![The Ultimate Guide to Accepting Stablecoins in Salesforce [2025]](https://web3enabler.com/wp-content/uploads/emplibot/stablecoin-integration-hero-1756987753.jpeg)

Ready to supercharge your Salesforce game? Stablecoins are about to crash the party, and trust us, you don’t want to miss out on this financial fiesta.

At Web3 Enabler, we’ve seen firsthand how stablecoin integration is revolutionizing business transactions. From slashing those pesky international fees to giving your customers more ways to pay, it’s like upgrading from a flip phone to the latest smartphone.

Buckle up as we guide you through the wild world of accepting stablecoins in Salesforce. It’s easier than you think, and way more fun than balancing your checkbook!

Why Stablecoins in Salesforce? Show Me the Money!

Global Transactions on Steroids

Picture this: You want to send money overseas. Normally, you’d wait for days, watching hefty fees eat your profits. But with stablecoins? Bam! Money zips across borders faster than you can say “blockchain.” We’re talking minutes, not days. And those fees? They shrink faster than your ex’s number in your phone.

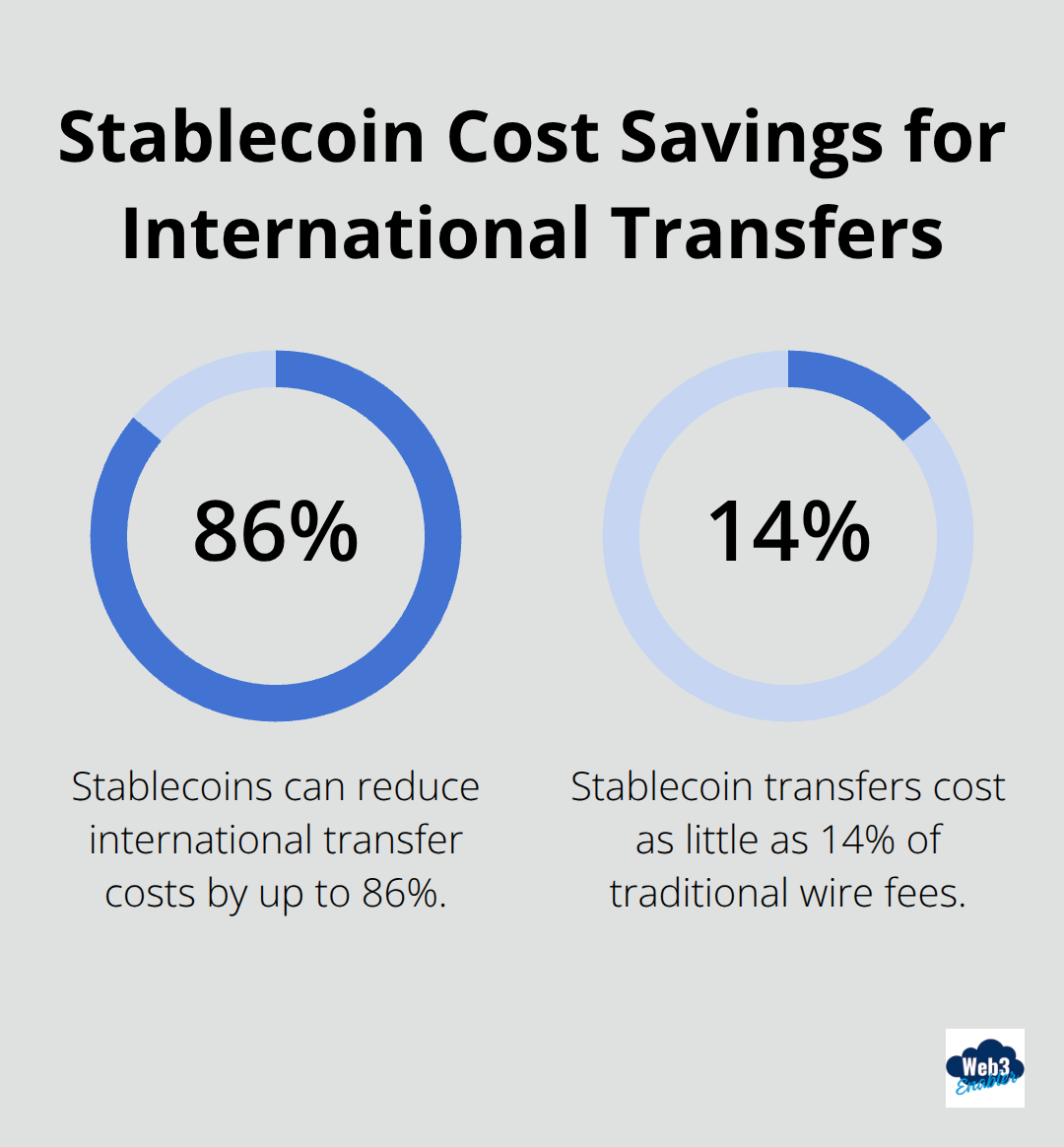

A recent McKinsey study reveals banks charge $15 to $50 for international wires. Stablecoins can make remittances up to 7x cheaper than traditional transfers. That’s not just pocket change – it’s a game-changer for your bottom line.

Bye-Bye, Forex Rollercoaster

Did the exchange rate ever take your profits on a wild ride? With stablecoins, you can kiss those currency headaches goodbye. These digital dynamos peg to stable assets like the US dollar, so your money won’t do the cha-cha while you sleep.

Crystal Clear Finances

Transparency isn’t just for windows anymore. Stablecoins on the blockchain record every transaction on a public ledger. It’s like having a financial glass house (minus the awkward neighbors). This level of clarity isn’t just neat; it’s a compliance officer’s dream come true.

Customer Choice is the New Black

