Revenue Cloud blockchain integration represents a fundamental shift in how enterprises manage their financial operations. Blockchain Payments for Revenue Cloud is a free addon to Blockchain Payments, connecting to the native Revenue Cloud Billing objects. Traditional revenue processes often involve manual reconciliation, delayed settlements, and limited visibility across global transactions.

We at Web3 Enabler see businesses struggling with outdated payment systems that drain resources and slow cash flow. Blockchain technology transforms these challenges into competitive advantages through automated processes and real-time transparency.

How Does Blockchain Transform Revenue Cloud Operations?

Automated Revenue Recognition at Scale

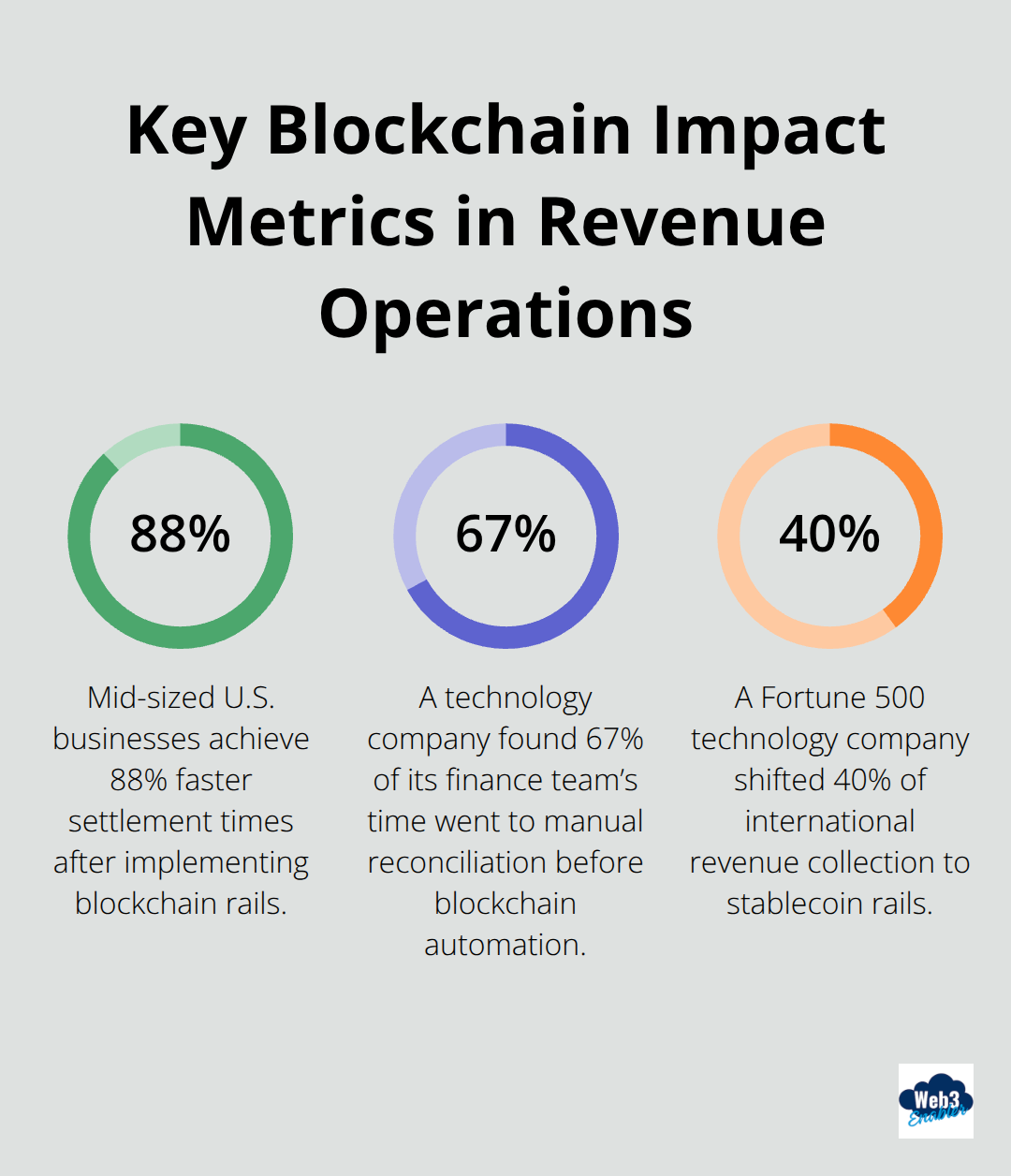

Revenue Cloud blockchain integration eliminates manual invoice tracking and accelerates payment confirmation through automated processes. Stablecoin payments complete in 3.2 seconds compared to traditional 3-5 day settlement cycles, which creates immediate revenue recognition opportunities. Mid-sized U.S. businesses report 88% faster settlement times when they implement blockchain rails for their revenue operations. The technology automatically updates revenue records within Salesforce the moment transactions confirm on-chain, which removes the typical 24-48 hour delay between payment receipt and system updates.

