Crypto and Salesforce: two powerhouses colliding in a regulatory tango. At Web3 Enabler, we’ve seen businesses struggle to keep up with the ever-changing KYC compliance landscape.

But fear not! This guide will show you how to seamlessly integrate KYC processes into your Salesforce setup, keeping regulators happy and your crypto transactions flowing smoothly.

Buckle up as we dive into the wild world of crypto KYC in Salesforce – it’s going to be a bumpy (but rewarding) ride!

Why KYC Matters in Crypto

The Legal Tango

Let’s face it, the crypto world often resembles the Wild West. But even in this digital frontier, rules exist. Enter KYC – the sheriff keeping things legit.

KYC isn’t just a buzzkill dreamed up by party-pooping regulators. It’s a legal necessity that prevents your crypto business from becoming the next cautionary tale on CNBC. Higher-value transactions are subject to full know-your-customer (KYC) verification and reporting obligations. Ignore this, and you might as well put out a welcome mat for the SEC to come knocking (and trust us, they don’t bring cookies).

Fraud: Not Just for Credit Cards Anymore

Think fraud only applies to shady characters trying to buy yachts with stolen Visa numbers? Think again. Crypto fraud is big business, with losses hitting $14 billion in 2021 according to Chainalysis. Proper KYC acts like a bouncer at an exclusive club, keeping the riffraff out and your digital assets safe (no VIP list for scammers here).

Trust: The Crypto Currency You Can’t Mine

In the world of ones and zeros, trust is the ultimate cryptocurrency. And guess what? You can’t mine it with a fancy GPU rig. You must earn it the old-fashioned way – by showing your customers you’re not just another fly-by-night operation. KYC helps build that trust by demonstrating that you take security and compliance seriously.

Robust KYC processes can transform a crypto business from sketchy to stellar in the eyes of customers and partners. It’s not just about ticking boxes; it’s about creating a foundation of trust that’ll keep your business growing long after the latest meme coin has crashed and burned.

The Global Compliance Puzzle

Crypto knows no borders, but regulations sure do. Navigating the global compliance landscape is like trying to solve a Rubik’s cube blindfolded (while riding a unicycle). Different countries have different KYC requirements, and keeping up with them all can make your head spin faster than a Bitcoin price chart.

But fear not! The next section will show you how to turn your Salesforce into a KYC powerhouse. We’ll reveal the secrets to making compliance so smooth, it’ll feel like you’re sliding into your DMs. Ready to level up your KYC game? Let’s roll!

How to Turn Salesforce into a KYC Powerhouse

Alright, crypto cowboys and compliance crusaders, it’s time to transform your Salesforce instance into a KYC-crushing machine. We’re not just talking about adding a few extra fields to your contact records – we’re going full-on compliance commando here.

