Sending money across borders shouldn’t feel like navigating a maze blindfolded. Yet here we are in 2025, still dealing with sky-high fees and transfers that take longer than a Netflix series to complete.

We at Web3 Enabler know there’s a better way. Global transfers are getting a blockchain makeover, and it’s about time.

The old system is broken, but the fix is already here.

Why Cross-Border Payments Cost So Much

Your business sends a $10,000 payment to a supplier in Germany. The bank charges you $330 in fees, and your money takes three days to arrive. Welcome to the cross-border payment nightmare that costs businesses worldwide billions annually.

The Fee Frenzy That Bleeds Your Budget

The World Bank reports that international money transfers cost an average of 6.49% of the total amount sent. That’s not a typo. Your $50,000 quarterly payment to an overseas manufacturer just cost you an extra $3,245 in fees.

Traditional banks layer on correspondent bank fees, currency conversion markups, and processing charges that stack up faster than parking tickets in Manhattan.

J.P. Morgan processes over $10 trillion daily across 60 million transactions, but even they can’t escape the multi-intermediary fee structure that makes international payments expensive. Each bank in the chain takes their cut. What should be a simple transfer becomes a profit center for financial institutions.

Speed Bumps in the Digital Age

Cross-border payments take two to five business days minimum, often stretch longer during weekends and holidays. Your supplier in Asia needs payment confirmation to ship goods, but your wire transfer sits stuck in processing limbo while SWIFT networks crawl through multiple correspondent banks.

This delay costs businesses real money through extended payment terms, strained supplier relationships, and missed early payment discounts. Financial institutions reported that payment fraud amounted to EUR 4.3 billion in 2022 across the European Economic Area, partly because slow settlement times create more opportunities for fraudulent interference.

The Black Box Problem

Payment tracking in traditional systems feels like following a package that disappeared into the Bermuda Triangle. You send money on Monday, and it vanishes into a web of correspondent banks with zero visibility until it hopefully appears in your recipient’s account days later.

This opacity creates compliance headaches, makes reconciliation a nightmare, and leaves businesses guessing about payment status. Regulatory requirements across different jurisdictions add another layer of complexity (each country imposes its own reporting standards and compliance checks that further slow down transactions).

The antiquated infrastructure that powers global payments wasn’t designed for today’s 24/7 business demands. Yet businesses still work within these broken constraints while blockchain technology offers a completely different approach to international transfers.