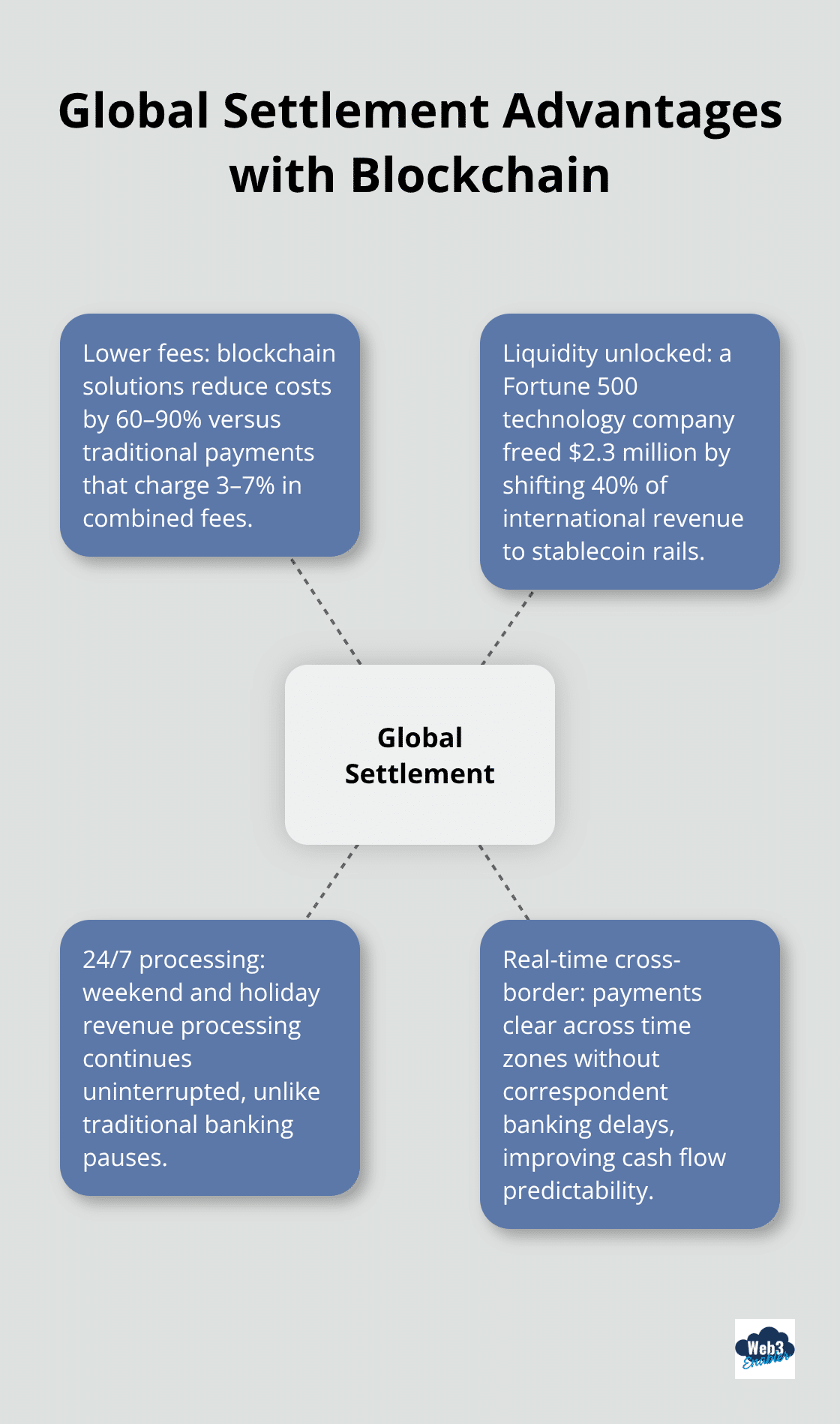

Global Settlement Without Banking Delays

Cross-border revenue collection becomes frictionless when blockchain networks process payments 24/7 across all time zones. Traditional international payments cost businesses 3-7% in fees while blockchain solutions reduce these costs by 60-90% according to recent industry analysis. A Fortune 500 technology company freed $2.3 million in trapped liquidity after it shifted 40% of international revenue collection to stablecoin rails.

Weekend and holiday revenue processing continues uninterrupted, unlike traditional banking systems that pause operations during non-business hours.

Complete Transaction Transparency

Blockchain provides complete audit trails for every revenue transaction, which enables real-time cash flow forecasting and supplier payment scheduling. Revenue teams gain immediate visibility into payment status without waiting for bank confirmations or manual reconciliation processes. This transparency reduces revenue recognition disputes and streamlines financial reporting cycles. Companies that use blockchain infrastructure report improved supplier relationships due to predictable payment timing and enhanced cash flow management capabilities.

Real-Time Liquidity Optimization

Blockchain settlement eliminates trapped funds that traditionally sit in correspondent banking networks for days. Organizations can now access revenue immediately upon transaction confirmation (typically within 27 seconds), which dramatically improves working capital management. This immediate access to funds allows finance teams to optimize cash deployment strategies and reduce the need for large cash reserves as safety buffers against payment delays.

