Finance teams managing global operations face a painful reality: revenue recognition has become a manual, error-prone bottleneck. Every transaction across borders, every settlement delay, every reconciliation cycle creates friction between your finance and operations teams.

We at Web3 Enabler built Revenue Cloud on-chain capabilities to eliminate this friction entirely. Blockchain payments settle instantly, creating immutable records that flow directly into your Salesforce environment without manual intervention.

Why Manual Revenue Recognition Breaks at Scale

The Daily Chaos of Global Transactions

Global companies process thousands of transactions daily across multiple currencies, payment methods, and jurisdictions. Each one triggers a revenue recognition event that finance teams must manually track, reconcile, and report. Salesforce FY2025 data shows the company manages over $63.4 billion in Remaining Performance Obligations across 150,000+ customers, many of them enterprises handling complex multi-period contracts. When revenue recognition happens manually, delays compound immediately. A payment settles on Monday, but reconciliation doesn’t happen until Friday. Three more payments arrive in the meantime, creating a backlog that makes real-time reporting impossible.

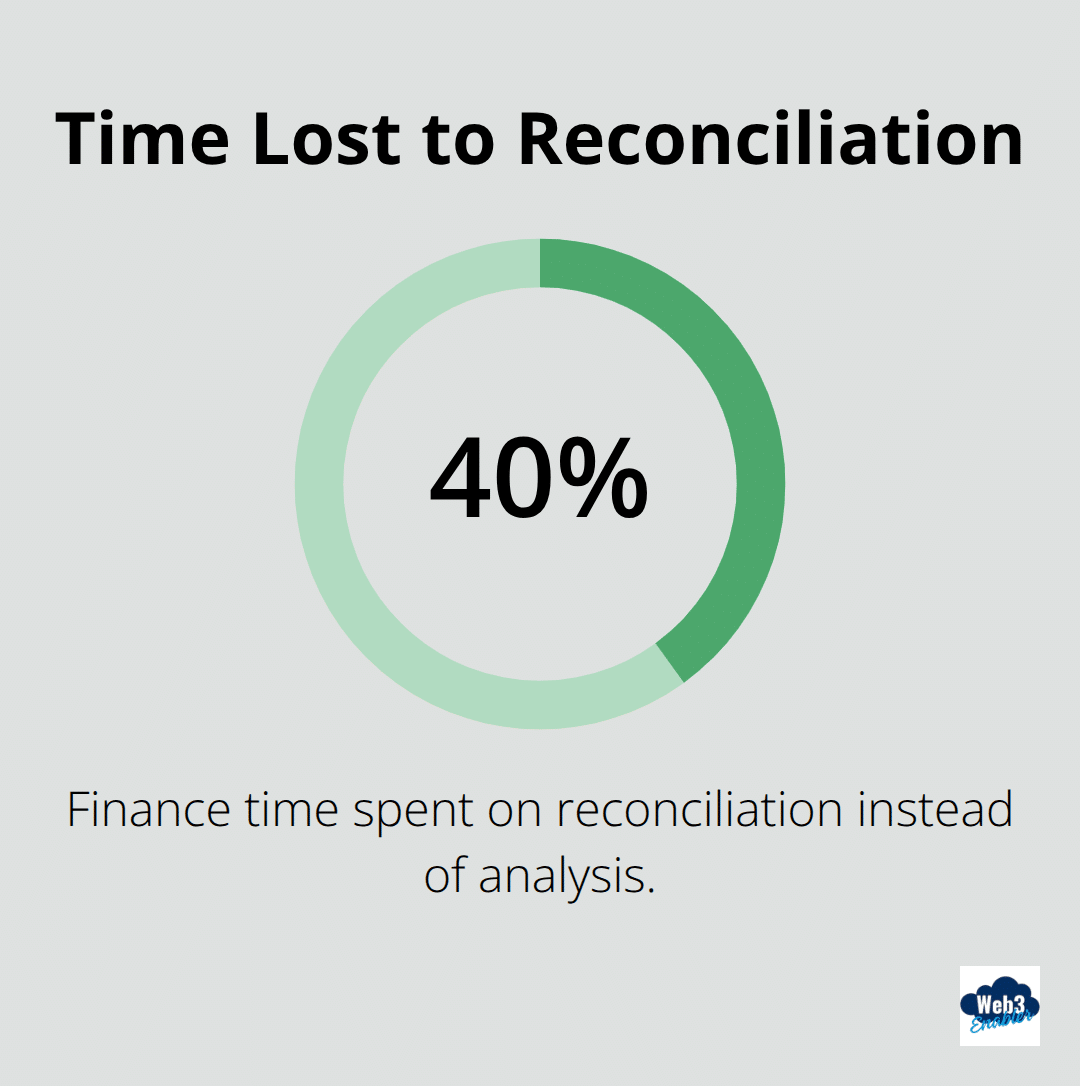

Where Time Gets Lost

Finance teams spend 40 percent of their time on reconciliation instead of analysis, according to industry surveys on finance automation. This drain accelerates when you add global expansion.

Cross-border payments introduce settlement delays, currency fluctuations, and regulatory timing differences. A stablecoin payment might settle in seconds, but traditional wire transfers take days or weeks. This gap between settlement and recognition creates blind spots in your cash flow visibility-you don’t know if revenue arrived yesterday or will arrive next month until someone manually checks the bank statement.

The Hidden Cost of Human Error

Manual processes introduce human error at every step. A finance analyst might misallocate a transaction to the wrong customer, apply the wrong exchange rate, or miss a payment entirely. These mistakes compound in audit trails and create compliance risk. When regulators ask for proof of when revenue was actually recognized, your spreadsheets and email confirmations become a liability. Each error requires investigation, correction, and re-reporting, multiplying the time your team spends on administrative work instead of strategic finance.

