Hey there, financial advisors! Feeling lost in the crypto compliance jungle? We get it.

At Web3 Enabler, we’ve seen firsthand how tricky it can be to navigate the wild world of digital assets while staying on the right side of the law.

But don’t sweat it – we’re here to help you tame that crypto compliance beast. From KYC tools to transaction tracking, we’ll show you how to keep your clients happy and the regulators off your back.

Why Is Crypto Compliance So Tricky?

Let’s face it, crypto compliance is about as straightforward as a drunk octopus trying to put on a sweater. But don’t worry, we’ll untangle those tentacles for you.

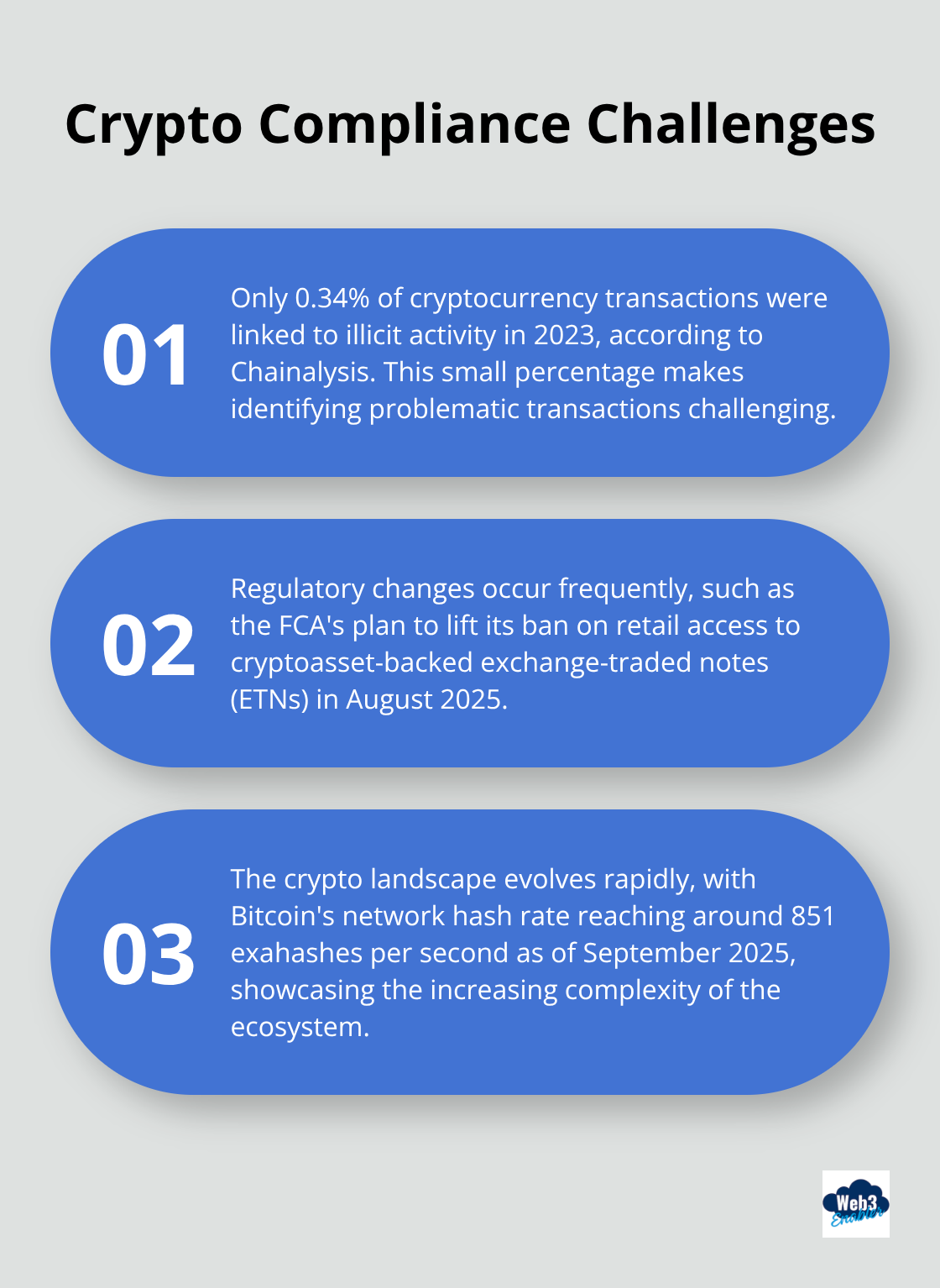

The Regulatory Rollercoaster

First up, we’ve got the regulatory rollercoaster. One minute you think you’ve got it all figured out, and the next – BAM! – a new regulation drops and you’re back to square one. The FCA has confirmed it will lift its ban on retail access to cryptoasset-backed exchange-traded notes (ETNs) in August 2025, marking a significant policy shift. It’s like playing Whack-A-Mole with regulations popping up all over the place.

