B2B payments are ripe for disruption. The current system is slow, expensive, and fraught with friction, especially for international transactions.

At Web3 Enabler, we believe stablecoins could be the solution. These digital assets offer the potential to revolutionize cross-border payments, particularly with regions like LATAM and Asia.

In this post, we’ll explore how stablecoin transactions can transform B2B payments and reshape global trade.

Why Are B2B Payments Still Stuck in the Past?

The Slow Dance of Traditional B2B Payments

Bank transfers dominate B2B transactions globally, capturing more than a 48.6% share of the market in 2023. These transfers can take 2-5 business days to process (according to a recent SWIFT study). This delay impacts cash flow, especially for small and medium-sized enterprises (SMEs).

Wire transfers, another common method, aren’t much faster. They often involve high fees, sometimes reaching up to $50 per transaction. For businesses making frequent international payments, these costs multiply quickly.

Hidden Costs and Friction Points

B2B payments incur hidden costs beyond visible fees. Manual invoice processing, reconciliation errors, and currency conversion fees all contribute to overall expenses. A Deloitte report found that manual processing can cost businesses up to $16 per invoice.

Currency fluctuations pose another significant challenge. For businesses trading with LATAM or Asian countries (where exchange rates can be volatile), this unpredictability erodes profit margins.

The Ripple Effect on Global Trade

These inefficiencies in B2B payments profoundly impact international trade. SMEs struggle to compete globally due to high transaction costs and slow processing times. A World Bank study revealed that reducing trade costs could significantly impact global trade growth.

Moreover, payment delays strain relationships with suppliers and partners. An Atradius survey reported that 39% of businesses experienced negative impacts from late payments by B2B customers.

The Need for Change

The current state of B2B payments doesn’t align with our increasingly digital and global economy. Businesses need faster, more cost-effective solutions that keep pace with modern trade.

Stablecoins offer a potential solution to address many pain points in traditional B2B payment systems. These digital assets provide near-instantaneous settlement times and significantly lower transaction fees, especially for cross-border payments.

As businesses explore new payment technologies, stablecoins emerge as a promising option to revolutionize B2B transactions. The next section will examine how these digital assets can transform the landscape of global trade and payments.

In fact, B2B cross-border payments on the blockchain are projected to exceed $4.4T, accounting for 11% of total B2B cross-border payments in 2024, indicating a significant shift towards more efficient payment methods.

How Stablecoins Transform B2B Payments

Defining Stablecoins

Stablecoins are digital assets that maintain a stable value, typically pegged to a fiat currency like the US dollar. They combine the benefits of cryptocurrencies with the stability of traditional currencies, making them ideal for B2B transactions.