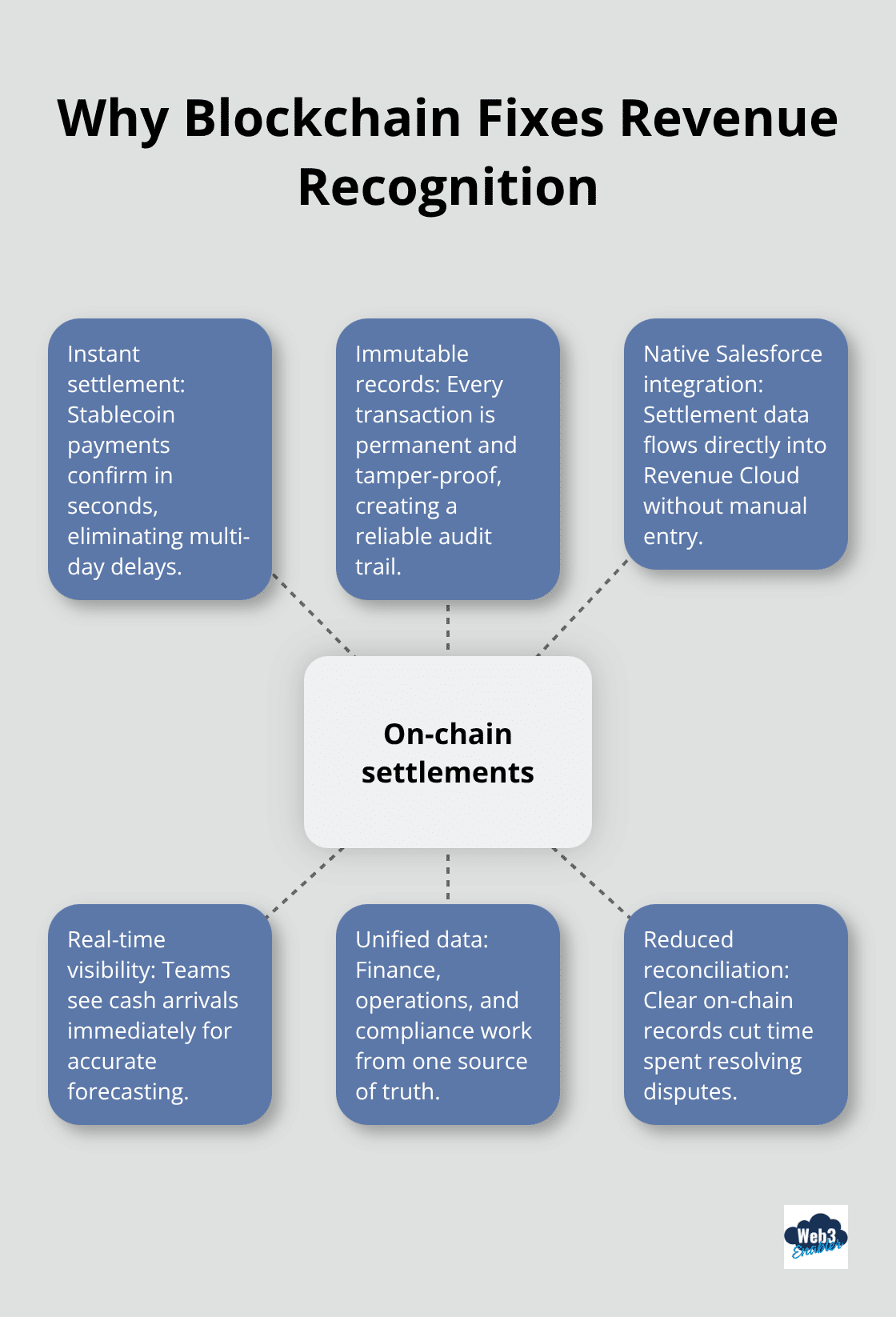

Why Blockchain Changes Everything

Blockchain payments eliminate this friction because they settle instantly and create immutable records automatically. The transaction happens on-chain, the record becomes permanent, and the data flows directly into your Salesforce environment without anyone typing it in. This means your finance team gains real-time visibility into settlements across all geographies and payment methods in a single system. Web3 Enabler brings this capability directly into Revenue Cloud, automating the entire recognition workflow so your team can focus on what matters: analyzing cash flow trends and optimizing global operations instead of chasing down missing transactions.

How Blockchain Settlements Transform Finance Operations

Instant settlement is not a luxury feature-it’s a competitive necessity for finance teams managing global operations. When a stablecoin payment arrives on-chain, settlement happens in seconds, not days. This speed fundamentally changes how your revenue recognition workflows operate. Traditional wire transfers take one to five business days to settle, creating a gap between when a customer intends to pay and when your finance team can recognize revenue. Stablecoin payments eliminate that gap entirely. The transaction confirms on-chain immediately, and your native Salesforce integration automatically captures that settlement data into Revenue Cloud without manual intervention. Your revenue recognition happens in real time, not after a Friday reconciliation session. This matters because Salesforce’s FY2025 data shows companies managing $63.4 billion in Remaining Performance Obligations need visibility into cash flow timing to forecast accurately. When settlements arrive instantly and flow directly into your system, your finance team stops guessing about cash arrival dates and starts making decisions based on actual data.

Immutable Records End Reconciliation Disputes