Salesforce’s Secret KYC Weapons

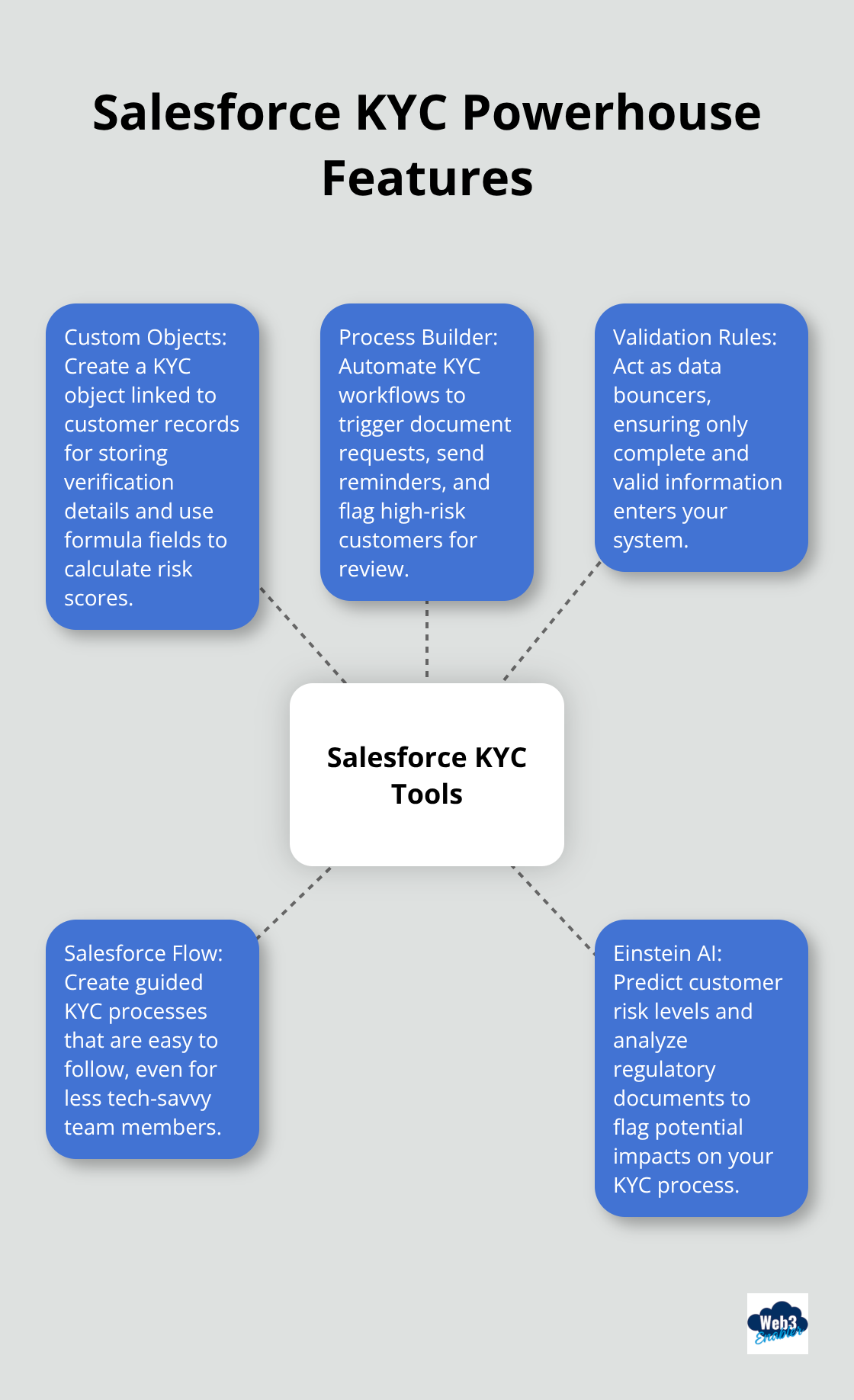

First things first, let’s talk about what Salesforce brings to the KYC party right out of the box. Custom objects will become your new best friends. Create a KYC object that links to your customer records, storing all those juicy verification details. Use formula fields to automatically calculate risk scores based on customer data. And don’t forget about validation rules – they’re like bouncers for your data, keeping out the riffraff (aka incomplete or suspicious info).

But the real MVP? Salesforce Flow. This bad boy can automate your KYC workflows faster than you can say “blockchain.” Set up processes to trigger document requests, send reminders, and flag high-risk customers for review. It’s like having a tireless KYC robot working 24/7 (minus the creepy AI overlord vibes).

Supercharge Your KYC with Third-Party Muscle

Now, let’s talk about beefing up your KYC game with some third-party heavyweights. Salesforce’s AppExchange is packed with KYC solutions that integrate smoother than a well-oiled crypto transaction. Look for apps that offer ID verification, PEP and sanctions screening, and ongoing monitoring.

One standout? Web3 Enabler. Their Salesforce-native blockchain solutions are tailor-made for businesses diving into the crypto deep end. They’ve got the tools to help you accept stablecoin payments and keep your compliance ducks in a row.

Automation: Your New Compliance BFF

Let’s face it, manual KYC checks are about as fun as watching paint dry on the blockchain. That’s where automation comes in to save the day (and your sanity). With Blockchain Payments integration of BitRank Verified, you can have this automation data pulled right into Salesforce.. Set up automatic case creation for suspicious activity, and use Einstein AI to predict customer risk levels.

