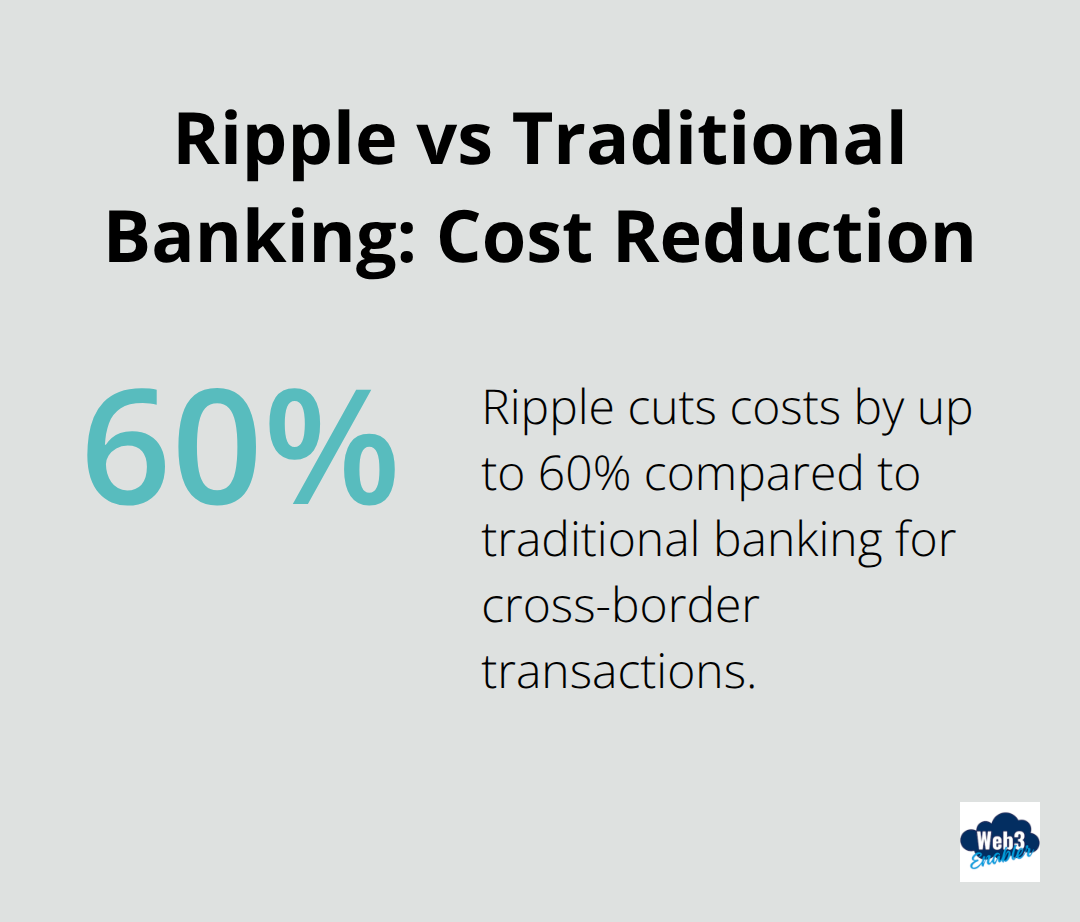

Ripple’s US expansion in crypto payments has transformed how businesses handle cross-border transactions. The platform processes payments in seconds rather than days, cutting costs by up to 60% compared to traditional banking.

We at Web3 Enabler see growing demand from companies seeking faster, more transparent payment solutions. This guide walks you through implementing Ripple payments for your US business operations.

Understanding Ripple’s Payment Infrastructure

Ripple’s XRP Ledger processes transactions in 3-5 seconds with fees under $0.01, which transforms how businesses move money across borders. The ledger handles significant payment volume across global payout markets annually, which proves its enterprise readiness. Traditional SWIFT transfers take 3-5 business days and cost $25 per transaction, while XRP settlements happen instantly at a fraction of the cost.

RippleNet’s Financial Institution Network

RippleNet connects financial institutions worldwide and creates direct pathways for cross-border payments. Major banks use this network to bypass correspondent relationships, which reduces settlement times from days to seconds. The network’s real-time gross settlement system eliminates the need for pre-funded nostro accounts and frees up billions in capital for institutions.

