Traditional payment systems cost businesses billions in delays and fees every year. Cross-border transactions take days to settle, while intermediary banks extract hefty charges at every step.

We at Web3 Enabler see how blockchain is changing money and business operations fundamentally. Companies now process payments in minutes instead of days, cutting transaction costs by up to 80% compared to traditional banking networks.

How Blockchain Changes Money Transfer

Businesses lose significant amounts through inefficient payment systems that banks designed decades before digital commerce existed. Traditional cross-border payments charge fees as high as $330 for a $10,000 transfer while they take 2-5 business days to complete. Banks extract profits at every intermediary step and create a system where money movement costs more than the technology that powers entire blockchain networks.

Payment Speed That Actually Matters

Blockchain networks process international transfers in 4-6 seconds compared to the multi-day delays of correspondent banks. Visa processes 65,000 transactions per second but still requires settlement periods that blockchain eliminates entirely. Companies that use blockchain payments report cash flow improvements of 40-60% because funds arrive when expected, not when banks decide to release them.

Real Cost Savings Beyond Marketing Claims

Blockchain reduces cross-border payment fees by up to 80% through direct peer-to-peer transactions. The Bitcoin network processes transactions for under $2 regardless of transfer amount, while Ethereum handles complex business payments for $5-15. These aren’t promotional rates or limited-time offers – they represent the actual cost structure of networks that eliminate bank intermediaries. Businesses that switch to blockchain payments save an average of $180,000 annually on international vendor payments alone.

Direct Business-to-Business Payments

Blockchain networks execute payments automatically when conditions are met and remove human approval delays that plague traditional systems. Companies can send payments to 50 international vendors simultaneously without bank relationship requirements or credit line restrictions (something impossible with traditional banking). Blockchain networks operate 24/7 without weekend delays, holiday closures, or regional bank hour limitations that cost businesses real revenue opportunities.

These fundamental changes in payment infrastructure create opportunities for businesses to transform their entire operational approach. Supply chains, vendor relationships, and customer transactions all benefit when companies can move money as easily as they send emails.

Business Applications of Blockchain Technology

Companies waste massive resources through outdated business processes that blockchain technology eliminates entirely. Walmart reduced food contamination investigation time from weeks to 2.2 seconds through blockchain tracking systems, while Hitachi processes contracts with over 2,000 suppliers monthly through automated blockchain workflows. These aren’t isolated success stories – they represent fundamental shifts in how businesses operate when they replace manual processes with blockchain automation.

