Your customers are asking for it, and your competitors are already doing it. Crypto payments aren’t just a trend anymore – they’re becoming table stakes for forward-thinking businesses.

We at Web3 Enabler see companies boosting their bottom line with lower fees and faster settlements. Learning how to accept crypto payments might seem intimidating, but it’s simpler than you think.

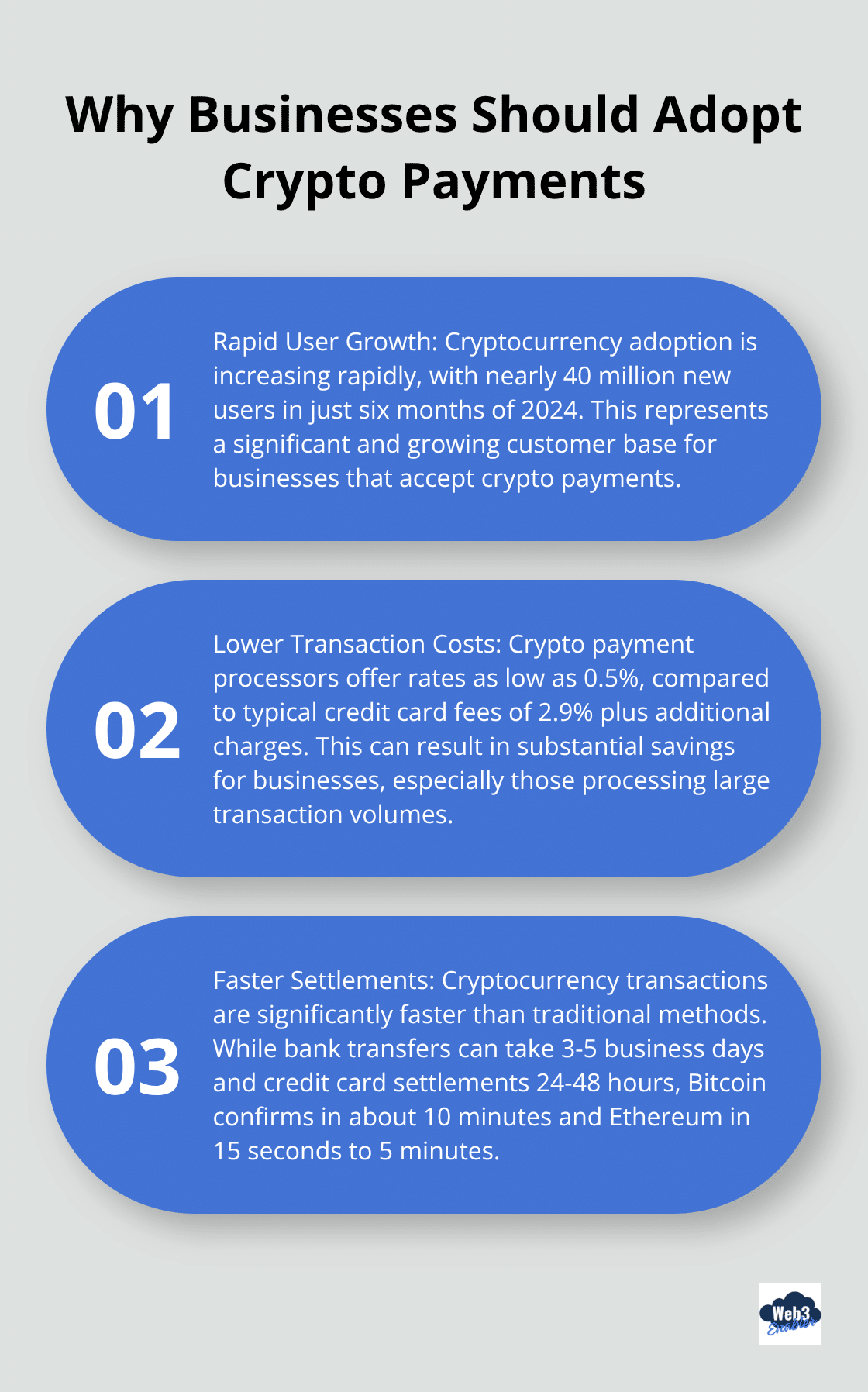

Why Smart Businesses Switch to Crypto Payments

The numbers don’t lie. Cryptocurrency adoption continues growing rapidly, with user numbers increasing by nearly 40 million in the second half of 2024 alone, yet most businesses still ignore this demand. Your customers already use crypto – they just spend it elsewhere. Companies that accept Bitcoin and Ethereum report they attract tech-savvy consumers who spend more and show stronger brand loyalty than traditional payment users.

