Ever wondered why your business payments feel like they’re stuck in the Stone Age? Well, buckle up, buttercup!

At Web3 Enabler, we’re about to take you on a wild ride through the world of blockchain and payment security.

Get ready to kiss those slow, fraud-prone transactions goodbye and say hello to a future where your money moves faster than a cat video goes viral.

Why Traditional Payment Systems Are Dinosaurs in a Digital Age

Slow as Molasses, Expensive as Caviar

Traditional payment systems move at the speed of a sloth on vacation. International transfers? You might as well send your money by carrier pigeon. These systems can take days to process payments, leaving businesses twiddling their thumbs and partners tapping their feet impatiently. And the fees? They’ll make your wallet weep. In 2024, the average cost for an international wire transfer hit a jaw-dropping $45. (That’s like paying for a five-star meal and getting served a gas station hot dog.)

Fraud: Where Your Money Takes Unplanned Vacations

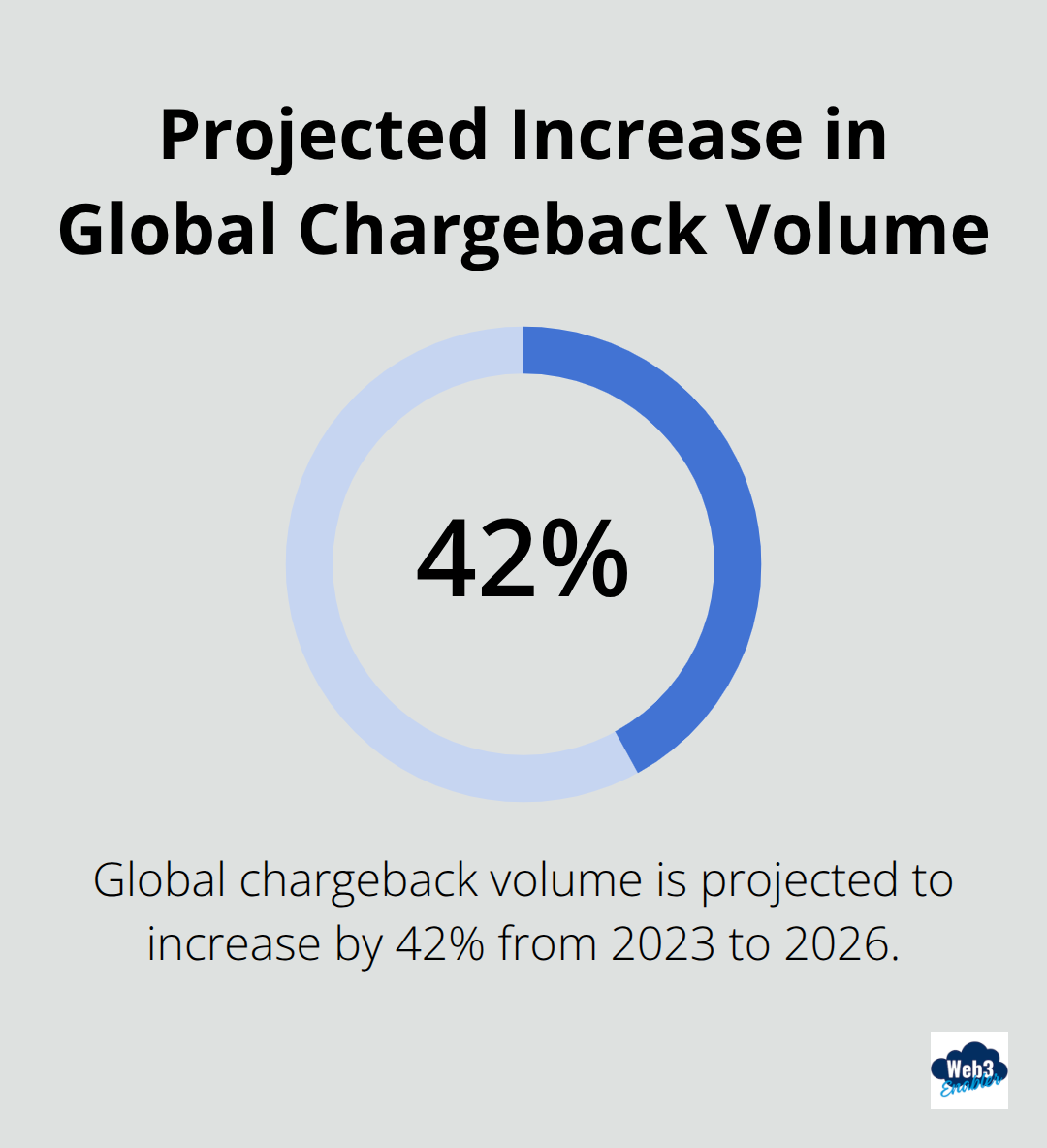

Traditional systems are about as secure as a paper lock on a bank vault. Chargebacks aren’t just a headache; they’re a full-blown migraine for your bottom line. Global chargeback volume was reported at more than 237 million transactions in 2023, with predictions suggesting it could reach 337 million by 2026. Your hard-earned cash is as safe as a snowball in a sauna.