Transaction Tracking Troubles

Next, let’s talk about tracking those pesky crypto transactions. It’s like trying to count grains of sand on a beach during a sandstorm. According to Chainalysis, as of 2023, only 0.34% of all cryptocurrency transactions linked to illicit activity. That’s great news, but it means you’ve still got to keep your eyes peeled for that needle in the haystack.

The Ever-Changing Crypto Landscape

Finally, we’ve got the ever-changing crypto landscape. It evolves faster than fashion trends in the 90s. Did you know that as of September 2025, Bitcoin’s network hashes at a rate of around 851 exahashes per second? That’s a lot of computing power (and it’s changing the game every day).

The Compliance Conundrum

So, what’s a financial advisor to do? Well, according to a recent Deloitte study, taking a proactive approach to cryptocurrency could give you a competitive edge. But that means staying on top of these challenges like a boss.

Financial advisors struggle with these issues daily. That’s why tools exist to help navigate this crypto compliance maze. But how exactly can you simplify this whole process and make your life a whole lot easier? Let’s explore some game-changing solutions in the next section that’ll have you saying, “Crypto compliance? Piece of cake!”

How Web3 Enabler Cracks the Crypto Compliance Code

At Web3 Enabler, we don’t just talk about simplifying crypto compliance for financial advisors – we make it happen. Our secret? A potent mix of cutting-edge tech and good old-fashioned common sense.

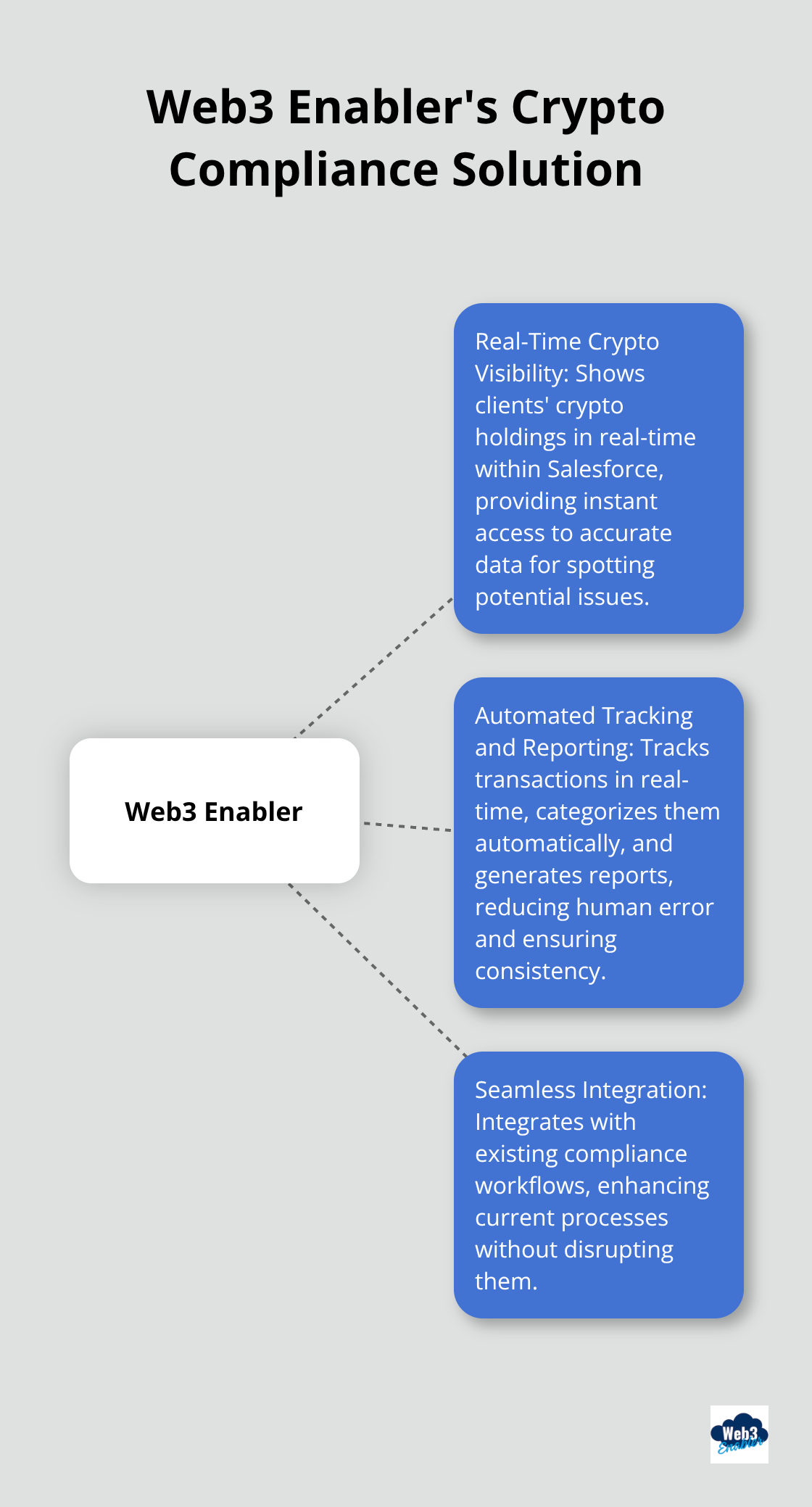

Real-Time Crypto Visibility

We’ve cooked up a way to show your clients’ crypto holdings in real-time, right within Salesforce. No more platform-juggling or playing crypto detective. It’s all there, in one place, updated faster than you can say “blockchain” (which is pretty darn fast, if you ask us).