Every blockchain transaction creates a permanent, cryptographically verified record that cannot be altered or deleted. This immutability becomes your audit trail. When a regulator asks when revenue was actually recognized, you don’t hunt through email confirmations or spreadsheet versions-you point to the on-chain record that shows the exact timestamp, amount, and customer. Finance teams typically spend 40 percent of their time on reconciliation instead of analysis, according to industry automation surveys. Blockchain payments cut that reconciliation time dramatically because there’s no dispute about what happened. The transaction occurred at block 18,456,789 on January 15, 2026 at 14:32 UTC. That record is permanent. No spreadsheet errors, no misallocated payments, no currency conversion mistakes hiding in email threads. When your audit trail lives on-chain and flows directly into Salesforce, compliance teams gain confidence immediately. The immutability also protects against fraud. A finance analyst cannot accidentally or intentionally change a transaction amount after the fact. The record exists on-chain forever, creating accountability that spreadsheets simply cannot provide.

Unified Data Eliminates Operational Silos

Finance teams and operations teams typically work in separate systems. Operations sees customer transactions in one place, finance tracks settlements in another, and compliance monitors risk in a third system. This fragmentation creates delays and errors because nobody has a complete picture. On-chain payment data flows directly into Revenue Cloud, creating a single source of truth that both teams access simultaneously. When a stablecoin payment settles, the transaction appears in your Salesforce environment instantly. Your operations team sees the settlement confirmation. Your finance team sees the revenue recognition automatically calculated. Your compliance team sees the immutable on-chain record. Everyone works from the same data, at the same time, in the same system. This unified approach reduces the time between settlement and reporting from days to minutes. It also eliminates the data entry errors that occur when teams manually transfer information between systems. One payment, one record, one source of truth across your entire organization.