Here’s a shocker: customers love options. Accepting stablecoins doesn’t just make you hip – it opens doors for tech-savvy clients who want to pay their way. It’s like offering both espresso and drip coffee. Some folks want their caffeine with a side of blockchain (and who are you to judge?).

Businesses boost customer satisfaction simply by adding stablecoin options. It’s not rocket science – it’s just good business.

Now that you’re pumped about the perks, let’s talk turkey. How do you actually set this up in Salesforce? Don’t worry, we’ve got you covered. In the next section, we’ll break down the steps to turn your Salesforce into a stablecoin-accepting powerhouse. Get ready to flex those tech muscles!

How to Turn Salesforce into a Stablecoin Powerhouse

Ready to give your Salesforce a blockchain makeover? Let’s jump into the nitty-gritty of setting up stablecoin payments. Don’t worry, it’s not as complicated as decoding your teenager’s text messages.

Pick Your Stablecoin Sidekick

First things first, you need a trusty stablecoin integration solution. Think of it as choosing a dance partner for your Salesforce – you want someone who won’t step on your toes. Web3 Enabler struts its stuff as the Fred Astaire of this blockchain ballroom, but other options exist. Just make sure your pick plays nice with Salesforce and has a track record smoother than a fresh jar of Skippy.

Salesforce Makeover Time

Now, let’s give your Salesforce environment a blockchain-friendly facelift. This isn’t about slapping on some digital lipstick; it’s about reconfiguring your system to speak fluent crypto. You’ll need to update your Salesforce org settings, tweak your payment fields, and maybe even sweet-talk your IT department into helping out. Pro tip: Bribe them with donuts. (Works every time.)

Wallet Wizardry and Payment Portals

Next up, set up your digital wallet addresses. Think of these as your company’s new bank accounts, but cooler and with fewer overdraft fees. You’ll also need to connect payment gateways that can handle stablecoins. It’s like installing a universal translator for your money – suddenly, your Salesforce can chat with blockchain networks without breaking a sweat. Use popular tools like Coinbase, Metamask, or the new Salesforce Native Wallet in Blockchain Payments v3.3!

