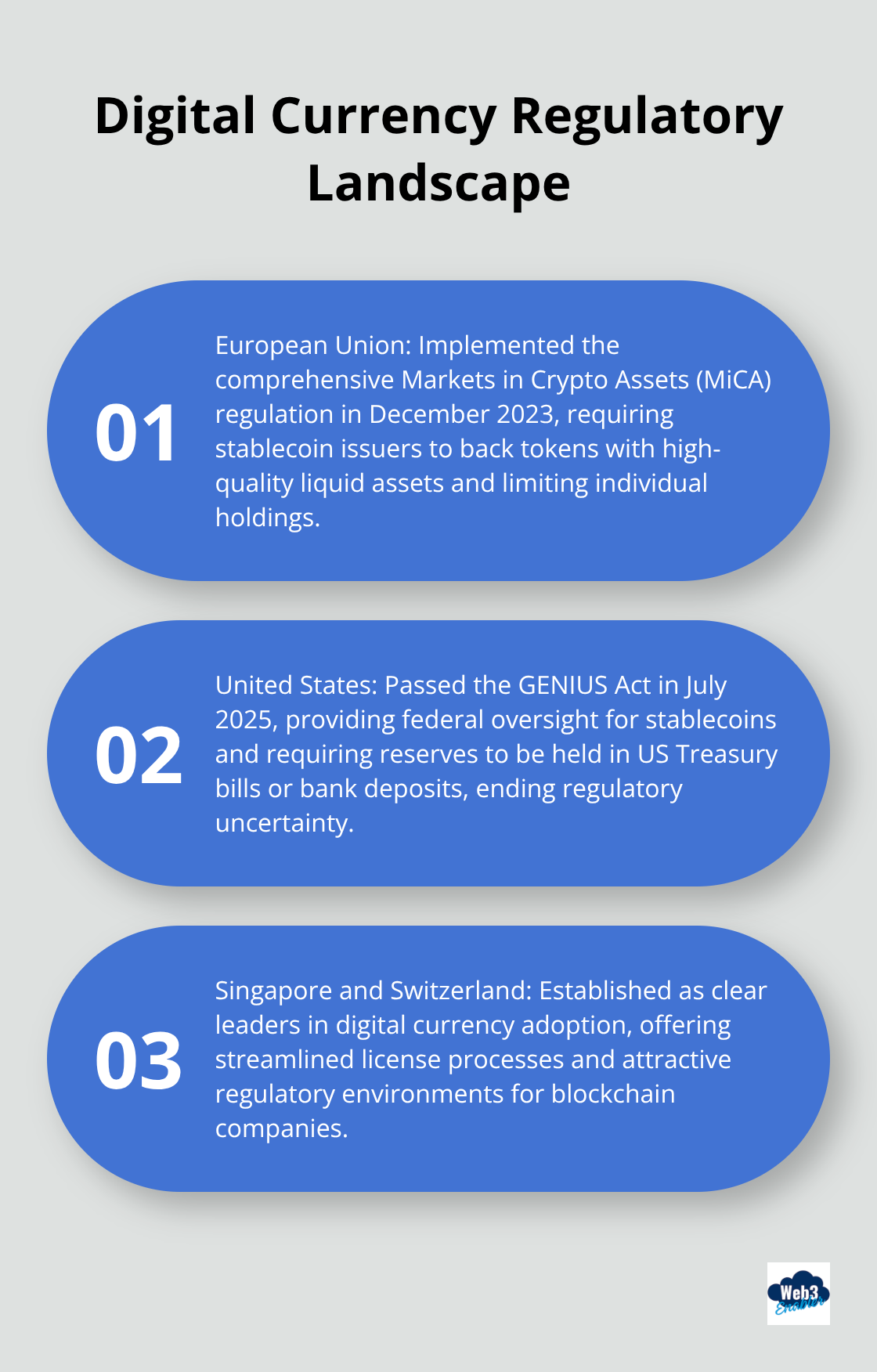

The European Union’s Markets in Crypto Assets regulation took effect in December 2023, creating the world’s first comprehensive digital currency compliance framework. MiCA requires stablecoin issuers to back their tokens with high-quality liquid assets and limits individual stablecoin holdings to prevent systemic risk. Circle moved its European operations to France to comply with MiCA requirements, while Tether faced restrictions on its USDT operations across EU member states. Companies that operate in Europe now face mandatory license requirements, capital reserves, and regular audits with significant compliance costs.

America Plays Catch-Up While Asia Leads

The United States passed the GENIUS Act in July 2025, which finally provided federal oversight for stablecoins and required reserves to be held in US Treasury bills or bank deposits. This legislation ended the regulatory uncertainty that prevented major US banks from fully embracing digital currencies for business payments. Singapore established itself as the clear winner in Asia by processing substantial digital asset transactions through licensed exchanges, while Switzerland’s Financial Market Supervisory Authority approved numerous blockchain companies for full banking licenses.

Singapore and Switzerland Dominate Global Competition

Smart businesses establish operations in Singapore or Switzerland now, as these jurisdictions offer the clearest regulatory pathways for digital currency adoption without the compliance costs imposed by European regulations. Singapore’s Monetary Authority processes crypto license applications significantly faster than most European countries. Switzerland offers competitive corporate tax rates for blockchain companies compared to traditional financial services in other major financial centers.

Regulatory Arbitrage Creates Business Opportunities

Companies that choose the right jurisdiction gain significant competitive advantages in digital currency adoption. Dubai’s Virtual Assets Regulatory Authority has approved numerous crypto businesses, offering attractive tax rates for qualifying blockchain operations. Hong Kong reversed its crypto restrictions in June 2024, allowing retail investors to trade Bitcoin and Ethereum directly, creating new opportunities for businesses that serve Asian markets.

Final Thoughts

The digital currency future has arrived faster than most businesses expected. China’s digital yuan processes billions in transactions while corporate treasurers at major companies abandon wire transfers for stablecoin payments that settle in minutes instead of days. This shift from speculative trades to practical business applications represents the most significant change in commercial payments since credit cards.

Regulatory frameworks like the EU’s MiCA regulation and America’s GENIUS Act provide the compliance clarity that enterprise finance teams demanded. Singapore and Switzerland lead global adoption through streamlined license processes, while traditional financial institutions now custody stablecoins as legitimate payment infrastructure. Companies that delay digital currency adoption risk competitors who already benefit from faster settlements and lower transaction costs.

The question that faces business leaders isn’t whether to adopt digital payments, but how quickly they can implement these solutions without operational disruption. We at Web3 Enabler help businesses navigate this transition through blockchain solutions that integrate stablecoin payments and global transfers directly into existing corporate infrastructure (smart businesses position themselves for this inevitable future now). The digital currency revolution happens now, and forward-thinking companies already embrace these transformative payment technologies.