Paying someone in crypto doesn’t have to feel like defusing a bomb. One wrong move and your money vanishes into the digital void forever.

We at Web3 Enabler know that learning how to pay someone in crypto safely is the difference between smooth transactions and expensive mistakes. The good news? With the right knowledge, crypto payments are actually more secure than traditional methods.

What Crypto Should You Use for Payments

The crypto payment world splits into two camps: stablecoins and traditional cryptocurrencies. Stablecoins like USDT and USDC maintain predictable prices by pegging to the US dollar, which makes them the obvious choice for business transactions. Traditional cryptocurrencies like Bitcoin and Ethereum fluctuate wildly and turn a $100 payment into $85 or $115 by the time it arrives.

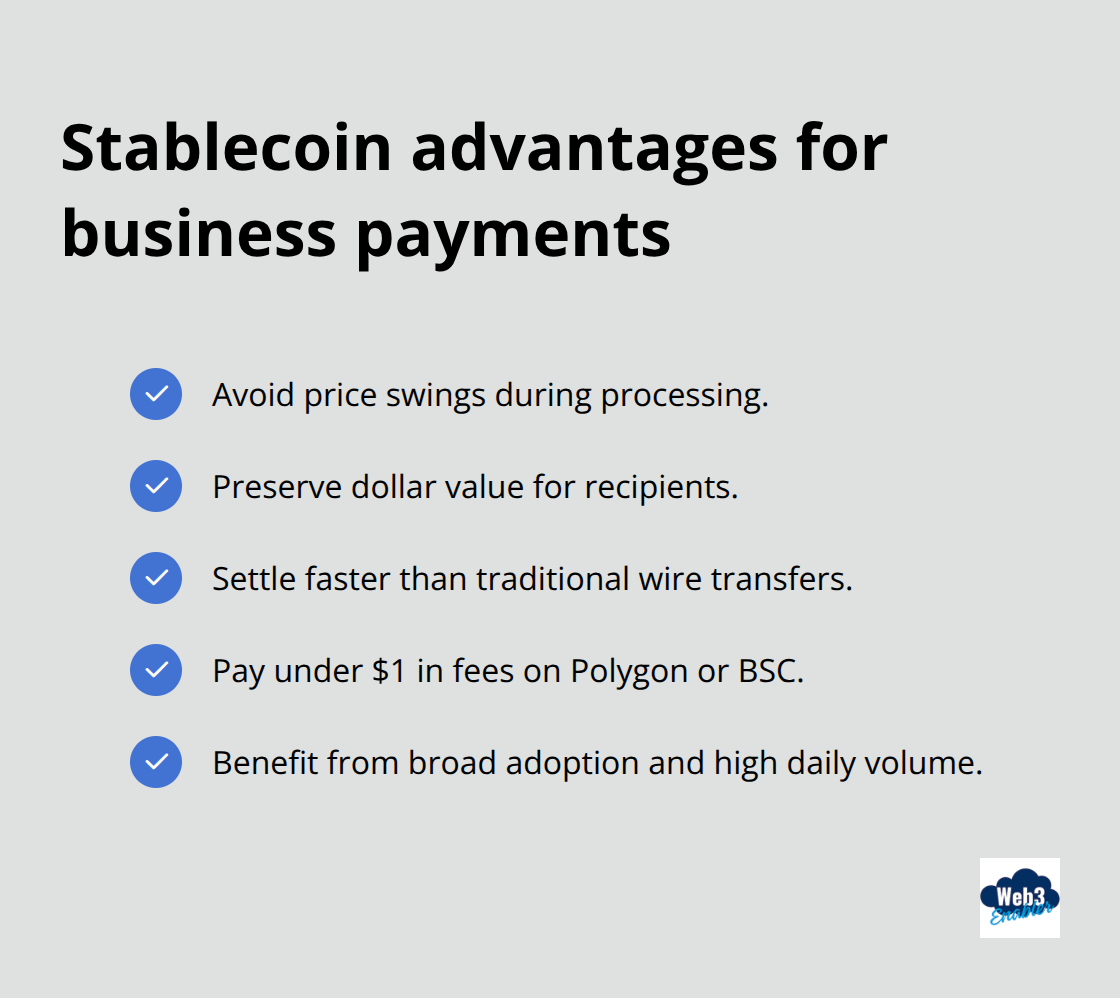

Pick Stablecoins for Predictable Payments

Smart businesses choose stablecoins for payments because volatility kills trust. When you send $1,000 in Bitcoin, the recipient might receive $950 worth due to price swings during transaction processing. USDT processes significant daily volume, which proves businesses prefer stability over speculation. USDC and RLUSD are the most regulated stablecoins. Ethereum-based stablecoins offer faster settlement than traditional wire transfers, while Polygon or Binance Smart Chain versions slash transaction fees to under $1.