The Financial Invisibility Cloak

Try tracking a payment through the traditional banking system. It’s like trying to follow a ninja through a fog machine factory. There’s zero transparency. Your money vanishes into the ether, and you’re left hoping it materializes where it should. It’s financial hide-and-seek, and you’re perpetually ‘it’.

The Tech Time Warp

These systems are stuck in a technological time warp. While the rest of the world zooms ahead with AI and quantum computing, traditional payment systems are still using the digital equivalent of stone tablets and carrier pigeons. They’re the flip phones in a smartphone world – clunky, outdated, and desperately in need of an upgrade.

The Global Marketplace Mismatch

In our interconnected world, businesses operate across borders with ease. But traditional payment systems? They’re still struggling to keep up. They’re like trying to use a local bus pass for international travel – it just doesn’t work. These systems weren’t built for the global, 24/7 marketplace we live in today.

It’s time to break free from these financial fossils. The future of payments is knocking, and it’s wearing a blockchain t-shirt. Ready to answer? Let’s explore how blockchain is revolutionizing payment security and leaving these dinosaurs in the dust.

How Blockchain Turns Your Money into Fort Knox

Welcome to the future of payment security, where your transactions become safer than a squirrel’s secret nut stash! Blockchain technology isn’t just a buzzword; it’s the superhero cape your business payments have been waiting for. Let’s explore how this digital ledger turns the payment world on its head.

Tamper-Proof Transactions: Your Financial Fortress

Picture a world where every penny you send locks itself in a virtual vault. That’s blockchain for you. Once a transaction records, it etches itself in digital stone. No sneaky edits, no mysterious disappearances. It’s like having a financial paper trail, but instead of paper, it’s made of unbreakable digital links.

