Blockchain technology is revolutionizing B2B transactions, offering unprecedented transparency, efficiency, and security. At Web3 Enabler, we’re witnessing a surge in enterprises adopting blockchain-based B2B solutions to streamline their operations and gain a competitive edge.

From supply chain management to cross-border payments, blockchain is reshaping how businesses interact and collaborate. In this post, we’ll explore the transformative potential of blockchain in B2B and how companies can overcome adoption challenges to harness its power.

How Blockchain Transforms B2B Transactions

Blockchain technology fundamentally changes the way businesses interact with each other. This revolutionary approach to B2B transactions offers significant advantages over traditional methods, reshaping the landscape of business interactions.

Unparalleled Transparency in Business Dealings

Blockchain’s distributed ledger technology provides an immutable record of all transactions. Every party involved in a B2B transaction can view the same information in real-time, which eliminates discrepancies and reduces disputes. In supply chain management, for instance, blockchain allows all stakeholders to track the movement of goods from manufacturer to end consumer, ensuring accountability at every step.

Dramatic Cost Reduction and Efficiency Gains

The automation capabilities of blockchain significantly reduce operational costs. Smart contracts (self-executing agreements with terms directly written into code) eliminate the need for intermediaries in many B2B transactions. This not only cuts costs but also speeds up processes dramatically. The global FinTech Blockchain market was valued at US$3.4 Billion in 2024 and is projected to reach US$49.2 Billion by 2030, growing at a CAGR of 55.9%.

Robust Security and Fraud Prevention

Blockchain’s cryptographic nature makes data tampering extremely difficult, providing a level of security that traditional systems can’t match. This proves particularly crucial in B2B transactions where large sums of money and sensitive information are at stake. The technology’s ability to create an unalterable audit trail also serves as a powerful deterrent to fraud. In 2023, over 52% of food safety recalls in the U.S. were traced using blockchain technology.

Real-Time Data Access and Decision Making

Blockchain enables real-time access to transaction data, allowing businesses to make informed decisions quickly. This immediate access to accurate information (without the need for reconciliation) improves cash flow management and financial planning. Companies can react faster to market changes and customer demands, giving them a competitive edge in fast-paced industries.

Streamlined Compliance and Auditing

The immutable nature of blockchain records simplifies compliance and auditing processes. All transactions are automatically recorded and cannot be altered, creating a clear audit trail. This feature reduces the time and resources required for audits and helps businesses meet regulatory requirements more easily. Regulators can also access this information directly, further streamlining the compliance process.

As blockchain continues to revolutionize B2B transactions, businesses must consider how to leverage this technology effectively. The next section explores key use cases where blockchain is already making a significant impact in the B2B world.