Transaction Costs That Actually Make Sense

Credit card processors typically charge 2.9% plus fees and eat into your margins with every swipe. Crypto payment processors offer rates as low as 0.5%, with some solutions that charge zero fees entirely. A boutique retailer that processes $50,000 monthly saves over $1,200 annually just by switching to crypto payments. These aren’t theoretical savings – they hit your bottom line immediately.

Speed That Changes Everything

Traditional payments crawl at a snail’s pace. Bank transfers take 3-5 business days, credit card settlements drag on for 24-48 hours. Bitcoin transactions confirm in roughly 10 minutes, while Ethereum processes in 15 seconds to 5 minutes. Stablecoins like USDC achieve near-instant settlement. A digital marketing agency switched to stablecoins for international clients and eliminated the week-long delays they faced with bank transfers. Cash flow problems become ancient history when payments arrive in minutes instead of days.

Global Reach Without Banking Headaches

Crypto payments work everywhere blockchain exists (which is everywhere). No more international banking fees, currency conversion nightmares, or customers whose banks block overseas transactions. Countries like El Salvador officially recognize Bitcoin as legal tender, while other nations rapidly develop clear regulatory frameworks. Your business can serve customers in regions where traditional card systems fail and expand your market without the usual banking bureaucracy.

The benefits are clear, but implementation matters more than theory. The right setup determines whether crypto payments become your competitive advantage or just another headache.

How Do You Actually Set Up Crypto Payments

Skip the payment processor middleman and connect directly to your customers’ wallets. Non-custodial processors like Blockonomics, Payscrypt, and Bitrequest let you receive funds straight into your own wallet. This approach cuts out third-party risks and reduces fees to nearly zero. Direct wallet integration takes under 10 minutes to set up – create an account, verify with minimal information, and generate your first payment QR code. Test the system with just $1 USDT to yourself to verify everything works before you go live.

