Hey there, crypto cats! Ready to ditch the paperwork and get your KYC groove on? At Web3 Enabler, we’re all about making blockchain as easy as swiping right on your favorite dating app.

KYC automation is the secret sauce that’s spicing up the crypto world. It’s time to say goodbye to mind-numbing manual processes and hello to a smoother, faster way of doing business in the digital asset space.

Why KYC in Crypto Is a Pain (And How to Fix It)

Let’s face it, KYC in Crypto is about as fun as a root canal. But here’s the tea: it’s a necessary evil we can’t ignore. The crypto world needs to clean up its act, and KYC is the industrial-strength soap.

The Regulatory Rollercoaster

Crypto regulations change faster than fashion trends. One day you’re compliant, the next you’re scrambling to keep up with new rules. It’s like trying to hit a moving target while blindfolded (and possibly after a few too many blockchain-themed cocktails).

Manual KYC: The Time-Sucking Vampire

Picture this: Your potential customer is ready to dive into the crypto pool, credit card in hand. But wait! They need to upload their ID, proof of address, and probably a lock of hair (kidding, but barely). Days later, your poor compliance team is still drowning in paperwork. That’s longer than some celebrity marriages!

Automation: The KYC Superhero

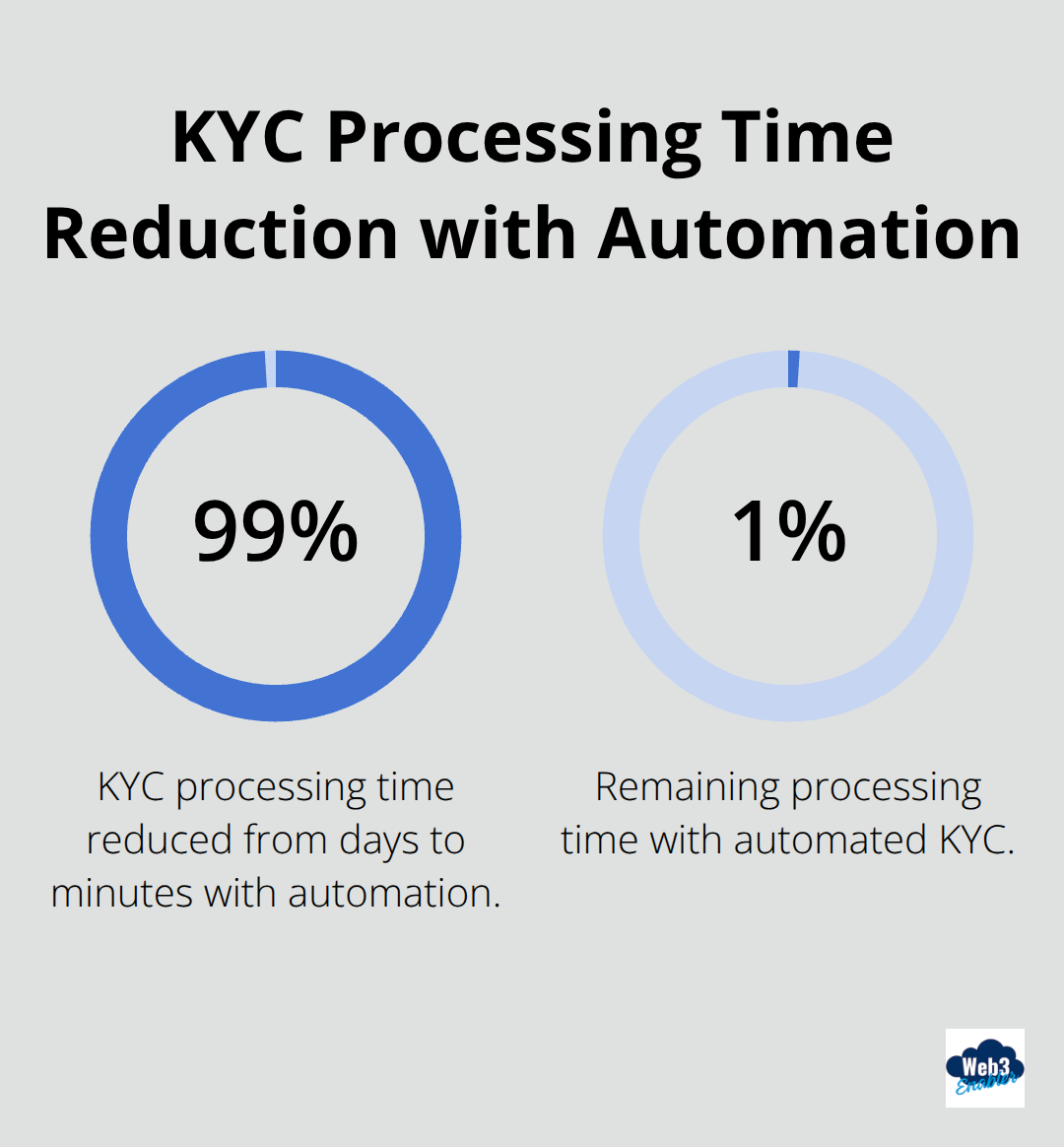

Here’s where KYC automation swoops in to save the day (cape optional). AI-powered identity verification and blockchain-based data storage can slash that ordeal to mere minutes. That’s not just pocket change, folks – it’s a game-changer.