Team Training Bootcamp

Last but not least, it’s time to turn your team into stablecoin superstars. This isn’t about boring PowerPoint presentations that make your eyes glaze over faster than a Thanksgiving turkey. We’re talking interactive sessions, hands-on practice, and maybe even a “Blockchain Bingo” game (patent pending). The goal? Make sure everyone from Susan in accounting to Bob in sales knows their USDC from their elbow.

Setting up stablecoin payments in Salesforce isn’t rocket science, but it does require some elbow grease and a dash of digital savvy. With the right tools and a sprinkle of patience, you’ll accept stablecoins faster than you can say “blockchain revolution.”

Now that you’ve got the setup down pat, let’s tackle the next big question: How do you manage these newfangled transactions without losing your mind (or your money)? Buckle up, because we’re about to spill the tea on best practices that’ll make you the envy of the blockchain block party.

Mastering Stablecoin Transactions in Salesforce

Fort Knox Your Digital Wallet

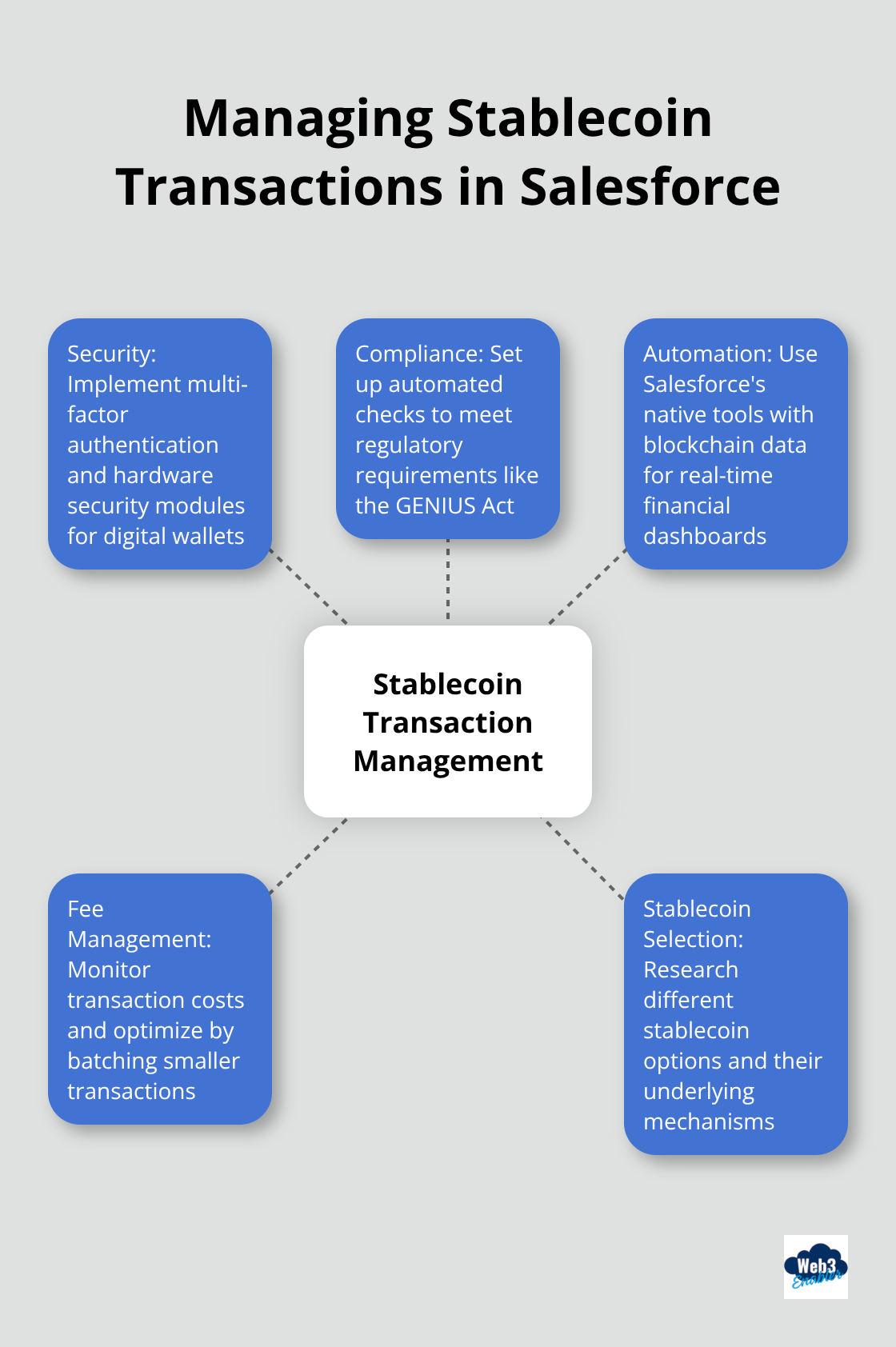

Security isn’t optional when it comes to your digital assets. Use multi-factor authentication for all accounts and implement hardware security modules (HSMs) to store private keys. (And please, don’t write your seed phrases on sticky notes!)

Regular security audits should become your new obsession. Think of them as financial fire drills – a bit annoying, but way better than getting burned. These audits will help you spot vulnerabilities before the bad guys do.

Navigate the Regulatory Rapids

Compliance isn’t just a buzzword; it’s your ticket to staying out of hot water. The GENIUS Act (signed into law in July 2025) mandates full reserves for dollar-backed stablecoins and monthly disclosures. This means you need to keep meticulous records.

Set up automated compliance checks within your Salesforce org. This isn’t about ticking boxes; it’s about building trust with your customers and staying on the right side of the law. In the world of stablecoins, transparency isn’t just nice – it’s necessary.

Automate or Stagnate

Manual reconciliation belongs in the past. With blockchain’s efficiency, you can cut reconciliation time from days to minutes. Use Salesforce’s native reporting tools combined with blockchain data to create real-time financial dashboards. This isn’t just cool tech; it’s a game-changer for your finance team.

