Your CRM handles customer relationships beautifully, but what about their money? Traditional remittance systems are slow, expensive, and frankly, a bit outdated for today’s global business needs.

Your CRM handles customer relationships beautifully, but what about their money? Traditional remittance systems are slow, expensive, and frankly, a bit outdated for today’s global business needs.

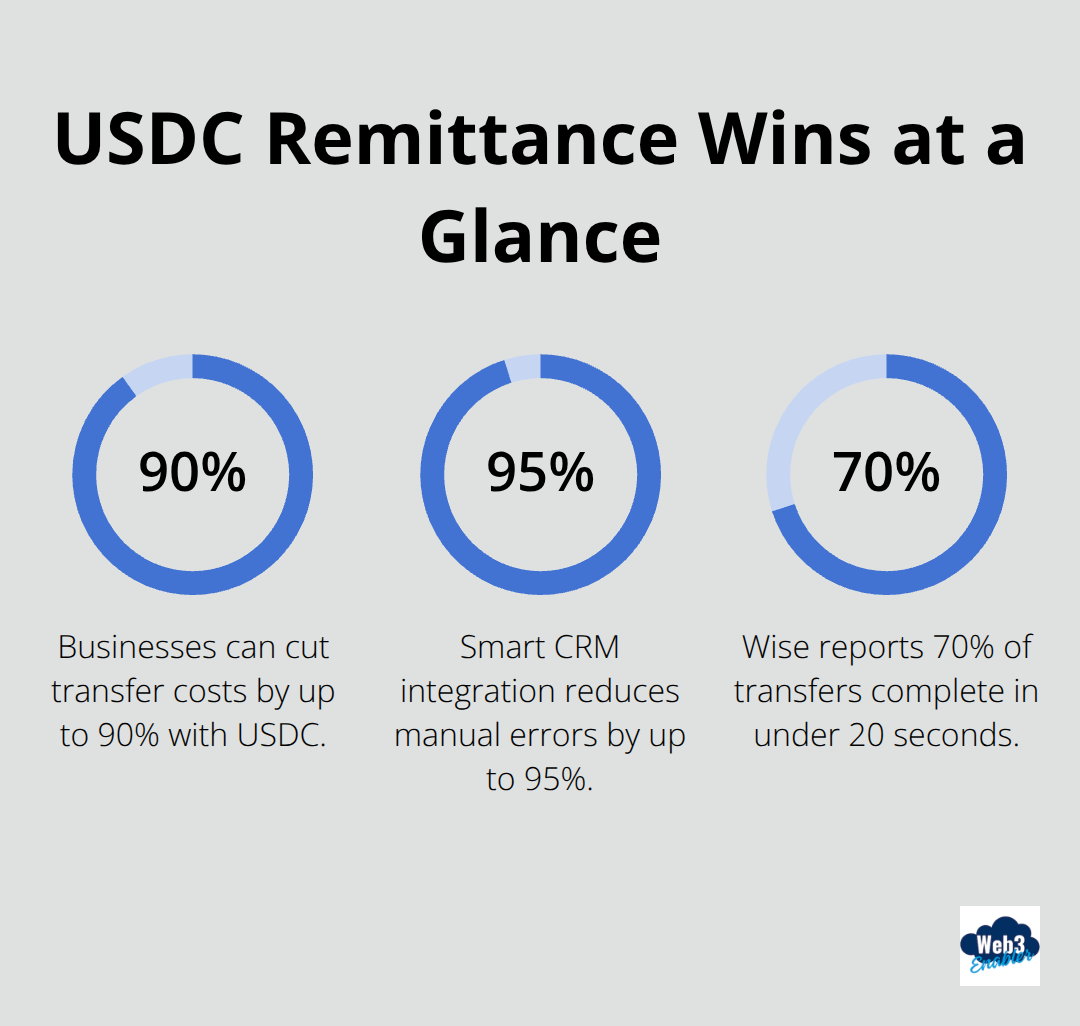

USDC remittance changes everything. We at Web3 Enabler see businesses cutting transfer costs by up to 90% while settling payments in minutes instead of days.

Ready to give your CRM some serious financial superpowers?

What Infrastructure Do You Need for USDC Remittances

Your CRM needs the right foundation to handle USDC transactions like a pro. Circle’s APIs and similar stablecoin payment networks provide enterprise-grade reliability that won’t let you down. Stablecoin trading reached $10.3 trillion in Q3 2025 with 99.9% uptime-that’s the kind of stability your business deserves.