US Regulatory Clarity Drives Adoption

The SEC’s August 2024 case dismissal removed regulatory uncertainty that had plagued XRP since 2020. This clarity triggered institutional adoption, with XRP reaching eight-year price highs. US banks now view XRP as a compliant digital asset for cross-border payments and increase their treasury system connections. The regulatory approval has accelerated corporate adoption, particularly among companies that process high-volume international transactions.

Technical Setup Requirements

Businesses integrate Ripple payments through APIs that connect directly to existing ERP and accounting systems. The setup requires minimal technical overhead compared to traditional partnerships (often weeks instead of months). Companies need basic wallet infrastructure and compliance protocols, but the process streamlines significantly compared to correspondent relationships. Most businesses find the technical barriers lower than expected, which makes the transition to your next implementation decision straightforward.

Setting Up Ripple Payments for Your Business

Account Setup and KYC Requirements

Business verification through Know Your Customer protocols requires comprehensive due diligence on compliance frameworks for most US companies. You must provide corporate documentation including Articles of Incorporation, EIN verification, and beneficial ownership details for any stakeholder who holds 25% or more equity. Financial institutions require additional compliance documentation including AML policies and transaction monitoring procedures. The verification process moves faster for established businesses with existing bank relationships, while startups face longer review periods.

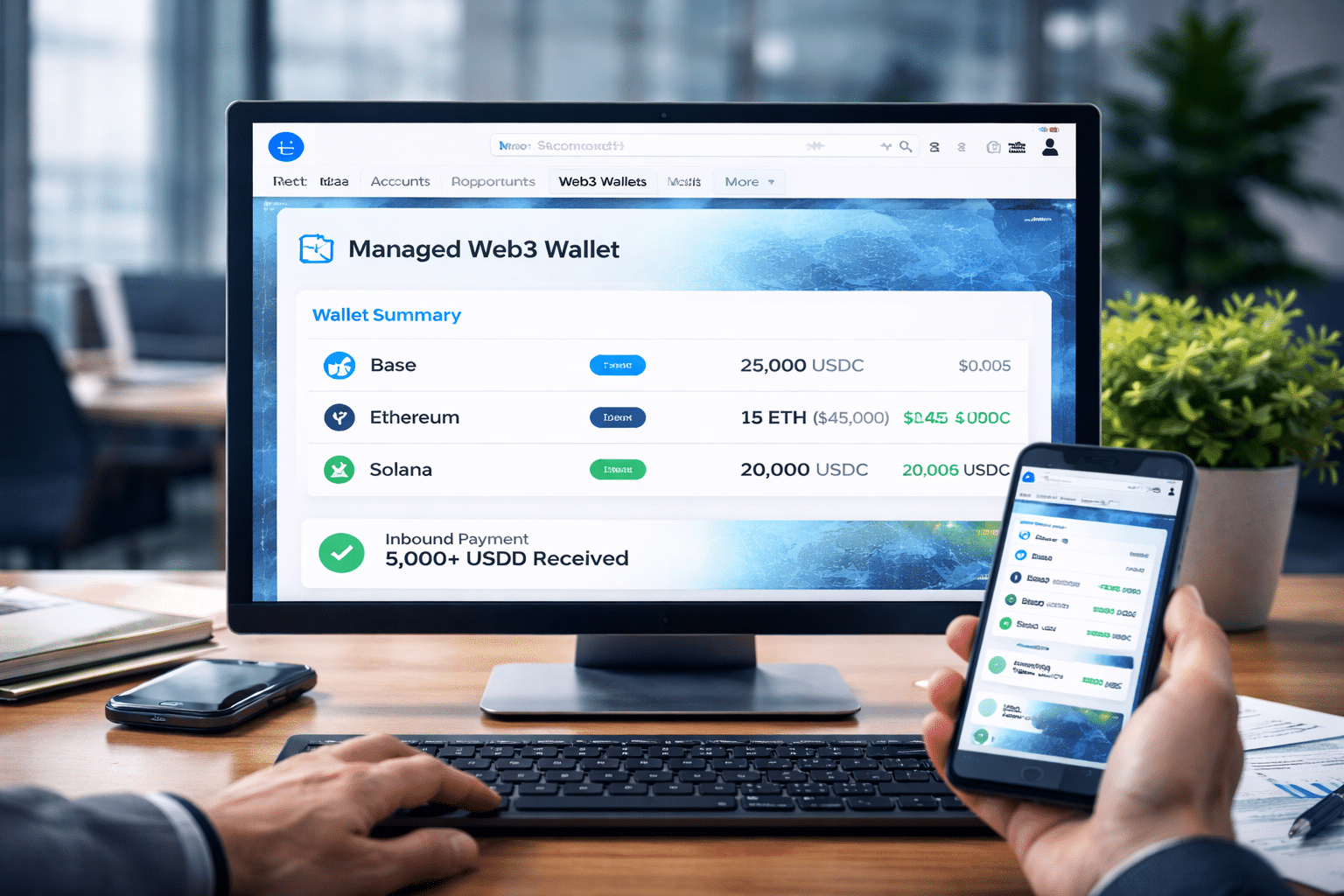

Direct API Integration vs Third-Party Solutions

Direct RippleNet integration through their Enterprise API provides full control over payment flows and settlement timing. Most mid-market companies choose third-party payment processors that offer Ripple connectivity for monthly fees between $500-2,500 (depending on transaction volume). These processors handle compliance overhead and provide user-friendly dashboards that integrate with existing accounting software like QuickBooks and NetSuite.

Transaction Processing and Fee Structure

XRP transactions settle in 3-5 seconds with network fees under $0.01 per transfer, but payment processors add markup fees that range from 0.5% to 2.5% of transaction value. Volume discounts apply for businesses that process over $100,000 monthly, with enterprise clients who negotiate rates as low as 0.25%. Payment processing follows a simple workflow where you input recipient details, specify payment amount in local currency, and the system automatically converts to XRP for settlement before it converts to the recipient’s preferred currency.

Implementation Timeline and Technical Requirements

Most businesses complete Ripple payment setup within 2-3 weeks after account approval. Technical integration requires basic API knowledge or developer support to connect payment systems with existing business software. Companies need wallet infrastructure and compliance protocols, but the process streamlines significantly compared to traditional correspondent bank relationships (which often take months to establish). The technical barriers prove lower than most businesses expect, which makes the transition decision more straightforward.

These setup considerations directly impact the financial benefits your business will experience once Ripple payments become operational.

