Ready for a wild ride through the future of B2B payments? Buckle up, because things are about to get crazy!

At Web3 Enabler, we’re shaking up the payment game with some seriously cool tech. From blockchain to AI, we’re cooking up a storm of payment innovation that’ll make your head spin.

Get ready to kiss those old-school payment headaches goodbye and say hello to faster, cheaper, and sexier transactions. Trust us, you won’t want to miss this!

B2B Payments: The Dinosaur in the Digital Age

Checks: The Prehistoric Payment Method

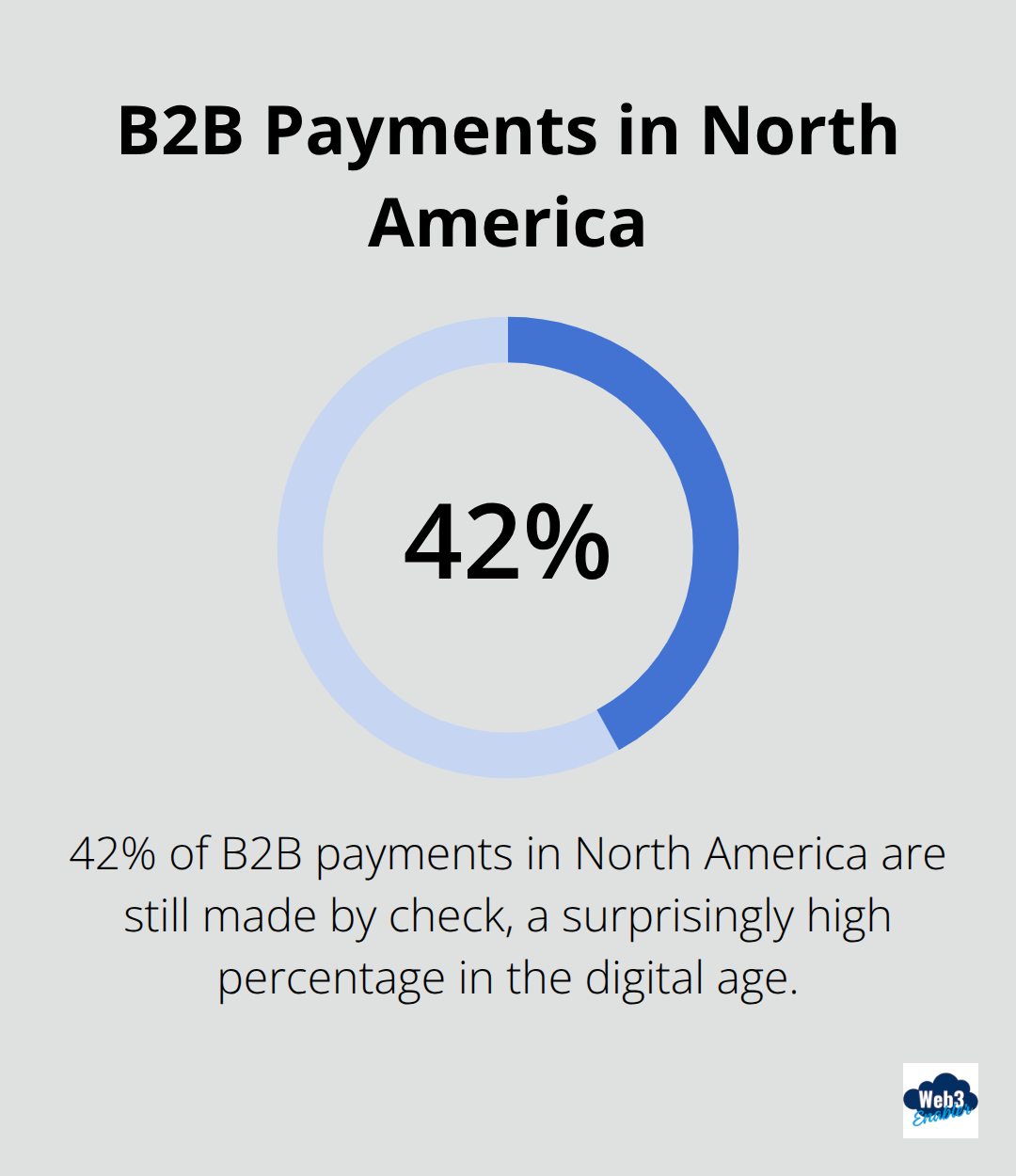

It’s 2025, and businesses still cling to paper checks like cavemen to their clubs. A recent study by the Association for Financial Professionals reveals that 42% of B2B payments in North America are made by check. (Talk about a financial fossil!)