How Blockchain Fixes These Payment Problems

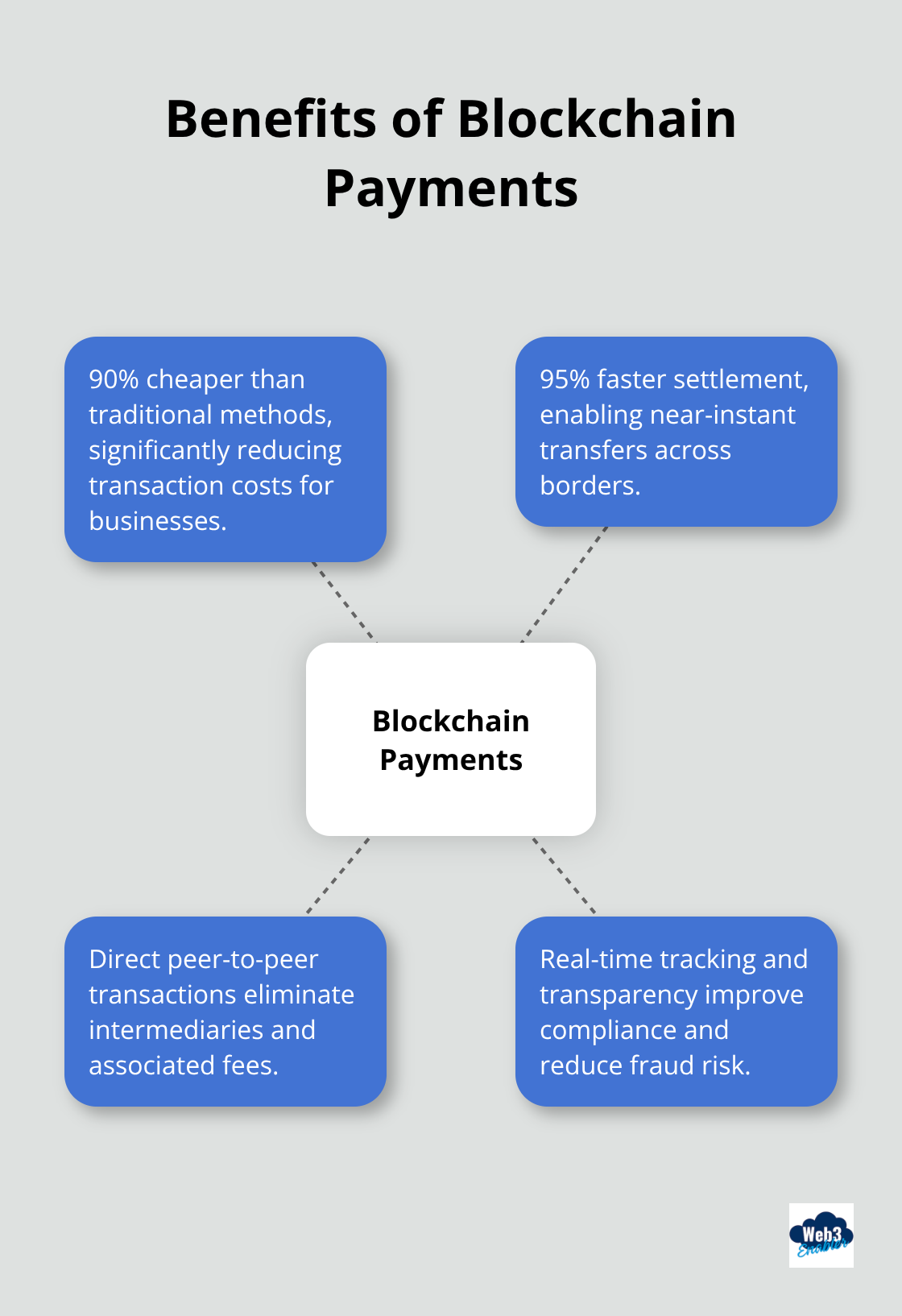

Blockchain payments are 90% cheaper and settle 95% faster than traditional methods, slashing those $330 fees down to around $66 for a $10,000 transfer. This 80% reduction puts money back where it belongs-your business account, not bank coffers.

Direct Payments Cut Out the Middlemen

Traditional banks orchestrate a parade of intermediaries that each take their cut. Blockchain eliminates this entirely through direct peer-to-peer transactions. No correspondent bank fees. No multiple currency conversion markups. No hidden charges that appear like surprise party guests you never invited.

Ripple XRP and Stellar XLM prove this works at enterprise scale. Circle’s new Arc network (with USDC as the gas coin) and Coinbase’s BASE L2 show it can work on general EVM networks. Major financial institutions process international transfers through these networks without the traditional fee structure that makes CFOs break out in cold sweats.

Instant Settlement Transforms Cash Flow

Blockchain transactions can transform cross-border payments versus the 2-5 business day marathon that traditional systems demand. Your supplier in Germany receives payment confirmation instantly, ships goods immediately, and your business relationship improves because you’re not the client who always pays late due to banking delays.

Smart contracts automate the entire process. They execute payments when predefined conditions are met without human intervention or weekend delays (because blockchain doesn’t take coffee breaks or observe bank holidays). Financial institutions report significant improvements in cash flow management because faster settlements mean better liquidity control.

Complete Transaction Transparency

Blockchain’s distributed ledger records every transaction with timestamps and immutable documentation. This gives you real-time tracking that makes traditional banking’s black box approach look like smoke signals.

Each payment creates a transparent audit trail that regulatory agencies can verify instantly. This eliminates the compliance guesswork that costs businesses time and money. Automating KYC processes boosts efficiency and compliance while the transparency reduces fraud risk significantly because every transaction is cryptographically secured and visible to all network participants.

Unauthorized changes become impossible. This addresses the payment fraud that affected 88% of businesses in recent studies-a problem that thrives in the opacity of traditional systems.

These technical advantages create the foundation for real-world applications that are already transforming how businesses handle international payments.