Supply Chain Transparency and Tracking

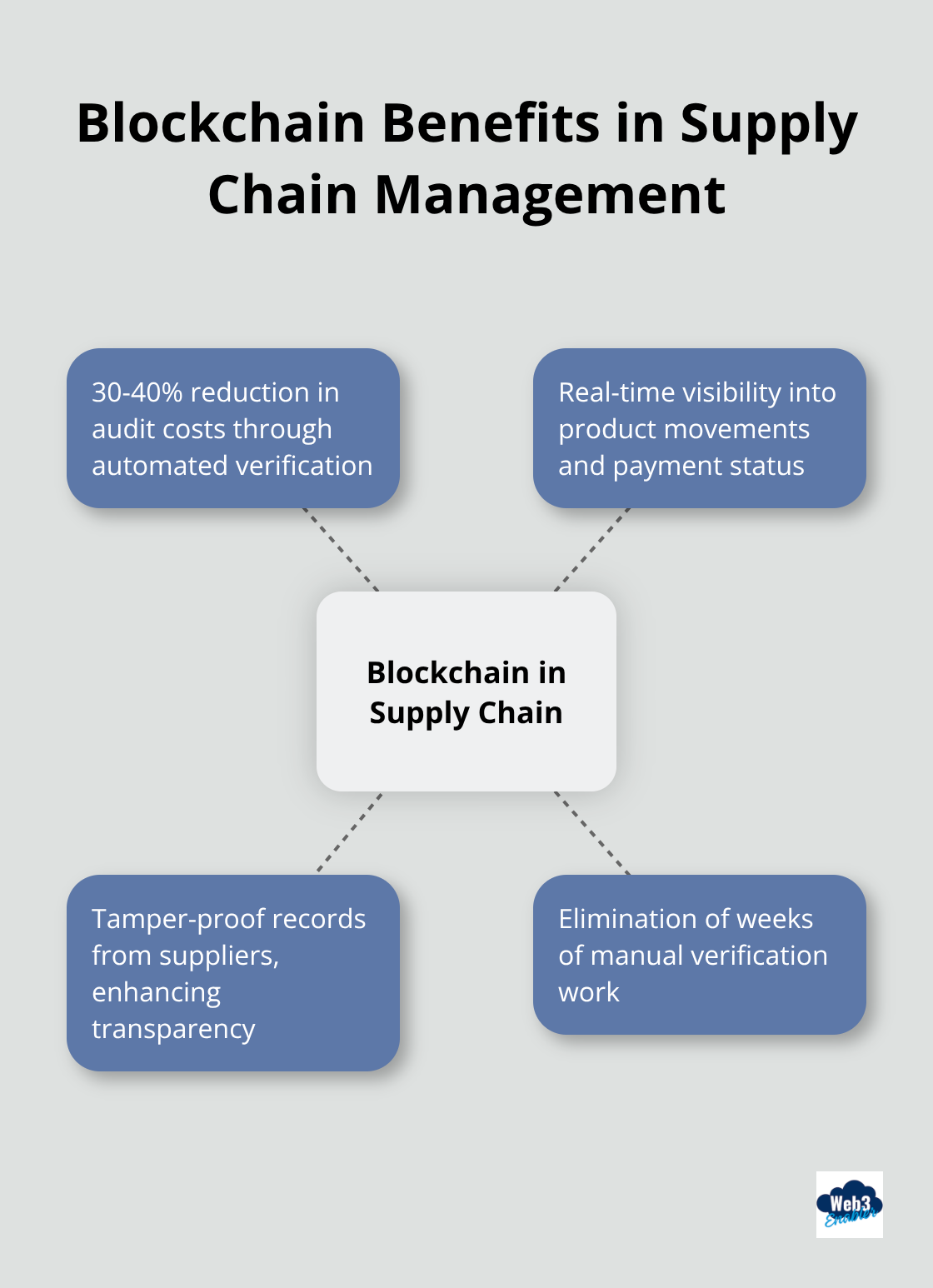

Traditional supply chains hide critical information behind layers of intermediaries and paper documentation. Blockchain networks provide real-time visibility into every product movement, payment status, and compliance requirement across global operations. IBM Food Trust tracks over 25 million food products annually and prevents contamination events that previously cost companies millions in recalls and lawsuits.

Renault reduced non-compliance expenses by 50% through blockchain component tracking that maintains tamper-proof records from suppliers. Companies that implement blockchain supply chain solutions report 30-40% reductions in audit costs and eliminate weeks of manual verification work that traditional systems require. Nestlé uses blockchain for infant formula traceability to enhance consumer trust while maintaining product safety and origin transparency.

Automated Payment Processing

Blockchain networks execute vendor payments automatically when delivery conditions are verified and eliminate approval delays that cost businesses real opportunities. AXA processes flight delay insurance claims instantly through blockchain automation, while traditional systems require 3-7 days of manual review. Companies process international vendor payments in minutes instead of the 2-5 business days that correspondent banks demand.

Barclays reduced letter of credit processing from 7-10 days to under 4 hours through blockchain automation that removes human bottlenecks entirely. Businesses that automate payments through blockchain report 60% improvements in vendor relationships and eliminate the cash flow disruptions that manual approval processes create across global operations.