Pro tip: Leverage Salesforce’s reporting and dashboard features to keep tabs on your KYC metrics. Create a KYC dashboard that shows completion rates, risk distribution, and pending verifications. It’s like a crystal ball for your compliance future.

Implementing KYC in Salesforce isn’t just about ticking boxes. It’s about creating a seamless, efficient process that keeps regulators happy and your crypto business booming. With these tips, you’ll run a KYC operation so smooth, it’ll make traditional banks green with envy.

But wait, there’s more! Just when you thought you had this KYC thing in the bag, the crypto world throws you a curveball. In the next section, we’ll tackle the unique challenges of KYC in the wild and woolly world of cryptocurrency. Spoiler alert: it’s not for the faint of heart!

Crypto KYC Hurdles: How to Clear Them

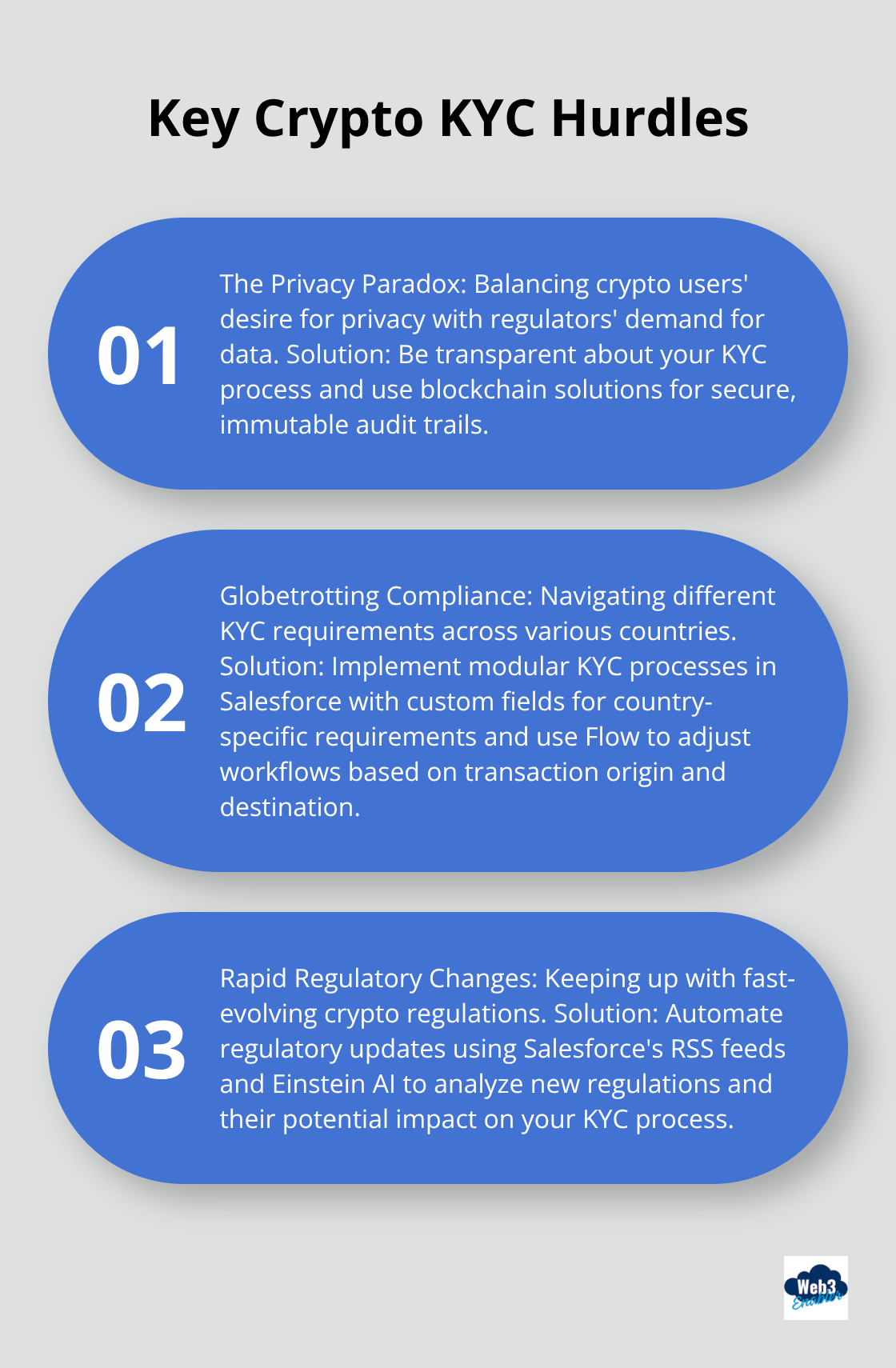

The Privacy Paradox

Crypto fans love their privacy. Regulators love their data. It’s a classic unstoppable force meets immovable object scenario. But here’s the secret sauce: transparency about your KYC process.

Tell your customers exactly what data you collect and why. Use Salesforce’s customer portal to give them control over their information. And for the love of Satoshi, encrypt everything. Blockchain solutions can help you create an immutable audit trail of KYC checks without compromising user privacy.

Globetrotting Compliance

Cross-border crypto transactions are a compliance nightmare. Different countries, different rules – it’s enough to make your head spin. The solution? Modular KYC processes in Salesforce.

Create custom fields for country-specific requirements. Use Flow to adjust your KYC workflow based on transaction origin and destination. And don’t forget about language! Salesforce’s translation workbench can help you localize your KYC forms faster than you can say “blockchain” in Mandarin (or any other language, for that matter).

Keeping Up with the Crypto-shians

Crypto regulations change faster than Bitcoin prices. Staying current is a full-time job. But here’s a pro tip: automate your regulatory updates.

Set up RSS feeds in Salesforce to pull in the latest crypto compliance news. Use Einstein AI to analyze regulatory documents and flag potential impacts on your KYC process. And consider joining a crypto compliance consortium – sharing intel with other businesses can help you stay ahead of the curve.