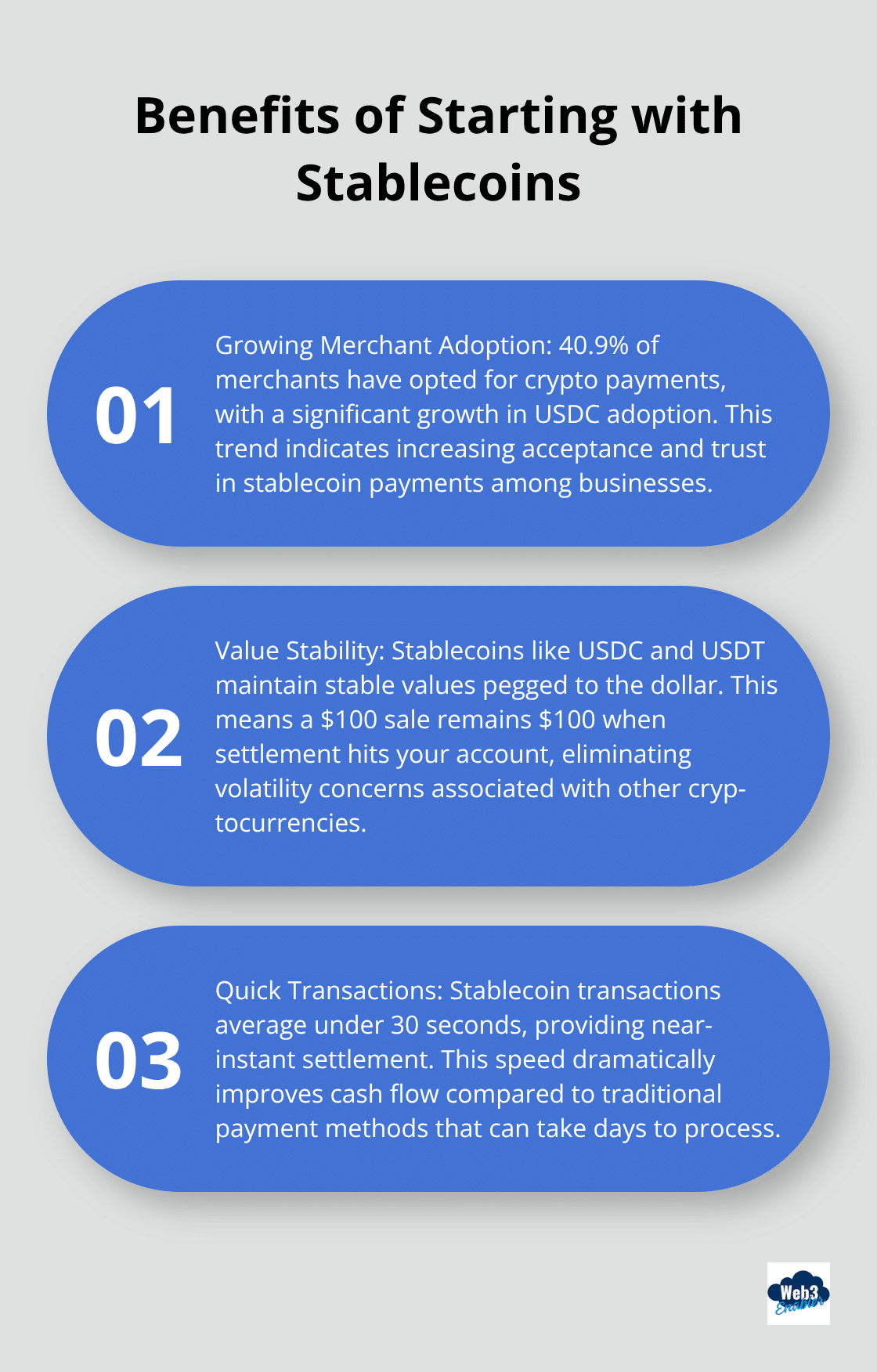

Start with Stablecoins Only

Forget Bitcoin volatility headaches. USDC and USDT maintain stable values pegged to the dollar, so your $100 sale stays $100 when settlement hits your account. 40.9% of merchants opted for crypto payments with significant growth in USDC adoption, and transaction times average under 30 seconds. Smart businesses focus exclusively on stablecoins for their first six months of crypto acceptance. Shopify and WooCommerce offer free plugins that automatically enable stablecoin checkouts (no code required).

Integration Takes Minutes Not Months

Modern crypto payment systems plug directly into your existing e-commerce platform faster than you can brew coffee. Install the plugin, paste your wallet address, and activate stablecoin payments. Your checkout page instantly displays crypto options alongside credit cards. Payment systems automatically convert received crypto to fiat if needed, which protects against any price swings. Multi-factor authentication on your crypto wallet prevents unauthorized access, while your existing software continues to track all transactions normally.

Test Before You Launch

Small transactions reveal big problems before they cost you customers. Send yourself a test payment of $5 USDC to verify your wallet receives funds correctly. Check that your e-commerce platform displays the correct payment amounts and confirms transactions properly. Generate QR codes for in-person payments and test them with your smartphone wallet app. This 15-minute test run saves hours of customer support headaches later.

The technical setup is straightforward, but compliance and staff preparation separate successful implementations from costly mistakes.