Wire Transfers: Fast but Ferocious

Wire transfers might be quicker than carrier pigeons, but they’ll bite your budget harder than a hungry T-Rex. With fees ranging from $25 to $50 per transaction, they’re about as wallet-friendly as a shopping spree at Gucci (minus the fabulous shoes).

The Never-Ending Wait for Payment

Remember when “Net 30” seemed reasonable? Now, payment terms stretch longer than a teenager’s summer vacation. Wholesale businesses are exploring new ways to manage these extended payment cycles and maintain cash flow.

Costs That Climb Higher Than King Kong

Processing a single invoice can cost anywhere from $4.35 to $15.97, according to Deloitte. Multiply that by thousands of transactions, and you’ve got a CFO’s worst nightmare (complete with cold sweats and midnight spreadsheet sessions).

The Global Payment Tango

Cross-border payments should be smoother than a fresh jar of Skippy. Instead, they’re more like trying to spread concrete with a plastic fork. The World Bank reports that the average cost of sending remittances across borders is still a jaw-dropping 6.5% of the transaction amount. That’s money literally vanishing into thin air (poof!).

As we stand on the brink of a payment revolution, it’s clear that B2B transactions need a serious upgrade. But fear not, dear reader! The cavalry is coming, armed with blockchain, AI, and enough tech wizardry to make even the most jaded CFO crack a smile. Let’s explore the game-changing solutions that are about to turn the B2B payment world on its head.

Tech Wizardry Transforming B2B Payments

Welcome to the future, where B2B payments get a major facelift! Say goodbye to snail-mail checks and wire transfer fees that make you want to cry. Let’s explore the tech that turns the payment world upside down.