These operational improvements set the foundation for measurable business benefits that extend far beyond simple payment processing.

What Financial Benefits Drive Blockchain Revenue Management Adoption?

Direct Cost Reduction Through Streamlined Settlement

Finance teams achieve measurable cost savings when they eliminate traditional banking intermediaries from their revenue collection processes. Cross-border payments through blockchain networks have reduced transfer costs by 30-40% on average, with some solutions achieving fees below 1%, compared to traditional wire transfers which typically charge 3-7% in combined fees from correspondent banks and foreign exchange markups. A mid-sized technology company reduced international payment processing costs from $47,000 to $8,200 monthly after it implemented stablecoin collection for their European and Asian markets. The 24/7 settlement capability eliminates weekend processing delays that traditionally cost businesses $2,000-$15,000 per day in trapped liquidity for high-volume operations.

Immediate Working Capital Access

Blockchain settlement transforms cash flow management and provides immediate access to revenue within 27 seconds of transaction confirmation. Traditional ACH and wire transfers lock funds for 3-5 business days, which forces companies to maintain larger cash reserves as operational buffers. Organizations that use blockchain rails report 40-60% reductions in required safety stock because payment certainty eliminates cash flow gaps. Revenue teams can now schedule supplier payments and operational expenses with precise timing (which improves vendor relationships and often secures 2-3% early payment discounts). The predictable settlement timing enables aggressive cash deployment strategies that generate additional investment returns on previously idle funds.

