Move over, traditional banking – there’s a new kid on the block(chain)! Stablecoins are shaking up the B2B payment scene faster than you can say “cryptocurrency.”

At Web3 Enabler, we’re seeing stablecoin adoption skyrocket among businesses looking to ditch those pesky transaction fees and snail-paced settlements. Ready to find out how these digital dynamos are revolutionizing the way companies pay each other? Buckle up, because we’re about to take you on a wild ride through the world of stablecoins in B2B payments.

What Are Stablecoins and Why Should You Care?

Stablecoins 101: Digital Money That Behaves

Stablecoins are the cool kids of the crypto world – they’re like digital dollars that don’t go on wild rollercoaster rides. More businesses ditch their dusty old payment methods for these sleek new tokens. But what’s the big deal?

Think of stablecoins as the responsible adults at the crypto party. They’re cryptocurrencies, but they’re tied to real-world assets like good ol’ US dollars or gold. This means they don’t go on crazy price benders like Bitcoin after too many espressos.

The most popular stablecoins, like Tether (USDT) and USD Coin (USDC), are pegged to the US dollar. For every token in circulation, there’s supposedly a dollar tucked away in a bank account somewhere. It’s like having a digital twin of your money, but way cooler and more useful for zapping payments around the globe.

Why Businesses Fall Head Over Heels for Stablecoins

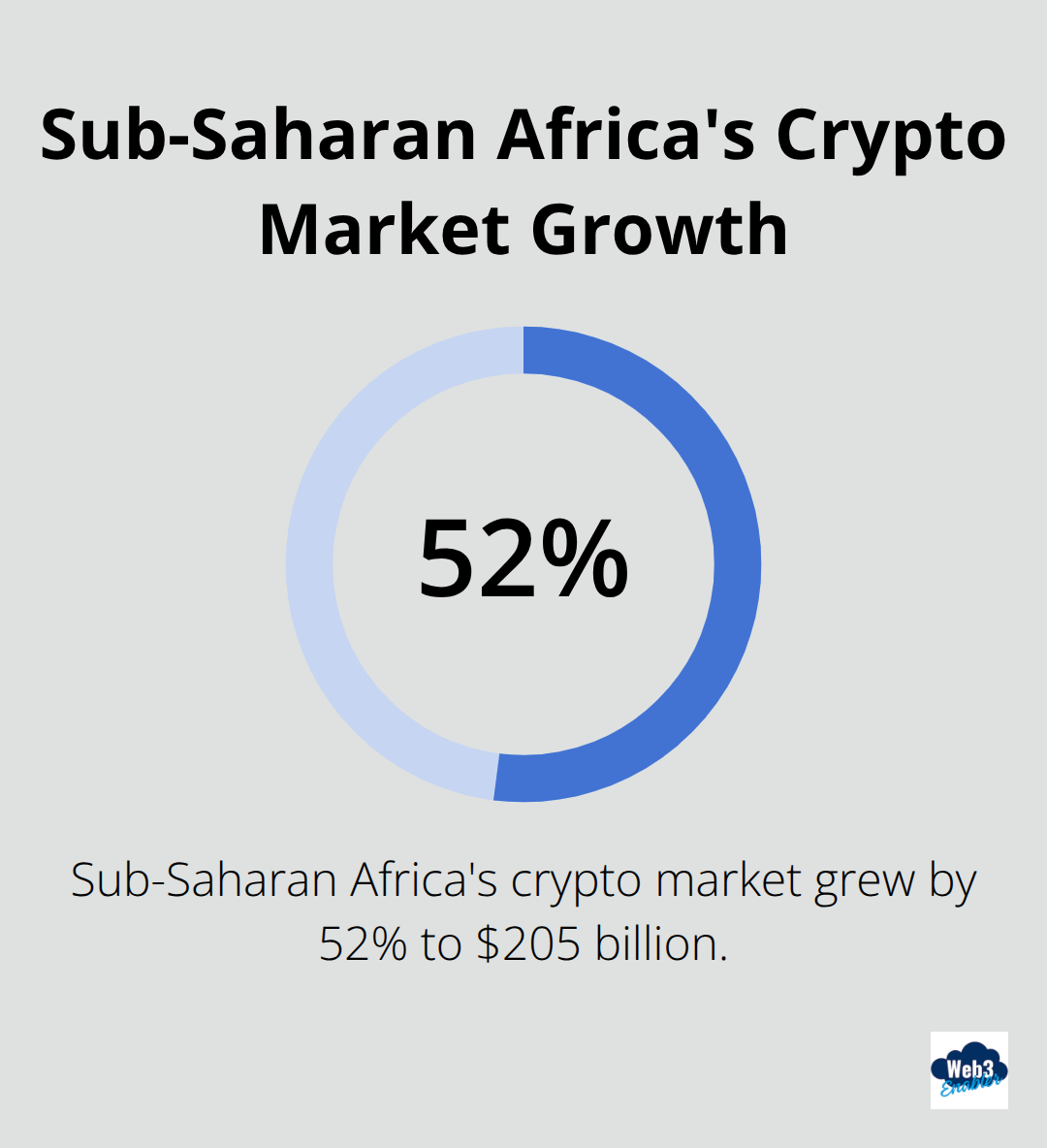

Businesses aren’t just flirting with stablecoins – they’re in a full-blown love affair. Recent analysis shows that Sub-Saharan Africa’s crypto market grew by 52% to $205 billion, driven by retail transactions. It’s the third fastest-growing region globally. Why? Because they solve real problems:

- Speed demon payments: Say goodbye to those three-day bank transfers. Stablecoins move at the speed of the internet.

- 24/7 availability: No more waiting for banks to open. Stablecoins never sleep (just like that one coworker who’s always online).

- Lower fees: Traditional wire transfers can cost up to $50. Stablecoin transfers? Often less than a dollar. Ka-ching!

The Big Players in the Stablecoin Game

