Ready to shake up global finance? Blockchain and Salesforce are teaming up, and it’s about to get wild.

At Web3 Enabler, we’re seeing financial institutions ditch their dusty old systems for this dynamic duo. Stablecoins are crashing the cross-border payment party, while crypto visibility is giving financial advisors superpowers.

Buckle up, because we’re about to show you how this tech mashup is turning the financial world on its head.

Blockchain and Salesforce: The Power Couple of Finance

A Match Made in Financial Heaven

Salesforce and blockchain are like peanut butter and jelly – separately, they’re great, but together? They’re unstoppable. This dynamic duo is revolutionizing the financial sector, and it’s time to spill the tea on how they’re shaking things up.

Supercharging Salesforce with Blockchain

Picture Salesforce on steroids. That’s what happens when you inject blockchain into the mix. Suddenly, you’ve got a CRM system that’s not just smart, but downright genius. It’s as if Salesforce acquired a crystal ball – it now predicts customer behavior with uncanny accuracy, thanks to the immutable and transparent nature of blockchain data.

But it doesn’t stop at predictions. Blockchain turbocharges Salesforce’s data management capabilities. Say goodbye to data silos and inconsistencies across departments. With blockchain, everyone’s singing from the same hymn sheet (and that hymn is called “Efficiency”).

Making Banks Cool Again (Yes, Really)

Financial institutions using this blockchain-Salesforce combo have suddenly become the cool kids on the block. They’re offering services that make traditional banking look like it’s stuck in the Stone Age.

For starters, cross-border payments become a breeze. No more waiting days for transactions to clear. With blockchain, it’s almost instant. And for clients? It’s like Christmas came early. They get faster services, lower fees, and the kind of transparency that makes them feel like they’re part of an exclusive club (spoiler alert: they are).

Stablecoins Shake Up Cross-Border Payments

Stablecoins 101: Digital Dollars on Steroids

Stablecoins are cryptocurrencies pegged to real-world assets, usually the US dollar. They act like digital dollars that zoom around the globe at the speed of light. Unlike their volatile crypto cousins (Bitcoin, we’re looking at you), stablecoins maintain a steady value, making them ideal for business transactions.

Circle is currently the second-largest stablecoin issuer, accounting for $65 billion of the approximate $260 billion total U.S. dollar-pegged stablecoin supply. That’s not just pocket change – it’s a clear signal that businesses recognize the potential of these digital dynamos.

Salesforce Gets a Stablecoin Makeover

Innovative platforms now supercharge Salesforce with stablecoin superpowers. These solutions allow businesses to accept and send stablecoin payments directly through their Salesforce dashboard. No more juggling multiple systems or scratching your head over exchange rates.

Here’s the lowdown: A client wants to pay you in USDC (a popular stablecoin). You generate a payment request in Salesforce, they pay, and voila – the payment appears in your wallet or bank account account faster than you can say “blockchain”. It’s so smooth, you might forget you’re using cutting-edge tech.

Traditional Transfers Take a Back Seat

Traditional international payments are about as efficient as sending a letter by carrier pigeon. Stablecoin payments through Salesforce, however, teleport money across borders.

Let’s break it down:

The Stablecoin Revolution

Financial institutions that embrace stablecoin-powered Salesforce solutions report significant improvements. Some have seen a reduction in cross-border payment processing times and a decrease in associated costs. That’s not just an improvement – it’s a revolution.

Stablecoins don’t just change the game; they create a whole new playing field. And with Salesforce as their teammate, they become unstoppable. But what about keeping track of all these digital assets? Strap in – we’re about to explore how blockchain gives financial advisors X-ray vision into their clients’ crypto holdings.

Crypto X-Ray Vision for Financial Advisors

The Crypto Tracking Imperative

Financial advisors, pay attention! Crypto isn’t a mystical realm anymore. It’s right here, in your clients’ portfolios, whether you like it or not. If you don’t track it, you’re flying blind.