Automated Compliance Documentation

Blockchain transactions create immutable records that satisfy regulatory requirements without manual documentation processes. Every revenue transaction includes cryptographic proof of payment, timestamp verification, and complete transaction history that auditors can verify independently. This transparency reduces financial reporting preparation time by 30-40% according to firms that have implemented blockchain revenue systems. Compliance teams eliminate quarterly reconciliation disputes because blockchain records provide definitive proof of payment timing and amounts. The technology automatically generates the documentation required for SOX compliance, international tax reporting, and anti-money laundering audits without additional administrative overhead.

These financial advantages create the foundation for successful blockchain implementation, but organizations need strategic approaches to integrate this technology effectively into their existing Revenue Cloud infrastructure.

How Do You Successfully Implement Blockchain in Revenue Cloud?

Start with Process Mapping and Pain Point Analysis

Finance teams must conduct detailed assessments of their current revenue workflows before they implement blockchain technology. Map every step from invoice generation to payment receipt and identify specific delays and manual processes that consume staff time. A technology company discovered that 67% of their finance team’s time went to manual reconciliation tasks (which blockchain automation completely eliminated). Document exact costs associated with each inefficiency, including bank fees, FX spreads, and staff hours dedicated to payment tracking.

Revenue operations teams should measure current settlement times, calculate trapped liquidity amounts, and quantify compliance documentation overhead. Organizations typically find that international payments represent their highest-cost processes, with the Global Cross-border Payments Market projected to reach USD 413.1 billion by 2034, rising from USD 198.6 billion in 2024.

Deploy Native Salesforce Blockchain Infrastructure

Revenue teams can accept and send stablecoin payments directly through Revenue Cloud without external APIs or third-party platforms that create security vulnerabilities. Native integration provides real-time visibility into on-chain transactions through standard Salesforce objects and automation, which means finance teams use familiar interfaces rather than learn new systems.

Implementation typically requires 2-3 weeks for basic stablecoin payment acceptance and 4-6 weeks for full treasury automation features. Organizations should prioritize high-volume international payments as their initial use case because these transactions generate the most immediate cost savings and process improvements. Web3 Enabler partners with major CRM providers to deliver these blockchain solutions natively.

Establish Team Training and Operational Workflows

Finance teams need structured training programs that focus on practical blockchain operations rather than technical concepts. Staff should learn transaction monitoring, reconciliation processes, and compliance documentation within their existing Salesforce workflows. Create standard operating procedures for both traditional and blockchain payment processing (allowing teams to choose optimal rails based on transaction requirements).

Most organizations implement a phased approach where 20-30% of international payments move to blockchain rails initially, expanding to 60-80% within six months as team confidence grows. Training should emphasize the immediate benefits teams will experience, such as instant payment confirmation and automated reconciliation, rather than abstract blockchain technology concepts that can create resistance to adoption.

Final Thoughts

Revenue Cloud blockchain integration transforms enterprise finance operations and delivers immediate competitive advantages. Organizations achieve 88% faster settlement times, reduce transaction costs by 60-90%, and eliminate manual reconciliation processes completely. Finance teams see measurable results within weeks as mid-sized businesses free millions in trapped liquidity while cutting international payment costs by 80% or more.

The 24/7 settlement capability and real-time transaction visibility shift cash flow management from reactive to predictive operations. Modern enterprises cannot maintain outdated payment systems that drain resources and slow growth. Blockchain technology provides the operational efficiency and cost savings that finance leaders need to optimize working capital and improve supplier relationships.

Web3 Enabler delivers native blockchain solutions that enable organizations to accept stablecoin payments and automate global settlements directly within Revenue Cloud. Our platform integrates seamlessly with existing CRM workflows without complex third-party systems. The question remains how quickly your organization will adopt this technology to maintain competitive advantage in an increasingly digital economy (rather than whether blockchain will transform revenue operations).