The Customer Experience Makeover

Let’s talk about your users for a sec. They want a smooth, Netflix-like experience, not a DMV simulator. Automated KYC gives them just that. Happy customers, happy life, right?

Now that we’ve spilled the tea on why KYC automation is the hottest trend since crypto itself, let’s explore the secret ingredients that make this magic happen. Spoiler alert: it involves more than just crossing your fingers and hoping for the best.

What’s Under the Hood of Automated KYC?

Let’s pop the hood on automated KYC and see what makes this baby purr. It’s not just a bunch of fancy algorithms and buzzwords – it’s a finely tuned machine that’s revolutionizing how we handle identity verification in the crypto world.

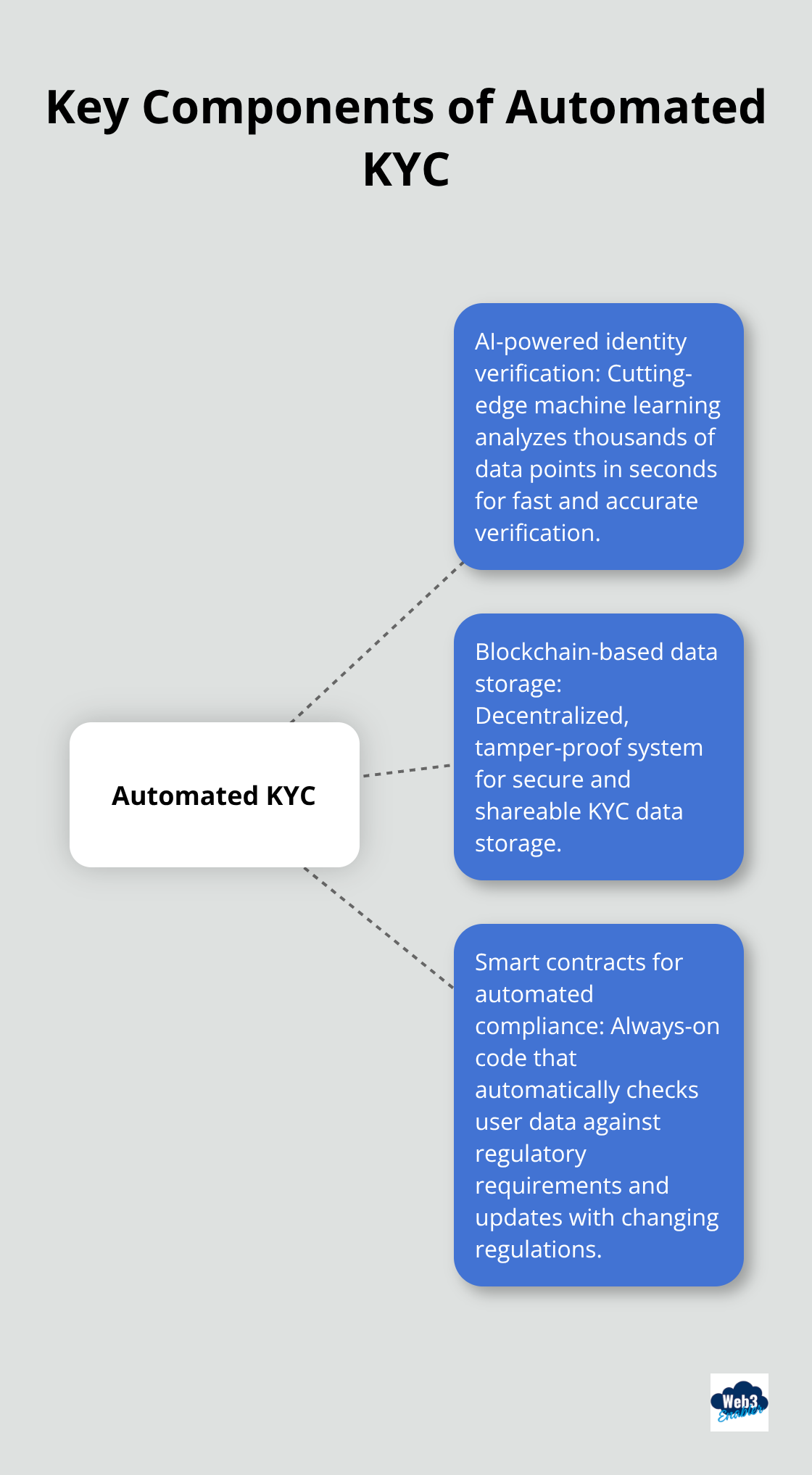

AI: The Brains of the Operation

First up, we’ve got AI-powered identity verification. This isn’t your grandma’s pattern recognition – we’re talking cutting-edge machine learning that’s transforming crypto banking with automation, fraud detection, compliance, and smarter decisions for secure digital finance. These systems analyze thousands of data points in seconds, making manual checks look like they’re running on dial-up.

And let’s face it, in the fast-paced world of crypto, waiting around for manual checks is about as fun as watching paint dry (or explaining blockchain to your grandma).

Blockchain: The Fort Knox of Data

Next, we’ve got blockchain-based data storage and sharing. This isn’t just about slapping “blockchain” on everything like it’s 2017 all over again. We’re talking about a decentralized, tamper-proof system that makes traditional databases look like a leaky sieve.

With blockchain, every piece of KYC data gets encrypted, time-stamped, and linked in a chain that’s harder to break than your New Year’s resolutions. And the best part? It’s all shareable between verified parties, so your users don’t have to go through the KYC wringer every time they want to use a new platform.

Smart Contracts: The Automated Compliance Ninjas

Last but not least, we’ve got smart contracts for automated compliance checks. These little bits of code are like the bouncers of the crypto world – they’re always on duty, never sleep, and follow the rules to a T.

Smart contracts automatically check user data against regulatory requirements, flag suspicious activity, and even update themselves when regulations change. It’s like having a compliance team that works 24/7, never takes coffee breaks, and doesn’t need a salary (talk about efficiency!).

Now that we’ve lifted the hood on automated KYC, you might be wondering how to actually implement these high-tech solutions in your crypto platform. Don’t worry, we’ve got you covered. In the next section, we’ll break down the nitty-gritty of integrating automated KYC into your existing systems. Spoiler alert: it’s easier than you think!

