Your payment systems are probably talking to each other about as well as cats and dogs. Banks use one rail, fintech apps use another, and your customers are stuck juggling multiple platforms just to move money around.

Your payment systems are probably talking to each other about as well as cats and dogs. Banks use one rail, fintech apps use another, and your customers are stuck juggling multiple platforms just to move money around.

We at Web3 Enabler have watched this fragmentation cost businesses real money and real time. Interoperability in digital payments isn’t some distant dream-it’s the fix that’s actually available right now, and it works.

Why Your Payment Systems Are Stuck in Silos

The Fragmentation Reality

Right now, across your organization, money moves through at least three different payment systems that barely acknowledge each other’s existence. A customer pays via their bank account on one rail. Another pays through a digital wallet on a completely different one. Your accounts receivable team manually reconciles transactions across platforms because the systems refuse to talk.

This isn’t inefficiency-it’s expensive fragmentation, and it’s costing you more than you realize.

The numbers tell the story. Visa research shows only 50% of merchants have cross-border trade-compatible payment processing infrastructure, meaning half the business world still duct-tapes together payment solutions that were never designed to work together. When you operate across multiple payment rails without interoperability, you face duplicate infrastructure costs, longer settlement times, and manual workarounds that introduce errors and delay cash flow. A bank processing payments through traditional wire transfers, card networks, and real-time payment systems simultaneously runs three separate operations instead of one.

Why FedNow Matters (But Most Businesses Miss It)

The FedNow system connected over 1,300 financial institutions by March 2025 according to the Federal Reserve, existing precisely because the old fragmented approach was killing efficiency. Yet most businesses haven’t integrated it into their workflows, meaning they still wait days for settlements that could happen in minutes. This gap between available technology and actual adoption represents billions in lost productivity across the economy.

The Customer Experience Problem

Your customers feel this friction constantly. They expect to pay however is convenient for them-whether that’s a card, a wallet, a bank transfer, or a stablecoin-and have it work instantly. Instead, they encounter payment failures, delayed confirmations, and the need to maintain accounts across multiple platforms just to do business with you. When a customer’s preferred payment method doesn’t work on your platform, they don’t blame the technical infrastructure. They blame you and move to a competitor who accepts more payment types.

