Your business moves at lightning speed, but your payment rails are stuck in the Stone Age. While you’re closing deals and shipping products, traditional payment systems are quietly bleeding your cash flow dry.

Your business moves at lightning speed, but your payment rails are stuck in the Stone Age. While you’re closing deals and shipping products, traditional payment systems are quietly bleeding your cash flow dry.

We at Web3 Enabler see companies losing thousands daily to slow settlements and hefty processing fees. The math is brutal: every delayed payment costs you money, customers, and competitive edge.

What Are Traditional Payments Really Costing You

The Processing Fee Trap

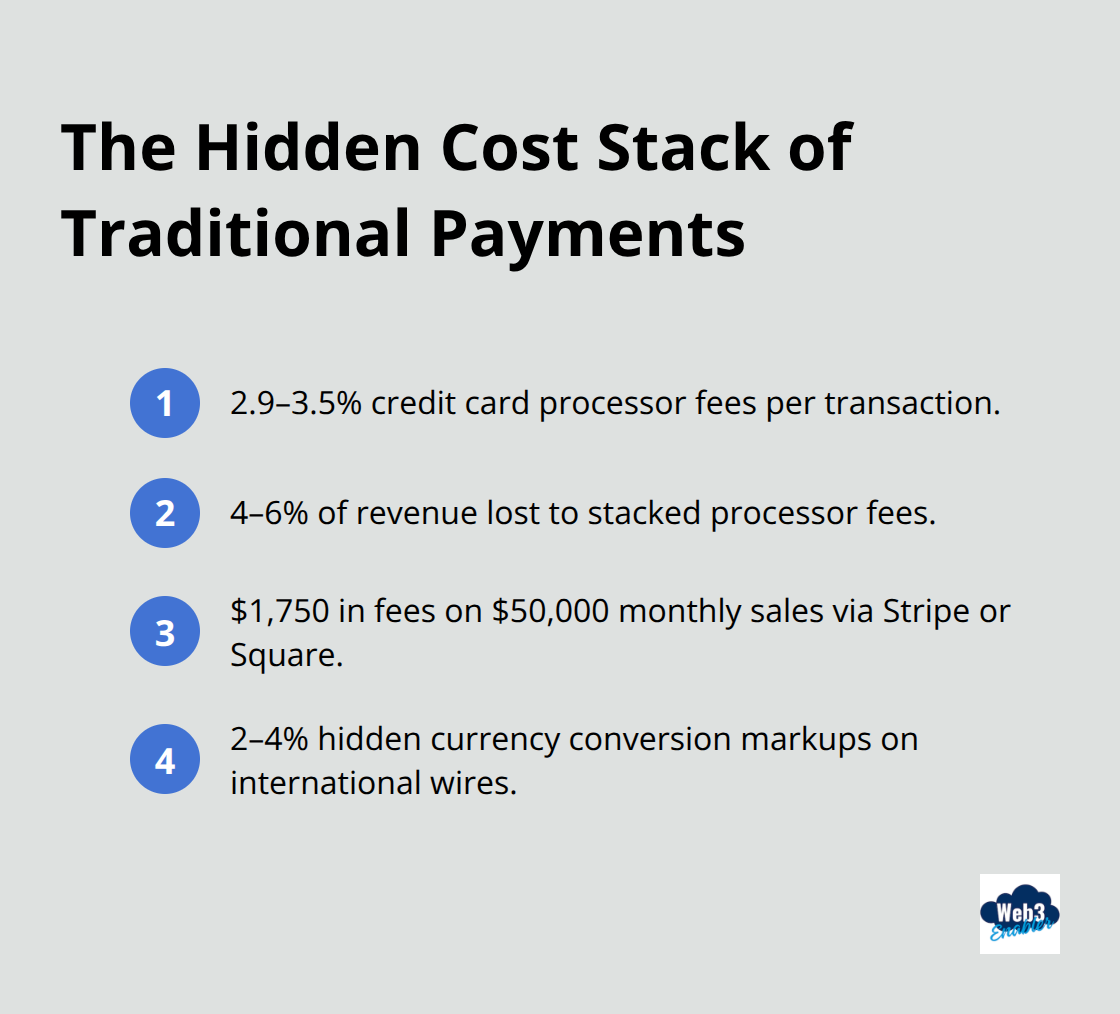

Traditional payment processors excel at concealing their true costs. Credit card processors charge businesses between 2.9% and 3.5% per transaction, but that’s just the beginning. Interchange fees, assessment fees, gateway fees, and monthly maintenance charges stack up to devour 4-6% of your revenue. Stripe and Square appear transparent, but their fees still hit small businesses with $50,000 in monthly sales for roughly $1,750 in fees alone.