Automate everything you can – from transaction logging to tax calculations. The less human intervention, the fewer errors. Plus, your team can focus on strategy instead of data entry. (It’s a win-win situation!)

Fee-nomics 101

Transaction fees with stablecoins are way lower than traditional methods, but they’re not zero. Monitor these costs like a hawk. Set up alerts for unusual fee spikes and review your transaction patterns regularly.

Consider batching smaller transactions to optimize costs. Keep an eye on network congestion – sometimes, waiting an hour can save you a bundle in fees. It’s like timing your commute to avoid rush hour, but for your money.

Choose Your Stablecoins Wisely

Not all stablecoins are created equal. Research different options and their underlying mechanisms. Some are backed by fiat currency, others by commodities or algorithms. Each has its pros and cons.

Web3 Enabler urges you to be flexible in the stablecoins you accept, but diligent in the ones you old. You can always instantly off-ramp the stablecoins, reducing your risk and exposure. Our native solution supports several stablecoins on a variety of networks.

Stablecoin transactions can reduce friction, cut costs, and tap into global markets with greater agility for businesses adopting these payment solutions.

Final Thoughts

Stablecoins revolutionize financial transactions, offering businesses lightning-fast global payments and smoother currency management. These digital dynamos provide crystal-clear financial tracking and expanded payment options for customers. Salesforce users can easily set up stablecoin payments with the right integration solution and team training.

Stablecoin integration in enterprise systems promises a bright future, potentially becoming as common as email in the corporate world. As more businesses recognize the benefits, we anticipate a seismic shift in how companies handle payments and manage finances. The stablecoin train is leaving the station, and forward-thinking businesses won’t want to be left behind.

Web3 Enabler specializes in connecting blockchain tech with existing corporate infrastructure. Our Salesforce-native solutions support payments, compliance, and automation (no crypto speculation required). Don’t wait to future-proof your business and give your customers the payment options they crave – explore stablecoin integration today!