Real-Time Cash Flow Visibility Across Borders

Global operations demand visibility into cash flow timing across multiple currencies and jurisdictions. Traditional settlement delays create blind spots that make forecasting unreliable. Stablecoin payments settle instantly, giving your finance team immediate visibility into when cash actually arrives. This real-time visibility transforms how you manage liquidity and plan for operational needs. Your team no longer waits for bank statements to confirm payment arrival-the on-chain record confirms it immediately. Currency fluctuations matter less when settlements happen in stablecoins pegged to major fiat currencies. Your finance team gains the visibility needed to optimize cash positioning and reduce the working capital tied up in settlement delays. When this data flows directly into Revenue Cloud, your forecasting becomes accurate because it reflects actual settlement timing, not assumptions about when payments might arrive.

The combination of instant settlement, immutable records, and unified data creates a foundation for automating your entire revenue recognition process. Your next step involves connecting these on-chain settlements directly to your billing systems and automating the workflows that currently consume your team’s time.

Practical Implementation in Revenue Cloud

Configure Your Stablecoin Payment Connector

Setting up on-chain revenue recognition in Revenue Cloud requires three critical steps: installing Blockchain Payments and Blockchain Payments for Revenue Cloud, Creating your Organization’s Wallets – liquidation or traditional, and automating the Web3 Payment Request rules through Salesforce Flow.

When a customer sends a stablecoin payment, the transaction settles on-chain within seconds. Blockchain Payments captures the settlement timestamp, amount, and customer identifier automatically and pushes this data into a custom Blockchain Payments object and standard Revenue Cloud object. This object becomes your source of truth for on-chain settlements.

Map Settlement Data to Billing Records

Next, map this settlement data to your existing billing and revenue recognition objects in Salesforce. Your billing system already knows which customer owes what amount and when revenue should be recognized. The integration aligns on-chain settlement data with these billing records, eliminating manual lookup work. When a $50,000 stablecoin payment arrives for Customer ABC, the system automatically matches it to the corresponding invoice and marks revenue as recognized at the exact settlement timestamp. This matching happens in seconds, not days. The speed advantage matters significantly for forecasting accuracy. Companies managing Remaining Performance Obligations need precise visibility into cash timing. When revenue recognition happens automatically at settlement time, your RPO calculations reflect actual cash arrival, not assumptions about when payments might clear.

Automate Recognition Workflows with Salesforce Flow

Automate your revenue recognition workflow using Salesforce Flow. When settlement data flows into Revenue Cloud, a Flow trigger fires automatically. This Flow updates your revenue recognition records, calculates any currency adjustments if needed, and posts the transaction to your general ledger integration. Your finance team no longer manually creates journal entries or reconciles payments. The entire workflow executes automatically from settlement to recognition to reporting. Your forecasting accuracy improves immediately because the data is real and current.

Monitor Settlements in Real Time

Real-time settlement visibility transforms how your finance team manages global cash flow. Instead of waiting for daily bank statements or settlement confirmations from payment processors, your team monitors on-chain settlements directly within Revenue Cloud dashboards. Create a dashboard that displays total stablecoin settlements received today, settlements pending recognition, and settlement amounts by customer or geography. This visibility lets your team spot trends immediately. If settlement velocity drops unexpectedly, your team notices within hours, not days. If a major customer’s payment arrives early, your team can accelerate recognition and improve cash flow forecasting.

Eliminate Context Switching Across Systems

Everything happens inside the CRM where your operations team already works, then the data flows into the ERP or GL where the accounting team works. This unified environment eliminates context switching and reduces the operational friction that slows down traditional finance teams. When settlement data, billing records, and revenue recognition all exist in one system with automated workflows connecting them (rather than scattered across blockchain explorers and external payment platforms), your finance team stops managing transactions and starts managing strategy.

Final Thoughts

Revenue recognition at scale demands speed, accuracy, and visibility that manual processes cannot deliver. Blockchain payments eliminate the friction that slows down global finance teams through instant settlement, immutable records, and direct integration into your systems without human intervention. When your revenue recognition happens automatically at settlement time instead of days later during reconciliation, your finance team gains the real-time cash flow visibility needed to forecast accurately and manage liquidity effectively.