International wire transfers through traditional banks cost $15-50 per transaction, with hidden currency conversion markups of 2-4% that banks conveniently forget to mention upfront.

Cash Flow Strangulation Through Settlement Delays

ACH transfers take 1-3 business days to settle, while international SWIFT payments drag on for 5-7 days. This isn’t just inconvenience; it’s cash flow murder. A company that waits for a $100,000 international payment loses approximately $27 daily in opportunity cost at current interest rates. Multiply this across dozens of transactions monthly, and you hemorrhage thousands in capital. Traditional banks hold your money hostage while they earn interest on your funds, essentially making you pay for the privilege of using your own cash.

Cross-Border Payment Nightmares

International payments through traditional rails are financial torture chambers. SWIFT network transfers average $42 per transaction, but correspondent banks can stack additional fees that reach $100-150 for complex routes. Currency conversion spreads often hit 3-5% above market rates, which means a $50,000 EUR to USD transfer costs an extra $1,500-2,500 in hidden markups. European businesses that send payments to Asian suppliers regularly face 7-10 day settlement periods, during which exchange rate fluctuations can cost thousands more. These delays force companies to maintain expensive pre-funded accounts in multiple currencies (tying up capital that could fuel growth instead of feeding bank bureaucracy).

But the real damage goes beyond your balance sheet. These payment delays create ripple effects that touch every corner of your business operations.