This isn’t just convenient – it’s a total game-changer for compliance. With instant access to accurate data, you can spot potential issues before they morph into full-blown problems. It’s like having a crypto crystal ball, minus the mystical mumbo-jumbo (and the creepy fortune teller).

Automated Tracking and Reporting

Let’s chat about automated transaction tracking and reporting. We’ve taken the headache out of this process with a system that does the heavy lifting for you. Our tools track transactions in real-time, categorize them automatically, and generate reports that would make even the most stringent regulator crack a smile (and trust us, that’s no small feat).

This automation isn’t just about saving time (though it does that too). It’s about reducing human error and ensuring consistency in your compliance efforts. No more late nights poring over spreadsheets or worrying about missed transactions. (Your social life will thank us later.)

Seamless Integration with Existing Workflows

But here’s where we really shine – our tools integrate seamlessly with your existing compliance workflows. We’re not here to reinvent the wheel or force you to overhaul your entire system. Instead, we’ve designed our solutions to slot right into your current processes, enhancing rather than disrupting.

This means you can maintain your existing compliance procedures while leveraging the power of blockchain technology. It’s the best of both worlds – cutting-edge tech with the comfort of familiar workflows. Like putting a jet engine on your trusty old bicycle (okay, maybe not exactly like that, but you get the idea).

The Web3 Enabler Edge

So, what does all this mean for you? It means less time wrestling with compliance issues and more time focusing on what really matters – serving your clients and growing your business. With Web3 Enabler, you’re not just keeping up with crypto compliance – you’re staying ahead of the curve.

Now that we’ve cracked the code on simplifying crypto compliance, let’s explore some best practices to keep you on top of your game. After all, in this fast-paced world of digital assets, you don’t just want to survive – you want to thrive!

Mastering Crypto Compliance: Your Winning Playbook

Regulatory Radar: Stay Alert

To become a regulatory ninja, you must set up alerts from key regulatory bodies like the FCA, SEC, and CFTC. Don’t stop there – follow crypto-focused law firms and compliance experts on social media. They often break down complex regulations into actionable insights (that won’t make your head spin).

Pro tip: Allocate 30 minutes daily to scan these updates. It might seem excessive, but it’s a small investment for peace of mind (and avoiding those pesky fines).

KYC and AML: Beyond the Acronyms

Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures form your first line of defense. Implement a tiered KYC approach based on transaction volumes. For transactions under $1,000, basic ID verification might suffice. But for anything over $10,000, you’ll want to dig deeper.

AML proves trickier with crypto, but it’s not impossible. Use transaction monitoring tools to flag suspicious patterns. We have a partnership with BitRank Verified, importing their data directly into your Salesforce Org for maximum compliance.

Client Education: Your Secret Weapon

Here’s where you can really shine. Don’t just tell your clients about crypto risks – show them. Create a simple risk scorecard for different cryptocurrencies. Bitcoin might score a 7/10 for volatility, while a new altcoin could hit a solid 9/10.

Organize monthly “Crypto Coffee” sessions where clients can ask questions in a relaxed setting. You’d be surprised how much compliance headache this can prevent down the line.

Tech Tools: Your Compliance Sidekick

Leverage technology to streamline your compliance efforts. Tools like Web3 Enabler offer real-time visibility of client crypto holdings within Salesforce, automated transaction tracking, and seamless integration with existing workflows. These features can significantly reduce the time and effort spent on compliance tasks.

Continuous Learning: Stay Ahead of the Curve

The crypto world evolves at breakneck speed. Try to attend webinars, conferences, and workshops focused on crypto compliance. Join online communities and forums where professionals discuss the latest trends and challenges. This continuous learning approach will help you anticipate changes and adapt your strategies proactively.

Wrapping Up

Crypto compliance doesn’t have to be a headache for financial advisors. We’ve explored the challenges in this wild crypto landscape and uncovered powerful solutions to tame this beast. Staying informed about regulatory updates is key, as is implementing robust KYC tools and AML procedures to keep your practice safe. Educating your clients about crypto risks and responsibilities builds trust and provides value.

Embracing crypto compliance tools isn’t just smart – it’s essential in today’s rapidly evolving financial world. These tools can streamline your processes, reduce errors, and free up your time to focus on serving your clients. That’s where Web3 Enabler comes in as your partner in navigating the crypto compliance maze.

Our Salesforce-native solutions offer real-time visibility of client crypto holdings, automated transaction tracking, and seamless integration with your existing workflows. We help you stay ahead of the curve (not just keep up with it). Financial advisors, it’s time to simplify your crypto compliance and transform it from a burden into a competitive advantage with Web3 Enabler.