The Tech Tango

Integrating KYC processes with existing systems can feel like trying to teach a blockchain to tango. But fear not! Salesforce’s robust API ecosystem makes it easier than ever to connect your KYC tools with other platforms.

Try to leverage Salesforce’s native integration capabilities to connect with external identity verification services. Use Apex triggers to automatically update customer risk profiles based on data from third-party sources. And don’t forget about mobile – Salesforce’s mobile SDK allows you to build KYC processes that work seamlessly on smartphones (because let’s face it, who doesn’t manage their crypto portfolio from the bathroom these days?).

The Human Element

While automation is great, don’t forget the human touch in your KYC process. Train your team to spot red flags that AI might miss. Use Salesforce’s case management features to handle complex KYC scenarios that require human judgment.

And most importantly, partner with experts who eat, sleep, and breathe crypto compliance. Web3 Enabler’s team stays on top of the latest regulations so you don’t have to. They’ll help you build a KYC process in Salesforce that’s more flexible than a yoga instructor and tougher than a blockchain.

Final Thoughts

Crypto enthusiasts, we’ve navigated the wild waters of KYC compliance in Salesforce. KYC isn’t just a regulatory requirement – it builds trust, prevents fraud, and keeps your crypto business legal. Salesforce’s features, third-party integrations, and automated workflows create a KYC process smoother than a freshly minted NFT.

The crypto landscape changes rapidly, and staying ahead is vital. Web3 Enabler offers Salesforce-native blockchain solutions to help businesses navigate crypto compliance. Their tools support payments, compliance, and automation, making it easier to accept stablecoin payments and send global transactions securely.

With the right tools, partners, and creativity, you can turn KYC compliance from a necessary evil into a competitive advantage. Your Salesforce-powered KYC fortress awaits (and it’s more secure than Fort Knox)! Go forth and conquer the crypto compliance world.