Blockchain: The New Sheriff in Town

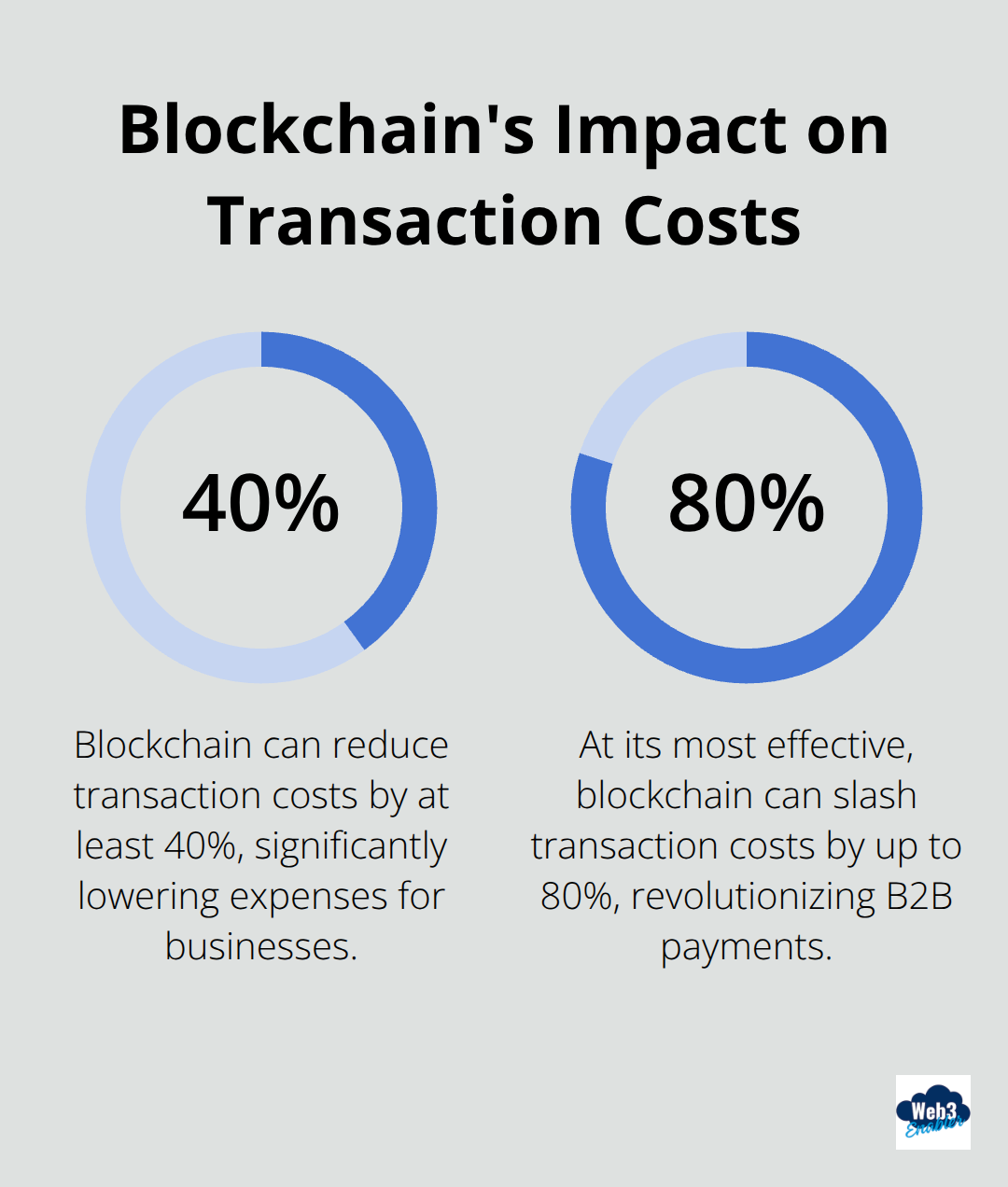

Blockchain struts into the B2B payment scene like it owns the place – and honestly, it kind of does. This bad boy slashes transaction times from days to seconds. A study by Deloitte shows blockchain can cut transaction costs by a whopping 40-80%. That’s not just pocket change, folks.

AI and Machine Learning: The Dynamic Duo

AI and machine learning fight fraud, automate processes, and predict payment behaviors like psychics on steroids. Juniper Research predicts AI-powered fraud prevention will save businesses $10 billion annually by 2026. (That’s a lot of dough staying where it belongs – in your pocket!)

These smart systems also streamline invoice processing. No more manual data entry or chasing down approvals. AI does the heavy lifting, leaving your team free to focus on more important things – like deciding where to spend all that money you save.

Real-Time Payments: Speed Demons of Finance

Real-time payment systems act as the espresso shots of the financial world – quick, potent, and exactly what you need to keep your business buzzing. Instant payment methods are being readily adopted by small-business owners, moving cash in seconds rather than days. (It’s like teleportation for your money!)

For businesses, this means improved cash flow management and the ability to make split-second financial decisions. No more thumb-twiddling while waiting for payments to clear. With real-time systems, you can pay suppliers, receive customer payments, and manage your cash flow faster than you can say “cha-ching!”

The Tech Trifecta in Action

Imagine a world where you send money across the globe in seconds, AI catches fraudulent transactions before they happen, and your cash flow moves at the speed of light. This isn’t science fiction – it’s the new reality of B2B payments.

But wait, there’s more! The next chapter will blow your mind with how Web3 Enabler takes these technologies and turns them into a payment powerhouse. Get ready to see how we’re not just riding the wave – we’re making the tsunami!

How Web3 Enabler Revolutionizes B2B Payments

At Web3 Enabler, we don’t just ride the wave of payment innovation – we create tsunamis. Our Salesforce-native blockchain solutions turn the B2B payment world upside down, and we love every minute of it.