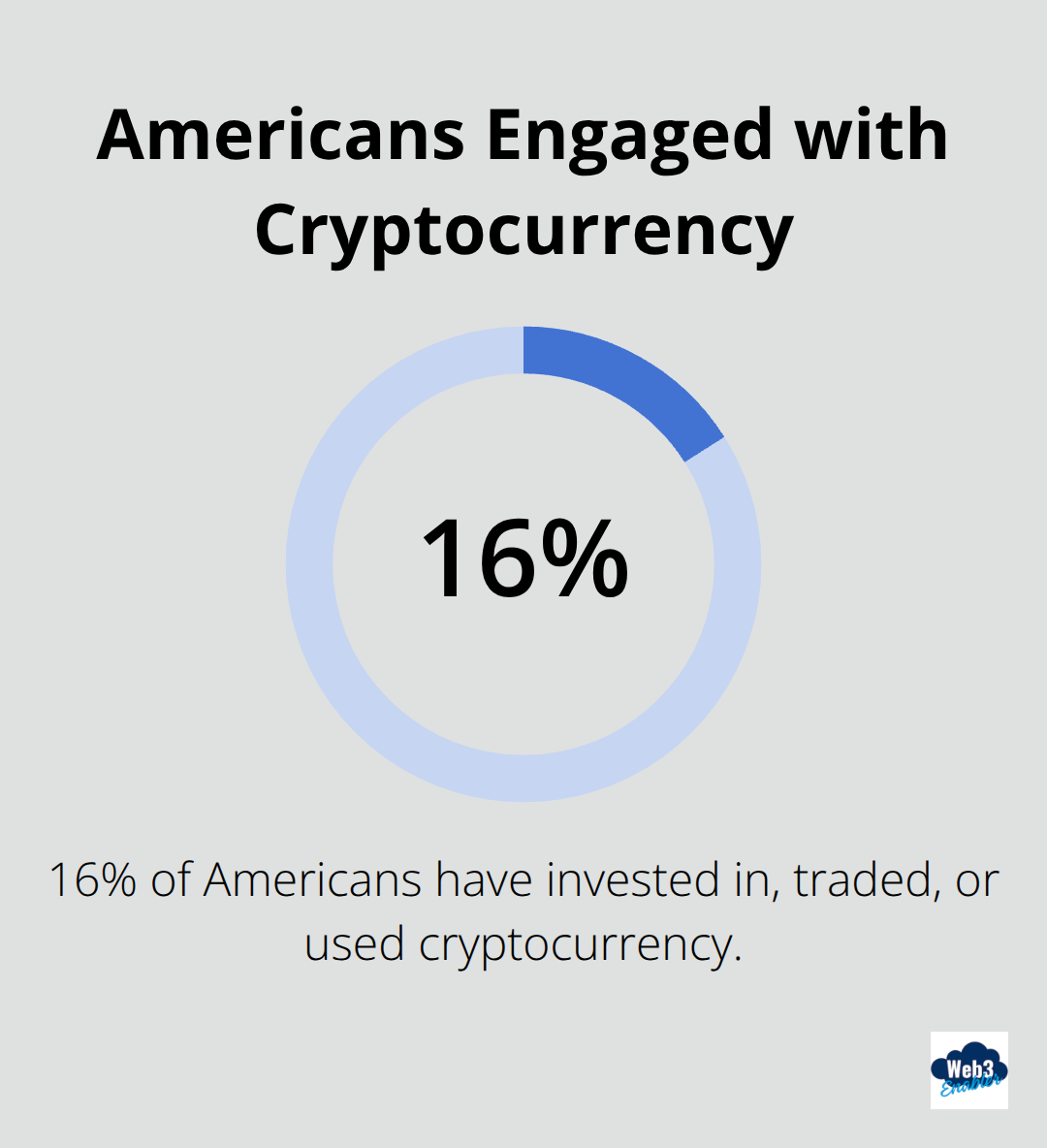

Crypto isn’t going anywhere. A recent Pew Research Center survey found that 16% of Americans have invested in, traded, or used cryptocurrency. That’s millions of potential clients with crypto assets you need to know about.

Ignoring crypto is like pretending smartphones don’t exist. It’s not just unwise; it’s downright dangerous for your business. Without a clear view of your clients’ crypto holdings, you work with an incomplete financial picture. In the world of finance, incomplete information leads to bad advice.

Blockchain: Your New Financial Sidekick

Blockchain integration comes in like a knight in shining armor. It provides seamless Salesforce integration, right within your dashboard. No more reliance on clients to remember (or choose to disclose) their crypto investments.

With blockchain integration, you get a live feed of your clients’ crypto transactions and holdings. It’s like having X-ray vision into their financial lives. Every purchase, sale, or transfer appears on the blockchain and reflects in your Salesforce system.

Tools That Transform You Into a Crypto Wizard

Some companies develop tools that turn Salesforce into a crypto-tracking powerhouse. These solutions don’t just show you what crypto your clients hold; they give you the context you need to provide informed advice.

For instance, price tracking features show you the current value of your clients’ holdings and their historical performance. You can see at a glance if a client’s Bitcoin investment from last year has doubled or tanked.

Risk assessment tools analyze your clients’ crypto portfolios and flag potential issues. Is a client overexposed to a particular cryptocurrency? The system will let you know before it becomes a problem.

For those clients dabbling in DeFi (Decentralized Finance), you’re covered too. DeFi trackers show you which protocols your clients use and what returns they’re getting. It’s like having a financial advisor specifically for the wild west of crypto.

Real-Time Knowledge: Your Crypto Superpower

The crypto world moves fast, but with these tools, you’ll always stay one step ahead. Your clients will think you’re a crypto wizard, and you’ll have the confidence to guide them through this new financial frontier.

In the world of finance, knowledge is power. In the crypto world, real-time knowledge is a superpower. Don’t let your clients’ crypto assets remain in the shadows. Shine a light on them with blockchain-powered Salesforce integration. Your clients (and your bottom line) will thank you.

Final Thoughts

Blockchain and Salesforce reshape global finance today. This powerful combination transforms financial institutions, accelerates processes, reduces costs, and increases transparency. Financial advisors now provide comprehensive advice with real-time crypto insights, gaining a competitive edge in this evolving industry.

The future of finance will see more innovative applications of blockchain technology. AI-driven predictive analytics, automated regulatory compliance, and seamless integration with emerging technologies will become commonplace. This revolution isn’t just a trend; it’s the new reality of global finance.

At Web3 Enabler, we stand at the forefront of this transformation. Our Salesforce-native blockchain solutions help businesses navigate the new financial frontier (whether for stablecoin payments, efficient global transfers, or crypto holdings visibility). Don’t get left behind – embrace the change and ride the wave of innovation in global finance.

![Navigating Compliance in the Blockchain Era [2025]](https://web3enabler.com/wp-content/uploads/emplibot/blockchain-compliance-hero-1761160171.jpeg)