Ever wondered why sending money abroad feels like you’re stuck in a financial time warp? At Web3 Enabler, we’ve got the lowdown on how blockchain is flipping the script on global transactions.

Say goodbye to sky-high fees, snail-paced transfers, and that nagging feeling your money’s playing hide-and-seek. We’re about to show you how blockchain is making cross-border payments as easy as sliding into your crush’s DMs.

Why Traditional Cross-Border Payments Are a Nightmare

Let’s face it, sending money abroad is about as enjoyable as a root canal performed by a clumsy dentist. Traditional cross-border payments are slow, expensive, and more confusing than trying to decipher your grandma’s secret recipe. Let’s break down this financial fiasco, shall we?

The Fee Frenzy

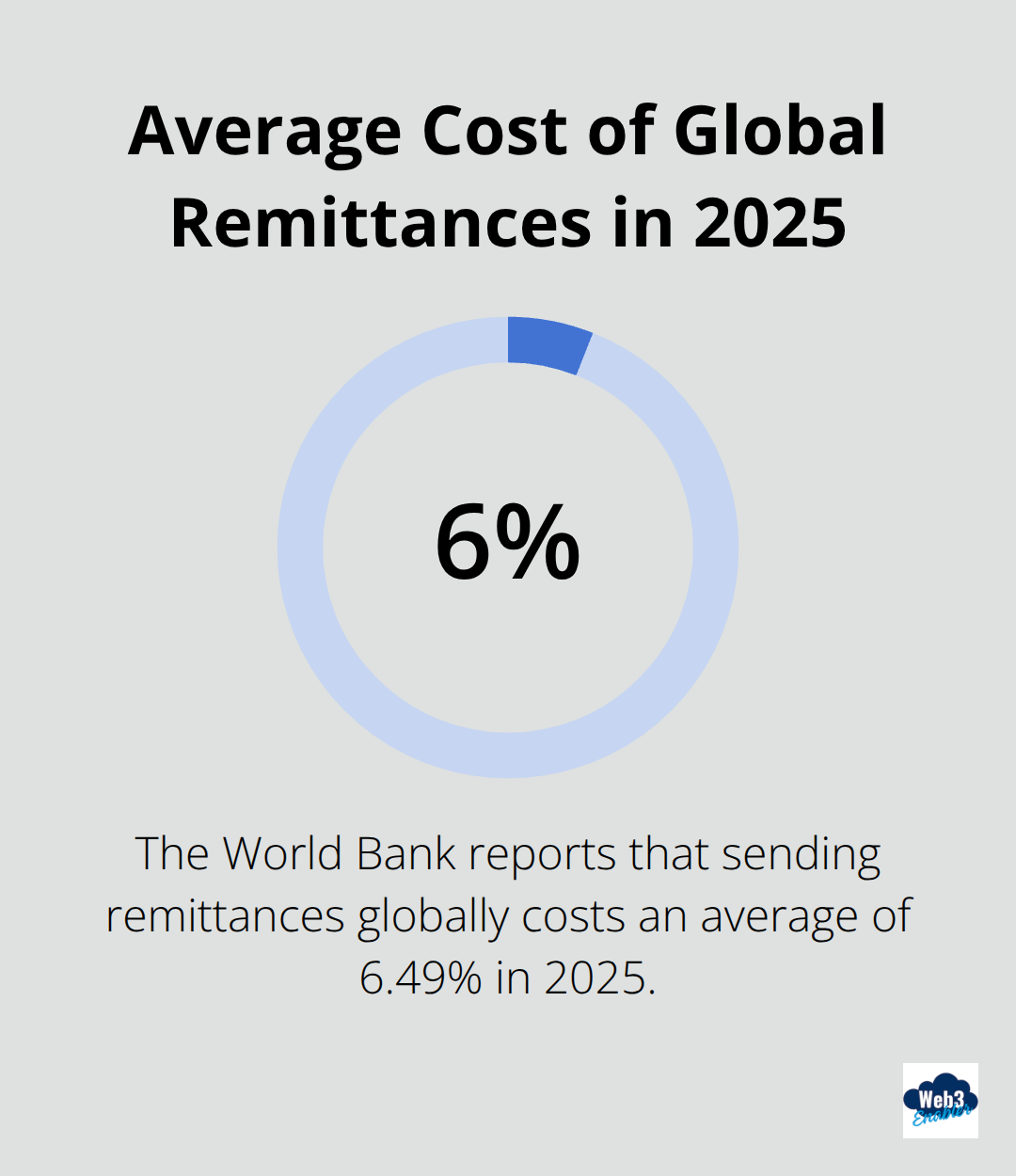

First up, let’s talk about those fees. Banks and money transfer services treat your wallet like an all-you-can-eat buffet. You’ve got upfront fees, exchange rate markups, and sneaky “correspondent bank” charges. According to the World Bank, the average cost of sending remittances globally is 6.49% as of 2025. That’s nearly $13 just to move $200 of your own money around! (Talk about highway robbery.)