How Payment Delays Sabotage Your Business

Customer Frustration Becomes Customer Flight

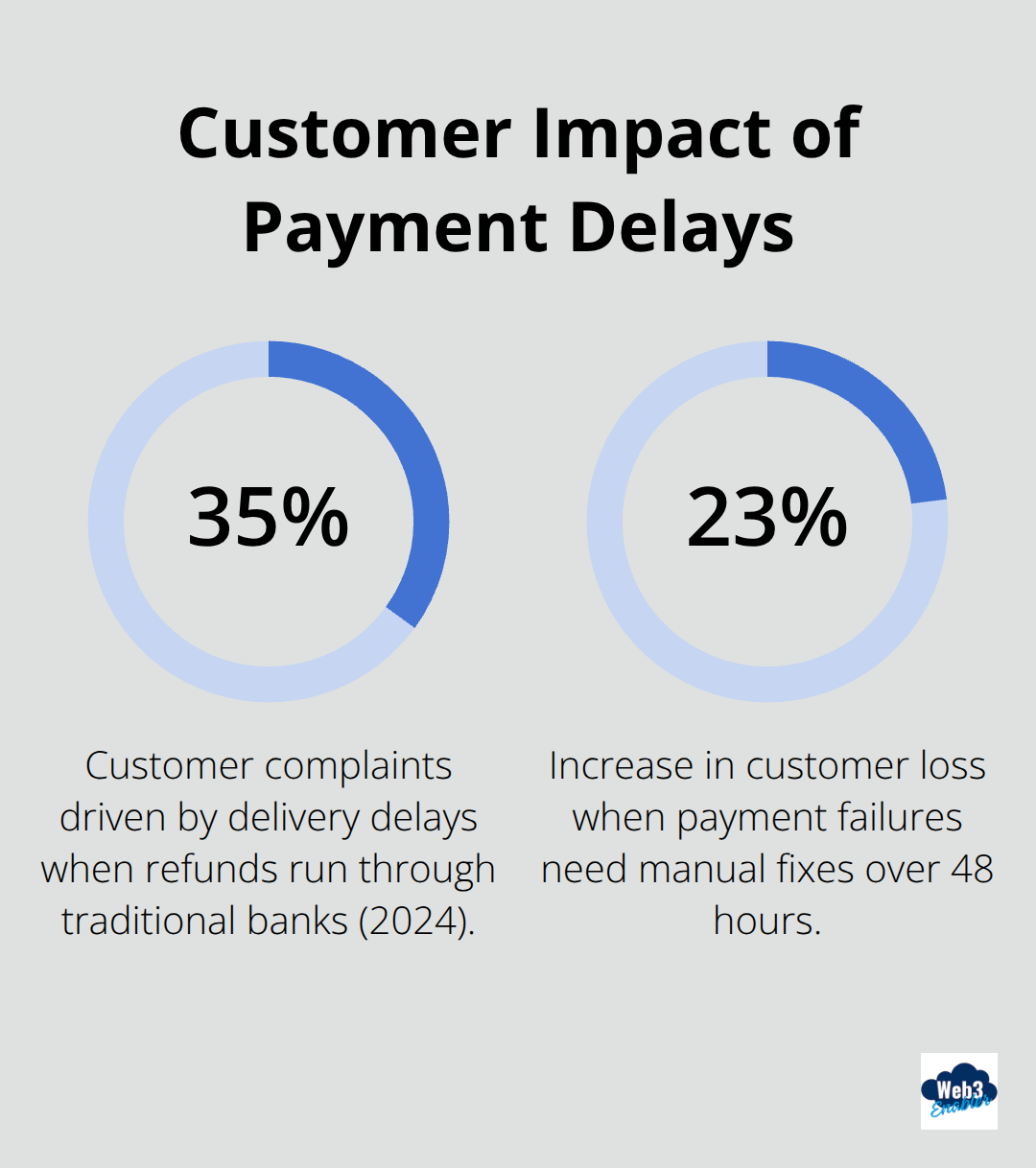

Payment delays destroy customer relationships faster than bad customer service. E-commerce businesses that process refunds through traditional banks see delivery delays accounting for over 35% of customer complaints in 2024. Subscription companies lose 23% more customers when payment failures require manual intervention that lasts over 48 hours.

Amazon’s same-day delivery expectations have trained customers to expect instant everything, including refunds and vendor payments. When your payment system takes days to process a simple transaction, customers assume your entire operation runs on outdated infrastructure. They don’t wait around to find out if they’re wrong.

Supplier Relationships Turn Toxic Under Payment Pressure

Late payments poison vendor relationships and cost you negotiation power. Small suppliers that wait 30-60 days for payment from larger clients charge 8-12% higher prices to offset cash flow risks (research from QuickBooks shows this pattern across industries). Manufacturing companies that delay supplier payments by just 10 days face 15% higher material costs and reduced priority during supply shortages.

Your 90-day payment terms might seem smart for cash flow, but suppliers respond by building delays and premium pricing into every quote. Payment speed directly correlates with supplier loyalty and preferential treatment during market disruptions.

Competitors Speed Past While You Wait for Settlements

Fast-moving markets punish businesses stuck with slow payment rails. Fintech companies that use blockchain settlements can launch new products 40% faster than traditional banks because they avoid lengthy reconciliation processes. Real estate companies that offer instant earnest money transfers through stablecoins close 25% more deals than competitors who use wire transfers.

Your competition isn’t just beating you on price or features. They win because their payment infrastructure lets them move at market speed while yours forces customers to wait. These payment roadblocks don’t just slow down transactions – they actively sabotage your competitive edge. Modern payment alternatives exist that can level the playing field without requiring you to rebuild your entire financial stack.