Transaction Processing Works Differently Than Banking

Crypto transactions bypass traditional banking rails entirely. Your payment goes directly from your wallet to the recipient’s wallet through blockchain networks that operate 24/7. Bitcoin requires six confirmations for full settlement (taking roughly 60 minutes), while Ethereum transactions confirm in 2-15 minutes depending on network congestion. Gas fees fluctuate based on network demand, so you save money when you time your payments during low-traffic periods. The transaction becomes irreversible once confirmed, which eliminates chargeback fraud that costs merchants billions annually.

Choose Networks Based on Speed and Cost

Multi-chain wallets like Bitget Wallet let you optimize for different priorities. Ethereum offers maximum security but higher fees during peak times. Polygon provides sub-second transactions for under $0.01 (perfect for frequent payments). Binance Smart Chain balances speed and cost effectively. The key insight: match your network choice to your payment urgency and budget constraints rather than follow crypto hype.

Now that you know which crypto to use, the real challenge begins: how do you actually send it without losing your money to a simple mistake?

How Do You Send Crypto Without Losing It

Triple-check wallet addresses to save yourself from the most expensive typos in human history. People have lost hundreds of millions of dollars worth of Bitcoin by making simple mistakes like forgetting passwords or accidentally throwing away hard drives, and wrong address transfers account for a significant portion of these losses. Copy-paste errors happen more often than you think because wallet addresses contain 26-35 random characters that look identical to the human eye.