Enhanced Security for Business Data

Blockchain technology creates tamper-proof audit trails that secure business data beyond traditional database capabilities. The American Hospital Association highlights that blockchain enhances patient data security and access control in healthcare systems (where data breaches cost an average of $10.93 million per incident). Governments pilot blockchain for tamper-proof public records and identity documents to increase transparency while reducing administrative costs.

IPwe collaborated with IBM to create a transparent blockchain-based intellectual property marketplace that enhances investment opportunities through verified ownership records. Companies that implement blockchain data security solutions eliminate the vulnerabilities that centralized databases create and reduce compliance costs through automated verification processes.

These operational improvements demonstrate how blockchain transforms business efficiency across multiple sectors. The technology’s impact extends beyond individual company benefits to reshape entire industry standards and market dynamics.

Current Adoption Trends and Market Growth

Enterprise blockchain spending reached $67 billion in 2023 according to IDC research, with financial services companies leading adoption at 34% of total investment. Fortune 500 companies allocate an average of $15.2 million annually to blockchain initiatives, while mid-market businesses invest $2.8 million per year in blockchain infrastructure. These numbers reflect actual deployment costs, not research budgets or pilot programs that never reach production environments.

Major Companies Move Beyond Pilot Programs

BlackRock explores tokenization of ETFs to enhance investment products through blockchain technology, while Tether launched USAT, a US-compliant stablecoin (like USDC) that indicates regulatory compliance trends within digital currency markets. Korea and Japan collaborate on digital bonds through blockchain to streamline bond issuance and trading processes.

Hong Kong implements wholesale Central Bank Digital Currency and interbank tokenized deposits, which represents significant steps toward modernized banking operations. The US Department of Commerce plans to publish GDP data on blockchains through Chainlink and Pyth oracles, which enhances data distribution accuracy for financial markets.

These implementations demonstrate that blockchain adoption moves from experimental phases to core business operations across government and enterprise sectors.

Market Expansion Through Real Business Value

Blockchain technology continues to expand rapidly across enterprise sectors, with supply chain management applications that drive 42% of enterprise adoption. Companies report average cost reductions of $3.2 million annually through blockchain implementation, while transaction processing improvements generate $1.8 million in additional revenue per year for mid-sized businesses.

The total addressable market for blockchain business applications reaches $1.4 trillion by 2030 (with payment processing and vendor management as the largest growth segments). Financial institutions adopt blockchain solutions to improve operational efficiency and reduce cross-border payment costs that traditional systems impose.

Enterprise Integration Accelerates

Major corporations integrate blockchain technology into existing business systems rather than replace entire infrastructure networks. Walmart processes food safety tracking through blockchain systems that reduce contamination investigation time from weeks to seconds. Hitachi handles contracts with over 2,000 suppliers monthly through automated blockchain workflows that eliminate manual approval delays.

Companies choose blockchain solutions that work within established enterprise software environments. Salesforce-native blockchain solutions provide the compliance and integration capabilities that Fortune 500 companies require for vendor management and payment processing workflows.

Final Thoughts

Blockchain technology transforms how businesses handle money and operations through measurable improvements that traditional systems cannot match. Companies reduce cross-border payment costs by 80% while they process transactions in seconds instead of days. Supply chain transparency increases through real-time tracking that prevents contamination events and reduces compliance expenses by 50%.

The evidence shows how blockchain is changing money and business operations across Fortune 500 companies and mid-market organizations. Walmart investigates food contamination in 2.2 seconds through blockchain systems, while Hitachi processes contracts with over 2,000 suppliers monthly through automated workflows. These operational improvements generate average cost reductions of $3.2 million annually for enterprises (with transaction processing as the largest contributor to savings).

Companies ready to implement blockchain solutions need platforms that integrate with existing business systems. Web3 Enabler provides blockchain solutions on the Salesforce AppExchange that enable businesses to accept payments and send global transfers faster while they maintain compliance standards. Our platform helps companies eliminate the delays and fees that traditional systems impose on global business operations.