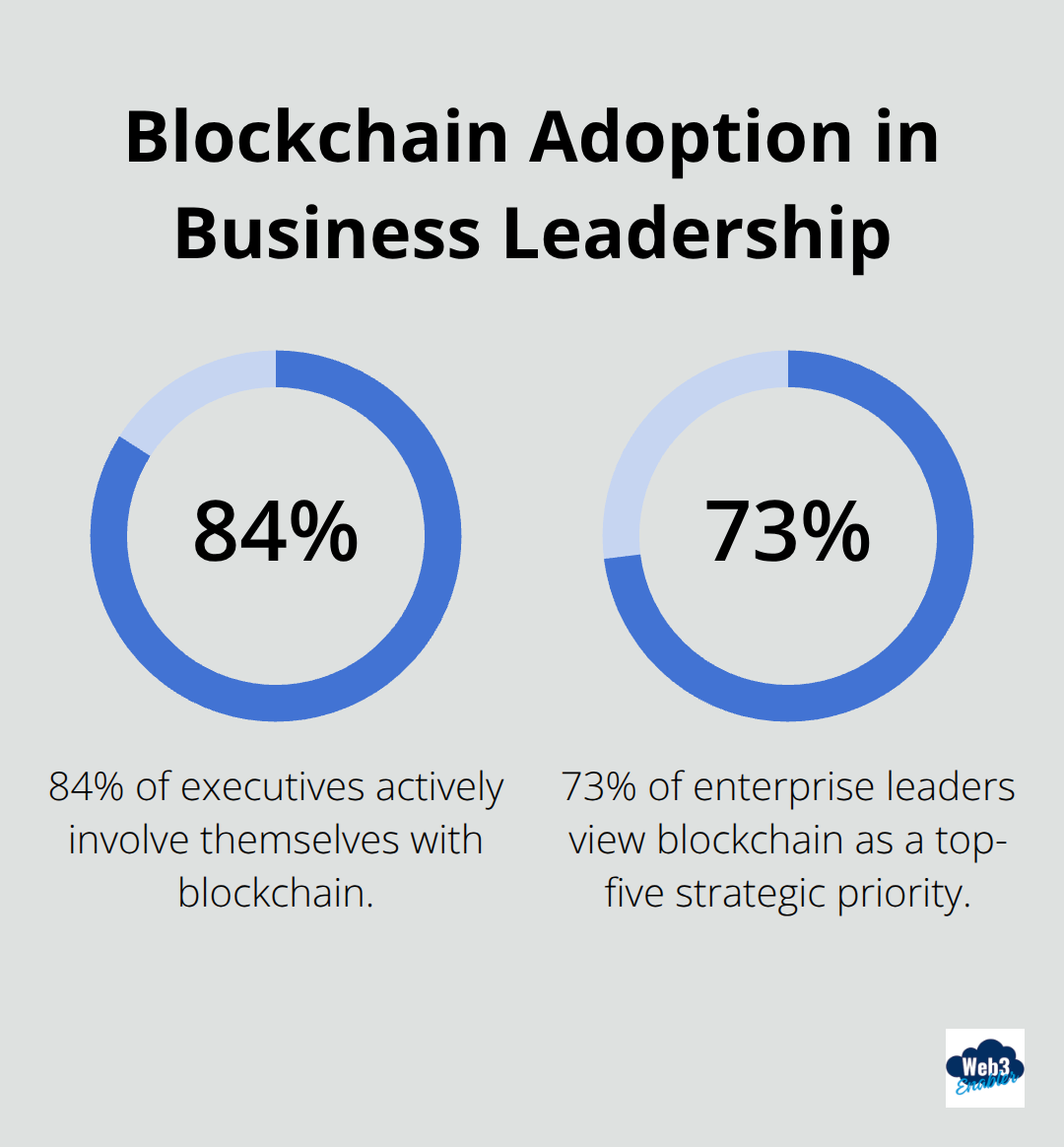

A report by Deloitte shows that 73% of enterprise leaders view blockchain as a top-five strategic priority. Why? Because it’s like having a team of incorruptible accountants working 24/7 to keep your transactions pristine.

Decentralized Verification: Trust No One, Verify Everything

In the blockchain world, we don’t just trust; we verify. And not by one, not by two, but by thousands of computers spread across the globe. It’s like having the entire planet double-check your math homework. This decentralized approach means there’s no single point of failure. Hackers? They’d have better luck trying to steal sunshine.

A study by PwC found that 84% of executives actively involve themselves with blockchain. They’re not just jumping on a bandwagon; they’re securing their financial future.

Encryption That Would Make James Bond Jealous

Blockchain doesn’t just lock your data; it puts it in a digital safe, buries it in a bunker, and surrounds it with laser beams. Each transaction seals itself with advanced cryptography. It’s so secure, even the NSA might break a sweat trying to crack it.

And let’s talk digital signatures. They’re like your financial fingerprint, unique to you and impossible to forge. Every transaction you make carries this unforgeable mark, ensuring that your payments are you, and only you.

Now that we’ve seen how blockchain turns your money into Fort Knox, let’s explore how businesses are putting this tech to work in the real world. Spoiler alert: It’s not just for crypto-bros anymore!

How Are Businesses Actually Using Blockchain Payments?

Let’s cut through the hype and get down to the nitty-gritty. How do real businesses use blockchain for payments? (Spoiler alert: It’s not just for buying digital cats or speculating on the next meme coin.)