The stablecoin market heats up faster than a summer sidewalk. Here are the heavy hitters:

- Tether (USDT): The OG of stablecoins, with a market cap of over $80 billion as of September 2023.

- USD Coin (USDC): The rising star, backed by financial giants like Coinbase and Circle.

- Binance USD (BUSD): The exchange-backed token that gives the others a run for their money.

But it’s not just crypto companies getting in on the action. Traditional finance jumps on the bandwagon too. JPMorgan launched its own stablecoin, JPM Coin, for B2B payments. Even Facebook tried to get in on the game with its Libra project (now rebranded as Diem).

Businesses of all sizes start to explore stablecoins for their B2B payments. From small startups to Fortune 500 companies, everyone realizes that these digital tokens could be the key to faster, cheaper, and more efficient transactions.

The Stablecoin Revolution: Join or Get Left Behind

Are you ready to join the stablecoin revolution? Or will you stick with your carrier pigeon and abacus for B2B payments? The choice is yours, but we know which way the wind blows. (Spoiler alert: it’s towards the blockchain.)

Now that we’ve covered the basics of stablecoins and their growing popularity, let’s dive into the juicy details of how these digital dynamos are transforming B2B payments. Buckle up, because things are about to get even more exciting!

Why Stablecoins Are the B2B Payment Superheroes

Slashing Fees, Boosting Savings

Traditional wire transfers can cost up to $50 per transaction. Stablecoins? They laugh in the face of such extortion. Most stablecoin transfers cost less than a dollar. This isn’t just pocket change – it’s a financial revolution for businesses making frequent transactions.

Ripple’s On-Demand Liquidity (ODL) service uses XRP as a bridge currency, cutting transaction costs by up to 60% compared to traditional methods. (That’s like finding money in your couch cushions, but way more exciting.)

Lightning-Fast Settlements

In the B2B world, waiting three days for a transfer to clear is about as fun as watching paint dry. Stablecoins move at internet speed, which means near-instantaneous settlements. No more thumb-twiddling while you wait for payments to clear.