The Snail’s Pace of Transactions

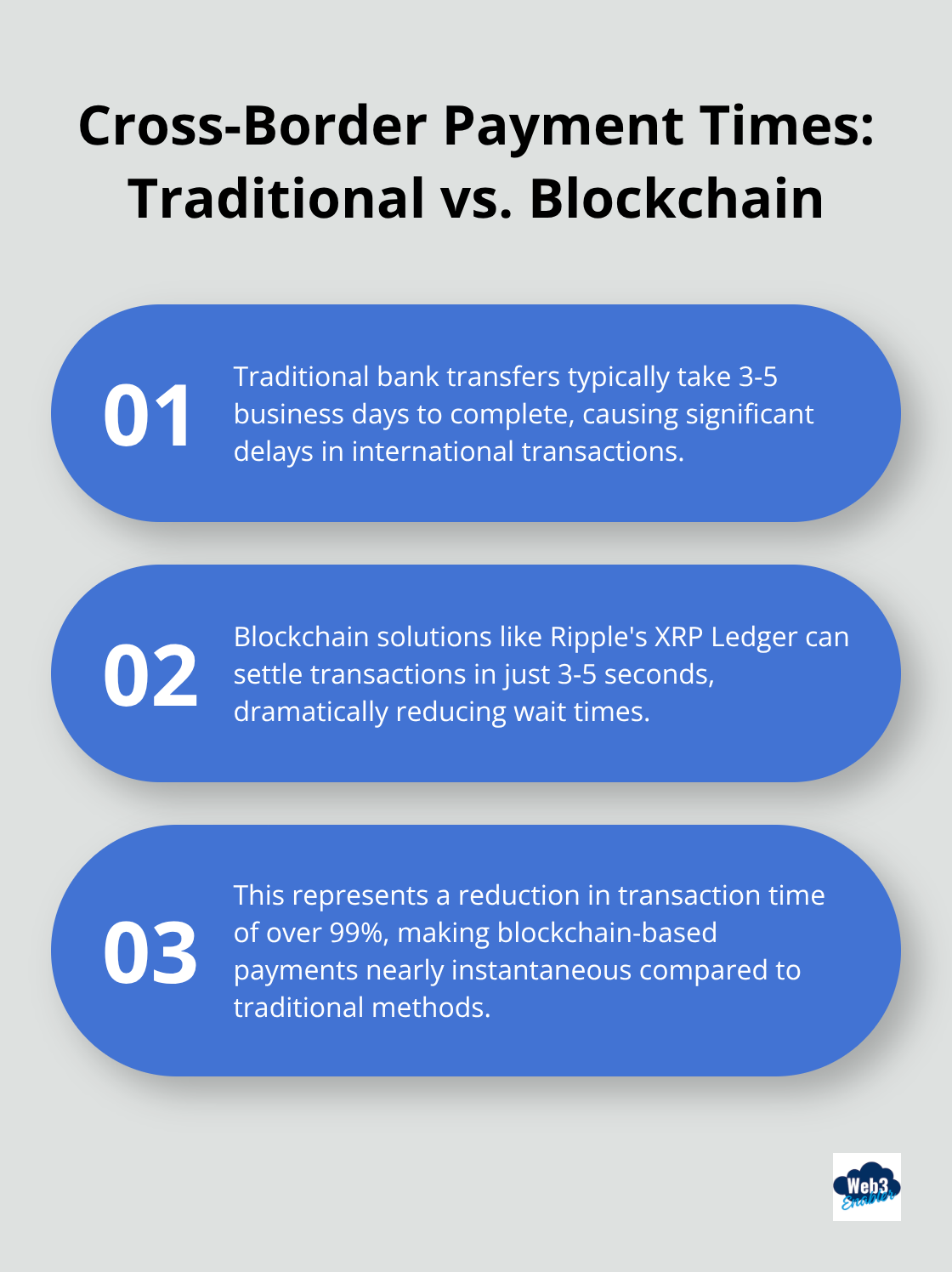

Speed? What speed? Traditional bank transfers move slower than a sloth on vacation. We’re talking 3-5 business days here, folks. In a world where you can order a pizza and have it at your doorstep in 30 minutes, waiting days for your money to arrive feels like financial purgatory.

The Black Hole of Transparency

Tracking your payment is like trying to find a needle in a haystack… while blindfolded. Once you hit “send,” your money vanishes into a labyrinth of intermediaries. You’ll spend more time refreshing your account balance than a teenager checks their phone for a crush’s text.

The Regulatory Obstacle Course

And let’s not forget the regulatory maze. Anti-money laundering (AML) and know-your-customer (KYC) checks are important, sure, but they’ve turned cross-border payments into a bureaucratic nightmare. Each country has its own set of rules, making compliance as straightforward as nailing jelly to a wall.

The bottom line? Traditional cross-border payments are stuck in the Stone Age while the rest of us are living in the age of AI and same-day deliveries. It’s high time for a change, and that’s where blockchain struts in like a superhero ready to save the day. (Cue dramatic music!)

But before we unveil how blockchain is reshaping global remittance for businesses, let’s take a moment to appreciate the sheer absurdity of our current system. After all, if we don’t laugh, we might cry at the thought of all those wasted fees and lost hours.

How Blockchain Zaps Away Payment Headaches

Welcome to the future of cross-border payments, where blockchain struts in like the cool kid making everyone else look like they’re still using carrier pigeons. Let’s cut through the noise and show you how this tech turns the financial world on its head.