What Financial Benefits Drive Ripple Adoption

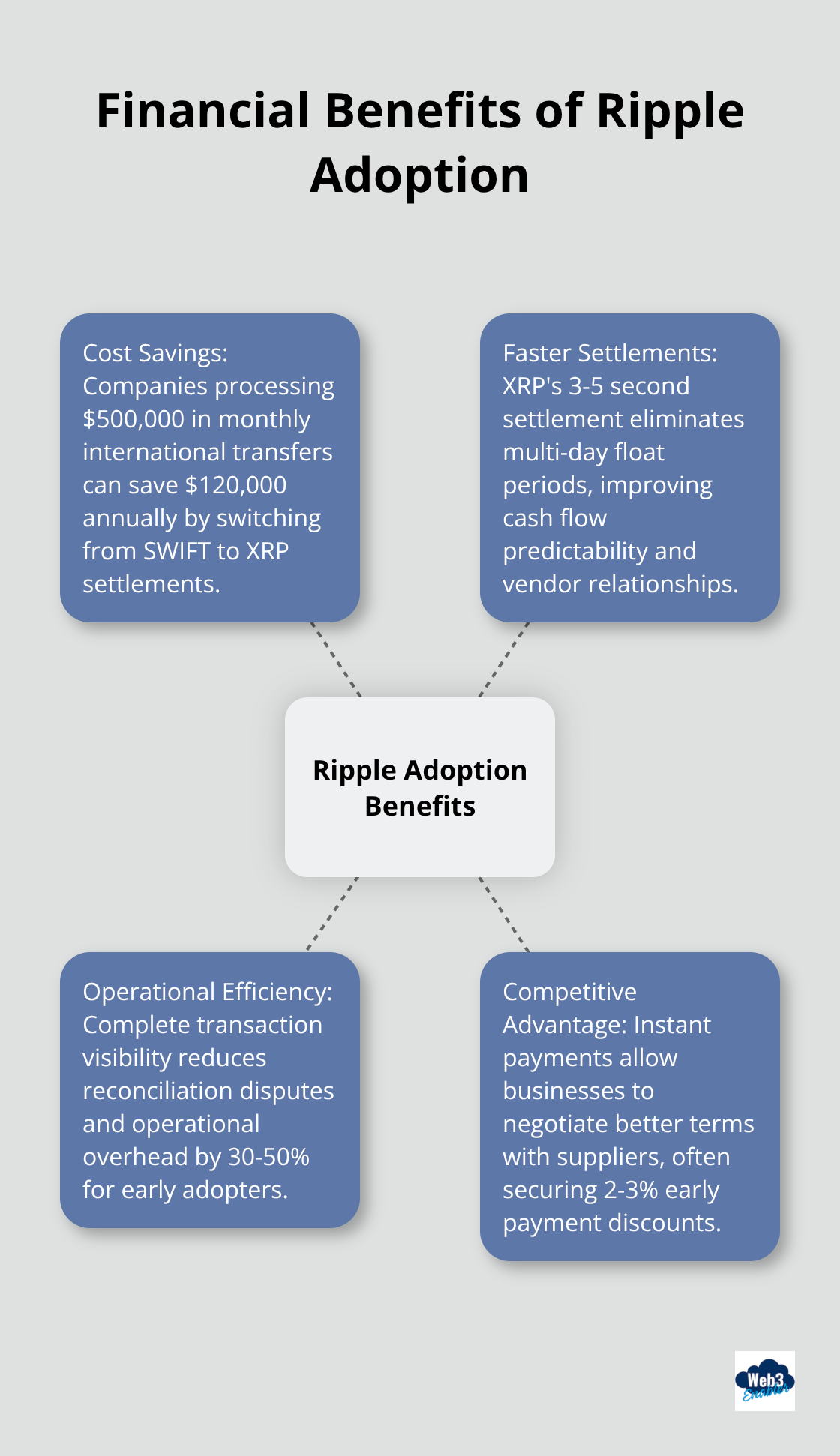

Cross-border payments through Ripple deliver measurable cost reductions that transform business cash flow. Companies that process $500,000 in monthly international transfers save $120,000 annually when they switch from SWIFT to XRP settlements, based on the $25 average SWIFT fee versus sub-penny XRP transaction costs. Manufacturing companies benefit from real-time international transactions, while service businesses see 60% faster client collection times when they offer XRP payment options.

Settlement Speed Creates Competitive Advantage

XRP’s 3-5 second settlement eliminates the capital burden that traditional banks create through multi-day float periods. Businesses that previously waited 3-5 business days for international wire confirmations now complete transactions instantly, which improves cash flow predictability and vendor relationships. Companies with global supply chains report stronger positions when they negotiate with suppliers who receive immediate payment confirmation, often they secure 2-3% early payment discounts that compound savings beyond transaction fee reductions.

Transaction Transparency Reduces Operational Overhead

The XRP Ledger provides complete transaction visibility through immutable records that eliminate reconciliation disputes and reduce overhead by 30-50% according to early adopters. Finance teams access real-time payment status updates instead of they call correspondent banks for wire transfer confirmations, which saves 5-10 hours weekly for businesses that process 50+ international payments monthly. This transparency creates audit trails that satisfy compliance requirements while it reduces the manual verification work that traditional banks require.

Cost Structure Analysis Shows Clear ROI