How to Implement Automated KYC in Crypto Platforms

Integration: Simpler Than You Think

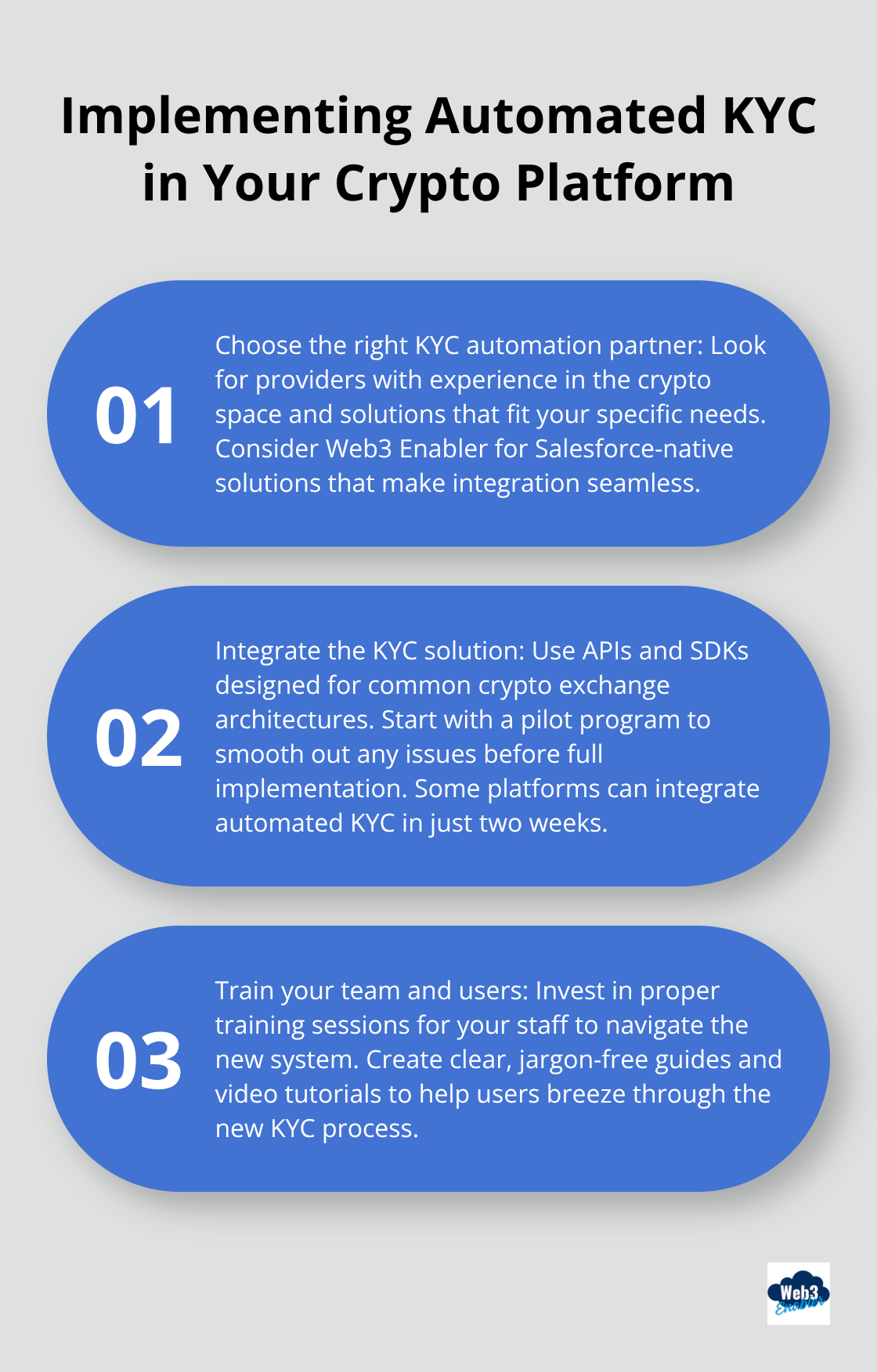

Integrating automated KYC into your crypto platform isn’t as complex as cracking the Da Vinci Code. The secret? Pick a solution that meshes with your current tech stack like peanut butter and jelly.

Some platforms integrate automated KYC in just two weeks. How do they pull off this magic trick? They use APIs and SDKs designed to play nice with common crypto exchange architectures. It’s like upgrading your flip phone to a smartphone – a bit of setup, but you’ll wonder how you ever lived without it.

Pro tip: Start small. Launch a pilot program with a subset of your users. This approach lets you smooth out any wrinkles before you go big.

Training: Upskilling Your Team

You’ve got the fanciest KYC system in town, but if your team can’t use it, it’s as useful as a screen door on a submarine. Time to get everyone up to speed!

The silver lining? Most automated KYC systems boast user-friendly interfaces that even your tech-averse aunt could navigate. But don’t throw your team into the deep end. Invest in proper training sessions (complete with snacks – trust us, it helps).

Don’t forget your users! They need a helping hand too. Create clear, jargon-free guides on breezing through the new KYC process. Throw in some video tutorials for the visual learners (bonus points if you use cute animal GIFs).

Overcoming Resistance: Turning Skeptics into Believers

Change can ruffle feathers. You might face some pushback from both your team and users. But don’t sweat it – we’ve got some tricks to turn those frowns upside down.

For your team, spotlight the benefits. Less manual work? Check. Fewer errors? Double check. More time for coffee breaks? Triple check! Show them how automated KYC will make their lives easier, not harder.