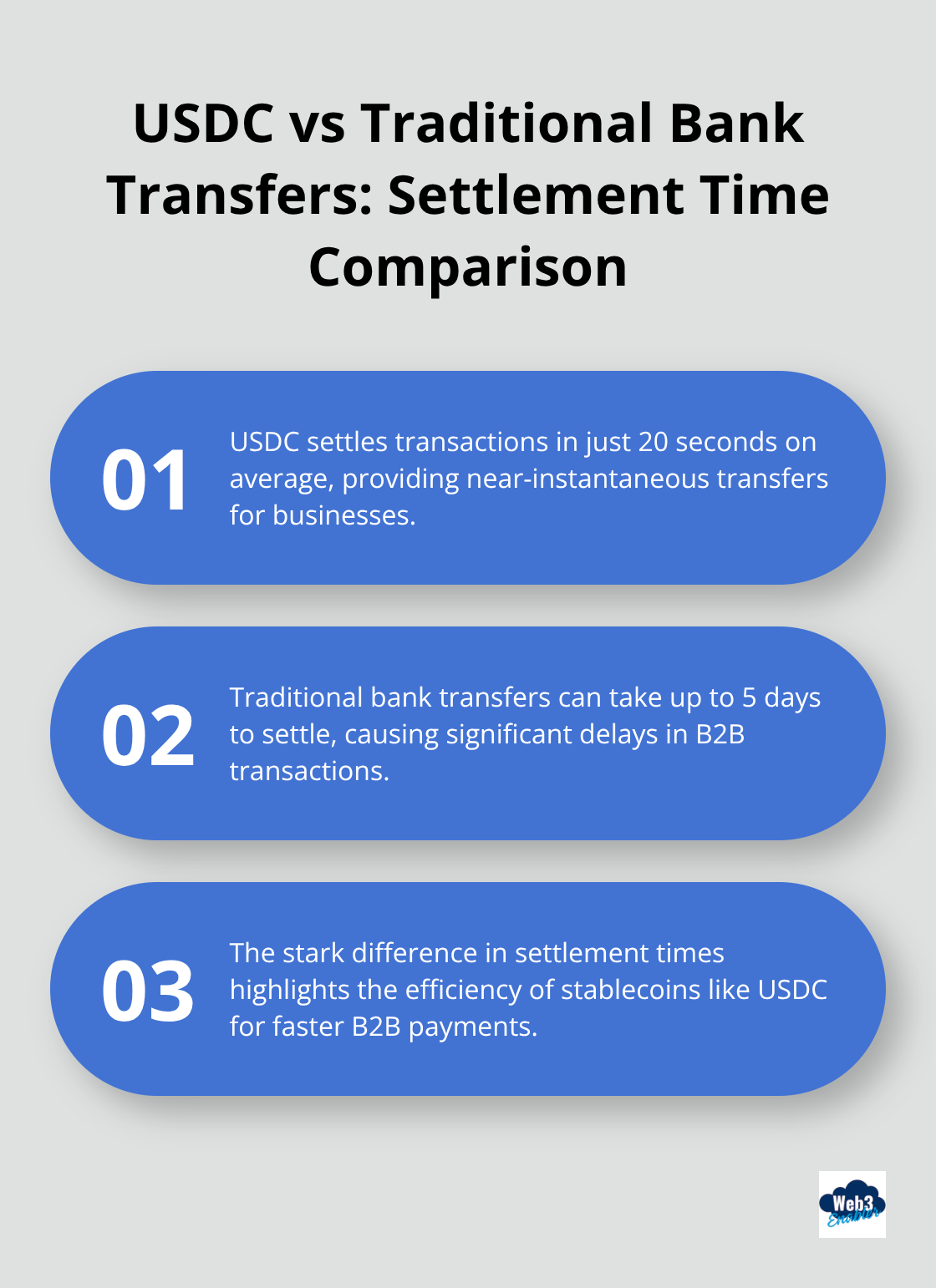

Circle’s USD Coin (USDC) boasts settlement times of just 20 seconds on average. Traditional bank transfers take up to 5 days. (It’s like comparing a cheetah to a sloth in a race.)

Global Payments Without the Forex Nightmare

International payments used to involve a complex dance of currency conversions and exchange rate roulette. Stablecoins flip the script by providing a universal medium of exchange. Pay a supplier in Taiwan or receive payment from a client in Brazil – stablecoins keep it simple and predictable.

Binance’s stablecoin, BUSD, allows businesses to transact across borders without worrying about volatile exchange rates. It’s like having a financial Swiss Army knife in your digital wallet.