What Payment Solutions Actually Work Right Now

Stablecoins Beat Banks at Their Own Game

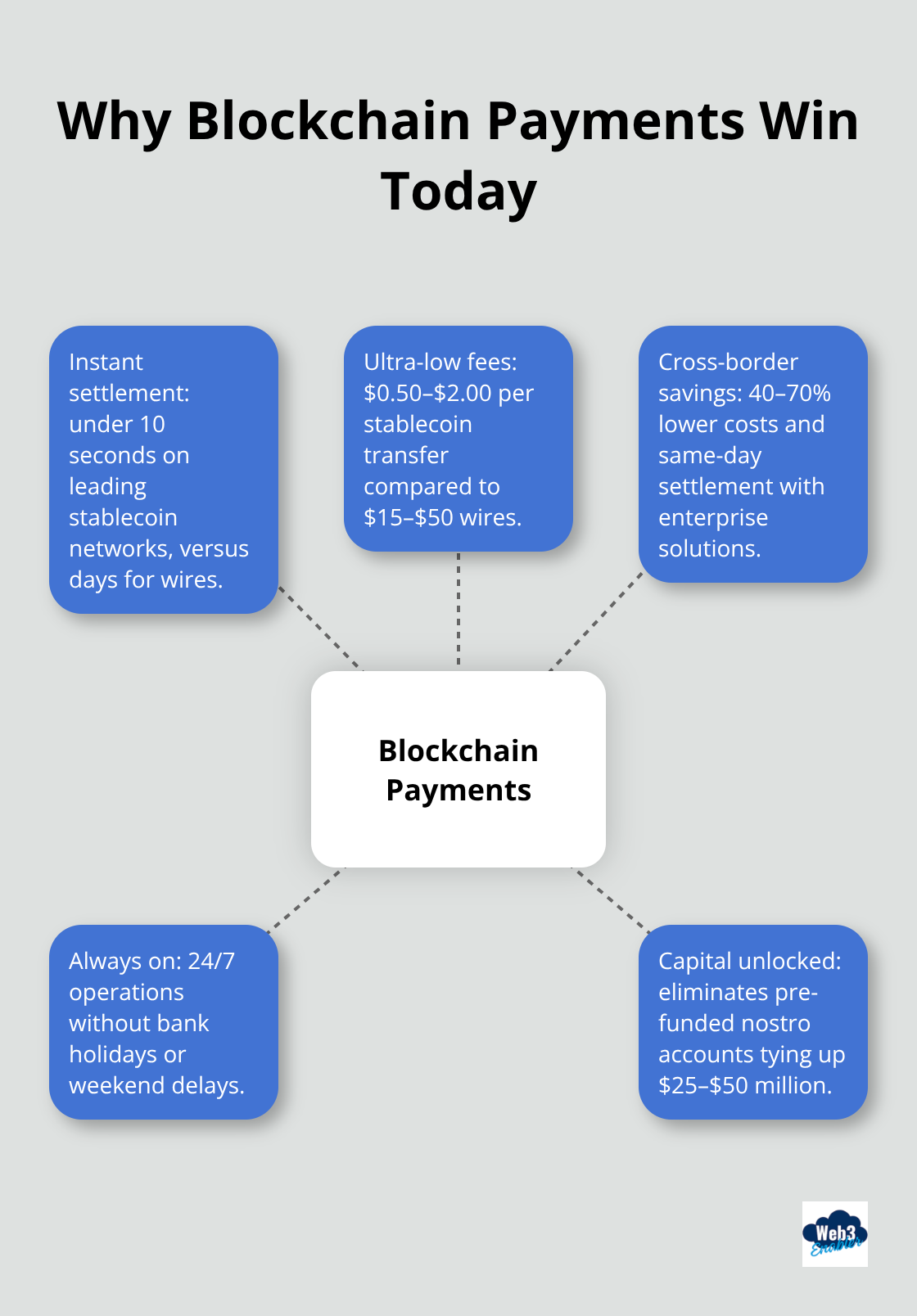

Stablecoins process payments in under 10 seconds while traditional wire transfers crawl along for days. USDC and USDT transactions cost $0.50-2.00 regardless of amount, compared to wire transfer fees of $15-50 plus currency conversion markups. JPMorgan Chase operates their JPM Coin platform for blockchain-based settlements, and cuts settlement times from hours to minutes. J.P. Morgan projects the stablecoin market could hit $500–750 billion in the coming years.

Circle’s USDC handles $3 trillion in annual transaction volume with 99.9% uptime, which proves enterprise-grade reliability that matches traditional banks. Visa partnered with Circle to enable USDC settlements on their network and processes payments 150x faster than ACH transfers. Companies that switch to stablecoin payments see immediate cash flow improvements because funds settle instantly rather than sit in bank limbo for days.

Cross-Border Payments Get the Blockchain Treatment

Blockchain networks process international transfers in minutes instead of the 5-7 days that SWIFT requires. Ripple’s enterprise clients save 40-70% on cross-border payment costs while they achieve same-day settlement globally. The Bank of England completed successful trials of digital pound transfers that settled in 20 seconds (compared to traditional correspondent routes that take 3-5 days).

Stellar Network processes cross-border payments for companies like MoneyGram at $0.0001 per transaction with 3-5 second settlement times. These networks operate 24/7 without bank holidays or weekend delays that plague traditional payment rails. Companies that use blockchain for international payments eliminate pre-funded nostro accounts that typically tie up $25-50 million in idle capital for large enterprises.

Integration Without Infrastructure Overhaul

Modern blockchain payment solutions plug directly into ERP and accounting systems through APIs. Companies can start to process blockchain payments within days rather than months that traditional payment processor integration requires. QuickBooks and Xero both offer cryptocurrency payment reconciliation features that automatically match blockchain transactions to invoices.

Payment processors like BitPay and Coinbase Commerce provide familiar merchant interfaces that feel identical to traditional payment gateways but settle transactions 100x faster. These solutions require zero blockchain expertise from finance teams because they handle wallet management, compliance reports, and tax documentation automatically.

Final Thoughts

Payment speed separates thriving businesses from those that struggle to survive in today’s market. Companies that upgrade their payment rails gain immediate advantages while competitors lose money, customers, and market position to outdated systems. The numbers prove this reality: businesses save 40-70% on cross-border transfers and settle transactions in seconds instead of days.

The transition requires no complete overhaul of your financial infrastructure. Modern blockchain solutions integrate with existing ERP systems and accounting software seamlessly. You can process stablecoin payments within days rather than months (unlike traditional payment processor implementations that drag on forever).

We at Web3 Enabler help businesses connect blockchain technology with their existing Salesforce infrastructure through native solutions. Your payment infrastructure should accelerate your business rather than anchor it to outdated banking timelines. Companies that modernize their payment rails now will dominate their markets while others wait for traditional banks to catch up.