Blockchain’s Game-Changing B2B Applications

Revolutionizing Supply Chain Management

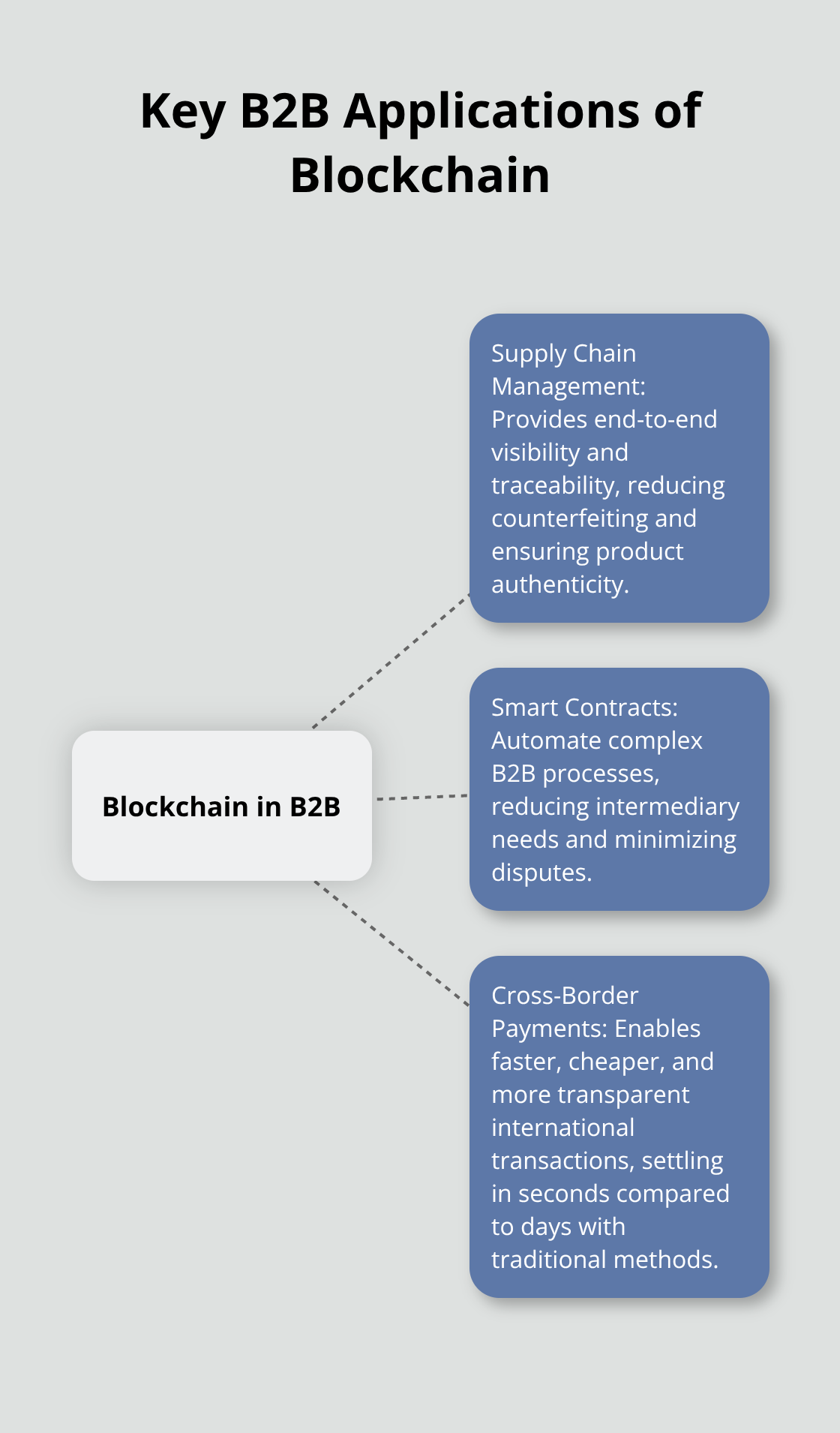

Blockchain technology transforms supply chain management by providing end-to-end visibility and traceability. This tamper-evident, shared digital ledger records all transactions in public or private peer-to-peer networks, enabling businesses to track products from origin to destination, which reduces counterfeiting and ensures product authenticity.

Walmart exemplifies this transformation with its blockchain-based system to track mangoes in U.S. stores. This system slashed tracing time from 7 days to 2.2 seconds, significantly improving food safety and recall efficiency.

To implement blockchain in your supply chain:

- Identify pain points in your current process

- Select a blockchain platform compatible with existing systems

- Launch a pilot project to demonstrate value

- Expand gradually to cover more products and suppliers

Automating Agreements with Smart Contracts

Smart contracts automate complex B2B processes, reducing intermediary needs and minimizing disputes. Gartner estimates that three billion B2B internet-connected machines can act as customers today, growing to eight billion by 2030.

The insurance industry showcases practical applications. AXA, a global insurance company, utilizes smart contracts for its flight delay insurance product. These contracts automatically trigger payouts to policyholders when flights are delayed, eliminating manual intervention.

