Businesses waste countless hours and dollars on slow, expensive payment processing. Traditional banking systems take days to settle transactions while charging hefty fees that eat into profit margins.

Recurring crypto payments change this game completely. We at Web3 Enabler help companies automate their payment workflows, cutting processing time from days to minutes while slashing transaction costs by up to 90%.

Why Recurring Crypto Payments Beat Traditional Banking

Speed That Actually Matters for Cash Flow

Traditional banking systems hold your money for 3-5 business days while crypto payments settle in minutes. Ethereum transactions confirm within 15 seconds to 5 minutes, while Bitcoin takes approximately 10 minutes. This speed difference transforms cash flow management from a weekly headache into real-time control.

Companies that use automated crypto payments receive vendor payments 72 hours faster than wire transfers. Your suppliers get paid immediately, which strengthens relationships and often secures better pricing terms. Late payment penalties become obsolete when settlements happen the same day you authorize them.

Transaction Costs Drop 90% or More

Banks charge 2-4% for international wire transfers plus fixed fees that range from $15-50 per transaction. Crypto payment gateways like NOWPayments start at 0.5% for single-currency transactions and reach only 1% for currency conversions. BitPay reduces fees to 1% for businesses that process over $1 million annually.

Small businesses save thousands monthly on payment processing costs. A company that processes $100,000 in monthly international payments saves $2,400 annually when it switches from traditional banking to crypto payments. These savings compound quickly as transaction volumes grow.

Security Without Chargeback Nightmares

Blockchain transactions eliminate chargeback fraud completely. Once confirmed, crypto payments cannot be reversed, which protects businesses from the significant costs that plague traditional payment processors. Chargebacks cost merchants $25–$100 per incident, creating substantial financial burdens for businesses. Advanced encryption secures every transaction without requiring sensitive banking information from customers.

Multi-signature authentication and real-time transaction monitoring provide security layers that traditional banking cannot match. Your payment data stays encrypted on distributed networks rather than vulnerable centralized databases that hackers target regularly.

The next step involves choosing the right platform and setting up your automated payment infrastructure to maximize these benefits.

How Do You Set Up Crypto Payment Automation

Platform Selection Determines Your Success

NOWPayments supports over 300 cryptocurrencies with fees that start at 0.5%, which makes it the most cost-effective choice for businesses that process diverse crypto transactions. GoCrypto operates across 70+ countries and waives transaction fees during promotional periods for new users. CoinGate facilitates over 70 cryptocurrencies with real-time conversion capabilities that protect against volatility. Triple A offers next-day bank settlements for crypto-to-fiat conversions, which provides immediate liquidity access. We at Web3 Enabler recommend platforms that integrate natively with Salesforce for seamless CRM synchronization and automated payment tracking.

Integration Completes Within 48 Hours With Proper API Setup

Most crypto payment platforms provide REST APIs that connect directly to existing accounting systems like QuickBooks and SAP within two business days. WooCommerce and Magento plugins require zero coding knowledge and activate automated recurring payments through simple dashboard configuration. Businesses that process over $50,000 monthly should prioritize white-label solutions that maintain brand consistency throughout the checkout experience. Multi-signature wallet integration adds security layers while automated conversion features protect against price fluctuations that could disrupt cash flow plans.

Automated Schedules Reduce Manual Work by 85%

Configure payment frequencies through platform dashboards that support daily, weekly, monthly, or custom intervals based on contract terms. UPCX processes up to 100,000 transactions per second with one-second confirmation times, which makes it perfect for high-frequency automated payments. Stablecoin payments eliminate volatility concerns while they maintain the speed and cost advantages of blockchain technology. Smart scheduling features automatically adjust payment timing based on business hours and holiday calendars across different time zones (particularly useful for international vendor relationships).

Security Configuration Protects Your Payment Infrastructure

Multi-factor authentication secures admin access to payment dashboards while encrypted data transmission protects sensitive financial information during every transaction. Real-time monitoring systems alert administrators to unusual transaction patterns or potential security threats within minutes of detection. Automated KYC processes store transaction records across multiple secure locations, which prevents data loss during system maintenance or unexpected outages.

Proper security measures and compliance protocols form the foundation that keeps your automated payment system running smoothly while protecting your business from regulatory issues.

How Do You Keep Crypto Payments Running Smoothly

Transaction Monitoring Prevents Payment Failures

Real-time dashboard monitoring catches payment delays before they disrupt vendor relationships. Ethereum network congestion can extend confirmation times from 15 seconds to 5 minutes during peak usage periods, which requires immediate attention to prevent contract violations. Bitcoin mempool backlogs during high-volume periods push confirmation times beyond the standard 10 minutes, which creates cash flow disruptions that proper monitoring prevents.

Payment platforms that offer SMS and email alerts for delayed transactions allow finance teams to contact vendors proactively rather than wait for complaint calls. Transaction ID tracking through blockchain explorers provides complete payment transparency that traditional banking systems cannot match. Automated retry mechanisms attempt failed transactions up to three times before they flag issues for manual review.