How Blockchain Actually Solves This

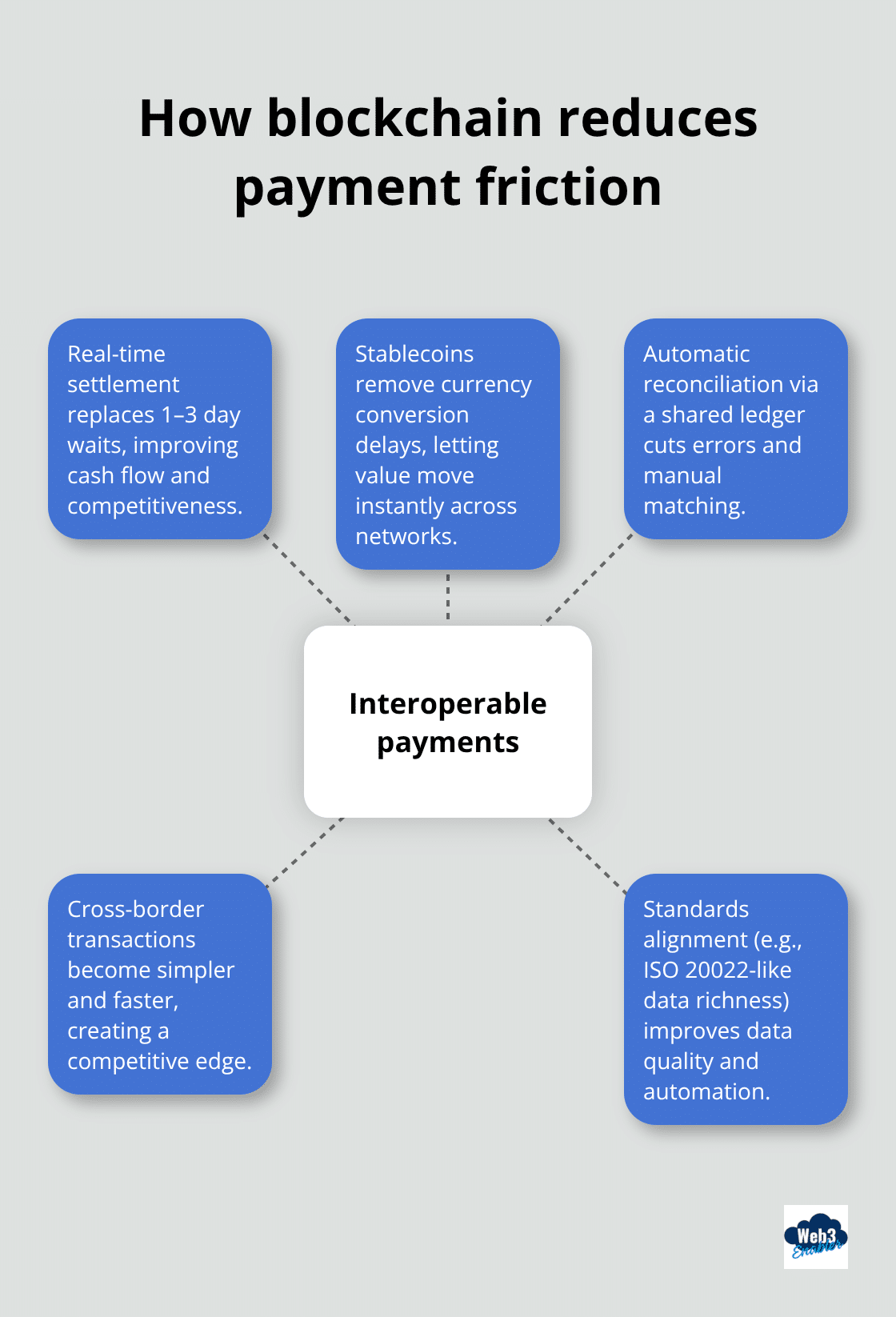

Here’s where blockchain-native solutions actually solve a real problem instead of creating hype. Unlike traditional payment rails built in isolation, blockchain infrastructure is fundamentally designed for interoperability. Multiple parties settle transactions on the same network without a central intermediary controlling access. Stablecoins like USDC and USDT move across different blockchains and payment systems, giving you a universal denominator for value transfer that works across borders without currency conversion delays.

When you build on blockchain infrastructure, you choose a foundation that connects incompatible systems rather than choosing between them. This is where the real opportunity sits-not in replacing your existing payments stack, but in extending it with interoperable rails that your customers and partners already understand.

How Blockchain Removes Payment Friction

Settlement Speed That Actually Matters

Blockchain infrastructure works differently from traditional payment rails because it was built for interoperability from day one. Instead of banks and fintechs each maintaining separate systems that require middlemen to translate between them, blockchain creates a shared ledger where multiple parties settle transactions directly. This architectural difference matters in practice. When you move money through traditional rails, settlement happens on someone else’s schedule-usually 1 to 3 business days. When you use blockchain-based stablecoins like USDC, settlement happens in seconds, regardless of whether you’re paying someone across the street or across a continent. The Federal Reserve’s FedNow system connected over 1,300 institutions by March 2025 specifically because real-time settlement was becoming non-negotiable for competitive businesses.

Stablecoins Remove Currency Conversion Headaches

Stablecoins achieve speed by removing currency conversion friction entirely. Instead of converting dollars to euros and back again, a stablecoin maintains a fixed value against the underlying currency and moves instantly across any blockchain that supports it. This means a business operating in multiple countries can accept payments in one stablecoin and settle instantly without waiting for forex conversion or navigating multiple payment processors. A merchant using traditional wires, SWIFT transfers, and card networks simultaneously maintains three separate payment operations with three separate fee structure. A blockchain-based approach consolidates these into one rail, cutting infrastructure costs while improving settlement speed.

Reconciliation Becomes Automatic, Not Manual

Blockchain networks eliminate the reconciliation nightmare that plagues fragmented systems. When transactions settle on a shared ledger rather than across incompatible databases, your finance team stops manually matching transactions across platforms. You get a single source of truth for payment status, which means faster cash flow visibility and fewer errors.