Middlemen Get the Boot, Your Wallet Rejoices

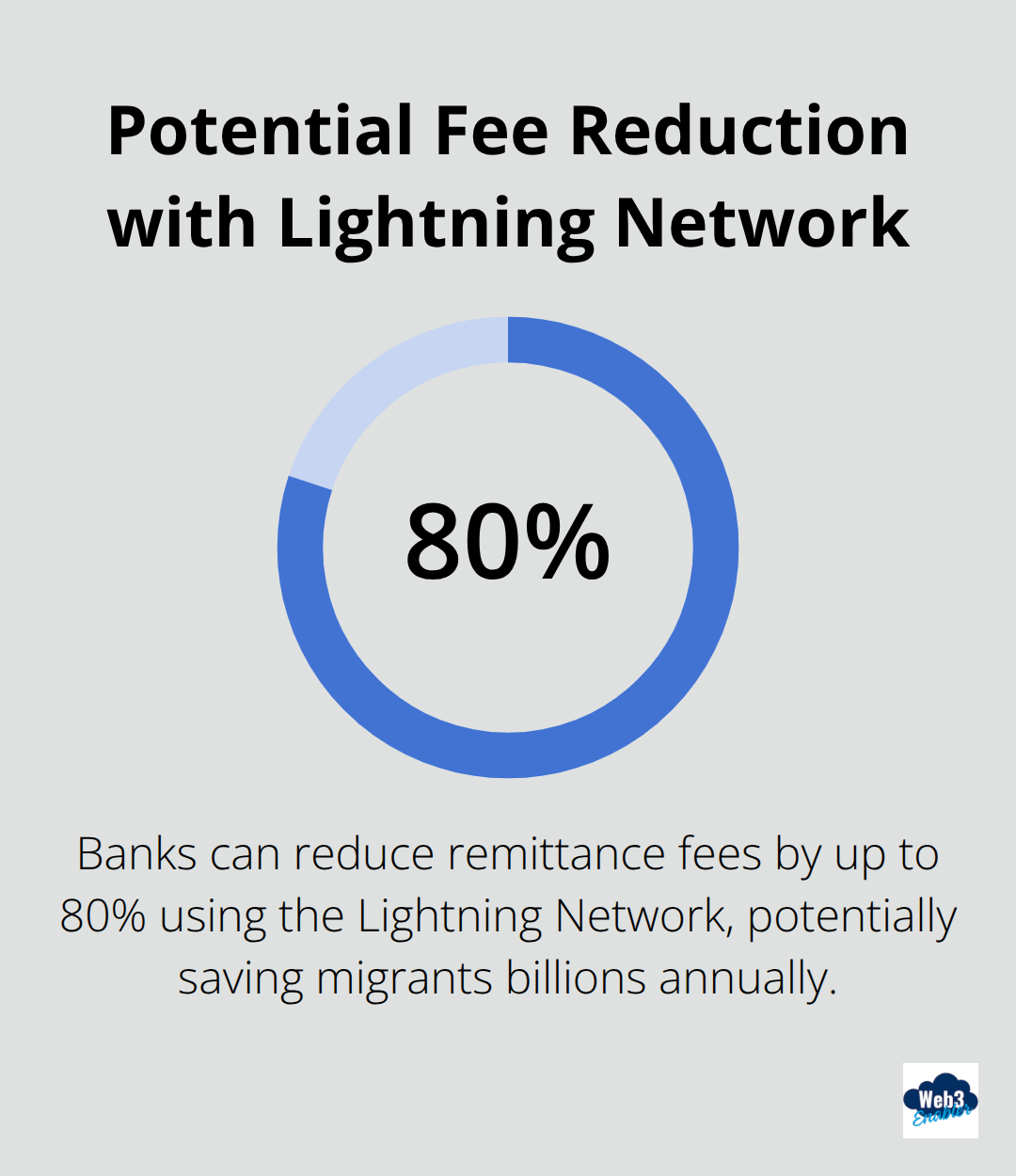

Blockchain kicks those pesky intermediaries to the curb. It connects payers and payees directly, like a financial teleporter. Banks can cut remittance fees by up to 80% with the Lightning Network, potentially saving migrants billions annually. (That’s a lot of extra lattes, folks!)

Speed That Makes Light Look Slow

Traditional payments crawl across borders? Not anymore. Blockchain transactions zip faster than gossip in a small town. We’re talking seconds, not days. Ripple, a blockchain company, demonstrates cross-border payments settling in 3-5 seconds. (Quicker than you can say “Where’s my money?”)

Crystal Clear Transparency

Tracking your payment becomes easier than stalking your ex on social media. Every transaction gets recorded on a public ledger, providing real-time updates. No more mysterious “processing” statuses or phone tag with customer service. You’ll pinpoint your money’s location, down to the last decimal point.

Smart Contracts: Your Compliance Superhero

Compliance nightmares? Meet smart contracts, the automated rule-following superheroes. These self-executing contracts handle KYC and AML checks faster than you can say “regulatory headache.” They work like a team of lawyers and accountants on a 24/7 shift, minus the billable hours.

Blockchain isn’t just buzzwords and tech jargon – it solves real problems with real solutions. It makes cross-border payments cheaper, faster, and more transparent than ever before. The best part? You don’t need a PhD in computer science to reap the benefits.

Now that we’ve seen how blockchain zaps away payment headaches, you might wonder: “How do I actually implement this magic in my business?” Don’t worry, we’ve got you covered. Let’s roll up our sleeves and get into the nitty-gritty of putting blockchain to work for your cross-border payments.

How to Implement Blockchain Payments: A No-Nonsense Guide

Ready to jump into the blockchain deep end? Let’s turn this tech talk into real-world action. Implementing blockchain for cross-border payments isn’t rocket science, but it does require some savvy moves. Here’s how to make it happen without losing your sanity (or your shirt).