Payment processor fees range from 0.5% to 2.5% of transaction value for Ripple-based transfers, compared to 3-7% total costs for traditional international wires (these include correspondent bank fees, currency conversion spreads, and intermediary charges). Businesses that process over $100,000 monthly qualify for enterprise rates as low as 0.25%, which makes the economics compelling for mid-market companies. The break-even point occurs at approximately $50,000 monthly international payment volume, after which blockchain payments are 90% cheaper and savings accelerate substantially.

Implementation ROI Timeline

Most businesses see positive returns within 60-90 days after they implement Ripple payments. Companies that process high-volume international transactions recover their setup costs within the first month through reduced fees alone. The savings compound over time as businesses optimize their payment workflows and negotiate better terms with suppliers who prefer instant settlement options.

Final Thoughts

Ripple’s US expansion in crypto payments delivers measurable advantages through 3-5 second settlements, sub-penny transaction fees, and complete payment transparency. Companies that process $50,000+ monthly in international transfers achieve positive ROI within 60-90 days. Annual savings reach $120,000 for businesses that handle $500,000 in cross-border payments.

Implementation takes 2-3 weeks for account setup and basic API integration, but technical barriers remain lower than traditional correspondent bank relationships. US regulatory clarity after the SEC’s August 2024 case dismissal has accelerated institutional adoption and removed compliance uncertainty. The break-even point occurs at approximately $50,000 monthly payment volume, after which savings compound substantially.

We at Web3 Enabler help businesses integrate blockchain payment solutions seamlessly into existing Salesforce workflows. Manufacturing companies benefit from real-time supplier payments, while service businesses see 60% faster client collections when they offer XRP options. Start your Ripple payment integration today to capture these cost savings and operational efficiencies.