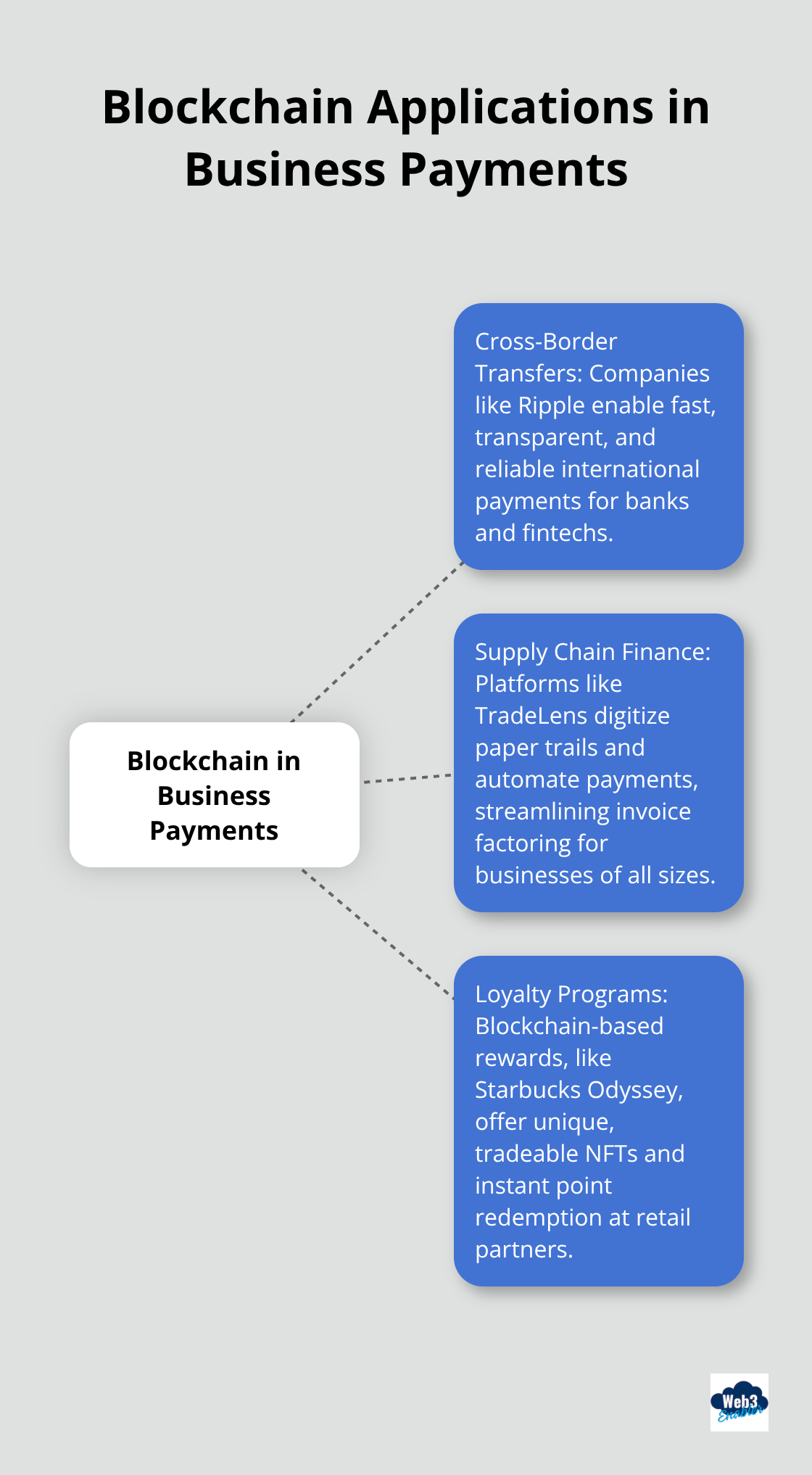

Zapping Money Across Borders

International money transfers used to move slower than a snail race. Not anymore. Companies like Ripple revolutionize cross-border payments. They enable fast, transparent, reliable payments for banks, crypto companies, and fintechs worldwide. Your money no longer takes a scenic route through SWIFT.

Supply Chain Finance Gets a Blockchain Makeover

Imagine if invoices could pay themselves. With blockchain, they practically do. IBM and Maersk’s TradeLens platform shakes up supply chain finance. It digitizes the paper trail and automates payments, making invoice factoring smoother than a freshly waxed surfboard.

Here’s the kicker: It’s not just for big players. Small businesses jump on the action too. Platforms like we.trade democratize access to trade finance, helping SMEs get paid faster and more reliably.

Loyalty Programs That Actually Feel… Loyal

Let’s face it, most loyalty programs excite about as much as watching paint dry. But blockchain changes the game. Starbucks Odyssey, launched in 2022, uses blockchain to offer unique, tradeable NFTs as rewards. It turns your coffee addiction into a digital treasure hunt.

And it’s not just coffee. Singapore Airlines’ KrisFlyer program uses blockchain to allow members to spend their miles at retail partners instantly. No more hoarding points like a digital dragon – use them or trade them, all in real-time.

Blockchain for the Rest of Us

You might think, “But I’m not a tech giant.” Don’t worry. Solutions like Web3 Enabler make blockchain accessible to businesses of all sizes, right within your existing Salesforce setup. (It’s like having a blockchain expert on speed dial, but without the caffeine jitters.)

These aren’t just pie-in-the-sky ideas. They solve real problems, right now. So, will you join the blockchain payment revolution? Or will you stick with carrier pigeons and abacuses? The choice is yours, but the future of business payments waits for no one.

Wrapping Up

Blockchain revolutionizes payment security for businesses. It outperforms traditional systems with tamper-proof records, decentralized verification, and unbreakable encryption. Companies already benefit from faster cross-border transfers, streamlined supply chains, and innovative loyalty programs.

The future of blockchain payments shines bright. As adoption grows, we’ll see quicker, cheaper, and more secure transactions become standard. Fraud will diminish, and transparency will prevail. The global financial landscape will transform, with blockchain as the driving force.

You don’t need to be a tech expert to start with blockchain. Educate your team on the basics and explore platforms that integrate with your current systems. Web3 Enabler brings blockchain payments directly into Salesforce (it’s like having a blockchain wizard on your team). Consider accepting stablecoins or using blockchain for international transactions to enhance your payment security today.