Revenue Cloud on-chain capabilities transform how enterprises handle global billing and treasury operations. Your finance team stops chasing transactions across multiple systems and starts analyzing trends that drive business decisions. Settlement data, billing records, and revenue recognition all exist in one unified environment where workflows execute automatically, eliminating context switching, reducing errors, and accelerating the time between payment settlement and financial reporting.

We at Web3 Enabler built this capability specifically for enterprises managing complex global operations within Salesforce. Our platform enables you to accept and send stablecoin payments, automate on-chain revenue recognition, and gain real-time visibility into settlements without leaving your CRM. Organizations already trust Web3 Enabler to modernize their cross-border payments and treasury operations-your finance team can start automating revenue recognition immediately by connecting stablecoin payments to your billing systems and letting Salesforce Flow handle the rest. Visit Web3 Enabler to explore how Revenue Cloud on-chain automation can transform your global finance operations.

Frequently Asked Questions

What does “Revenue Cloud on-chain” mean?

Revenue Cloud on-chain means your payment settlement events are confirmed on a blockchain and then written into Salesforce Revenue Cloud as structured records. That gives finance teams a verifiable settlement timestamp, amount, and transaction trail that can drive revenue recognition automation instead of manual reconciliation.

How does on-chain settlement automate revenue recognition in Salesforce?

When a payment settles on-chain (for example, a stablecoin payment), the settlement confirmation can trigger Salesforce automation (like Salesforce Flow) to update billing and revenue recognition objects. This reduces manual matching between invoices, bank statements, and payment confirmations.

Do stablecoins replace traditional payment methods in Revenue Cloud?

No. Stablecoins add an additional settlement rail. Many businesses run stablecoin payments alongside cards, ACH, and wires, then consolidate reporting and revenue recognition in Salesforce Revenue Cloud to reduce operational silos.

What’s the main benefit for finance teams?

The biggest benefit is removing the delay between “payment sent” and “payment recognized.” On-chain settlement can confirm payment completion quickly, enabling faster close cycles, fewer reconciliation disputes, and more accurate cash flow visibility inside Salesforce.

How does this help with ASC 606 or IFRS 15 revenue recognition?

On-chain records can strengthen evidence of settlement timing and reduce ambiguity in audit trails. Your accounting policy still determines when revenue is recognized based on performance obligations, but automated settlement proof helps support documentation and reduces manual errors. For policy decisions, confirm requirements with your accounting team.

How are invoices and on-chain payments matched in Revenue Cloud?

Typical implementations map a payment (amount, customer reference, invoice ID, and settlement timestamp) into Salesforce objects, then automatically match it to the relevant billing record. That match can update invoice status, trigger recognition steps, and push clean data downstream to your GL or ERP integration.

Can we settle to fiat instead of holding crypto on the balance sheet?

Yes. Many companies use an auto-conversion approach where stablecoins are converted to fiat and deposited to a bank account, while Salesforce still stores the on-chain transaction record and the settlement lifecycle for reconciliation and reporting.

How does Revenue Cloud on-chain handle multi-currency and FX rates?

Most teams define a consistent FX policy (invoice-date rate, payment-date rate, or a reference rate source) and store the rate used alongside the transaction. Salesforce can then calculate recognized amounts consistently across currencies while preserving the underlying on-chain settlement details for auditability.

Is on-chain settlement data actually audit-ready?

Yes, if it’s captured with the right fields: transaction hash, timestamp, network, wallet addresses, amount, and customer/invoice references. When those details are stored in Salesforce records and tied to customer and contract data, audits become faster because the settlement trail is verifiable and complete.

What security and compliance controls should we use?

Common controls include KYB/KYC where required, sanctions and wallet screening, transaction monitoring thresholds, role-based approvals, and segregated wallet permissions. The goal is to ensure stablecoin payments follow the same (or stronger) governance as traditional payment workflows.

How long does it take to implement Revenue Cloud on-chain automation?

Timelines depend on your billing complexity and compliance requirements, but most teams start with a single use case (one product line, one region, or one payment corridor) and expand after proving matching, reporting, and controls work end to end inside Salesforce.

Does this integrate with ERP or general ledger systems?

Yes. A common setup is: on-chain settlement confirms payment, Salesforce updates billing and recognition objects, and then summarized, policy-aligned entries flow to the GL/ERP. This reduces manual journal entry creation and improves consistency between operational data and financial reporting.