Your CRM requires direct API integration with these networks, plus wallet infrastructure that handles both outbound and inbound USDC payments. Most businesses choose hosted wallet solutions over self-custody because nobody wants the nightmare of private key management (trust us on this one).

Compliance That Won’t Give You Headaches

Financial transactions demand automated KYC and AML monitoring built into every transaction flow. Platforms like Chainalysis provide real-time transaction monitoring with 99.5% accuracy in fraud detection, while services like Jumio handle identity verification in under 30 seconds.

Configure your CRM to automatically flag transactions above certain thresholds and maintain audit trails for every payment. The smart move is to embed these checks seamlessly into your existing customer onboarding process rather than create separate compliance workflows that slow everything down.

Customer Data Integration Done Right

USDC payments become powerful when they connect with your existing customer database. Map payment addresses to customer records, track transaction history alongside sales data, and automate reconciliation processes without breaking a sweat.

Your CRM should automatically update customer payment preferences, track outstanding invoices, and trigger payment confirmations. Smart integration means your sales team sees payment status in real-time without juggling multiple systems.

This approach reduces manual errors by up to 95% compared to traditional payment methods.

Now that your infrastructure foundation is solid, let’s explore why USDC remittances will transform how your business handles global payments.

Why USDC Remittances Beat Traditional Payments

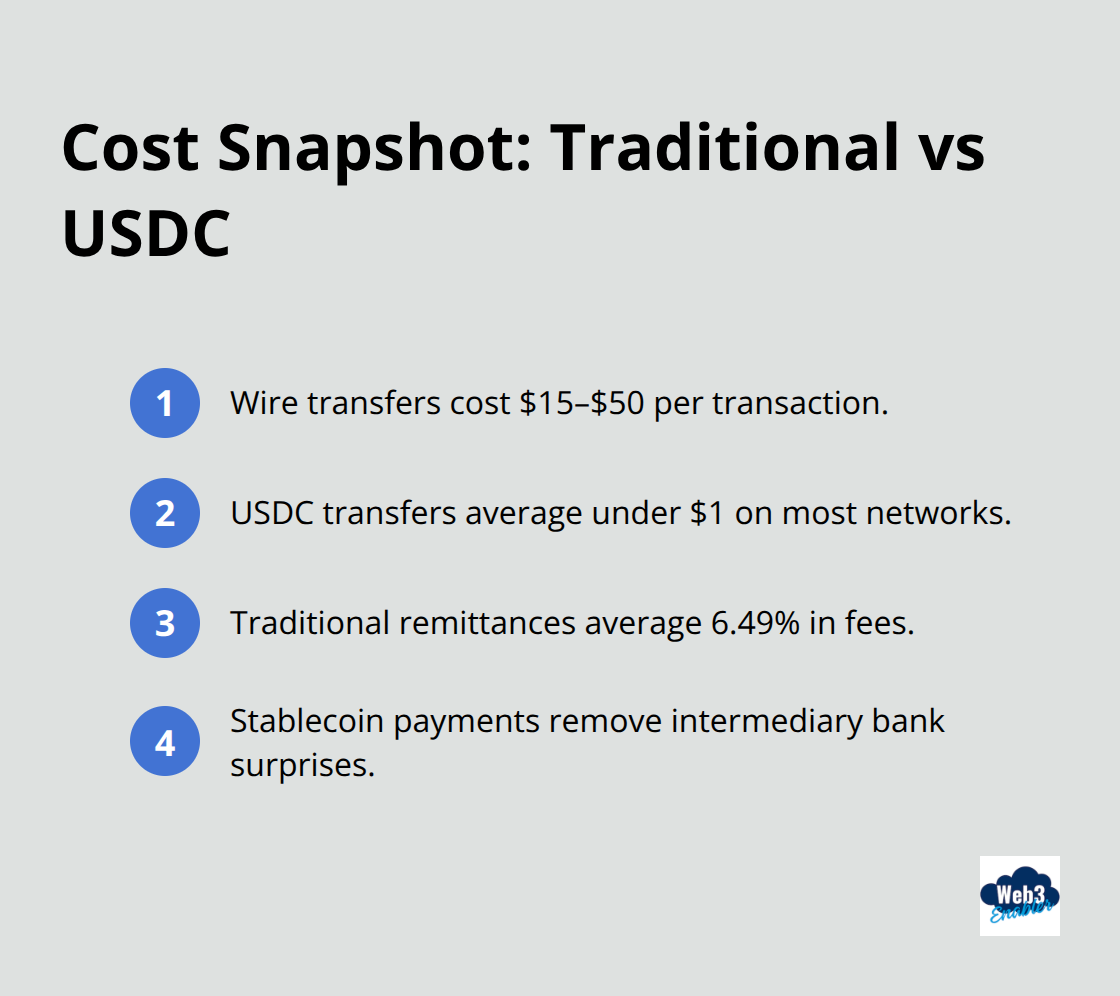

Traditional wire transfers cost businesses between $15-50 per transaction, while USDC transfers average under $1 on most networks. When businesses switch to stablecoin payments instead of correspondent banking, they can achieve significant cost reductions. Your accounting team will appreciate the predictable fee structure rather than surprise charges from intermediary banks.