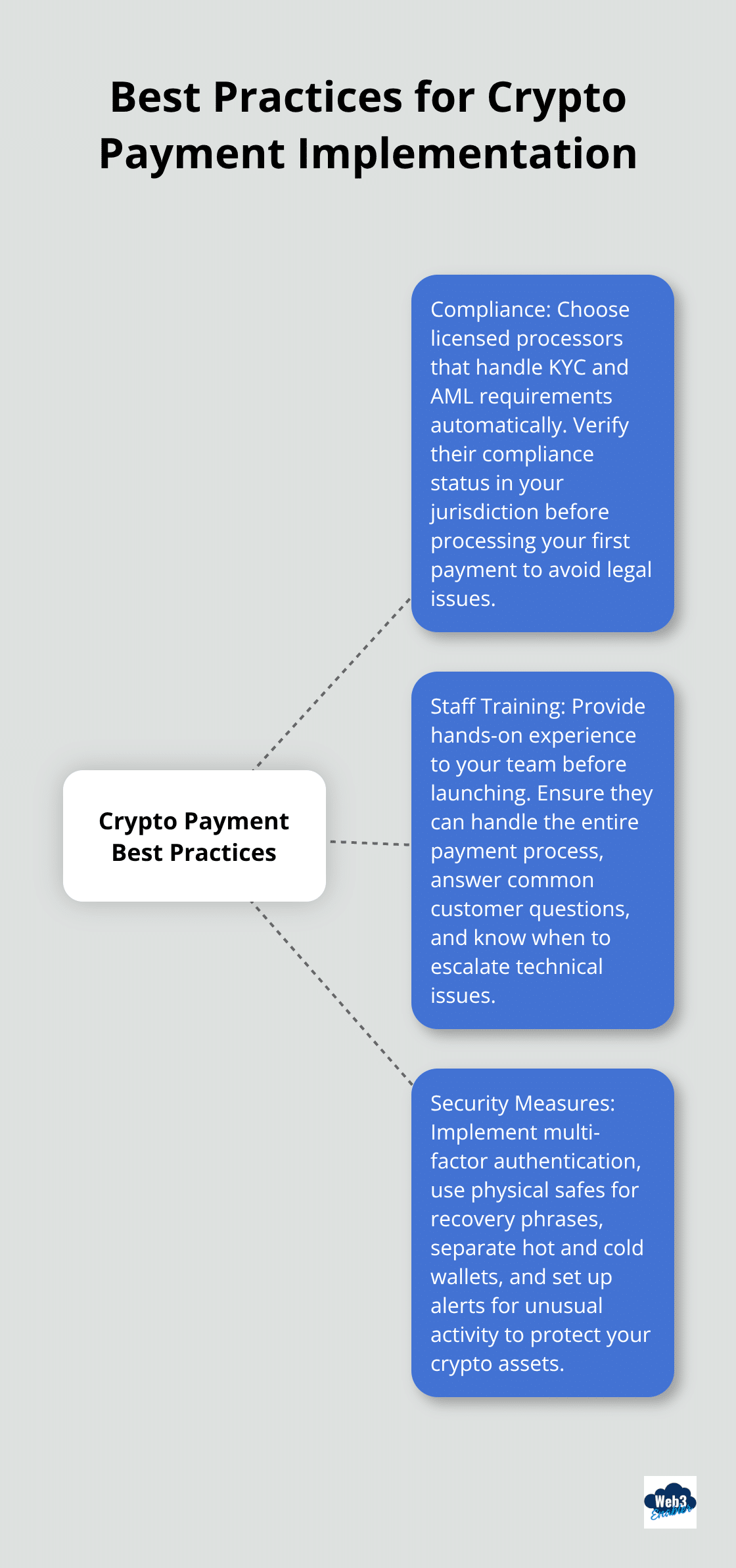

Best Practices for Crypto Payment Implementation

Choose Licensed Processors for Automatic Compliance

Regulatory compliance starts with licensed payment processors that handle Know Your Customer and Anti-Money Laundering requirements automatically. The EU’s Markets in Crypto Assets regulation requires businesses to verify customer identities and report suspicious transactions. Licensed providers regulated under MiCA frameworks manage these obligations for you, but you must verify their compliance status in your specific jurisdiction before you process your first payment. Unregulated processors expose your business to legal conflicts and customer trust issues that cost more than any fee savings. Treat cryptocurrency earnings as regular income for tax purposes in the US and EU (this simplifies reporting requirements and prevents compliance headaches later).

Train Your Staff Before Customers Arrive

Your team needs hands-on experience with crypto payments before customers show up. Walk through the entire payment process from QR code generation to wallet confirmation with each staff member. Train them to recognize common customer questions about transaction times, wallet compatibility, and confirmation requirements. Create a simple customer guide that explains how to pay with crypto and have staff practice explaining it clearly. When technical issues arise, staff should know exactly when to escalate to technical support versus handle simple troubleshooting themselves. Most payment gateway providers offer dedicated customer support teams, but your staff represents the first line of defense against confused customers.

Implement Security Measures That Actually Work

Multi-factor authentication on your crypto wallet prevents unauthorized access attempts. Store wallet recovery phrases in physical, fireproof safes rather than digital storage that hackers can compromise. Separate your hot wallet for daily transactions from cold storage for larger amounts. Implement strong security protocols to protect your crypto assets through multi-signature wallets and regular security audits. Keep only what you need for immediate operations in the active wallet. Monitor transactions daily through your payment gateway dashboard and set up alerts for unusual activity patterns. Payment forwarding systems automatically convert received crypto to fiat currency within minutes, which eliminates exposure to price volatility and reduces the window for potential security breaches.

Final Thoughts

Crypto payments deliver measurable benefits that traditional processors can’t match. Lower fees save thousands annually, instant settlements improve cash flow, and global reach expands your customer base without banking restrictions. The implementation process takes minutes rather than months when you choose the right tools and focus on stablecoins first.

USDC eliminates volatility concerns while it maintains all the speed and cost advantages of crypto payments. Licensed processors handle compliance automatically, staff training prevents customer confusion, and proper security measures protect your assets. The technical barriers that once made crypto payments complex have disappeared completely.

Companies that master how to accept crypto payments position themselves ahead of competitors who still rely on outdated payment systems. We at Web3 Enabler help businesses integrate Salesforce Native blockchain solutions that connect seamlessly with existing corporate infrastructure. Start with a single stablecoin, test thoroughly, and expand gradually as your team gains confidence with the new payment methods.