Addressing Key B2B Payment Challenges

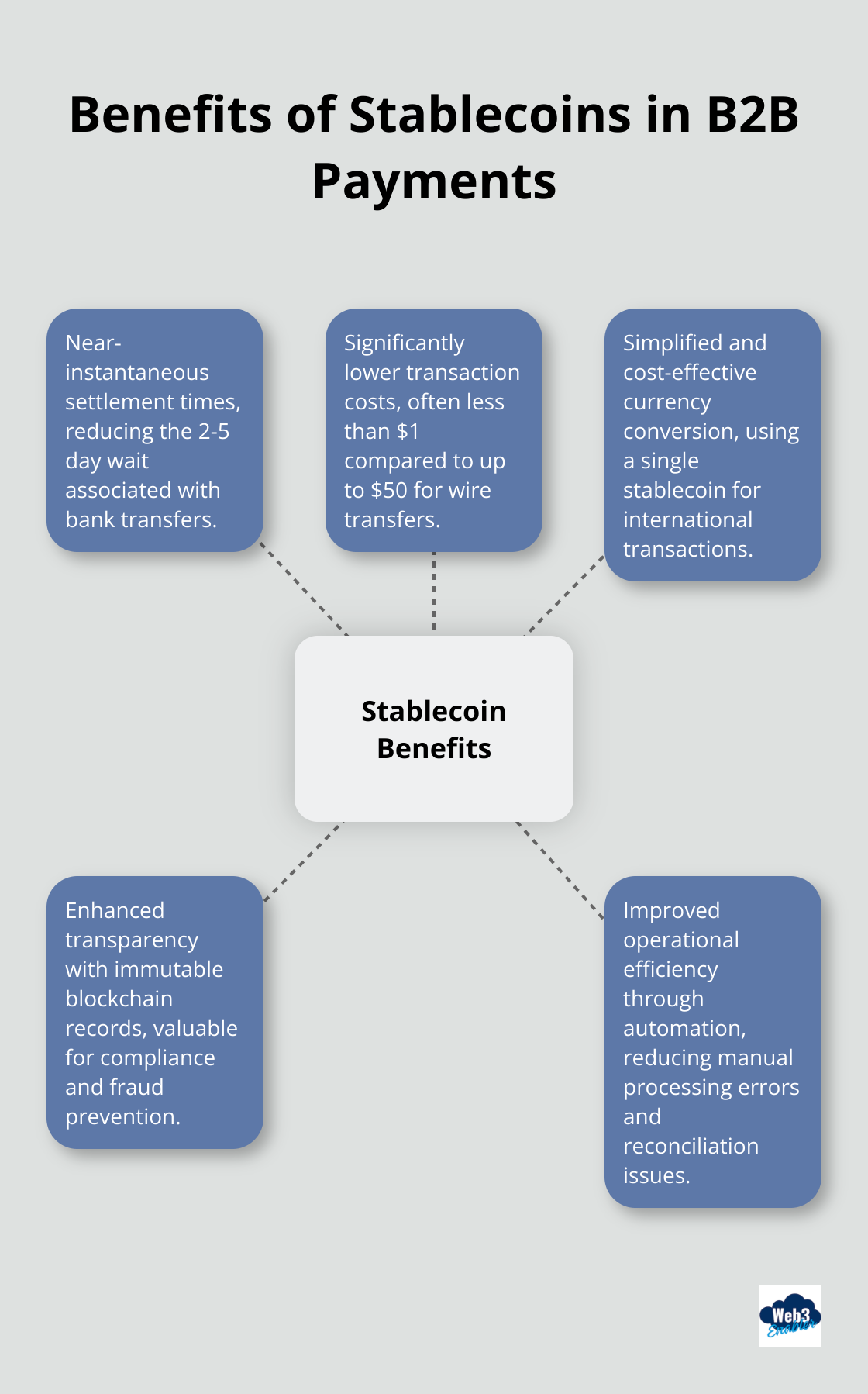

Stablecoins tackle several pain points in traditional B2B payment systems. They enable near-instantaneous settlement times, drastically reducing the 2-5 day wait associated with bank transfers. This speed improves cash flow, especially for SMEs.

Transaction costs plummet with stablecoins. While wire transfers can cost up to $50 per transaction, stablecoin transfers often cost less than $1. For businesses making frequent international payments, these savings add up quickly.

Currency conversion becomes simpler and more cost-effective with stablecoins. Instead of dealing with multiple currency pairs and their associated fees, businesses can use a single stablecoin for all their international transactions.

Revolutionizing Cross-Border Transactions

The impact of stablecoins on cross-border payments is significant. Stablecoins have seen growing attention in cross-border payments and beyond, indicating their potential as a viable solution for international transactions.

For businesses trading with LATAM and Asia, stablecoins offer unique advantages. They provide a way to bypass often volatile local currencies, reducing exchange rate risk. This is especially valuable in countries like Argentina, where inflation rates have historically been high.

In Brazil, the adoption of blockchain technology contributes to more secure and efficient payment transactions. Stablecoins can build on this trend, offering Brazilian businesses a reliable means of conducting international trade.

Real-World Applications and Benefits

JPMorgan’s Kinexys Digital Payments enables transactions 24/7, with cross-border transactions completed in minutes by seamlessly integrating with existing systems. This demonstrates the scalability and reliability of digital payment solutions for large-scale B2B payments.

Stablecoins also enhance transparency in B2B transactions. All transfers are recorded on a blockchain, providing an immutable audit trail. This feature is particularly valuable for compliance and fraud prevention.

Businesses integrating stablecoins into their payment systems often experience improved operational efficiency. The automation potential of stablecoin transactions reduces manual processing errors and reconciliation issues, addressing a key pain point in traditional B2B payments.

The Future of Global Trade

As stablecoins continue to gain traction, they reshape the landscape of global trade and B2B payments. Their ability to address long-standing issues in cross-border transactions makes them a compelling option for businesses looking to streamline their payment processes and expand their international operations. The next section will explore how businesses can implement stablecoins in their existing payment systems and the potential challenges they might face.

How to Implement Stablecoins in Your B2B Payment System

Technical Requirements for Stablecoin Integration

To accept stablecoin payments, you need a digital wallet that can hold and transact with stablecoins. Blockchain payments integrates with existing wallets, and with the latest version, is adding 100% native Salesforce wallets.