Speed That Changes Everything

SWIFT payments require 3-5 business days for international transfers, but USDC settlements complete in seconds. Wise processes 70% of their transfers in under 20 seconds, and they still use traditional rails for fiat conversions. Pure USDC transactions eliminate banking delays entirely (your suppliers get paid instantly and your cash flow improves immediately).

Complete Transaction Visibility

Every USDC payment creates an immutable record on the blockchain with timestamp, amount, and wallet addresses. Your finance team can track payments in real-time without phone calls to banks or waiting for confirmation emails. Chainalysis provides 99.5% accuracy in transaction monitoring, which gives you complete audit trails that regulators actually appreciate.

This transparency reduces reconciliation time by up to 95% because disputed payments become virtually impossible when everything gets recorded permanently on-chain. Finance teams love this level of clarity (no more mystery fees or lost transfer details).

Operational Advantages That Stack Up

USDC payments integrate directly with your existing CRM workflows without the complexity of traditional banking partnerships. Companies with distributed teams benefit from lower costs when they pay international contractors through stablecoins rather than traditional remittance methods. Cross-border payments see even bigger improvements, with traditional remittances averaging 6.49% fees according to World Bank data, while stablecoins offer significantly lower costs.

Smart implementation strategies will help you maximize these benefits and avoid common pitfalls that trip up businesses new to stablecoin payments.

How Do You Execute USDC Remittances Flawlessly

Partner Selection That Actually Matters

Circle Business Account provides reliable USDC infrastructure with regulatory compliance across 190+ countries. Fireblocks offers institutional-grade custody with multi-signature wallets and insurance coverage up to $30 million per incident. SDK.finance delivers API-first integration that connects USDC payments directly to your CRM in under two weeks.

Skip the flashy startups that promise revolutionary features – established providers like these handle the boring stuff (compliance, security, uptime) so you can focus on growth. Your technology stack should include a primary payment processor, backup custody solution, and compliance monitor because single points of failure will cost you more than redundancy ever will.

Team Training Without the Drama

Your finance team needs hands-on training with actual USDC transactions, not theoretical blockchain workshops. Start with small test payments between internal wallets so everyone understands transaction confirmation times, fee structures, and error procedures.

Sales teams require wallet address verification training because one wrong character sends payments to digital oblivion with zero recovery options. Customer service representatives need clear escalation procedures for payment disputes and technical issues because blockchain transactions cannot be reversed like credit card payments. Most businesses complete comprehensive team training in 3-4 weeks with daily practice sessions rather than one-time seminars that people forget immediately.

Performance Optimization Through Data

Monitor transaction success rates, average confirmation times, and fee costs across different blockchain networks because Ethereum mainnet costs $15+ during peak congestion while Polygon averages under $0.01. Set up automated alerts for failed transactions, unusual fee spikes, and compliance flag triggers through platforms like Chainalysis that provide real-time dashboards.

Track customer payment preferences and optimize routes based on transaction amounts – smaller payments work better on Layer 2 networks while large transfers benefit from Ethereum mainnet security. Your CRM should automatically switch between networks based on transaction size and urgency because manual optimization wastes time and increases costs unnecessarily.

Final Thoughts

USDC remittance transforms your CRM from a simple customer database into a global payment powerhouse. Your business gains 90% cost savings, instant settlements, and complete transaction transparency while it eliminates banking delays that frustrate customers and suppliers alike. Start with a pilot program that uses established providers like Circle or Fireblocks.

Train your finance team on wallet management and compliance procedures before you roll out to your entire customer base. Most businesses see positive ROI within 60 days of implementation (the speed of adoption often surprises even skeptical CFOs). The long-term impact extends beyond cost savings as your CRM becomes the central hub for global operations.

Companies that adopt stablecoin infrastructure now position themselves ahead of competitors still wrestling with traditional banking limitations. We at Web3 Enabler provide Salesforce Native blockchain solutions that integrate USDC payments directly into your existing CRM workflows. Our tools support payments, compliance, and automation with backing from trusted partners, making implementation straightforward for businesses ready to modernize their global payment operations.