To leverage smart contracts in your business:

- Identify automatable processes

- Collaborate with legal experts to accurately translate contract terms into code

- Deploy smart contracts on platforms like Ethereum or Hyperledger Fabric

- Conduct regular audits and updates to maintain security and efficiency

Streamlining Cross-Border Payments and Settlements

Blockchain revolutionizes international B2B payments with faster, cheaper, and more transparent transactions. The World Economic Forum projects that by 2027, blockchain technology will store 10% of global GDP.

Ripple (a blockchain-based payment protocol) partners with over 300 financial institutions to facilitate cross-border transactions. These transactions settle in seconds (compared to days with traditional methods) and at a fraction of the cost.

To optimize your cross-border payments with blockchain:

- Evaluate blockchain-based payment solutions that integrate with existing financial systems

- Consider stablecoins for transactions to mitigate cryptocurrency volatility

- Ensure compliance with international regulations and KYC/AML requirements

- Educate your finance team on blockchain technology and its benefits

As blockchain continues to reshape B2B operations, businesses must address adoption challenges to fully harness its potential. The next section explores these challenges and provides strategies to overcome them, ensuring a smooth transition to blockchain-powered B2B solutions.

Overcoming Blockchain Adoption Challenges

Addressing Scalability Issues

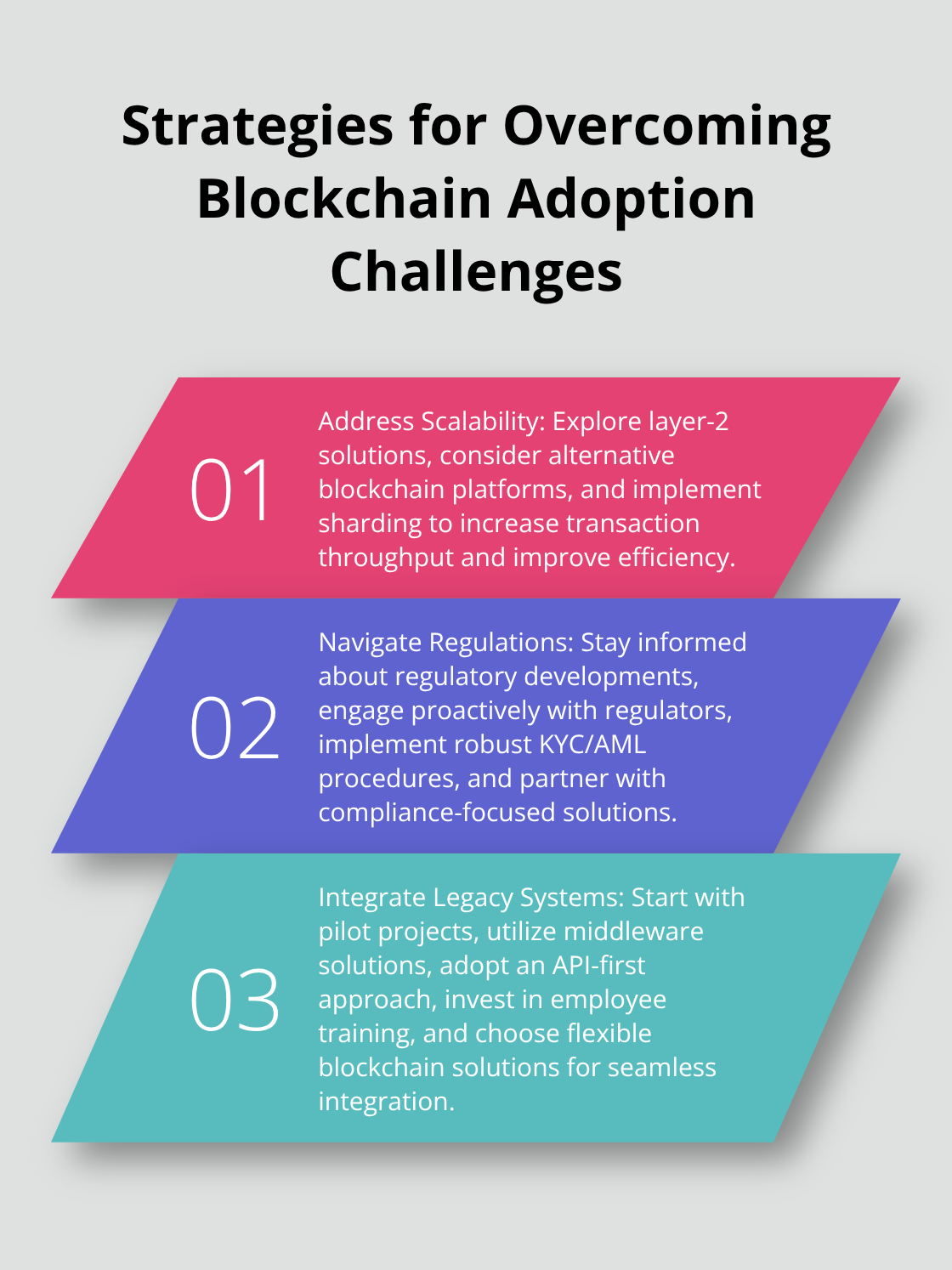

Scalability remains a significant concern for businesses considering blockchain adoption. Ethereum’s 2025 upgrades boosted scalability to 100,000 TPS, which addresses many enterprise-level application needs. To further enhance scalability:

- Explore layer-2 solutions: Technologies like Polygon or Optimism can increase transaction throughput while maintaining security.

- Consider alternative blockchain platforms: Platforms such as Solana or Algorand offer higher transaction speeds and lower costs (potentially better suited for high-volume B2B operations).

- Implement sharding: This technique divides the blockchain network into smaller, more manageable pieces, allowing for parallel processing and improved scalability.

Navigating Regulatory Complexities

The evolving regulatory environment complicates blockchain adoption in B2B. To navigate this landscape:

- Stay informed: Monitor regulatory developments in your industry and jurisdictions of operation regularly.