For your users, transparency is your best friend. Be upfront about why you’re implementing automated KYC. Highlight the improved security and faster onboarding times. And if all else fails, dangle some carrots. A small discount for completing the new KYC process can work wonders (who doesn’t love free stuff?).

Choosing the Right Partner

Picking the right KYC automation partner is like choosing a good dance partner – you need someone who can keep up with your moves. Look for providers with a track record in the crypto space and a solution that fits your specific needs like a glove.

While there are many fish in the sea, Web3 Enabler stands out as the top choice. Our Salesforce-native solutions make integration a breeze, and our focus on business use cases (rather than crypto speculation) aligns perfectly with serious crypto platforms.

Remember, implementing automated KYC is a journey, not a sprint. But with the right approach (and maybe a dash of Web3 Enabler magic), you’ll be up and running faster than you can say “blockchain revolution”!

Wrapping Up

KYC automation revolutionizes the crypto world, transforming identity verification from a tedious chore into a seamless process. Crypto platforms can now onboard users in minutes, not days, while maintaining top-notch compliance standards. This technology acts as a fraud detection powerhouse, spotting suspicious activity with lightning speed and precision.

The future of KYC automation in crypto shines bright, promising even more sophisticated systems as regulations and technology evolve. We’ll witness AI that predicts compliance issues and blockchain-based identity solutions that simplify data sharing. These advancements will reshape how crypto platforms operate and interact with users.

It’s time to upgrade your crypto platform with KYC automation and stay ahead of the curve. Web3 Enabler offers Salesforce-native blockchain solutions tailored for businesses aiming to harness crypto’s power (without the headaches). Don’t let your platform fall behind – embrace KYC automation and watch it soar to new heights.