Smart contracts automate this further by executing conditional payments automatically-if goods ship, payment releases; if conditions aren’t met, funds remain locked. This removes the manual intervention that currently causes delays in business-to-business payments. The ISO 20022 messaging standard, which the Federal Reserve adopted for Fedwire in 2025, addresses this same problem on traditional rails, but blockchain networks already operate with this level of data richness built in.

Cross-Border Payments Gain a Real Competitive Edge

For cross-border payments specifically, blockchain interoperability becomes a competitive advantage. Businesses that accept stablecoins alongside traditional payment methods consistently outperform competitors who stick exclusively to legacy rails. This is why the real opportunity sits not in replacing your existing payments stack, but in extending it with interoperable rails that your customers and partners already understand. The next step involves figuring out how to actually integrate these capabilities into your current infrastructure without disrupting operations.

Building Your First Interoperable Payment Integration

The gap between knowing blockchain solves interoperability and actually implementing it is where most businesses get stuck. The good news is that you don’t need to rip out your existing payment infrastructure or hire a blockchain engineering team. What you need is a practical integration strategy that layers interoperable rails onto systems you already operate.

Map Your Current Payment Friction Points

Start with your current payment flows: which systems handle inbound customer payments, which handle outbound disbursements, and where manual reconciliation currently happens. This audit reveals your highest-friction points. If your accounts receivable team spends hours matching transactions across bank portals, wallet platforms, and payment processor dashboards, that’s your first integration target. Stripe, for example, supports stablecoin payments with fiat settlement directly into your Stripe balance, meaning you accept USDC without maintaining separate crypto infrastructure. This approach lets you test interoperable rails with minimal operational disruption. FedNow connected 1,300+ institutions by March 2025 precisely because banks recognized that real-time settlement capability became table stakes for competitive advantage. Your business faces the same reality: customers increasingly expect faster settlement and broader payment method acceptance. Start small with a single interoperable payment rail rather than attempting to rebuild your entire stack simultaneously.

Select the Right Blockchain Foundation

Not all blockchain networks and stablecoin options deliver equivalent interoperability benefits. USDC and USDT operate across multiple blockchains, which matters because it means your customers can pay from whichever network they already use without forcing them to bridge assets or switch platforms. The Federal Reserve’s adoption of ISO 20022 messaging for Fedwire in 2025 created a data richness standard that blockchain networks already support natively. This alignment means your blockchain integration naturally positions you ahead of competitors still waiting for legacy systems to catch up. When evaluating providers, prioritize those with Salesforce integration capabilities because your finance and sales teams already live in Salesforce. A practical approach involves selecting a stablecoin that operates on multiple networks and a payment provider with existing integrations into your current systems rather than forcing you to rebuild everything. This reduces implementation complexity and lets you move from pilot to production within weeks instead of months. Your choice of partners determines whether interoperability becomes a competitive advantage or another infrastructure headache.

Align Your Partnerships Around Shared Rails

Interoperability only works when your partners adopt the same rails. This means selecting payment providers and networks where your key customers and vendors already operate or are actively moving toward. Visa Direct expanded its real-time disbursement capabilities in October 2024 to support higher-value payouts for insurance, payroll corrections, and gig economy earnings, signaling that traditional payment networks themselves now compete on interoperability speed. Your vendor contracts should explicitly address payment method flexibility and settlement timeline expectations. If your suppliers still require wire transfers with 3-5 day settlement, you’ve found a partnership opportunity to modernize their infrastructure alongside yours. The practical step involves reaching out to your top 10 customers and vendors with a simple question: which payment methods do they actually prefer, and how fast do they need settlement? Their answers reveal which interoperable rails deliver immediate business value. Businesses accepting stablecoins alongside traditional methods consistently report faster cash flow and lower payment failure rates compared to competitors offering limited payment options. This competitive advantage compounds because faster settlement improves working capital and frees up resources for growth. Your integration strategy should prioritize partnerships where interoperability delivers mutual benefit rather than forcing adoption where it creates friction.