- Engage with regulators: Communicate proactively with regulatory bodies to understand their concerns and demonstrate your commitment to compliance.

- Implement robust KYC/AML procedures: Use blockchain-native identity solutions to streamline compliance processes while meeting regulatory requirements.

- Partner with compliance-focused solutions: Platforms like Web3 Enabler offer built-in compliance features, which simplify regulatory adherence for businesses.

Integrating with Legacy Systems

Integrating blockchain with existing enterprise systems often proves complex. To overcome this:

- Start with a pilot project: Identify a specific use case and implement a small-scale blockchain solution to demonstrate value and learn from the integration process.

- Utilize middleware solutions: Platforms like Chainlink provide oracle services that can bridge the gap between on-chain and off-chain systems.

- Adopt an API-first approach: Develop standardized APIs for your blockchain solution to facilitate easier integration with various enterprise systems.

- Invest in employee training: Equip your IT team with the necessary skills to manage and maintain blockchain systems alongside traditional infrastructure.

- Choose flexible blockchain solutions: Opt for platforms that offer customizable integration options. Web3 Enabler’s native Salesforce integration allows for seamless incorporation of blockchain capabilities into existing CRM workflows.

Final Thoughts

Blockchain technology transforms the B2B landscape, offering unmatched transparency, efficiency, and security. Its applications in supply chain management, smart contracts, and cross-border payments deliver tangible benefits to businesses worldwide. The potential for blockchain to streamline operations, cut costs, and build trust between partners is significant.

Businesses must address adoption challenges to harness blockchain’s full potential. Scalability issues, regulatory complexities, and integration with legacy systems present hurdles. However, with the right strategies and partners, companies can overcome these obstacles and position themselves as leaders in the digital economy.

Web3 Enabler facilitates blockchain adoption for businesses through our native Salesforce integration. We enable seamless management of digital assets and cryptocurrencies within the familiar Salesforce environment, making blockchain accessible for B2B solutions. Companies that embrace this technology today will be well-equipped to thrive in tomorrow’s blockchain-powered B2B landscape.