24/7 Availability: The Always-On Payment Solution

Banks close. Holidays happen. But stablecoins? They never sleep. This 24/7 availability means businesses can send and receive payments anytime, anywhere. No more waiting for Monday morning to roll around or cursing bank holidays.

JPMorgan’s JPM Coin, for instance, enables real-time, round-the-clock value transfer. It’s like having a personal banker who never takes a coffee break.

Improved Transparency and Traceability

Stablecoins operate on blockchain technology, which means every transaction is recorded on a public ledger. This transparency is a game-changer for businesses that need to track payments and maintain accurate records.

Tether (USDT), the largest stablecoin by market cap, provides a full transaction history that’s accessible to anyone. It’s like having a financial crystal ball that shows you exactly where your money has been and where it’s going.

As stablecoins continue to revolutionize B2B payments, businesses face new challenges in adopting this technology. Let’s explore how companies can overcome these hurdles and fully embrace the stablecoin revolution.

Navigating the Stablecoin Maze: Challenges and Solutions

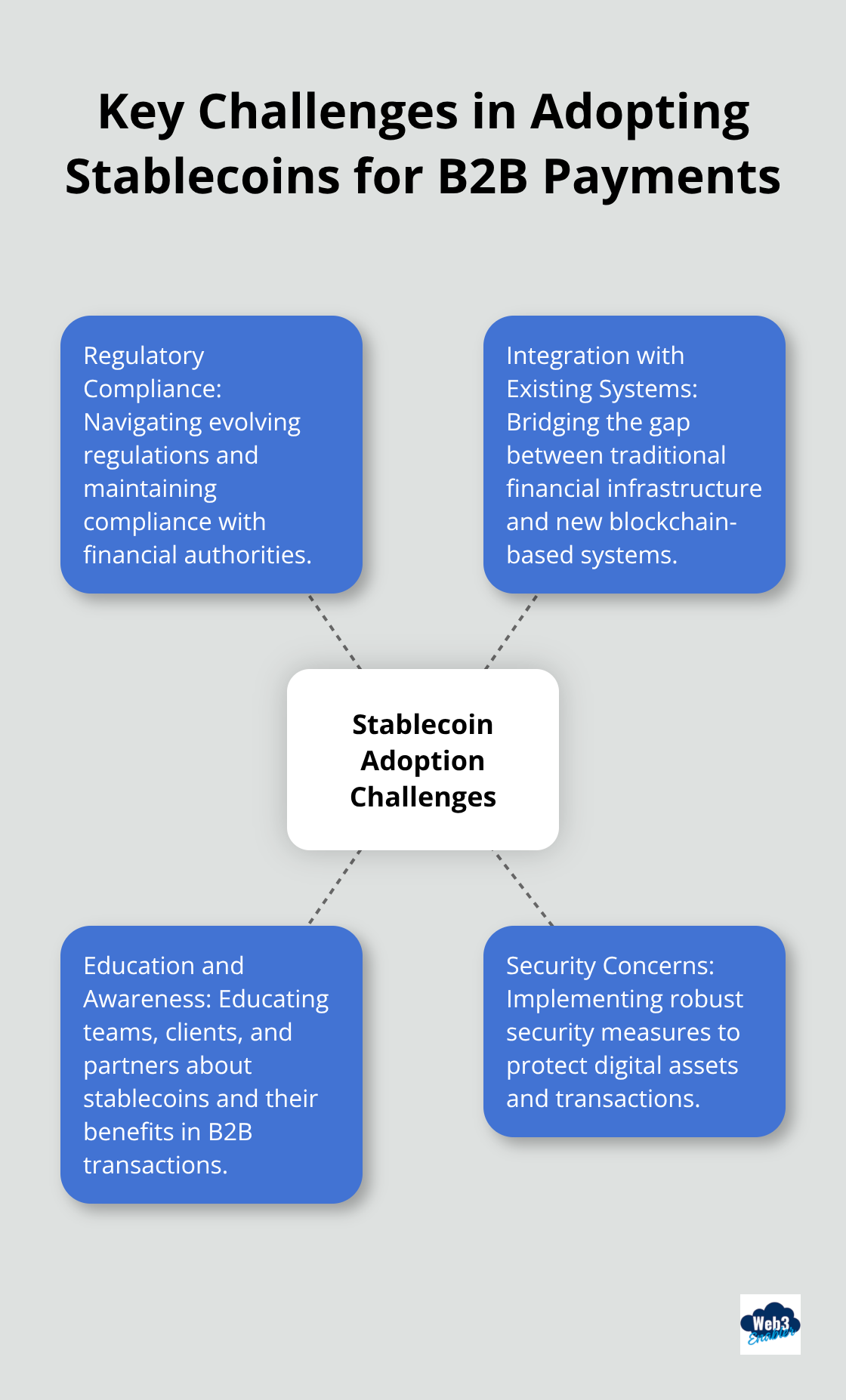

Taming the Regulatory Beast

Regulators eye stablecoins like hawks watching their prey. The US Securities and Exchange Commission (SEC) and other global watchdogs scramble to keep up. But don’t let that scare you off!

Stay ahead of the game by partnering with stablecoin issuers who play nice with regulators. USDC has taken a proactive approach to regulatory compliance. They’ve obtained licenses from various authorities, showing they’re serious about playing by the rules.

Businesses diving into stablecoins should keep meticulous records and stay informed about evolving regulations. Try hiring a compliance officer or partnering with a blockchain compliance firm. It might seem like a pain now, but it’ll save you headaches (and potentially hefty fines) down the road.

Bridging the Old and New Financial Worlds

Integrating stablecoins with existing financial systems can feel like trying to fit a square peg in a round hole. But it’s not impossible.

Many companies develop solutions to bridge this gap. Ripple’s RippleNet, for example, allows traditional financial institutions to seamlessly integrate with blockchain technology for cross-border payments. They’ve partnered with hundreds of financial institutions worldwide, proving that old and new can play nice together.

For smaller businesses, platforms like Coinbase Commerce offer easy integration of crypto payments (including stablecoins) into existing e-commerce systems. It’s a great way to dip your toes in the stablecoin waters without overhauling your entire financial infrastructure.