Final Thoughts

Interoperability in digital payments isn’t coming someday-it’s here now, and businesses that ignore it lose ground every day. The fragmentation you’ve tolerated for years (multiple payment rails, manual reconciliation, settlement delays) has real alternatives available today. Blockchain-based solutions deliver what legacy systems promised but never managed: instant settlement, universal value transfer, and payment systems that actually talk to each other without intermediaries translating between them.

The competitive advantage belongs to businesses moving first. When you accept stablecoins alongside traditional payments, your cash flow improves immediately. When you settle in seconds instead of days, your working capital works harder. When your customers pay however they prefer, they stop abandoning carts and switching to competitors, and these measurable improvements show up directly in your financial statements.

The practical path forward doesn’t require abandoning your existing infrastructure-you layer interoperable rails onto systems you already operate, starting with your highest-friction payment processes. We at Web3 Enabler help businesses make this transition without complexity through Salesforce-native solutions that connect blockchain technology directly to your existing corporate infrastructure, letting you accept stablecoin payments, send global payments faster, and gain visibility into payment flows all within the systems your teams already use.

Frequently Asked Questions: Interoperability in Digital Payments

What is interoperability in digital payments?

Interoperability in digital payments means different payment systems and rails can exchange value and payment data seamlessly, without manual workarounds. In practice, it allows businesses to accept and send payments across cards, bank transfers, digital wallets, and blockchain rails while keeping reporting, settlement status, and reconciliation consistent in one workflow.

Why do payment systems get stuck in silos?

Most organizations run multiple payment rails that were built independently. Bank transfers, card networks, wallet providers, and cross-border systems often use different settlement timelines and data formats, which forces teams to reconcile transactions manually and manage multiple dashboards just to understand cash flow.

How does interoperability reduce payment costs and operational overhead?

Interoperability reduces duplicate infrastructure and the time your teams spend on reconciliation, exceptions, and payment investigations. When payment status and transaction data are standardized and visible in one place, businesses can cut failed payments, speed up settlement, and improve working capital visibility.

How does blockchain improve interoperability in payments?

Blockchain improves interoperability by providing a shared settlement layer where multiple parties can move value and verify payment status without relying on disconnected databases. Stablecoins can function as a “universal denominator” for transferring value across borders and platforms, helping reduce friction caused by currency conversions and multi-rail handoffs.

Do stablecoins replace cards, ACH, and wire transfers?

No. For most businesses, stablecoins work best as an additional interoperable rail, not a full replacement. The goal is to layer stablecoin settlement into your existing payment stack so customers and partners can pay how they prefer, while your internal teams keep consistent reporting and reconciliation.

What’s the difference between interoperability and real-time payments?

Real-time payments focus on faster settlement speed, while interoperability focuses on systems being able to work together across rails and providers. A modern payment strategy often uses both: real-time rails for speed and interoperable rails for broader payment method support and simpler operations.

How do FedNow and ISO 20022 relate to payment interoperability?

FedNow supports faster settlement in the U.S., which helps businesses reduce delays tied to banking hours and multi-day settlement windows. ISO 20022 is a messaging standard that improves payment data consistency, making it easier to automate reconciliation and reporting. Together, they reflect the broader industry push toward faster, richer, and more compatible payment workflows.

What are the first steps to achieve interoperability in our business?

Start by mapping where payment friction happens today: inbound methods, outbound disbursements, settlement delays, and reconciliation bottlenecks. Then pilot one interoperable rail (often stablecoin acceptance or stablecoin payouts) in a high-friction workflow, and measure improvements in settlement time, exceptions, and reconciliation effort before expanding.

How do we choose the right stablecoin and network for interoperability?

Businesses often prioritize stablecoins that are widely supported and easy for partners to use. Network selection depends on fees, settlement speed, reliability, and where your customers already operate. The best choice is the combination that minimizes cost and friction while meeting internal compliance and treasury requirements.

How does Web3 Enabler help implement interoperable payments in Salesforce?

Web3 Enabler brings blockchain payment capabilities into Salesforce so teams can manage payment activity alongside customer, vendor, and compliance records. This reduces context switching across portals and explorers, and helps create cleaner audit trails and reporting from a single system your teams already use.