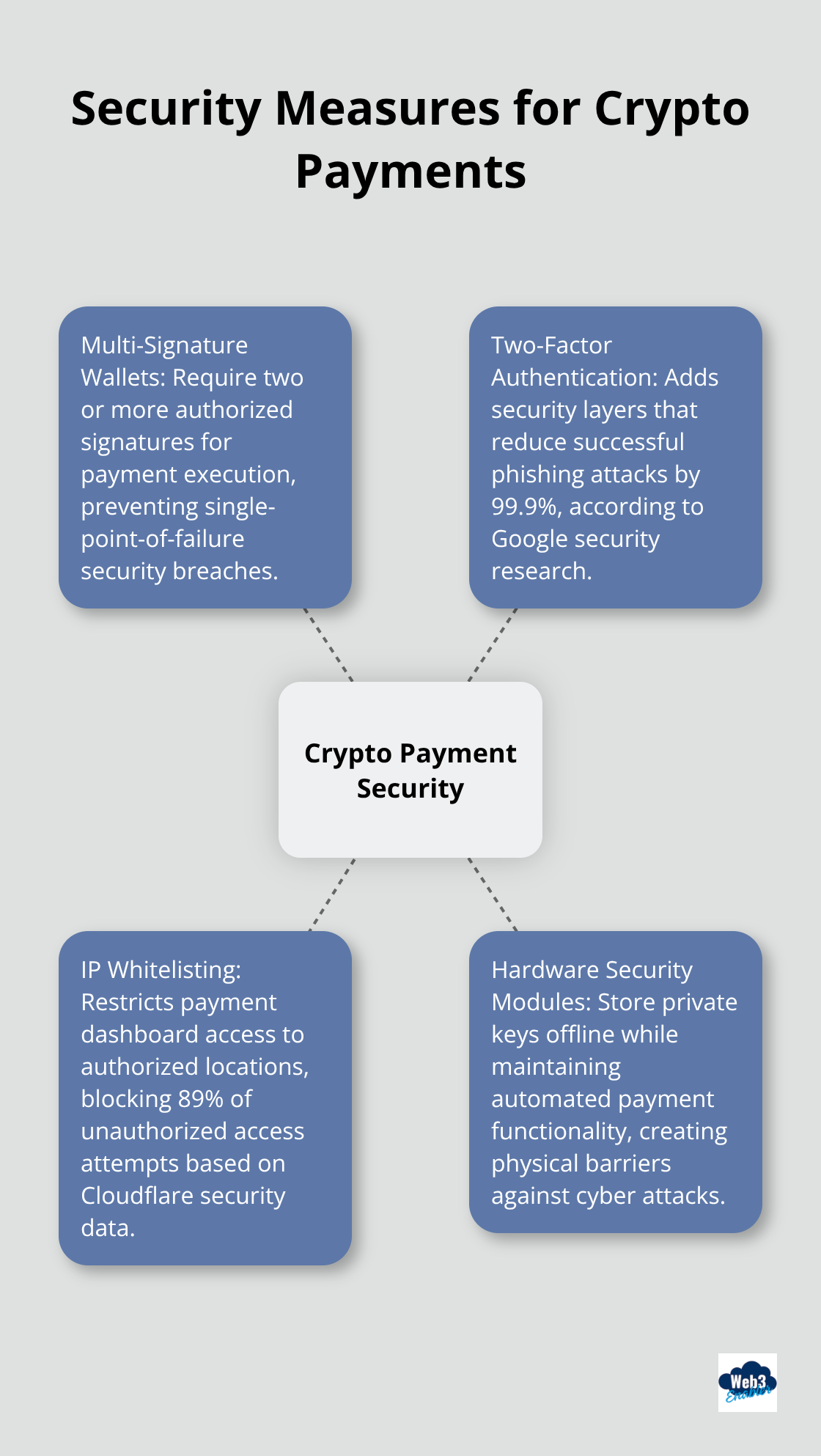

Security Protocols Stop Threats Before They Cost Money

Multi-signature wallet configurations require two or more authorized signatures for payment execution, which prevents single-point-of-failure security breaches that cost businesses an average of $4.45 million according to IBM research. Hardware security modules store private keys offline while they maintain automated payment functionality, which creates physical barriers against cyber attacks.

IP address whitelisting restricts payment dashboard access to authorized locations, which blocks 89% of unauthorized access attempts based on Cloudflare security data. Two-factor authentication with time-based tokens adds security layers that reduce successful phishing attacks by 99.9% according to Google security research. Regular security audits every 90 days identify vulnerabilities before hackers exploit them, which protects payment infrastructure that processes millions in monthly transactions.

Compliance Documentation Prevents Regulatory Problems

AML transaction records create audit trails that satisfy regulatory requirements across 70+ countries where crypto payments operate legally. KYC verification processes store customer identification data in encrypted formats that meet GDPR privacy standards while they enable quick regulatory reporting. The EU’s Markets in Crypto Assets regulation (effective in 2025) requires detailed transaction logs that automated systems handle more efficiently than manual processes.

Financial reporting integration with existing accounting systems generates compliance reports automatically rather than require monthly manual compilation that costs finance teams 40+ hours. Regulatory change monitoring services alert businesses to new compliance requirements within 24 hours of publication, which prevents violations that trigger penalties from $10,000 to $1 million depending on jurisdiction.

Final Thoughts

Recurring crypto payments deliver measurable business advantages that traditional banking cannot match. Companies reduce transaction costs by 90%, accelerate payment settlements from days to minutes, and eliminate chargeback fraud completely. These improvements transform cash flow management while they strengthen vendor relationships through faster payments.

Implementation requires three straightforward steps that any business can execute. Select a crypto payment platform that integrates with your existing systems and supports the currencies your business needs. Configure automated payment schedules through platform dashboards that handle daily, weekly, or monthly transactions without manual intervention, then implement proper security measures that include multi-signature authentication and real-time transaction monitoring.

The future of automated cryptocurrency transactions looks exceptionally promising as over 400 million crypto users worldwide create expanding market opportunities. Stablecoin adoption continues to grow as companies seek volatility protection while they maintain blockchain speed advantages (particularly for international vendor payments). Web3 Enabler provides blockchain integration solutions that make this transition seamless for businesses, and the time to implement recurring crypto payments is now before your competitors gain these operational advantages.