Educating the Masses (and Your Team)

Let’s face it – many people still think “crypto” means “magic internet money.” Education is key to widespread stablecoin adoption in B2B payments.

Start with your own team. Organize workshops or bring in experts to explain the basics of blockchain and stablecoins. Companies like ConsenSys offer comprehensive blockchain education programs for businesses.

For your clients and partners, create easy-to-understand guides or webinars about stablecoin payments. Explain the benefits in terms they’ll understand – faster payments, lower fees, and simplified international transactions.

Knowledge is power. The more people understand stablecoins, the more likely they are to embrace them.

Locking Down Security

Security concerns keep many businesses up at night when it comes to new payment technologies. But stablecoins can actually enhance security when implemented correctly.

Implement multi-signature wallets for your business stablecoin transactions. This requires multiple approvals for transactions, reducing the risk of fraud or theft. BitGo, a leader in institutional digital asset security, offers multi-sig wallet solutions for businesses.

Regular security audits are also important. Firms like CertiK specialize in blockchain security audits and can help identify potential vulnerabilities in your stablecoin payment system.

Don’t forget about employee training. Human error is often the weakest link in security. Ensure your team understands best practices for handling stablecoin transactions and storing private keys.

Wrapping Up

Stablecoins shake up B2B payments like a financial earthquake, with aftershocks that grow stronger. These digital dynamos slash fees, speed up settlements, and smooth international transactions. Stablecoin adoption skyrockets as companies recognize their potential to revolutionize financial operations.

We predict stablecoins will become the go-to for savvy businesses worldwide. More companies will wake up to the benefits of these digital dollars, leading to innovative uses like smart contracts and loyalty programs. Businesses that don’t embrace stablecoins risk falling behind competitors who enjoy faster, cheaper transactions.

Web3 Enabler stands ready to help you join the stablecoin revolution. Our Salesforce-native blockchain solutions can support your transition to this new financial frontier (think accepting stablecoin payments or sending global transfers at lightning speed). Don’t let your business linger in the financial stone age – embrace stablecoins and watch your transactions soar.