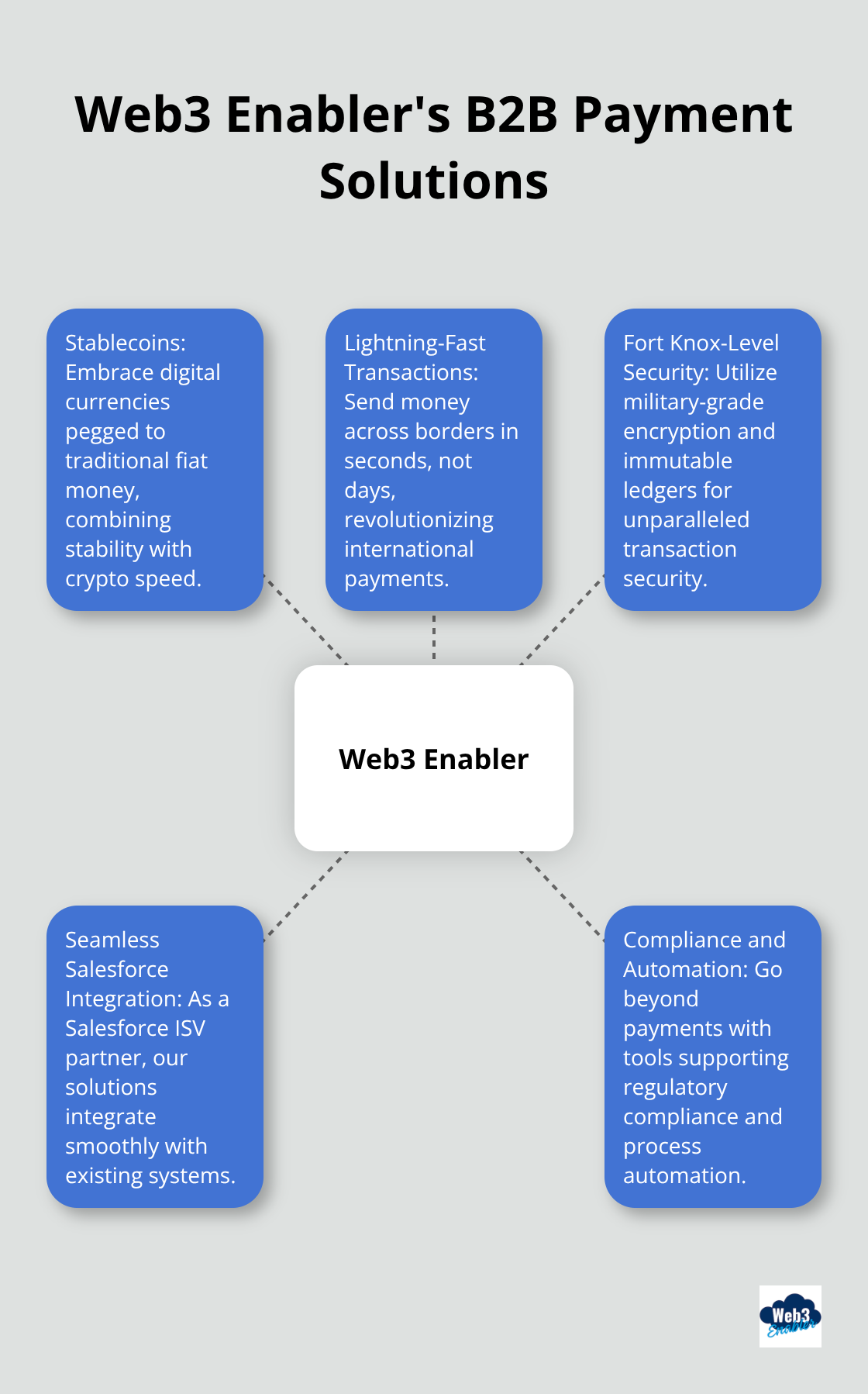

Stablecoins: The Cool Kid on the Block

Accepting crypto payments once felt riskier than skydiving without a parachute. Those days are over. We embrace stablecoins, and it’s a game-changer. These digital currencies peg to traditional fiat money, giving you the best of both worlds – the stability of good old dollars and the speed of crypto.

Stablecoin payments open doors to a whole new world of customers. You’ll slash those pesky international transaction fees faster than a samurai with a grudge.

Lightning-Fast Transactions

International payments no longer move slower than a sloth on vacation. Our blockchain-powered solutions zip money across borders faster than you can say “show me the money!”

How fast? Try seconds instead of days.

Fort Knox-Level Security

We take security seriously. Like, really seriously. Our blockchain solutions come with military-grade encryption that would make even the most determined hacker throw in the towel.

Every transaction records on an immutable ledger, creating an audit trail clearer than a mountain stream. No more he-said-she-said disputes over payments. With our system, the proof lies in the blockchain pudding.

Seamless Integration with Salesforce

As a Salesforce ISV partner, we specialize in connecting blockchain technology with existing corporate infrastructure. Our 100% Salesforce Native blockchain solutions integrate seamlessly with your existing systems, making adoption a breeze.

Beyond Payments: Compliance and Automation

Our tools go beyond just payments. We support compliance and automation, helping businesses streamline their operations and stay on the right side of regulations. (It’s like having a financial superhero on your side!)

Wrapping Up

The B2B payment revolution has arrived, and it’s more exciting than a blockchain in a bikini. The future of finance moves faster, thinks smarter, and guards secrets better than ever before. Those who don’t adapt will find themselves left behind quicker than you can say “wire transfer fee.”

Web3 Enabler doesn’t just ride the wave of payment innovation – we craft the surfboard and teach you to hang ten. Our Salesforce-native blockchain solutions act like a Swiss Army knife for your B2B payments. We offer lightning-fast transactions, Fort Knox-level security, and smooth integration with your existing systems.

The future of B2B payments beckons, and it promises a wild ride. With Web3 Enabler as your co-pilot, you’ll zoom through the financial fast lane like a pro. (Are you ready to revolutionize your payments and watch your competitors eat your dust?)