Choose Your Blockchain Platform Wisely

First up: pick your blockchain platform. It’s like choosing a dance partner – you want one that won’t step on your toes. Ethereum’s popular, but it’s not the only fish in the sea. Ripple’s XRP Ledger settles transactions in 3-5 seconds, tailor-made for cross-border payments. Stellar’s another contender, designed for developing markets with low fees.

Here’s the kicker: don’t just go for the buzziest name. Look at transaction speeds, costs, and scalability. Make sure it plays nice with regulatory requirements in your target countries. The last thing you need is a blockchain that’s as welcome as a skunk at a garden party in your key markets.

Bridge the Old and New Financial Worlds

Now, let’s talk integration. You can’t just slap blockchain on your existing systems like a Band-Aid. Create a seamless bridge between your current financial setup and the blockchain world.

Start with API integration. Most blockchain platforms offer robust APIs that connect with your existing payment systems. It’s like teaching your old dog some very impressive new tricks. Companies like Ripple provide pre-built solutions that plug right into your current infrastructure, making the transition smoother than a freshly waxed floor.

Don’t forget about on and off-ramps – those crucial points where fiat currency enters and exits the blockchain ecosystem. You’ll need reliable exchanges or payment processors to handle these transitions. Circle’s USDC infrastructure offers a stable bridge between traditional finance and blockchain, ensuring your dollars don’t turn into Monopoly money overnight.

Keep Regulators Happy (and Off Your Back)

Let’s face it, regulatory compliance is about as fun as watching paint dry, but it’s non-negotiable. The good news? Blockchain can streamline compliance. Supporters argue that building Know Your Customer (KYC) and Anti-Money Laundering (AML) checks into blockchain infrastructure could make the process more efficient.

But here’s the rub: blockchain regulations evolve faster than fashion trends. Stay on top of the latest guidelines from bodies like FinCEN and OFAC. Consider partnering with compliance-focused blockchain services. Companies like Chainalysis offer tools to monitor transactions and flag suspicious activity, keeping you on the right side of the law without needing a full-time legal team.

Different countries have different rules. What flies in Singapore might flop in Switzerland. Do your homework on local regulations, or partner with a blockchain provider that’s got the global compliance game on lock.

Get Your Team on Board the Blockchain Train

Last but not least, don’t forget about the humans in this equation. Your staff needs to be as comfortable with blockchain as they are with their morning coffee. Invest in training programs that demystify the tech. (You might even find some workshops that can turn your team from blockchain newbies to savvy operators faster than you can mine a Bitcoin.)

Don’t stop at your staff. Educate your customers too. Clear communication about the benefits and mechanics of blockchain payments can turn skeptics into champions. Create user-friendly guides, FAQs, and maybe even some snazzy infographics. Try to make blockchain feel less like sci-fi and more like an everyday tool.

Implementing blockchain for cross-border payments isn’t just about adopting new tech – it’s about revolutionizing how you do business. It’s a journey, sure, but one that leads to faster, cheaper, and more transparent global transactions. (And in today’s borderless business world, that’s not just an advantage – it’s a necessity.)

Wrapping Up

Blockchain revolutionizes global transactions, transforming the landscape of international finance. This technology slashes fees, accelerates transfers, and brings unparalleled transparency to cross-border payments. The future of blockchain in finance shines brighter than ever, promising even faster, cheaper, and more secure transactions worldwide.

Businesses that embrace blockchain now will lead the charge into a new era of global finance. Those who hesitate risk falling behind in an increasingly interconnected financial world. The blockchain revolution waits for no one, and early adopters will reap the most significant benefits.

Ready to catapult your business into the future of cross-border payments? Web3 Enabler specializes in bridging the gap between blockchain and existing systems. We offer Salesforce-native solutions that streamline blockchain implementation. Don’t let your business get left in the financial Stone Age – the future of global transactions is here!

![Streamlining Cross-Border Payments with Blockchain [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/global-transactions-hero-1756462125.jpeg)