Which Companies Actually Use Blockchain Payments

J.P. Morgan Leads Enterprise Blockchain Adoption

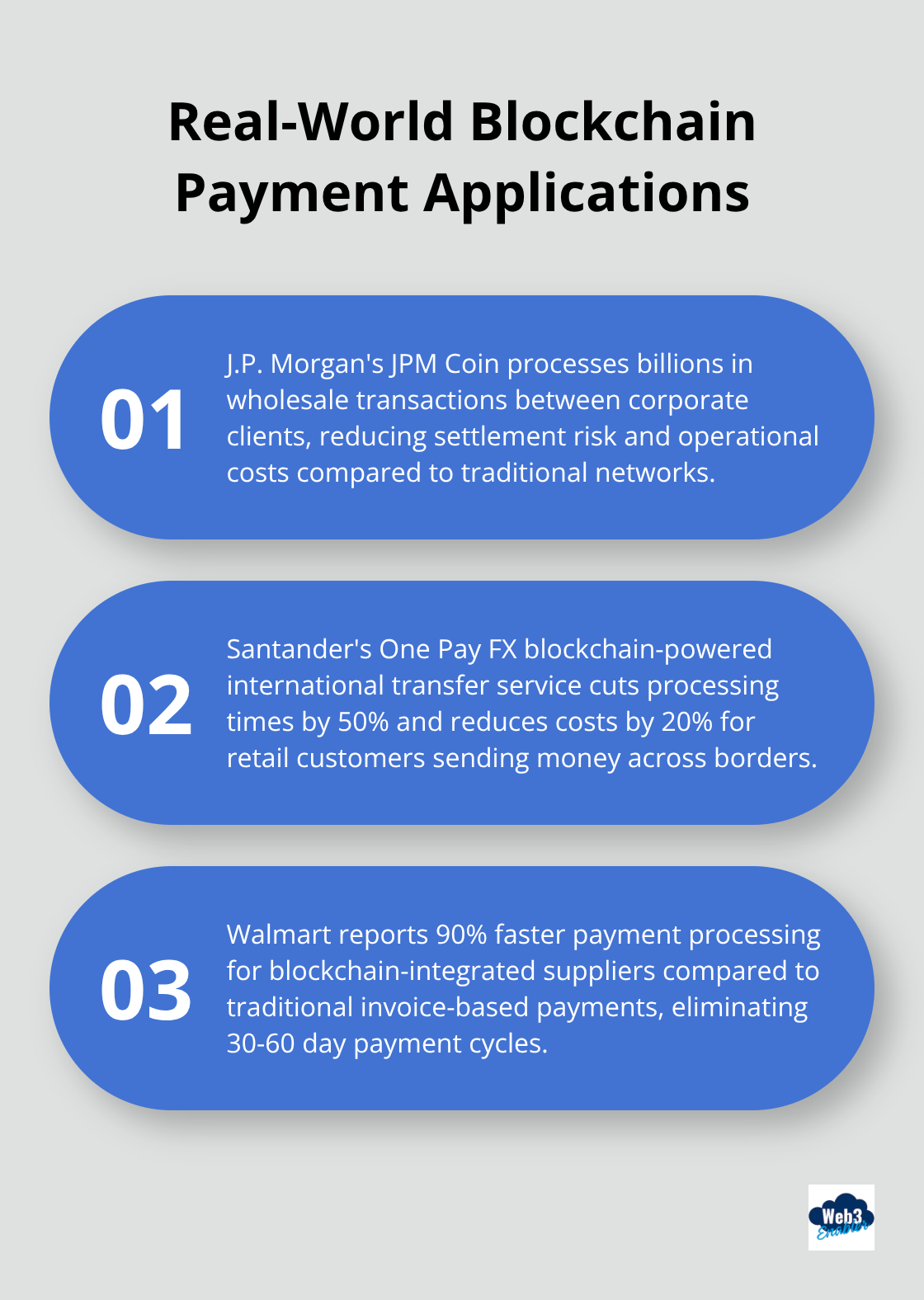

J.P. Morgan processes over $10 trillion daily across 60 million transactions and launched JPM Coin for institutional clients in 2019. Their blockchain-based payment system now handles billions in wholesale transactions between corporate clients, which proves that enterprise-grade blockchain payments work at massive scale. The bank reports significant reductions in settlement risk and operational costs compared to traditional correspondent networks.

Santander operates One Pay FX, their blockchain-powered international transfer service that processes payments in minutes instead of days. The Spanish bank cut processing times by 50% and reduced costs by 20% for retail customers who send money across borders. These aren’t pilot programs or experiments-they’re production systems that handle real customer transactions daily.

Stablecoin Networks Transform Remittances

Wise, formerly TransferWise, processes over $100 billion annually in cross-border transfers and increasingly relies on stablecoin rails for instant settlements. Their blockchain integration cuts settlement times from hours to seconds while it maintains regulatory compliance across 70+ countries. Circle’s USDC stablecoin facilitates $1.4 trillion in annual transaction volume with remittance companies like Remitly and WorldRemit that integrate stablecoin payments to serve customers who need instant money transfers to family overseas.

Supply Chain Payments Get Blockchain Upgrades

Walmart requires suppliers to use blockchain tracking for leafy greens, which creates an integrated payment and verification system that processes payments instantly when goods reach quality checkpoints. This eliminates the traditional 30-60 day payment cycles that strain supplier relationships. The retail giant reports 90% faster payment processing for blockchain-integrated suppliers compared to traditional invoice-based payments.

Maersk operates TradeLens, a blockchain platform that handles $1 trillion in global trade annually. Their system automates payments between shipping companies, ports, and customs authorities, which reduces documentation processing from weeks to hours. Container shipping payments now settle automatically when blockchain sensors confirm cargo delivery, which eliminates disputes over payment timing and reduces working capital requirements for logistics companies.

Final Thoughts

Blockchain technology cuts cross-border payment fees from 6.49% to under 1% while it reduces settlement times from days to seconds. Major banks like J.P. Morgan and Santander process billions through blockchain networks, which proves this technology works at enterprise scale right now. The complete transaction transparency eliminates the black box problem that plagues traditional banking systems.

Global transfers will reach $320 trillion by 2032, and businesses that adopt blockchain payment solutions gain competitive advantages through lower costs and faster processing. The technology removes intermediary fees, automates compliance reports, and provides real-time payment tracking that traditional banking cannot match. Companies that modernize their payment infrastructure now will dominate tomorrow’s global economy.

Smart businesses start with stablecoin integration for international suppliers and explore blockchain-native solutions that connect with existing systems. We at Web3 Enabler specialize in blockchain technology integration through Salesforce-native solutions that support payments and compliance without crypto speculation (our platform connects directly with your existing business infrastructure). The payment revolution happens now, not later.