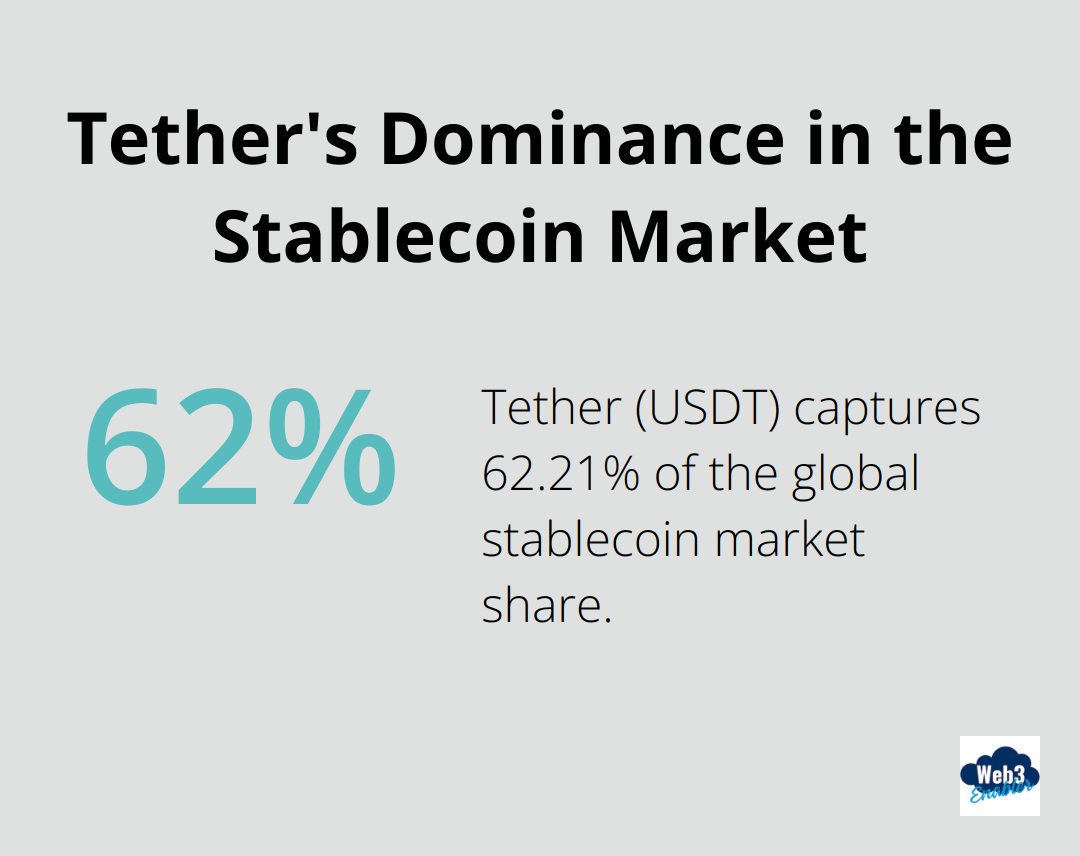

Web3 Enabler denies the proposition that you must choose a stablecoin, you simply choose the ones you accept and use, and handle it accordingly. Tether (USDT) dominates the stablecoin market with a 62.21% share, maintaining its lead as the most used stablecoin globally. Circle’s USD Coin (USDC) is the most popular option in the United States and Europe, where compliance with MiCA and GENIUS Act are important.

You need to set up a system to convert stablecoins to fiat currency if needed. Many cryptocurrency exchanges offer this service, often with lower fees than traditional forex conversion rates.

Success Stories in Stablecoin Adoption

Companies have successfully implemented stablecoins in their B2B payment systems. Visa has processed over $1 billion in stablecoin payments since 2021, which proves the viability of this technology for large-scale transactions.

Bitpay, a payment service provider, enables businesses to accept cryptocurrency payments, including stablecoins. They reported a 57% increase in stablecoin payments in 2022, which highlights the growing trend towards these digital assets in B2B transactions.

Overcoming Challenges in Stablecoin Adoption

Businesses may face hurdles when adopting stablecoins. Regulatory uncertainty is a primary concern. However, proactive engagement with regulatory bodies and staying informed about evolving guidelines can mitigate this risk.

Volatility is another potential issue, even for stablecoins. To address this, businesses can use instant conversion services or hold multiple stablecoins to diversify risk.

Employee training is essential. Investment in comprehensive education programs ensures your team can effectively manage stablecoin transactions and troubleshoot any issues that arise.

Choosing the Right Integration Partner

Selecting the right partner for stablecoin integration is critical. Look for companies with proven expertise in blockchain technology and experience in integrating with major business platforms (such as Salesforce).

Web3 Enabler stands out as a top choice in this field. As a Salesforce ISV partner, they offer the only native blockchain solution on the Salesforce AppExchange. Their platform is trusted by industry leaders like Circle, Ripple, and Cardano.

Future-Proofing Your B2B Payment System

Implementing stablecoins in your B2B payment system can streamline your operations and reduce costs. This technology can give you a competitive edge in the global marketplace.

As stablecoins continue to evolve, stay informed about new developments and regulations. Regular reviews and updates of your stablecoin strategy will ensure you continue to reap the benefits of this innovative payment method.

Final Thoughts

Stablecoins will transform B2B payments, offering faster settlements, lower costs, and increased transparency for cross-border transactions. This technology addresses key challenges in traditional payment systems, especially for businesses trading with LATAM and Asia. The projected growth of blockchain-based B2B cross-border payments to $4.4T in 2024 highlights the increasing adoption of these efficient payment methods.

Stablecoin transactions represent more than a technological shift; they signify a strategic move towards more efficient, secure, and globally accessible B2B interactions. As regulatory frameworks evolve to accommodate these digital assets, businesses must explore stablecoin integration to remain competitive in the global marketplace. The potential for cost savings and improved operations makes stablecoins an attractive option for companies of all sizes.

Web3 Enabler offers unique blockchain integration solutions, particularly for businesses using Salesforce. As a leader in enabling stablecoin payments and facilitating faster, cheaper global transactions, Web3 Enabler positions itself as an ideal partner for businesses ready to embrace the future of B2B payments. The time to act is now; businesses that adopt stablecoin technology will lead the financial revolution in our increasingly connected global economy.