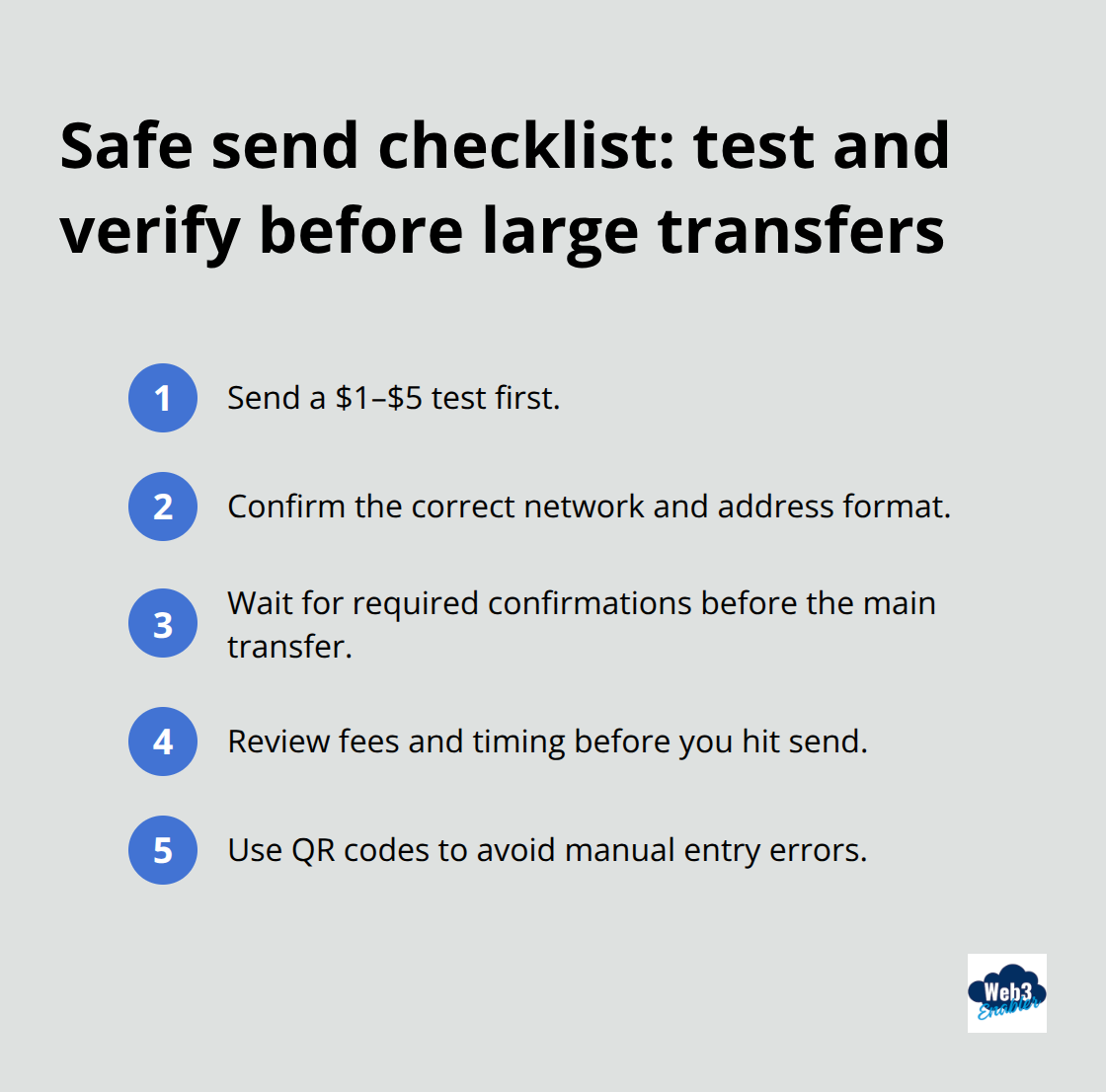

QR Codes Eliminate Manual Entry Mistakes

QR codes eliminate address entry risks entirely by encoding exact address data that your wallet app reads automatically. Crypto.com and Bitget Wallet both include QR code scanners that prevent manual entry mistakes, while blockchain explorers let you verify the recipient’s address before you hit send. Your phone camera does the heavy lifting while you avoid the stress of character-by-character verification.

Test Transactions Prevent Expensive Mistakes

Smart crypto users always send $1-5 test amounts before they transfer large sums, especially to new wallet addresses. This practice costs you an extra transaction fee but protects against catastrophic losses that happen when you send Bitcoin to an Ethereum address or choose the wrong network. Bitcoin transactions require six confirmations for full settlement (taking roughly 60 minutes), while Ethereum confirms in 2-15 minutes depending on network congestion.

Major exchanges like Coinbase and Binance recommend test transactions for amounts over $500 because transaction reversals are impossible once the blockchain confirms them. The FBI reported substantial increases in crypto-related fraud cases where victims lost funds through address verification failures that test transactions would have prevented.

Platform Security Beats Convenience Every Time

Choose exchanges and wallets based on security track records rather than flashy features or promotional offers. Regulated exchanges like Crypto.com and Coinbase maintain insurance funds and comply with KYC requirements that reduce fraud risks significantly. Digital wallets for businesses keep your private keys offline, making them immune to online attacks that have compromised hot wallets repeatedly.

Enable two-factor authentication on every crypto account because password breaches affect millions of users annually, while 2FA adds a critical security layer that stops unauthorized access attempts. Your extra 30 seconds of login time prevents hackers from draining your wallet in minutes.

Even with perfect security practices, crypto payments still have common pitfalls that catch experienced users off guard.

What Mistakes Can Destroy Your Crypto Payment

Wrong network selections cause permanent fund losses that make traditional banking errors look like minor inconveniences. You send USDT on Ethereum to a Binance Smart Chain address and create an irreversible mistake because the tokens arrive at an incompatible network where the recipient cannot access them. Crypto.com reports that network mismatches account for significant support tickets, while Bitget Wallet now displays prominent network warnings to prevent these costly errors.

Address verification failures happen when users send Bitcoin to Ethereum addresses or vice versa. The funds disappear forever into blockchain limbo. The FBI documented cases where businesses lost substantial amounts through simple copy-paste mistakes that changed a single character in wallet addresses.

Gas Fee Surprises Drain Your Budget

Transaction fees fluctuate wildly based on network congestion and turn a $10 payment into a $50 total cost during peak periods. Ethereum’s block gas limit recently increased to 60 million from approximately 36 million, allowing more transactions to be processed directly on the main network, while Bitcoin fees reached $40 during network congestion spikes.

Smart crypto users check current fee estimates before they send payments and switch to cheaper networks like Polygon or Binance Smart Chain when fees become unreasonable. Weekend transactions often cost less than weekday peaks when businesses process bulk payments.

Many users ignore mempool congestion data that predicts fee trends hours in advance. This leads to overpaid transactions or stuck transfers that take days to confirm.

Phishing Attacks Target Crypto Users Specifically

Scammers create fake wallet interfaces and exchange websites that capture private keys the moment users enter them. These attacks increased 40% according to recent security reports, with fraudsters who target crypto payment users through fake customer support channels and emergency fund recovery schemes.

Legitimate exchanges never ask for private keys through email or social media, while real wallet providers include official verification badges and SSL certificates. Check URLs carefully because scammers register domains with tiny character differences that fool quick glances.

You should enable two-factor authentication on every crypto account and bookmark official exchange URLs to avoid phishing sites that appear in search results.

Final Thoughts

Safe crypto payments require three core practices: select stablecoins for stable value, verify addresses with QR codes and test transactions, and choose regulated platforms that prioritize security. Businesses gain significant advantages when they learn how to pay someone in crypto correctly. Cross-border transfers complete in minutes instead of days, fees stay under $1 on efficient networks, and payments work around the clock without banking restrictions.

The $400 billion in lost Bitcoin demonstrates that security practices matter more than convenience features. Smart businesses start with small test transactions and build confidence through practice. Your team gains experience while you scale crypto payment operations gradually.

We at Web3 Enabler connect crypto payments with existing business systems through our blockchain solutions. Our platform supports stablecoin payments and compliance tracking within your current infrastructure. Contact us to explore how crypto payments can streamline your business operations.